13 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Quarterly commentary from the Betashares investment strategy team. Providing an overview on global equity market performance, company earnings, valuations and fundamentals, asset class correlations, and asset flows.

Q3 2024

- Q3 2024 marks the point where the Fed’s singular focus on price stability and inflation shifted towards the second part of their mandate – employment and economic resilience – as a global interest rate cutting cycle commenced. Equities have so far responded positively overall however a rotation in market leadership in both the US and Australia may be underway.

- A Bank of Japan rate hike and fresh Chinese stimulus showed how domestic policy can reverberate to impact equity markets on a global scale.

- As markets enter a new phase of this cycle investors should revisit positioning across and within asset classes. We highlight the potential benefits of exposure to greater market breadth, global healthcare, gold, and duration during rate cutting cycles.

Global Equities

- Quarter three of 2024 was bookended by a third consecutive soft US CPI print at the start, all but confirming Fed rate cuts, and the first of those cuts at the end, with the Fed opting for a 50bps decrease to get a head start on reaching ‘neutral’.

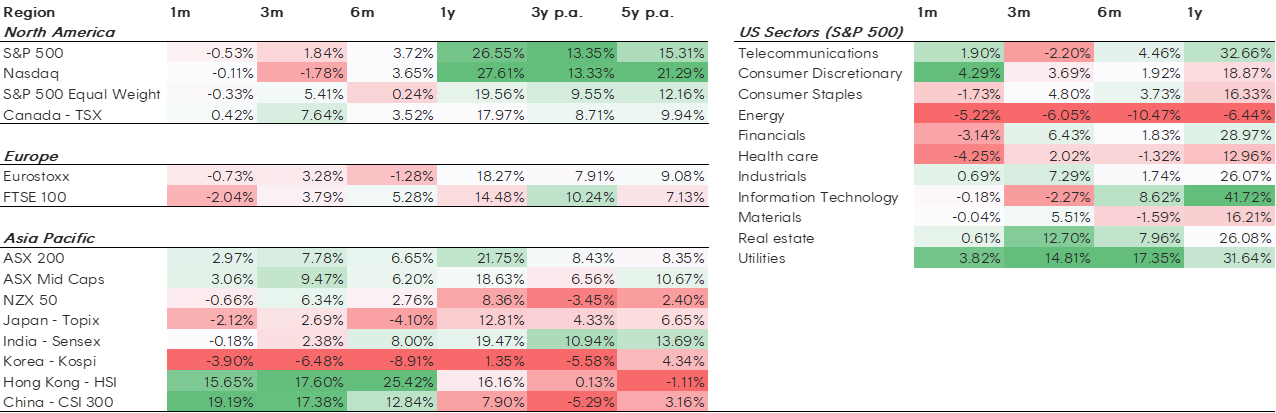

- Within US equity markets the expectation of rate cuts after June’s CPI print marked the start of a rotation out of mega-cap technology stocks as market breadth improved – with every sector outside of information technology, telecommunications and energy posting positive returns. Investors are betting that interest rate cuts will boost the rest of the US market, helping it catch up to the recent outperformance of mega-cap tech stocks, whose balance sheets actually benefited from earlier rate hikes.

Source: Bloomberg. 1 July 2024 to 30 September 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance.

- A Bank of Japan (BoJ) rate hike in July caused an unravelling of the ‘Yen carry trade’ and a one-day bear market in Japanese equities that threatened to derail global equity markets. Normalcy quickly returned suggesting that this was primarily a positioning and deleveraging event rather than signs of an imminent US recession or global slowdown that some feared. The next major domestic catalyst for Japan comes on October 27th , with the snap general election called by new leader of the Liberal Democratic Party (LDP) and incoming Prime Minister, Shigeru Ishiba.

- China’s central bank and Politburo announced coordinated monetary and fiscal stimulus measures at the end of the quarter, marking the most significant attempt to sure up economic growth in the face of a failing property market. The changes suggest the government is serious about China’s growth problems. While the policies have boosted the stock market it is yet to be seen how far they will go in solving China’s structural problems.

- Indian equities had another strong quarter boosted by a thriving IPO market. Indian listings have raised $US8.6b thus far in 2024 already outpacing levels reached over the past 2 years and accounting for ~25% of IPOs globally.

