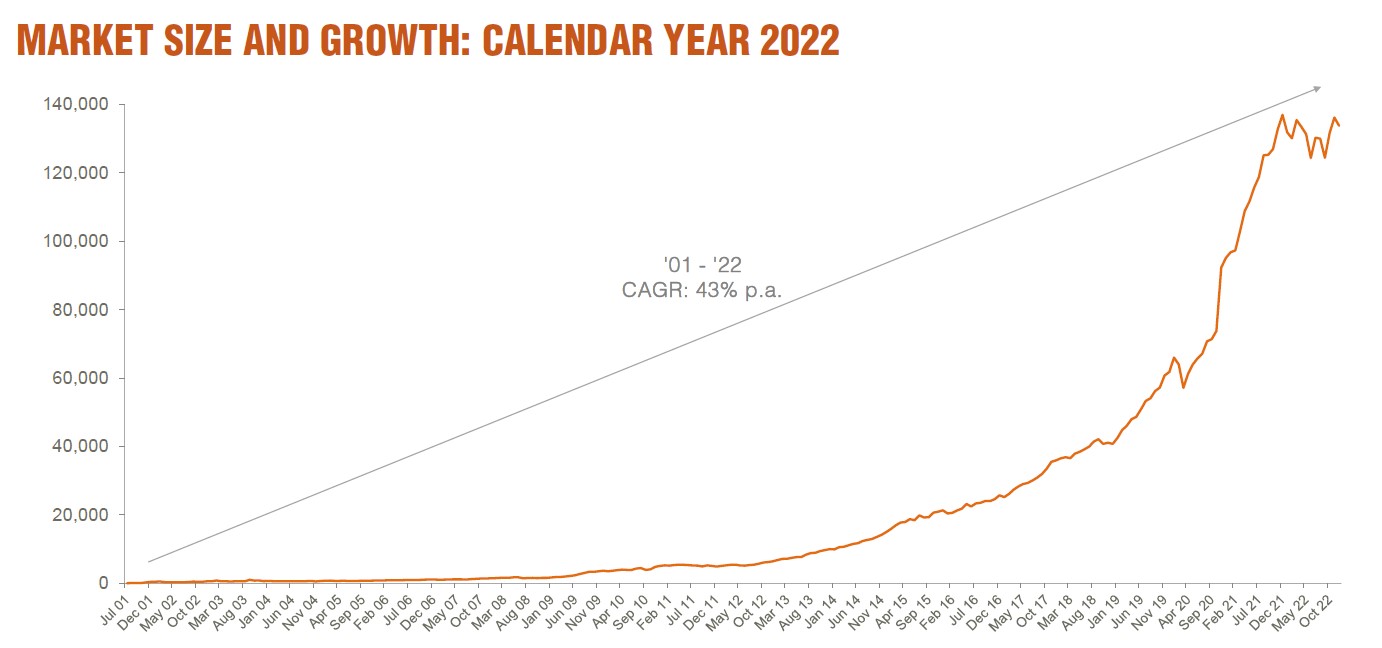

Australian ETF industry breaks more records

4 minutes reading time

End of 2022 Review: A port in the storm in 2022

In a highly turbulent year in financial markets, the ETF industry continued to take in new money from investors, even as asset values declined, making it one of the few bright spots in a very hard year for the broader asset management industry. Read on for details, including best performers, asset flow categories and more.

Exchanged Traded Funds Market cap

- Australian Exchange Traded Funds Market Cap(ASX + CBOE): $133.7B

- Market cap growth (decline) for year: -2%, -$3.2B

Comment: In total the Australian ETF industry received $13.5B of net inflows, in a year where the unlisted funds industry sustained net outflows of -$26.8B, marking the worst year on record for Australian managed funds1. The ETF industry’s positive net flows were, however, not enough to combat the asset value declines caused by falling share and bond markets, and, as a result the industry itself fell in value by 2%.

