Betashares Australian ETF Review: December 2024

4 minutes reading time

Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

ETF assets dip despite positive monthly inflows

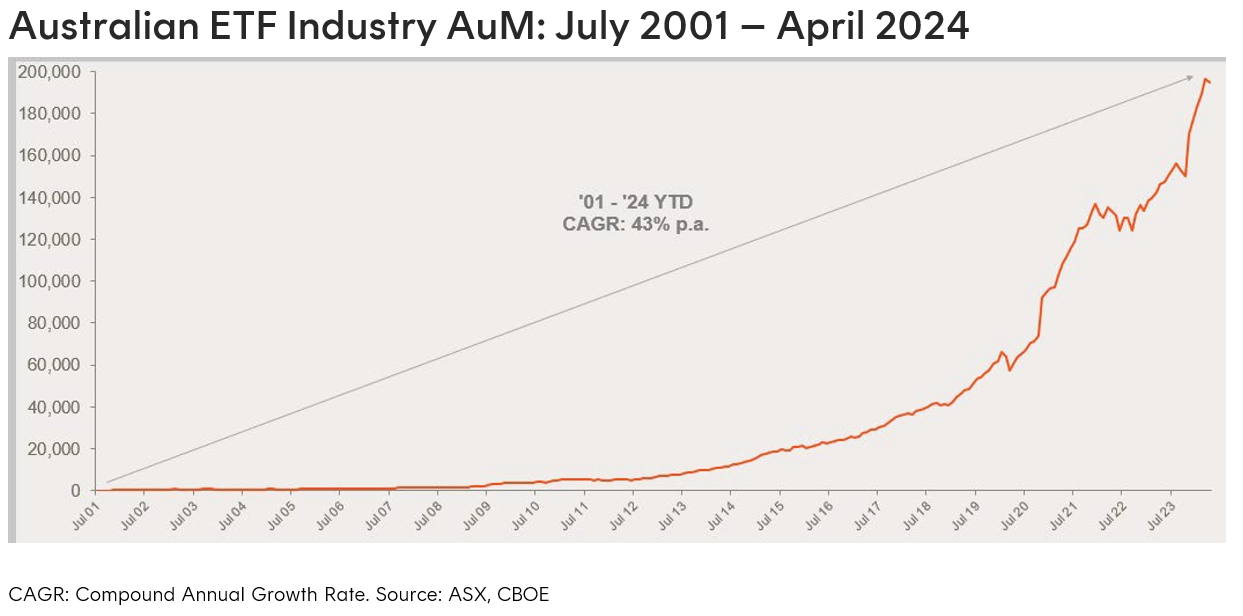

- Positive ETF inflows were not enough to offset global sharemarket declines, causing Australian ETF Industry assets to dip during April.

- April saw ETF industry assets fall less than one per cent (-0.9%) month-on-month, for a total monthly market cap decline of –$1.7B. The industry now sits at $195.0B – just shy of the all time high set last month ($196.7B).

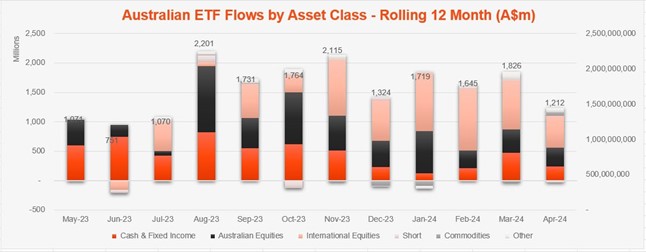

- Notwithstanding market volatility, industry flows remained positive, albeit muted – with $1.2B of net flows for the month.

- ASX trading value was ~$11B for the month, up 22% month on month from March.

- Over the last 12 months the Australian ETF industry has grown by 5%, or $49.0B.

- It was a busy month for product launches with 11 new funds launched in April, including two new moderately geared funds over Australian and Australian and Global Equities exposures and 8 Active ETF launches.

