Betashares Australian ETF Review: July 2023

3 minutes reading time

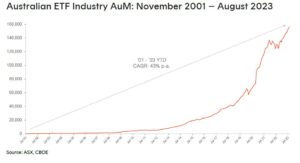

August 2023 Review: Strongest inflows for 12 months drive industry to record high

The strongest monthly inflows of the last 12 months drove the Australian ETF industry to a new all-time high in assets under management as at the end of August

Exchanged Traded Funds Market Cap

• Australian Exchange Traded Funds Market Cap (ASX + CBOE): $156.1B – new all time high

• ASX CHESS Market Cap: $140.8B1

• Market Cap increase for month: 1.6%, $2.5B

• Market Cap growth for last 12 months: 20.1%, $26.1B

New Money

• Net inflows for month: $2.2B – highest inflows for 2023 to date, and within the last 12 months

Products

• 342 Exchange Traded Products trading on the ASX & CBOE

• Three new ETFs launched: 2 Active ETFs from JP Morgan (Fixed Income and Emerging Markets), 1 new Active ETF from IML (Australian Shares) and a new US equities product from Global X

• 1 XTB single bond exposure was closed

Trading Value

• ASX ETF trading value grew 8% month on month, with ASX trading value rising above $11.B for the first time in 15 months with the 5th highest monthly value traded on record

Performance

• URNM Global Uranium ETF was the best performing product this month, rising ~15% as a result of a significant volume of long-term uranium purchase contracts being signed combined with concerns over disruptions to supply

Source: ASX, CBOE

Top 5 category inflows (by $) – August 2023

| Broad Category | Inflow Value |

| Australian Equities | $1,118,843,997 |

| Fixed Income | $612,531,802 |

| Cash | $212,099,899 |

| Short | $110,801,488 |

| International Equities | $74,042,451 |

Comment: In a departure from previous months, this month we saw the top category for inflows being broad Australian equities ETFs which, at $1.1B, represented a 50% of the total months inflows. Australian Fixed Income exposures also continued to be popular with investors ($612m), and even at position 2 for this month, received higher flows than the month before.

Source: ASX, CBOE

Top sub-category inflows (by $) – August 2023

| Sub-category | Inflow Value |

| Australian Equities – Broad | $1,007,290,322 |

| Australian Bonds | $420,779,978 |

| International Equities – Developed World | $246,616,915 |

| Cash | $212,099,899 |

| Global Bonds | $183,307,908 |

Top sub-category outflows (by $) – August 2023

| Sub-Category | Inflow Value |

| International Equities – Europe | ($180,250,890) |

| International Equities – Sector | ($96,136,177) |

| International Equities – Asia | ($43,957,545) |

| International Equities – Emerging Markets | ($28,718,059) |

| US Equities – Short | ($24,570,040) |

Comment: There were very little outflows at a category or sub-category level this month, with ETF investors largely choosing to hold or add to their positions, in aggregate.

*Past performance is not an indicator of future performance.

1. Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it excludes, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity.

1 comment on this

Looking for your “best” Aust minerals ETF.

Pls help.

Graeme

Currently holding several Beta, eg ACDC, past dip Fin Planner, aged 87yrs.