New money

- Net new money: +$13.5B – 42% year on year decrease v. 2021

Comment: As per above, net flows were very robust, particularly given the broader picture for funds management, amounting to $13.5B (42% lower than the net flow figure recorded in 2021, $23.2B, the highest net flows on record)

Products

- 319 Exchange Traded Products trading on the ASX (vs 280 as at end 2021)

- New products: 52 new products launched in the year (vs. 33 in 2021), 13 products closed/matured – all time high number of products launched

Comment: In terms of product launches, and consistent with the prediction we made in our Year End report for 2021, it was the biggest year on record, with 52 new exchange traded funds launched on Australian exchanges in 2022 (v. 33 in 2021) and ‘net product growth’ of 39 funds. Similarly to last year, a large proportion of the new launches this year were Active ETFs (33% or 17 funds), with the majority of these launches being via the creation of traded classes of existing unlisted funds. We would expect 2023 to again bring a number of new products, albeit not another record-breaking year given the breadth of product range currently available on ASX/CBOE.

Trading value

- Annual ASX trading value reached an all-time high (23% more compared to 2021) – with $117B of value traded on the ASX (v. $95B in 2021)

Performance

Given the declining market conditions, short leveraged US equity exposures were the best performers this year – for example our BBUS fund returned 45% for the year. Strong performance was also recorded in Global Energy and Australian Resources equity exposures given the popularity of these sectors in 2022.

Top 5 category inflows (by $) – December 2022

| Broad Category | Inflow Value |

| Fixed Income | $596,897,493 |

| Cash | $334,514,529 |

| International Equities | $139,515,132 |

| Listed Property | $31,387,364 |

| Multi-Asset | $24,200,736 |

Top category outflows (by $) – December 2022

| Broad Category | Inflow Value |

| Short | ($27,923,492) |

| Commodities | ($24,512,994) |

| Currency | ($3,675,612) |

| Australian Equities | ($2,280,281) |

Top sub-category inflows (by $) – December 2022

| Sub-category | Inflow Value |

| Cash | $334,514,529 |

| Australian Bonds | $333,418,438 |

| Global Bonds | $232,393,470 |

| International Equities – US | $84,276,089 |

| International Equities – E&R – Ethical | $71,604,997 |

Top sub-category outflows (by $) – December 2022

| Sub-category | Inflow Value |

| International Equities – Developed World | ($90,785,404) |

| Australian Equities – Broad | ($49,677,501) |

| US Equities – Short | ($36,468,581) |

| Gold | ($28,315,716) |

| Australian Equities – Sector | ($20,359,806) |

Comment: Overall, the mix of flows by category shifted in 2022 vs. 2021, with global equity flows more muted than in previous years – investors seemingly concerned over the market volatility experienced by global sharemarkets. As such, it was the Australian Equities category that led flows. Fixed Income mounted a comeback vs. 2021, to become the 2nd most bought category of ETFs in 2022 with investors more willing to invest this asset class as yield rises began to taper off.

*Past performance is not an indicator of future performance.

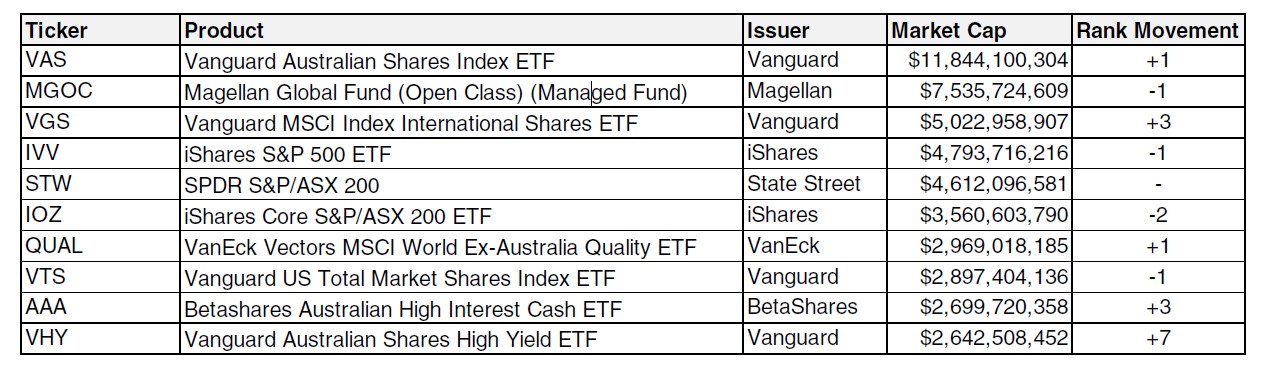

Top 10 Products: End of year 2022

Top Performing Products – 2022

| Product Name | Performance |

| Global X Ultra Short Nasdaq 100 Hedge Fund (ASX: SNAS) | 79.5% |

| Betashares US Equities Strong Bear Currency Hedged (Hedge Fund) (ASX: BBUS) | 45.0% |

