9 minutes reading time

Responsible investing survived the first Donald Trump presidency. It will survive the second.

This article examines the likely impact of a second Trump administration on responsible investing in the US, and explores where opportunities lie as the transition to a net zero economy accelerates.

Hitting the ground running

When Donald Trump was elected in 2016, many observers noted his lack of preparedness for government.

The Washington Post described his transition as ‘messy’ and his presidency as ‘chaotic’.1 And, while his first term left several notable legacies – corporate tax cuts, pressure on allies to increase defence spending and a conservative Supreme Court – despite his promises to ‘drain the swamp,’ Trump’s administration largely struggled with policy formulation and implementation. His achievements in pursuing an anti-establishment and ‘anti-woke’ agenda were modest2.

Donald Trump’s 2017 inauguration

Source: Wikimedia Commons

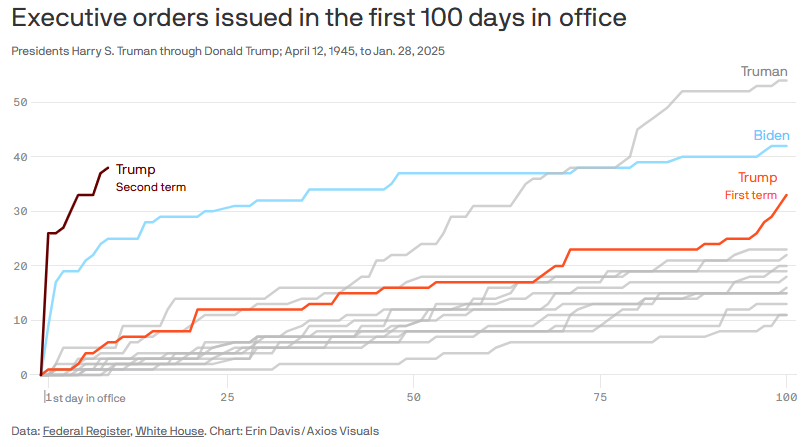

A second Trump presidency, however, is poised to be markedly different. Since the 2020 election, Trump’s supporters have been meticulously preparing for his return to power. This time, they have a detailed plan and have hit the ground running. After less than 2 weeks in office, President Trump has issued 38 executive orders, more than any predecessor this early in their presidency.

Source: axios.com

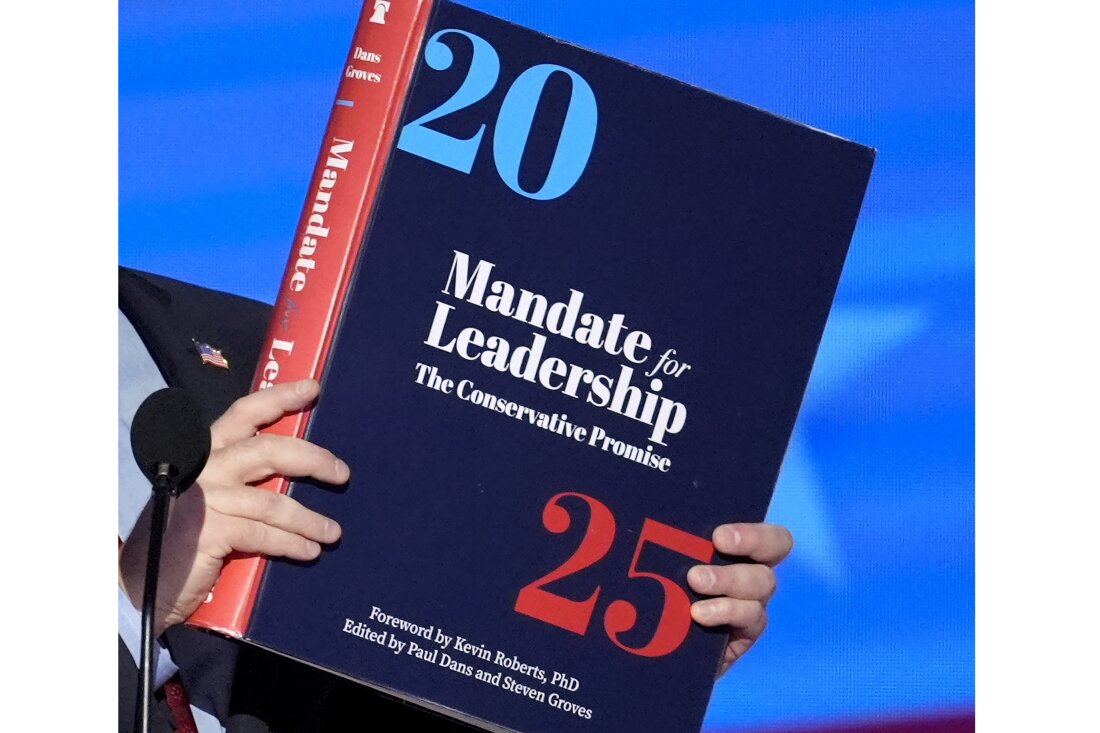

According to Time magazine, two-thirds of Trump’s executive actions align with proposals detailed in Project 2025, a blueprint developed by the Heritage Foundation, a conservative US think tank with links to the tobacco and fossil fuel industries.3, 4 While Trump at times distanced himself from the document during campaigning, since his election victory Project 2025 authors have been announced to key roles within his second administration5.

