7 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Quarterly commentary from the Betashares Investment Strategy team. Providing an overview on global equity market performance, company earnings, valuations and fundamentals, asset class correlations, and asset flows.

Q4 2024

Global Equities

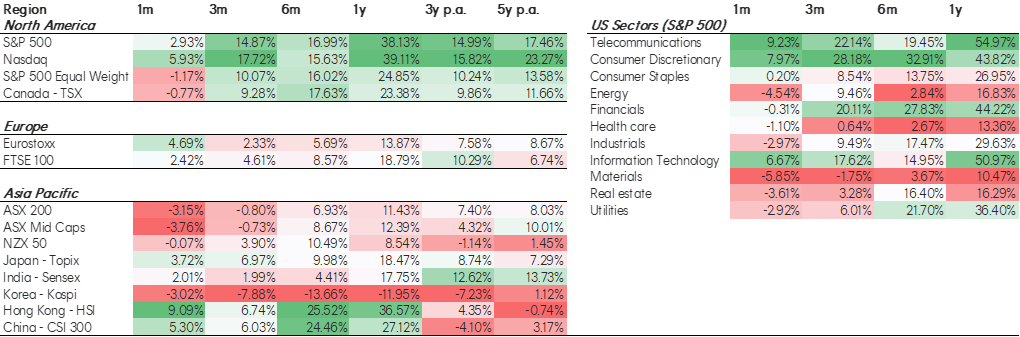

- The final quarter of 2024 was dominated by news flow around the US election which ultimately resulted in Donald Trump securing a second term for presidency and US equities outperforming global peers by some margin.

- The decisiveness of Trump’s victory provides him with a clear mandate for change which supported a US equity rally as investors pre-empted pro-business pro-America policies like tax cuts and deregulation within the US economy. Within the US, returns were led by the Consumer Discretionary, Telecommunications, and Financials sectors – all posting higher than 20% gains in the quarter. The Magnificent 7 also performed strongly versus the rest.

- Outside of the US, recession fears and political turmoil saw muted returns for the Eurozone. The HCOB Eurozone Manufacturing PMI fell dramatically over the third quarter into contractionary territory signalling a sharp decline in manufacturing, a continuation of the two-year trend. Meanwhile Germany’s governing coalition collapsed in November and the French Prime Minister lost a vote of no confidence triggering a collapse of the government.

- Japanese equities benefitted from Yen weakness and China faltered due to muted government follow up on stimulus details and the impending tariff war with the US.

Betashares Global Equity Markets Monitor – 31 December 2024

Source: Bloomberg, Betashares. As at 31 December 2024. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Australian Equities

- Australian equities posted negative returns for the final quarter of 2024. In a continuation of this year’s trend, the materials sector posted the worst returns, this time owing to disappointment around China’s lack of stimulus follow up, while financials posted the highest returns, again led by Australia’s big banks.

- Much has been talked about the stellar run of Australia’s banks this year. Explaining this performance may be that this sector was the only segment on the ASX to experience upward earnings revisions throughout 2024, while earnings from the Materials sector fell significantly.

Source: Bloomberg. As at 8 January 2025. Reflects changes in consensus Bloomberg earnings estimates for FY24 EPS from January 2024 to December 2024 for select ASX sectors.

- Nevertheless, the starting point for the Australian Banks’ rally was one with already expensive valuations and their expected earnings had only improved from negative to flat throughout the year. This means that Australian equity investors will enter 2025 with the same question on their mind – what to do about our historically expensive banks and their anemic earnings outlook? Looking to pockets of the ASX with strong earnings growth expectations may be the answer – high quality companies and tech come to mind.

Betashares Australian Equity Market Monitor – 31 December 2024

Source: Bloomberg, Betashares. As at 31 December 2024. MSCI World Factor Indices used to represent factor returns. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Corporate Earnings – US Q3 24’

- The banking sector was a clear winner from US Q3 reporting as every large cap bank reported a high-quality earnings’ beat driven by a resurgence in capital market fees. This was an experience shared by the Royal Bank of Canada as trading and investment banking revenues rebounded in major global markets.

- With banking volumes relative to GDP for M&A activity and debt and equity capital markets in the US coming off three-decade lows, there is optimism for a long runway of growth ahead. In earnings calls, management teams pointed to strong pipelines building as the macro environment normalises and financial sponsors gain confidence in the next phase of the cycle.

- More broadly the S&P 500 reported growth in earnings of 5.8%, the fifth straight quarter of earnings growth for the index carrying strong momentum in 2025, with 75% of companies reporting above estimate EPS.

Source: Bloomberg, Betashares. Q3 ‘24 earnings growth surprises of S&P 500 sectors. Past performance is not an indicator of future performance.

