Betashares Australian ETF Review: March 2025

4 minutes reading time

Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

Australian ETF industry continues hot streak

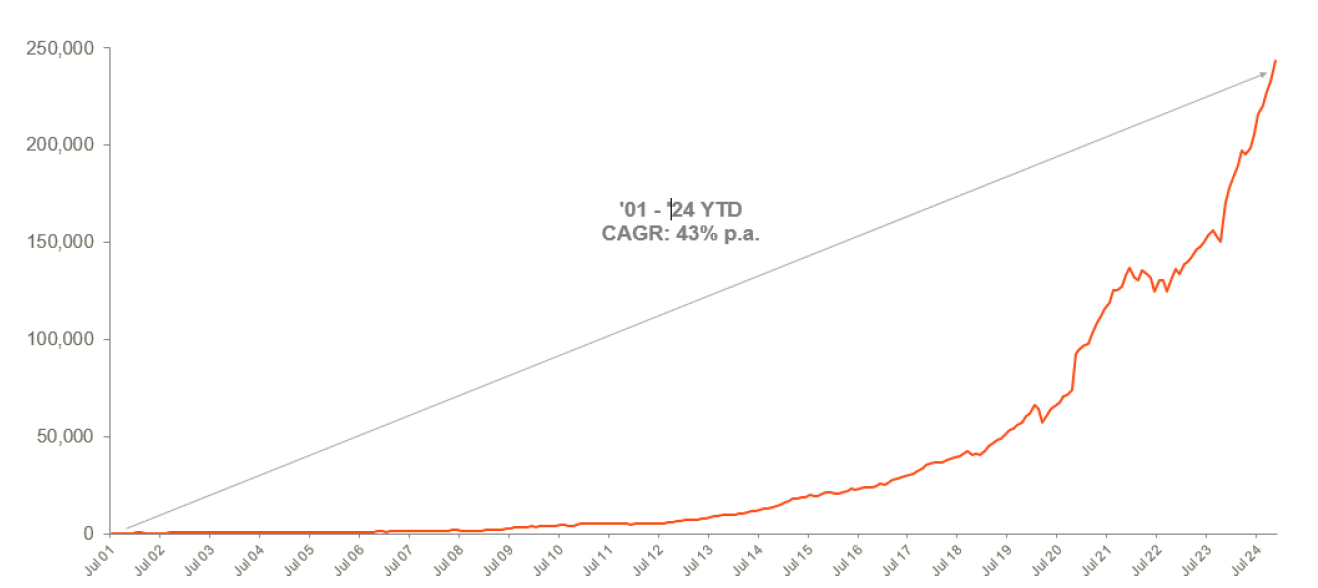

- The Australian ETF industry sees a new record in terms of assets under management – with the industry now within striking distance of the $250 billion milestone.

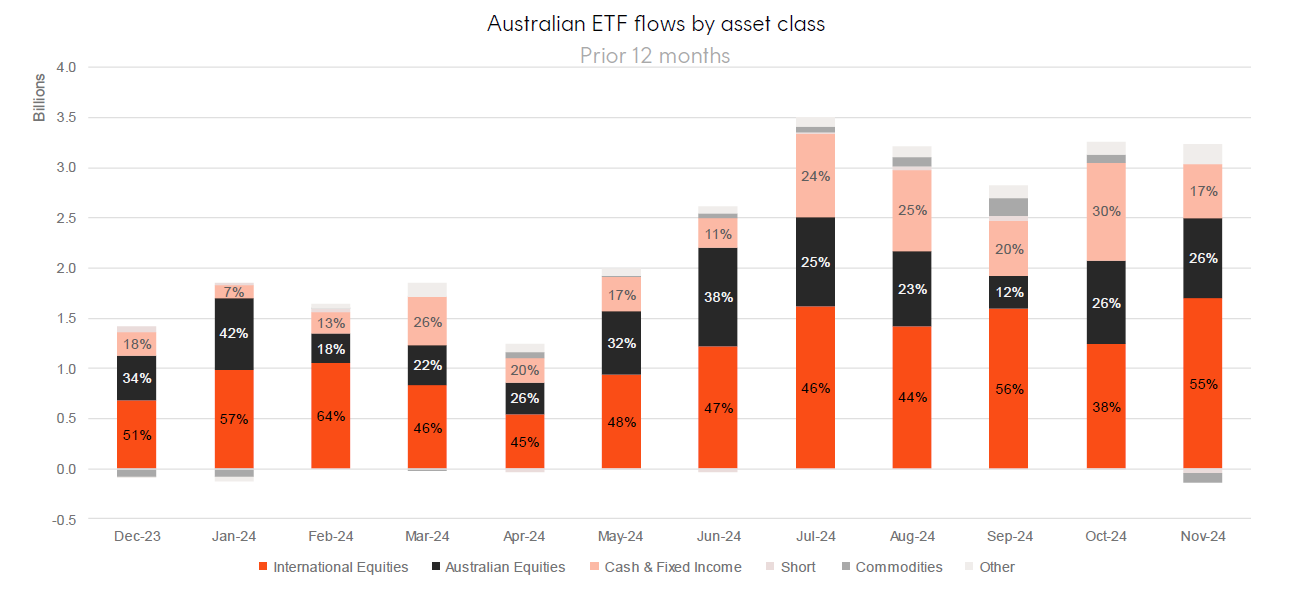

- Year to date industry net flows to November now stand at $26.9B, setting a new record and putting distance between the previous mark of $23.2B set in 2021.