Project 2025, which includes a first 180 days conservative playbook

Source: J. Scott Applewhite/AP

Project 2025

A key component of Project 2025 involves placing the entire federal bureaucracy under direct presidential control. This objective is rooted in ‘unitary executive theory’.

An interpretation of the US Constitution that expands presidential power, unitary executive theory limits the ability of Congress to appoint independent agency leaders, such as the Chair of the Federal Reserve or the FBI Director, or to delegate regulatory powers to independent agencies, such as the power of the Environmental Protection Agency (EPA) to prevent pollution. Moreover, it suggests that presidents are immune from legal repercussions for acts carried out while in office.

While it may seem far-fetched that this much power would be centralised in the presidency, recent decisions by the US Supreme Court, including the dismissal of charges against Trump related to the January 6, 2021, Capitol attack, suggest its members are increasingly prepared to interpret the US Constitution along lines consistent with unitary executive theory.6

Government cutbacks and responsible investing

The Securities and Exchange Commission (SEC), which regulates investment activity in the US, is slated for significant change under the Trump administration. Gary Gensler, the former SEC Chair, stepped down on January 20th and his reported likely replacement, former SEC commissioner Paul Atkins, is expected to roll back regulations on diversity, equity and inclusion (DEI), climate disclosures and CEO pay.

The ‘Names Rule,’ which requires investment funds to align their holdings with their stated focus (e.g., ESG, growth, value), is also expected to be repealed. 7 Additionally, changes under Gensler that limited companies’ ability to disregard ESG proxy voting proposals are likely to be reversed.8

“Drill baby drill.” Can Donald Trump halt the transition to net-zero?

A Chinese Hoax

Source: X.com

Trump has repeatedly expressed scepticism about climate change, calling it a hoax9, and this perspective would likely be reflected in the dismantling of the National Oceanic and Atmospheric Administration (NOAA), which Project 2025 describes as “one of the main drivers of the climate change alarm industry”.10 It was NOAA Chief Scientist James Hansen whose 1988 testimony to the US Senate first alerted many around the world to the risks of a warming climate.11 NOAA’s critical services, which include hurricane tracking and tsunami warnings, will become increasingly vital as climate change intensifies.

James Hansen, NOAA Chief Scientist, US Senate, 1988

Source: Zinn Education Project

One of Trump’s first actions was to pull the US out of the 2015 Paris Agreement on Climate Change, as he did in his first term. He may also consider withdrawing the US altogether from the UN Foundation Convention on Climate Change (UNFCCC).12

Another of Trump’s first executive actions was to declare a national energy emergency as part of a barrage of pro-fossil fuel measures including lifting restrictions on drilling on federal land and easing permitting processes for fossil fuel infrastructure projects.13 Chris Wright, an executive in the fracking services industry, has been nominated to lead the Department of Energy. Wright has previously stated, “There is no climate crisis, and we’re not in the midst of an energy transition either.”14

Momentum for net zero

However, the momentum behind the transition to net zero may well defy President’s Trump efforts to halt it.

During Trump’s first term, despite nearly 100 environmental rules being reversed, revoked or otherwise rolled back15, US greenhouse gas emissions still fell by 10.3%.16

The decarbonisation of the US economy is likely to continue. Under the Biden administration’s Inflation Reduction Act (IRA), clean energy production has surged, including solar panel factories, electric vehicle (EV) factories, EV battery factories and solar and wind farms. Notably, many of these developments have occurred in Republican-governed states. In August last year, 18 Republican members of Congress wrote a letter urging the retention of clean energy tax credits funded through the IRA. Policy experts expect this type of pressure from Republican congressional representatives, whose districts benefit from IRA programs, will help sustain these measures.17 And while President Trump has enacted a pause to federal government grants which includes grants and loans under the IRA, the order does not impact the $270 billion in tax credits that make up the bulk of the funding that is available through the IRA.18

Policies in Democrat controlled states with ambitious net-zero targets will continue and may be strengthened. All told, 25 states and Washington, D.C., have all instituted some form of target for achieving either economy wide net-zero carbon emissions, 100 per cent renewable or carbon-free electricity, or both.19

Economics beats ideology

Trump’s ability to put a handbrake on the transition to net zero is also contrary to energy industry economics. The significant decrease in the cost of wind and solar electricity, along with advancements in battery storage, has seen firmed renewable energy become the cheapest form of new electricity to build.

Levelised Cost of Electricity

Source: Lazard

Similarly, pro-oil policies may not result in substantial changes to US oil supply. Demand for oil around the world is softening, and prices are falling. Most US oil is produced through fracking, which comes at a higher cost of production than oil from Saudi Arabia or other oil states, around US$45 to $65 per barrel for a new well.20 With China’s oil demand already in decline, and the IEA forecasting peak oil this decade due to rising sales of electric vehicles (EVs) and higher fuel efficiency, the outlook for oil prices is weak21, making substantial expansion of the industry in the US uneconomical.

