8 minutes reading time

The world of ESG investing has come a long way in a short space of time, with most advisers now offering it as an investment choice for clients. But if we take a moment to focus on the ‘E’ in ESG in more detail it quickly becomes apparent that there is a broader conversation to be had.

Climate change and the resulting environmental impacts are likely to directly affect clients and their financial health. Let’s look at some of these risks and the ways they can be mitigated.

Private health insurance

The Australian Institute of Health and Welfare has indicated that there has been a noticeable rise in hospitalisations that are linked to extreme weather events (heat being the primary cause)1.

In periods of hot weather, the circulatory system works harder to reduce body temperatures. This increased stress on the body can affect the more vulnerable (pregnant women, the elderly, those who are immunocompromised), resulting in increased medicine usage and hospital stays.

Another consideration is the rise of mental health issues related to climate change. Recent research has shown an increased risk of suicide for men in farming communities that are subject to drought conditions2. Other concerns for health insurers will include:

- The spread of diseases due to changing climate conditions – the prevalence of diseases like dengue fever may increase as the areas where mosquitos can spread diseases grow.

- Deteriorating air quality – increasing incidence of bushfires may lead to longer term respiratory illnesses caused by poor air quality.

- Mental illnesses – those surviving extreme weather events are prone to psychological distress.

All of this means that clients may need to allow for significantly increased insurance premiums over time. For investors that believe there will be an increased reliance on healthcare products and services, then an investment exposure like the DRUG Global Healthcare Currency Hedged ETF could be considered.

General insurance

In recent years, extreme weather events have been escalating across the globe. Domestically, we have experienced 11 declared insurance catastrophes since the Black Summer bushfires in 2019/20, with almost 788,000 claims related to floods and storms3.

Clients can expect their premiums to continue to rise, and their policies to become more complex. Financial planners may find it useful to forge ties with insurance brokers who can provide specialist insurance advice. Assisting clients in understanding what level of extreme weather risk their homes will face (now and in the future) will help clients make informed property decisions. A useful starting point may be the climate risk map of Australia published by the Climate Council.

Advisers may also wish to provide the Resilient Building Council site to any clients who have property holdings in bushfire areas. The website (also available via a mobile app) is designed to bring the latest science and expertise on bushfire resilience into the hands of Australian households through an easy-to-use tool. It will measure the bushfire resilience of properties located in bushfire prone areas and provide a customised action plan.

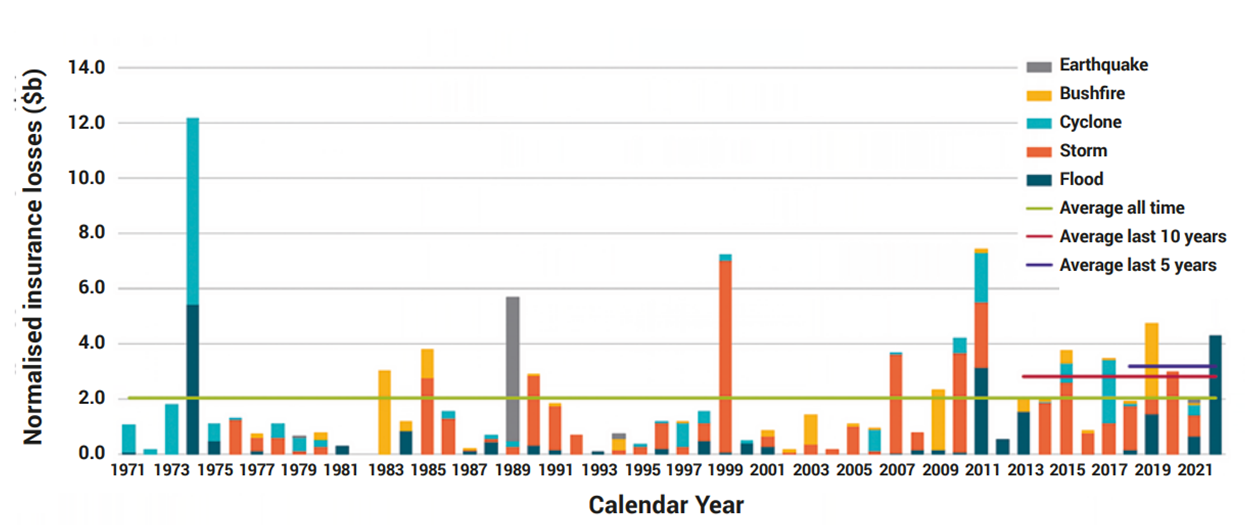

With the current trend of insurance losses (see below) in Australia it is fair to say that most households should expect large increases in insurance premiums over the coming years.

Figure 1: Home insurance affordability and socioeconomic equity in a changing climate

Source: R. Bannon “Home insurance affordability and socioeconomic equity in a changing climate”4

Life insurance

The extremes of heat over multiple days are expected to increase morbidity events in some regions. Changes in air quality, food insecurity and disease all may have long term impacts on the prevalence of cardiovascular and respiratory disease, cancer and cognitive decline. Life insurance companies may be affected by climate change in the following two ways:

- Invested assets – a life insurer may inadvertently invest in a ‘stranded asset’ – one that declines in value due to climate change concerns. It is also expected that extra disclosure and regulatory expenses will be incurred by insurers as climate change reporting intensifies.

- Increased payouts – payouts for related insurance claims (life, TPD, trauma) may increase due to longer term climate changes and increases in natural disasters. The unknown extent and volatility of these events may result in larger increases in premiums. The uncertainty of health outcomes may lead insurers to increase premiums by more than required to provide a sufficient margin of error.