| Betashares Global Energy Companies ETF – Currency Hedged (ASX: FUEL) | 40.2% |

| Betashares S&P/ASX 200 Resources Sector ETF (ASX: QRE) | 22.6% |

| SPDR S&P/ASX 200 Resource Fund (ASX: OZR) | 22.5% |

Industry Forecast:

In terms of 2023, we believe that market conditions will continue to act as a hinderance to industry growth but expect net inflows to remain consistently positive and ultimately that the industry will return to a growth footing. As such, we forecast total industry FuM at end 2023 to exceed $150B in assets.

5 comments on this

Are there any plans to close HVST at any time soon? I bought my original parcel on 6 October 2016 and DRP’d till 17 July 2018. My loss on the investment is 35.12%, ouch!!!

If no plans to close what are your thoughts to beef the stock price up so that I can recover my losses. Your reply would be appreciated.

Stay safe. Raimond.

Hi Raimond,

Betashares made significant changes to HVST effective from 31 May 2022. The aim of these changes was to reduce the Fund’s tracking error relative to the broader Australian share market by moving to an expanded, more diversified, sector neutral portfolio, while maintaining the Fund’s core income objective of seeking to provide regular income from a portfolio of Australian shares that exceeds the net income yield of the broad Australian share market on an annual basis.

The modifications were numerous, but included expanding the eligible universe for selection, increasing the number of securities in the portfolio, removing the futures-based risk management overlay which aimed to reduce the volatility of the Fund’s equity investment returns, and reducing the fee from 0.9% p.a. to 0.72% p.a.

You can read more about the changes here: https://ecomms.linkgroup.com/images/Link/58391/HVST%20Notice%20to%20Investors%202022.pdf

Regards,

Betashares.

it didn’t take long for doubts to creep in. As I started to interact with the platform, I noticed strange and inconsistent behavior. Transactions didn’t go as smoothly as promised, and customer support was elusive. Red flags were waving, and my gut told me that something was amiss. That’s when I realized I had fallen victim to a sophisticated scam. The platform’s behavior raised more eyebrows than a detective at a magic show. Withdrawal requests were delayed or denied outright, and the promised returns seemed too good to be true. It was like playing a game of hide-and-seek with my money, and the platform was constantly seeking new hiding spots. These inconsistencies were clear indicators that something fishy was going on so I searched for restoration and I discovered Wizard web recovery. Wizard Web Recovery is a hacking group that helps swindled people to reclaim their lost Bitcoin and they did exactly the same in my case. Write Wizard Web recovery using the email address at: wziardwebrecovery@ programmer . net if you require assistance in reclaiming your stolen Cryptocurrencies.

My name is Claire, and I am seeking legal assistance regarding a sensitive matter. After nine years of what I believed to be a perfect marriage, I recently discovered that my spouse has been engaging in infidelity with a close friend. For a while, I suspected this breach of trust, but lacked concrete evidence to confront the situation. However, my situation took a turn when I stumbled upon a Reddit post, where the author highlighted how they were able to gain access to a phone with the assistance of Cracker Cyberdude. Overcoming my initial hesitation, I decided to reach out to them for their expertise.

Cracker Cyberdude effectively helped me gain access to my husband’s phone, providing me with the necessary proof that I needed to proceed with a divorce and secure alimony. I am immensely grateful for their support during this difficult period. If you find yourself in a similar situation, I recommend reaching out to Cracker Cyberdude. Their contact information is provided below:

Website: http://www.crakercyberdud

Email:cracker(at)cyberdude(.)com

Please note that I am in no way affiliated with Cracker Cyberdude, and this recommendation is solely based on the positive experience I had with their services. I am confident they will be able to provide you with the assistance you may require.

Vanished Bitcoin, Relentless Hackers, and an Unbelievable Comeback