- November saw the ETF industry have its second strongest month on record in terms of asset growth. The industry rose by 4.5% for the month, with the total market cap increasing by $10.4B. Total industry assets now stand at $242.9B – a new all-time record high.

- Industry flows were strong again with $3.1B recorded for the month, the third all-time highest level for monthly flows on record.

- ASX trading value was slightly higher month on month, at ~$13.7B for November.

- Over the last 12 months the Australian ETF industry has grown by 36.9%, or $73.2B.

- In terms of product launches, there were 4 new funds launched in November, including Australia’s first ethical Australian fixed income ETF and three other funds. Conversely, Magellan closed three active funds from their Core range.

- Digital asset exposures again performed well, with the CRYP Crypto Innovators ETF topping the list with a 42.4% return for the month.

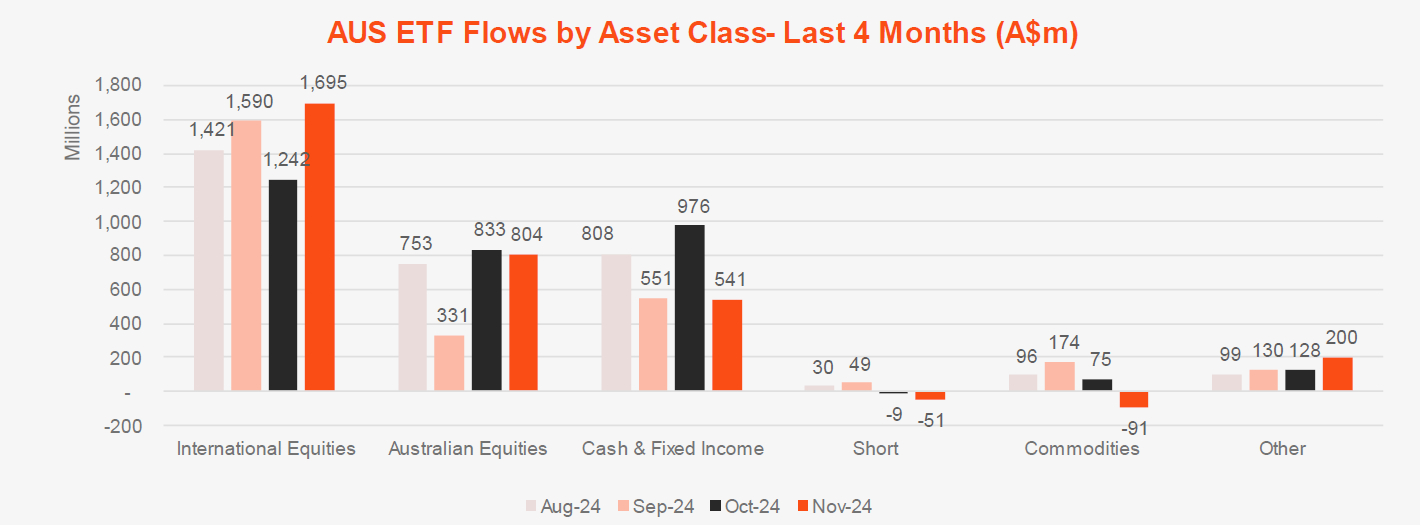

- November was a stand out month for International Equities products ($1.7B) more than doubling the nearest category. Australian Equities ($804 million) and Fixed Income ($565 million) products rounded out the top three in terms of category flows.

Australian ETF Industry AuM: July 2001 – November 2024

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $242.9B – all time high

- ASX CHESS Market Cap: $206.03B1

- Market Cap change for November: 4.5%, $10.4B

- Market cap growth for last 12 months: 36.9%, $73.2B

New Money

- Net inflows for month: $3.1B

Products

- 399 Exchange Traded Products trading on the ASX & CBOE

- In terms of product launches, there were 4 new funds launched in November, including Australia’s first ethical Australian fixed income ETF and three other Conversely, Magellan closed three active funds from their Core range.

Trading Value

- ASX trading value was high at ~$13.7B for the month.

Performance

- Digital asset exposures performed well again, with the CRYP Crypto Innovators ETF topping the list with a 42.4% return for the month.

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| International Equities | $1,694,782,276 |

| Australian Equities | $804,061,023 |

| Fixed Income | $565,677,156 |

| Multi-Asset | $101,801,693 |

| Currency | $61,770,382 |

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| International Equities – US | $922,926,478 |

| International Equities – Developed World | $554,725,073 |

| Australian Equities – Broad | $487,291,047 |

| Australian Bonds | $411,423,778 |

| International Equities – Sector | $174,225,048 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| Gold | -$86,573,065 |

| International Equities – Europe | -$48,812,983 |

| International Equities – Asia | -$40,159,518 |

| Australian Equities – Short | -$32,271,598 |

| Fixed Income – E&R – ESG Lite | -$25,316,613 |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

|---|---|---|

| CRYP | Betashares Crypto Innovators ETF | 42.4% |

| EETH | Global X 21Shares Ethereum ETF | 42% |

| BTXX | DigitalX Bitcoin ETF | 39.8% |

| EBTC | Global X 21Shares Bitcoin ETF | 39.8% |

| VBTC | VanEck Bitcoin ETF | 39.6% |

Explore

ETF industry

2 comments on this

IF I BUY CQQQ-NDQ FROM BETASHARE DO I HAVE TO FILL IN BEN FORM

Hey Thomas, CQQQ isn’t available on our investing platform, Betashares Direct, as we only offer ASX listed ETFs and shares.

Thanks,

Betashares Customer Support Team.