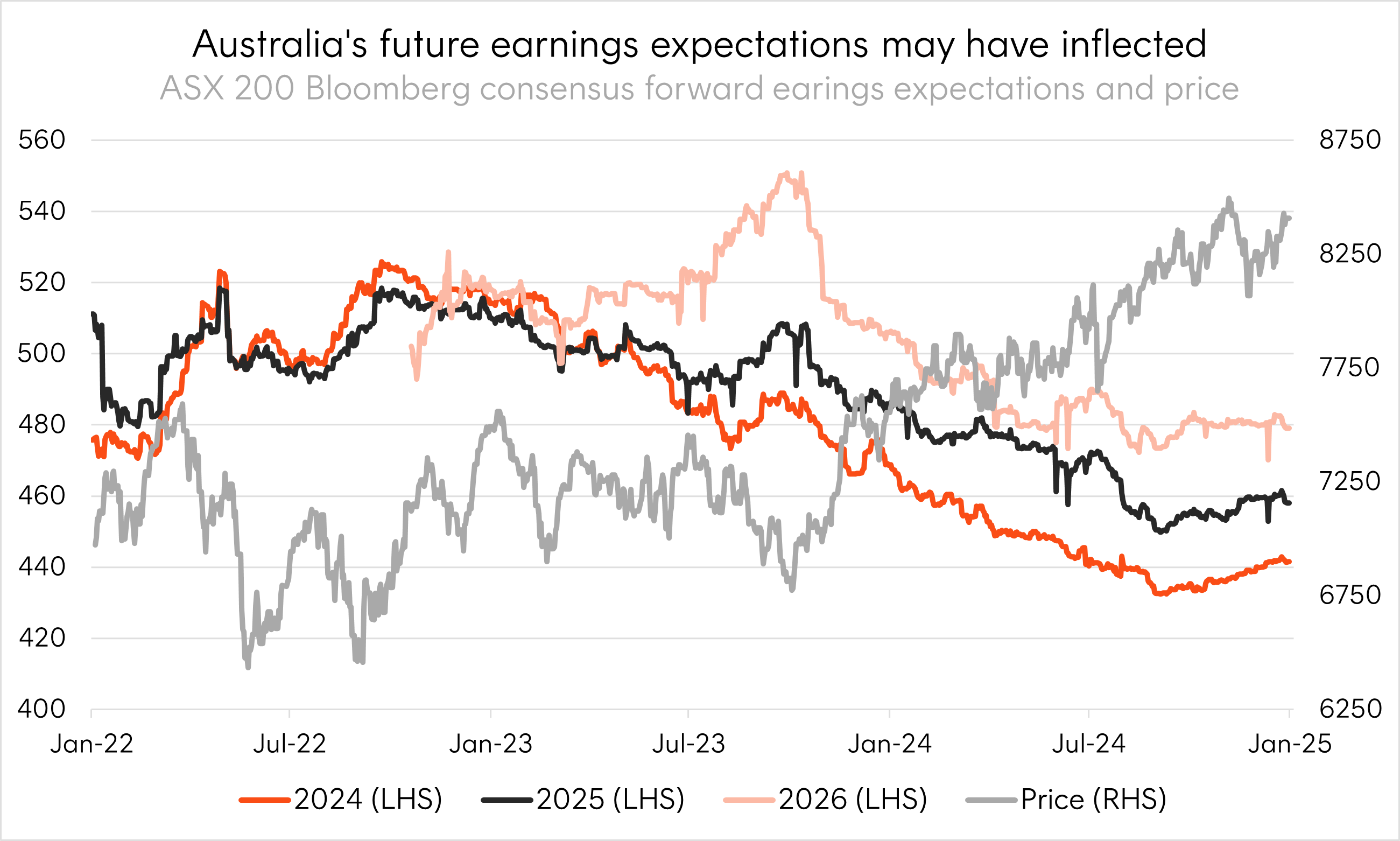

Corporate Earnings – Australia H1 25’

- Earnings per share for the S&P/ASX200 index fell in the last two financial years, and the broad-based downgrades throughout 2024 are not an encouraging sign for 2025. However future earnings inflected from a low point during Q4 which can hopefully be sustained into 2025.

- February will bring the first reporting season in Australia for 2025. With the low earnings growth outlook at the index level, investors will have a keen eye on both results and outlooks. We may see a higher than usual reward for companies posting positive results as investors are still looking for signs of how to navigate growth in Australia’s equity market in 2025.

Source: Bloomberg. As at 28 January 2025. Bloomberg consensus earnings estimates revisions for 2024, 2025, and 2026 since 31 December 2022. Actual results may differ.

Valuations and fundamentals

- Valuations remained central to the market narrative for investors into the end of 2024 with a continuation of outperformance by large/mega-caps in Australia in the US.

- Within the US equity market, a 30% premium has opened up between the S&P Index and its Equal Weighted counterpart. Historically the two have traded closer to par. This premium has been justified by many due to the strong earnings and monopolistic nature of the Magnificent 7. However, it does open these companies and the market as a whole to any fragility if either of these narratives are challenged.

Source: Bloomberg. February 2010 to January 2025. You cannot invest directly in an index. Past performance is not an indicator of future performance.

- Historically in Australia the Financial and Materials sector have tended to find themselves at the opposite ends of their respective cycles, benefitting investors. However, with the prospect of synchronised underwhelming earnings from both banks and miners, investors may need to consider how they can reduce cyclicality in their portfolios heading into 2025.

Betashares Global Equity Markets Monitor – 31 December 2024

Source: Bloomberg, Betashares. As at 31 December 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk.

To the extent permitted by law Betashares accepts no liability for any errors or omissions or loss from reliance on the information herein.