Betashares Global Equity Markets Monitor – 30 September 2024

Source: Bloomberg, Betashares. As at 30 September 2024. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Australian Equities

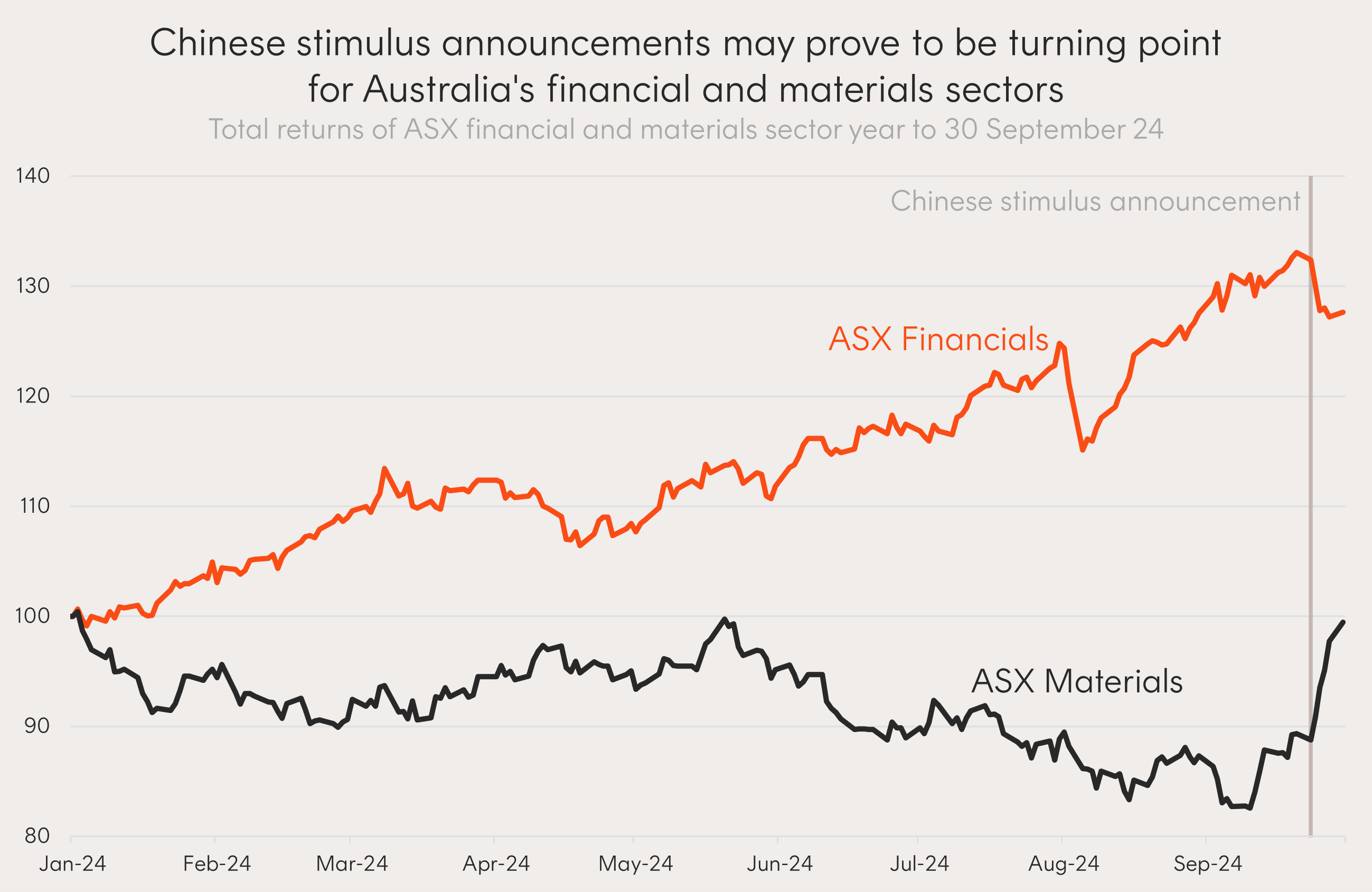

- Australian equities had a stellar quarter as the best performing developed equity market, with 7 out of 11 sectors posting returns above 7% and only the energy and utilities sectors negative. Despite concerns around recent valuation led performance CBA and the financial sector continued to defy analyst expectations remaining the largest contributors to the ASX’s returns on a stock and sector level (contribution accounts for total return and weight in the index).

