Betashares Australian ETF Review: August 2025

4 minutes reading time

Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

Big month for the industry with second highest net flows on record

- The second highest monthly net flows on record pushed the Australian ETF Industry to a new all- time high in assets under management.

- Notwithstanding market volatility, August saw the ETF industry continue its strong momentum, with high net flows – pushing the industry to a new all-time high. The industry rose by 2% for the month, with total market cap increasing by $4.6B. Total industry assets now stand at $220.2B – a new all- time record high.

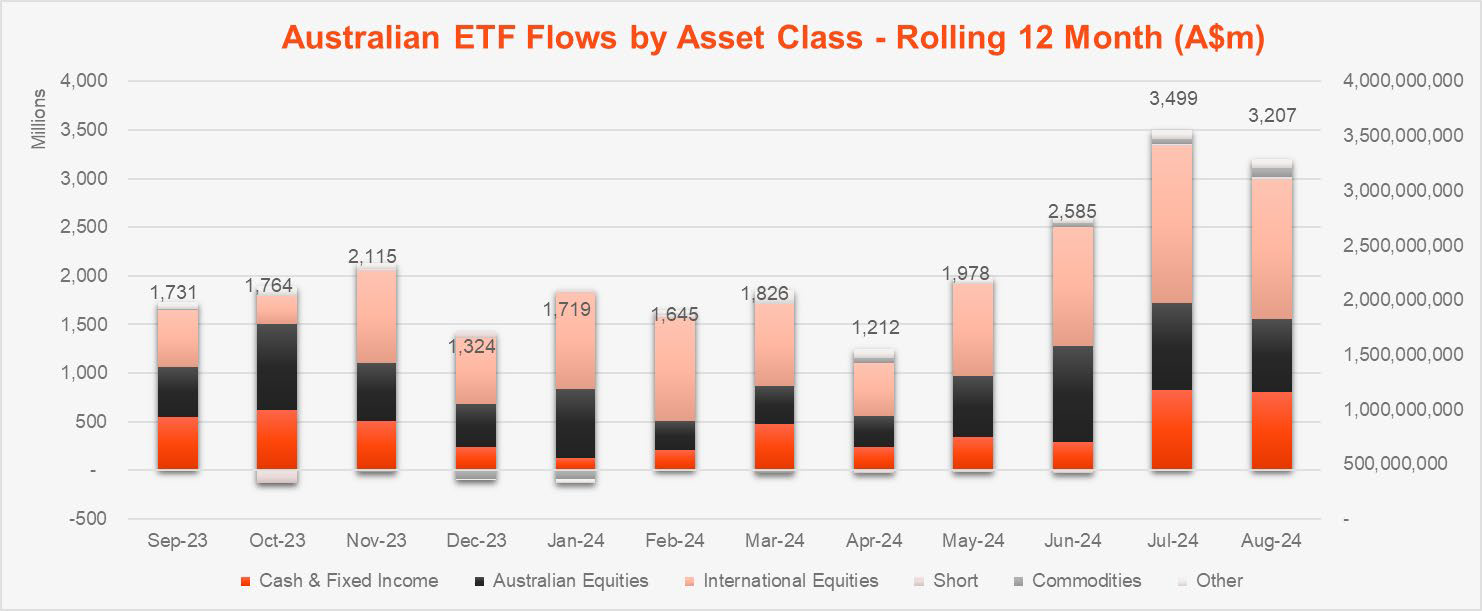

- Industry flows were elevated with $3.2B recorded for the month – as investors took advantage of the market volatility to add to their portfolio. It was the second straight month that monthly flows exceeded $3B. Net flows represented ~70% of the monthly growth, with the remainder coming from market appreciation and conversion activity.

- ASX trading value remained elevated at ~$14B for the month.

- Over the last 12 months the Australian ETF industry has grown by 43.4%, or $66.7B.

- In terms of product launches, there were 6 new funds launched in August, including from JP Morgan Asset Management and Dimensional, all of them actively managed ETFs, most of them conversions of existing unlisted funds into dual class structures.

- The best performing ETFs this month was a geared exposure to the AUDS Strong Australian Dollar Complex ETF and our ATEC S&P/ASX Australian Technology ETF .