Adoption of level premium policies and taking these on at an earlier age may assist in mitigating these increased costs.

Food Scarcity

Changing weather patterns and affected food production may see a rise in food insecurity. As of 2020 between 720 and 811 million people across the world were affected by hunger. As of 2024 this situation has been worsened5. Many risks that climate change poses will have direct consequences for food security. These risks include;

- Loss of rural livelihoods

- Loss of inland water ecosystems

- The breakdown of food systems

- Loss of marine and coastal ecosystems

Financial advisers may need to adjust upwards the future cashflow predictions used to cover living costs. This may mean using default rates over and above the rate of inflation which is currently used by many advisers to estimate the future cost of living expenses such as food and energy. If food scarcity does become more prevalent, advisers and investors may wish to consider the IEAT Future of Food ETF that invests in companies involved in food production and supply.

Green loans

These loans are available to borrowers who can demonstrate a commitment to minimising their impact on the environment by scoring a minimum of 7 stars under the Nationwide House Energy Rating Scheme6. The scoring is conducted by an independent assessor and focuses on multiple factors. Green loans can be up to 80bps lower than standard lending arrangements. It may be worth reminding clients who are building new dwellings that satisfy these requirements of the existence of such green lending arrangements.

Property prices

A common strategy for many retirees involves generating a lump sum of cash by downsizing. This usually occurs later in life when clients become ‘empty nesters’ or need to live closer to appropriate facilities.

For the adviser who has clients living coastally it might be worth bringing this strategy forward. Analytics firm CoreLogic has estimated that rising sea levels and beach erosion could jeopardise $25 billion worth of Australian residential properties, with $5.3 billion of property at very high-risk levels7.

A worst-case scenario may involve clients paying off a mortgage on a property that is uninhabitable. Many new purchasers in these highly affected areas may not be covered for ‘actions by the sea’.

Figure 2: Top 10 suburbs by number of buildings most at risk

Source: CoreLogic

Cost of living

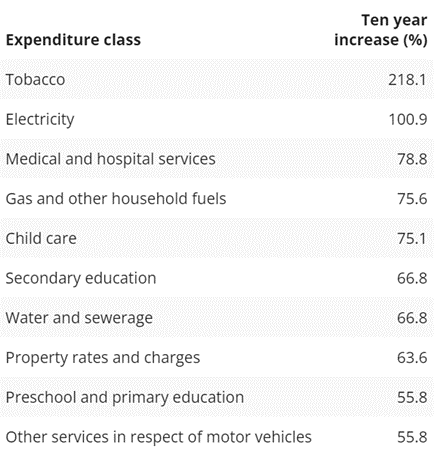

In real terms, energy prices have risen dramatically for households. In the 10 years to March 2019, prices increased by 100% for electricity and 75% for gas.

Figure 3: Highest percentage increases in prices over ten years, 2009 to 2019

Source: ABS, Consumer Price Index, cat. no. 6401.0, ABS, Canberra, 2019, Table 7; Parliamentary Library estimates.

Advisers may wish to encourage their clients (who are thinking about purchasing) to consider newer properties (for both residential and commercial use) as there could be a benefit of up to $2,200 in energy bills for properties-built post 2003 (when efficiency standards were introduced). Clients who own older properties (pre-2003) may wish to consider electrifying appliances and upgrading insulation8.

Estimates from Solar Victoria suggest that the installation of solar panels could result in savings of around $1,073 per annum. Financial planners may wish to consider allocating lump sums for these expenditures in their budgeting and modelling.

Conclusion

It seems clear that many aspects of the financial planning process will be affected by climate change. The affordability of insurance (general, life and health insurance) and the valuation of assets (shares/property) are all susceptible to climate change. Helping clients limit the financial impact of climate change can add significant value to the relationship.

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) (Betashares) is the responsible entity and issuer of the Betashares Funds. Before making an investment decision, read the relevant Product Disclosure Statement, available at www.betashares.com.au, and consider whether the product is right for you. You may also wish to consider the relevant Target Market Determination, which sets out the class of consumers that comprise the target market for each Betashares Fund and is available at www.betashares.com.au/target-market-determinations.

Investments in Betashares Funds are subject to investment risk and the value of units may go up and down. The performance of any Betashares Fund is not guaranteed by Betashares or any other person.

Sources:

1.https://www.aihw.gov.au/news-media/media-releases/2023/2023-november/extreme-weather-is-leading-to-more-injury-hospitalisations-with-heat-being-the-main-cause ↑

2. Hanigan, IC, Butler, CD, Kokic, PN, Hutchinson, MF. (2012). Suicide and drought in New South Wales, Australia, 1970-2007. https://doi.org/10.1073/pnas.1112965109 ↑

3. Insurance council of Australia, Insurance Catastrophe Resilience Report, 2021-22 ↑

4. https://www.actuaries.digital/2022/08/17/home-insurance-affordability-and-socioeconomic-equity-in-a-changing-climate/ ↑

5. https://emergencyaction.org.au/eaa-2021/posts/the-impact-of-climate-change-on-food-security#:~:text=Broadly%20speaking%2C%20the%20result%20of,unrest%2C%20conflict%2C%20and%20migration. ↑

6. https://mozo.com.au/home-loans/articles/green-home-loan-options-grow-for-eco-friendly-borrowers ↑

7. https://www.abc.net.au/news/2022-03-28/climate-change-risks-billions-of-dollars-of-coastal-property/100943830 ↑

8. https://energyconsumersaustralia.com.au/news/how-to-close-the-energy-divide#:~:text=Results%20from%20December%202023%20indicate,by%20the%20highest%20earning%20group. ↑