As one door closes…

Even if Trump’s policies create a period of uncertainty for responsible investment in the US, they are likely to create opportunities elsewhere.

Companies in regions like Europe, China, South Korea, Brazil and India may well benefit from reduced competition from US firms. Clean technology accounts for around 10 per cent of global GDP growth. While the imposition of tariffs on imports might restrict access to the US market, they would likely lead to less competition from US companies in other markets, as countries impose their own tariffs on US imports in retaliation, and countries ‘double down’ on their own energy transition.

According to the IEA, the global market for six key clean technologies – solar PV, wind turbines, EVs, batteries, electrolysers and heat pumps – is forecast to exceed US$2 trillion by 2035, a 186 per cent increase from 2023.22 Companies like Denmark wind manufacturer Vestas, Canadian microinverter manufacturer Enphase, Chinese EV manufacturer BYD and German clean tech leader Infineon Technologies could emerge as net winners from Trump 2.0.

The road ahead

Trump’s second term is set to be a transformative period for the US, with significant implications for corporate governance, climate change and responsible investing. By consolidating executive power and rolling back ESG protections, his administration will reshape the regulatory landscape. The prioritisation of fossil fuels over renewable energy and reduced climate commitments could challenge the resilience of the US transition to net zero. However, this shift may also empower state governments and the private sector to take the lead on sustainability initiatives.

For companies outside the US, this shift presents opportunities to step into leadership roles in clean energy and green technology. As the US becomes more insular, foreign firms aligned with global sustainability goals could strengthen their competitive edge in filling gaps in the global market. This dynamic could accelerate the transfer of economic power to regions more committed to net zero pathways, particularly in Asia and Europe.

For responsible investors, these developments highlight the importance of navigating uncertainty while identifying growth opportunities in markets driving the sustainability agenda. Trump 2.0 could ultimately underscore the resilience of global efforts to combat climate change and the rising role of responsible investing worldwide.

Sources:

1. https://www.washingtonpost.com/politics/it-went-off-the-rails-almost-immediately-how-trumps-messy-transition-led-to-a-chaotic-presidency/2017/04/03/170ec2e8-0a96-11e7-b77c-0047d15a24e0_story.html ↑

2. https://www.washingtonpost.com/politics/trump-drain-the-swamp/2020/10/24/52c7682c-0a5a-11eb-9be6-cf25fb429f1a_story.html ↑

3. https://time.com/7209901/donald-trump-executive-actions-project-2025/ ↑

4. https://www.theguardian.com/business/ng-interactive/2019/jan/23/free-market-thinktanks-tobacco-industry ↑

5. https://apnews.com/article/trump-project-2025-administration-nominees-843f5ff20131ccba5f056e7ccc5baf23 ↑

6. https://web.archive.org/web/20240703080240/https://www.pbs.org/newshour/politics/key-facts-from-the-supreme-courts-immunity-ruling-and-how-it-affects-presidential-power ↑

7. https://www.napa-net.org/news/2024/11/sec-poised-to-undergo-major-changes-under-republican-leadership/ ↑

8. https://www.responsible-investor.com/retrenchment-or-reform-the-sec-and-esg-proposals-under-trump/ ↑

9. https://www.bbc.com/news/world-us-canada-51213003 ↑

10. https://www.theguardian.com/us-news/2024/apr/26/trump-presidency-gut-noaa-weather-climate-crisis ↑

11. https://www.zinnedproject.org/news/tdih/james-hansen-testified-senate-climate-change/ ↑

12. https://www.climatechangenews.com/2024/11/04/legal-experts-say-trump-could-quit-paris-pact-but-leaving-unfccc-much-harder/ ↑

13. https://www.reuters.com/world/us/trump-will-declare-national-energy-emergency-incoming-administration-official-2025-01-20/ ↑

14. https://abcnews.go.com/Politics/trumps-energy-secretary-nominee-chris-wright/story?id=115935864 ↑

15. https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks-list.html ↑

16. https://ourworldindata.org/co2-emissions ↑

17. https://www.marketplace.org/2024/11/07/donald-trump-unspent-ira-funds-renewable-energy/ ↑

18. https://www.sustainableviews.com/critical-tax-credits-survive-trumps-ira-funding-pause-b68c2c8a/ ↑

19. https://energynews.us/2024/11/11/after-trump-win-its-up-to-states-to-lead-on-climate-action/ ↑

20. https://www.usatoday.com/story/money/2024/12/15/trump-drilling-gas-prices/76931654007/ ↑

21. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/crude-oil/101624-iea-sees-oil-supply-overhang-emerging-after-cutting-long-term-demand-projection#:~:text=After%20increasing%20by%20about%202.6,watched%20World%20Energy%20Outlook%202024. ↑

22. https://www.iea.org/news/global-market-for-key-clean-technologies-set-to-triple-to-more-than-2-trillion-over-the-coming-decade-as-energy-transitions-advance ↑