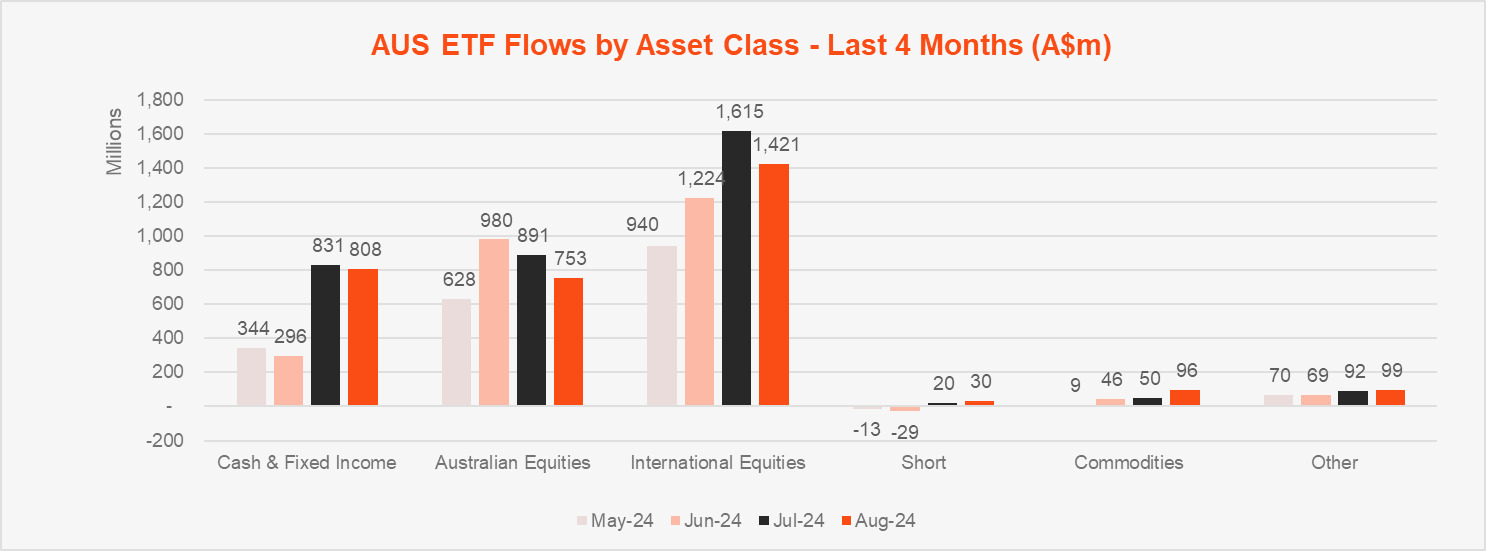

- August was another stand out month for International Equities products ($1.4B), as they again received almost double the amount of net flows of the second placed Australian Equities products ($751 million). Fixed income was in third spot with $678 million.

- No categories received outflows over the month.

Australian ETF Industry AuM: July 2001 – August 2024

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $220.2B – all time high

- ASX CHESS Market Cap: $186.83B1

- Market Cap change for July: 2.1%, $4.6B

- Market cap growth for last 12 months: 43.4%, $66.7B

New Money

- Net inflows for month: $3.2B

Products

- 393 Exchange Traded Products trading on the ASX & CBOE

- In terms of product launches, there were 6 new funds launched in August, including from JP Morgan Asset Management and Dimensional, all of them actively managed ETFs, most of them conversions of existing unlisted funds into dual class structures.

Trading Value

- ASX trading value remained elevated at ~$14B for the month.

Performance

- The best performing ETFs this month were geared exposure to the Australian Dollar and an Australian Technology ETF.

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

| International Equities | $1,421,265,535 |

| Australian Equities | $753,111,788 |

| Fixed Income | $678,982,672 |

| Cash | $128,755,603 |

| Commodities | $95,558,399 |

Top Category Outflows (by $) – Month

No category outflows

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

| International Equities – Developed World | $772,614,972 |

| Australian Equities – Broad | $664,872,553 |

| Australian Bonds | $428,469,259 |

| International Equities – US | $363,785,636 |

| Global Bonds | $236,287,471 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

| Australian Equities – Sector | ($35,685,863) |

| Australian Equities – Geared | ($34,316,434) |

| Australian Listed Property | ($27,623,153) |

| Fixed Income – E&R – Ethical | ($11,642,062) |

| International Equities – Emerging Markets | ($3,790,774) |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

| AUDS | Betashares Strong Australian Dollar Fund (hedge fund) | 7.5% |

| ATEC | Betashares S&P/ASX Australian Technology ETF | 5.9% |

| GLPR | iShares Core FTSE Global Property Ex Australia (AUD Hedged) ETF | 5.6% |

| REIT | VanEck FTSE International Property (Hedged) ETF | 5.6% |

| DRUG | Betashares Global Healthcare ETF – Currency Hedged | 4.6% |

1 Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it will exclude, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity.

Explore

ETF industry