Source: Bloomberg. As at 30 September 2024.

- However, China’s stimulus announcements, which saw iron ore futures rise above $US100, may prove to be the catalyst for a rotation out of financials and into the other big part of our equity market – the materials sector. Materials posted Q3 double digit returns and outperformed the financial sector for the first quarter this year, with plenty of room still to make up. Support for this rotation will hinge on whether China’s stimulus can stir the economy’s slump rather than just its stock market.

Source: Bloomberg. As at 30 September 2024.

- Australia’s information technology sector outperformed the US’ by 18% this quarter, an incredible run having returned 58% over the past 12 months. Strong earnings results reported during Q3, which saw global supply chain software developer Wisetech report 23% growth in EPS and leading hospital IT provider Pro Medicus increase profits after tax by 37%, put on display the robustness and growth potential of Australia’s technology companies.

Betashares Australian Equity Markets Monitor – 30 September 2024

Source: Bloomberg, Betashares. As at 30 September 2024. MSCI World Factor Indices used to represent factor returns. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Corporate Earnings – US Q2 24’

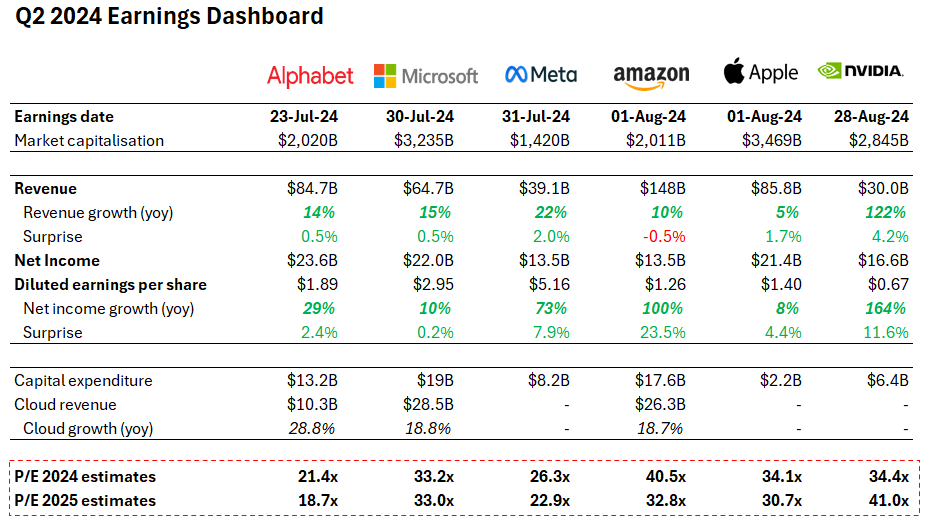

- Earnings season in the US continues to be headlined by the ‘Magnificent 7’ tech stocks given their importance and weighting in market indices like the S&P 500 and Nasdaq, with their performance driving a large portion of returns this year.

- Their Q2 2024 results were largely positive with relatively strong revenue and earnings growth across all business segments – including digital advertising, search, e-commerce and cloud services. Most exceeded consensus analyst forecasts for both revenue and earnings, highlighting the importance of maintaining some exposure to established market leaders. However, there were some mounting concerns around the level of capital expenditure required to support the build out of data centers and servers with $1 trillion in cumulative spending expected over the next five years across Microsoft, Alphabet, Meta and Amazon.

Source: Bloomberg. Market capitalisation and P/E estimates data as of 23 September 2024. Revenue, earnings and capital expenditure data as at relevant company’s earnings date. In US dollars. Tesla excluded on the view that its business model is not within the same supply chain as the companies represented above.

