3 minutes reading time

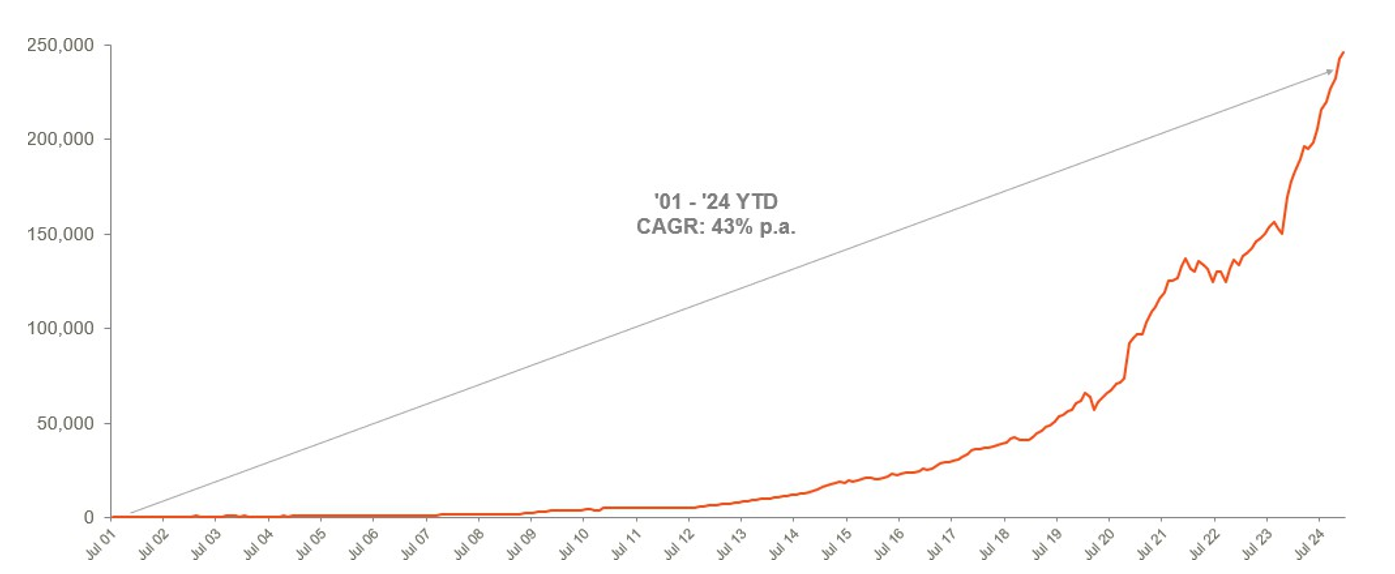

2025 off to a bang as ETF industry passes $250 billion

-

The Australian ETF industry surged past $250 billion in funds under management, on the back of record inflows and positive market performance.

-

2025 kicked off with a bang as the Australian ETF industry recorded a mammoth $4.6B in net flows. Following record inflows and strong market performance – the industry rose by 4.5% for the month, with the total market cap increasing by $11.1B. As a result, total industry assets now stand at $257.4B – a new all-time record high.

-

Interestingly, January has historically been a quieter month for the Australian ETF industry. However, 2025 has proven to be a very different story with a mammoth $4.6B in industry flows for the month – beating the prior record by over $600 million.

-

January also saw strong flows for smart beta exposures, with these funds recording $473.8 million in net inflows.

-

ASX trading value dipped month on month, sitting at $13B for January.

-

Over the last 12 months the Australian ETF industry has grown by 35.9%, or $79.9B.

-

In terms of product launches, there were 2 new Active ETFs launched in January.

-

Gold miner exposures, including the MNRS Global Gold Miners Currency Hedged ETF , were the highest performing funds in January – with the fund returning 13.96%.

-

January was a strong month for International Equities products ($1.8B), ahead of Australian Equities ($1.3B) and Fixed Income ($743 million).

Market Size and Growth: January 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $257.4B – all time high

- ASX CHESS Market Cap: $219.21B1

- Market Cap change for January: 5%, $11.1B

- Market cap growth for last 12 months: 9%, $79.9B

New Money

- Net inflows for month: $4.6B – all time high

Products

- 397 Exchange Traded Products trading on the ASX & CBOE

- There were 2 new Active ETFs launched in January

Trading Value

- ASX trading value dipped to ~$13B for the month

Performance

- Gold miner exposures, including the MNRS Global Gold Miners Currency Hedged ETF , were the highest performing funds in Jan – with the fund returning 13.96%.

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

| International Equities | $1,787,095,297 |

| Australian Equities | $1,333,114,543 |

| Fixed Income | $743,356,440 |

| Cash | $474,104,563 |

| Multi-Asset | $102,910,273 |

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

| Australian Equities – Broad | $1,362,999,482 |

| International Equities – Developed World | $881,426,284 |

| International Equities – US | $619,306,138 |

| Cash | $474,104,563 |

| Australian Bonds | $463,678,606 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

| Australian Equities – Sector | -$57,539,050 |

| Australian Equities – Geared | -$50,871,697 |

| Australian Equities – Large Cap | -$19,444,383 |

| International Equities – E&R – Sustainability | -$17,876,773 |

| Australian Equities – Short | -$16,234,664 |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

| GDX | VanEck Gold Miners ETF | 14.02% |

| MNRS | Betashares Global Gold Miners Currency Hedged ETF | 13.96% |

| IBTC | Monochrome Bitcoin ETF | 12.39% |

| GEAR | Betashares Geared Australian Equity Fund (Hedge Fund) | 10.18% |

| EBTC | Global X 21Shares Bitcoin ETF | 9.84% |