- The best performing ETFs this month were short funds, including our BBFD Geared Short U.S. Treasury Bond Fund – Currency Hedged (hedge fund) which returned ~11% for the Energy transition metals exposures, including our XMET Energy Transition Metals ETF , also performed relatively well.

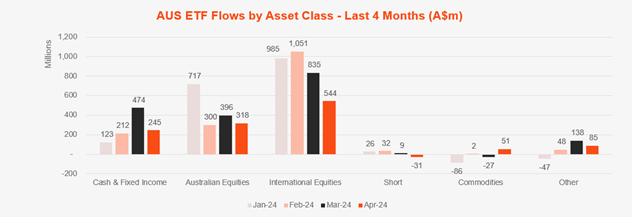

- Continuing the ongoing trend which started at the end of 2023, April was again a month where international equities products dominated in terms of the composition of net inflows, representing over half of the industry’s net flows ($544m). Australian equities returned to 2nd position for flows, followed by fixed income in 3rd spot.

- Outflows were limited to profit taking in Short funds after strong performance in April.

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $195.0B

- ASX CHESS Market Cap: $165.8B1

- Market Cap change for April: -0.9%, -$1.7B

- Market cap growth for last 12 months: 33.5%, $49.0B

New Money

- Net inflows for month: $1.2B

Products

- 370 Exchange Traded Products trading on the ASX & CBOE

- 11 new funds launched last month, including two new moderately geared funds over Australian and Australian and Global Equities exposures and 8 Active ETF launches

Trading Value

- Trading value increased by 22% in April, with ASX trading value of ~$11B for the month

Performance

- The best performing ETFs this month were short funds, including our BBFD Geared Short U.S. Treasury Bond Fund – Currency Hedged (hedge fund) which returned ~11% for the month. Energy transition metals exposures, including our XMET Energy Transition Metals ETF , also performed relatively well.

Top 5 category inflows (by $)

| Broad Category | Inflow Value |

| International Equities | $543,754,138 |

| Australian Equities | $317,505,990 |

| Fixed Income | $236,995,532 |

| Multi-Asset | $61,705,112 |

| Commodities | $51,450,596 |

Top category outflows (by $)

| Broad Category | Inflow Value |

| Short | ($30,607,971) |

Top sub-category inflows (by $)

| Sub-category | Inflow Value |

| International Equities – US | $316,673,124 |

| International Equities – Sector | $254,570,124 |

| Australian Equities – Broad | $237,359,516 |

| Global Bonds | $147,505,329 |

| Australian Bonds | $105,639,966 |

Top sub-category outflows (by $)

| Sub-category | Inflow Value |

| International Equities – Asia | ($131,470,481) |

| Australian Equities – Short | ($31,722,386) |

| Australian Equities – Sector | ($31,063,542) |

| Fixed Income – E&R – ESG Lite | ($23,835,501) |

| International Equities – Europe | ($20,809,925) |

Top Performing Products – April 2024

| Ticker | Product Name | Performance |

| SNAS | Global X Ultra Short Nasdaq 100 Hedge Fund | 11.7% |

| BBFD | Betashares Geared Short U.S. Treasury Bond Fund-Currency Hedged(Hedge Fund) | 11.5% |

| WIRE | Global X Copper Miners ETF | 10.5% |

| BBUS | Betashares US Equities Strong Bear Currency Hedged (Hedge Fund) | 10.5% |

| XMET | Betashares Energy Transition Metals ETF | 10.4% |

Footnotes:

1 Since February 2023, the ASX started reporting additional data on a CHESS-only basis. The primary use of such data is that it will exclude, amongst other things, the FuM and Flows in ‘dual class’ Active ETFs and potentially provide a more accurate picture of exchange traded activity.

Explore

ETF industry

1 comment on this

I am grateful that I had the opportunity to invest heavily in Betashares ETF’s and made a considerable profit. Then, timely, I sold up all and invested in PMGOLD, and made another big hit. As our FED and RB keep lying to us about the state of inflation, I will secure my future by staying in GOLD for the next few years. All ETF’s will take a big hit from now on.