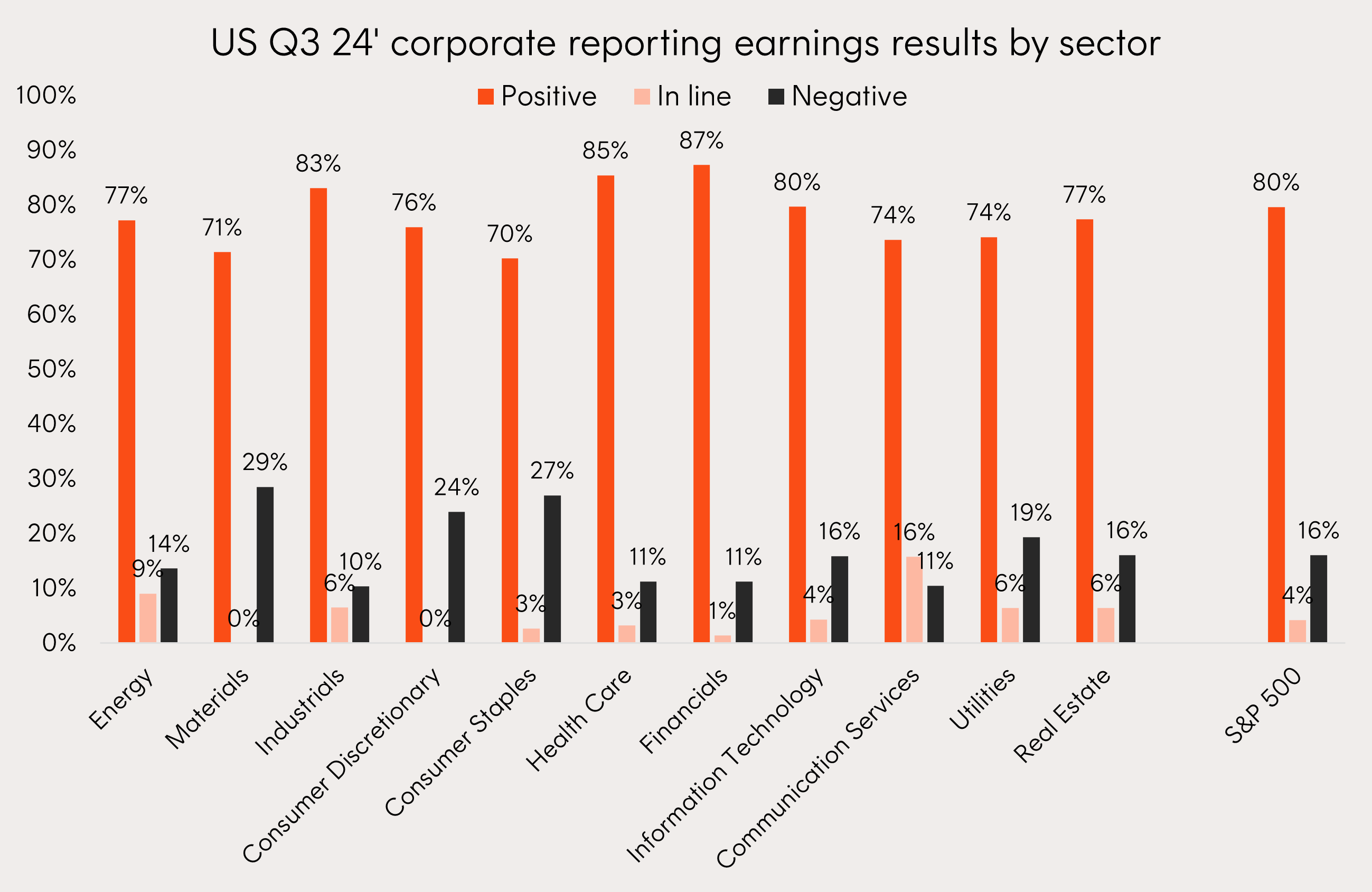

- Beyond technology, we saw a broadening out of US equity market performance in the third quarter of 2024. Sectors such as Real Estate, Utilities and Industrials performed well as the prospect of interest rate cuts, falling inflation, and robust economic growth is generally supportive for these industries. Notably, 80% of companies on the S&P 500 reported positive earnings surprises compared to just 16% which had negative earnings surprises.

- However, there were some concerns around lower income US consumers ‘trading down in quality’ (i.e., consumers purchasing lower quality/lower cost goods) which were highlighted in the earnings call of companies like McDonalds and Keurig Dr Pepper.

Source: Bloomberg, Betashares. Earnings of S&P 500 companies. Past performance is not an indicator of future performance.

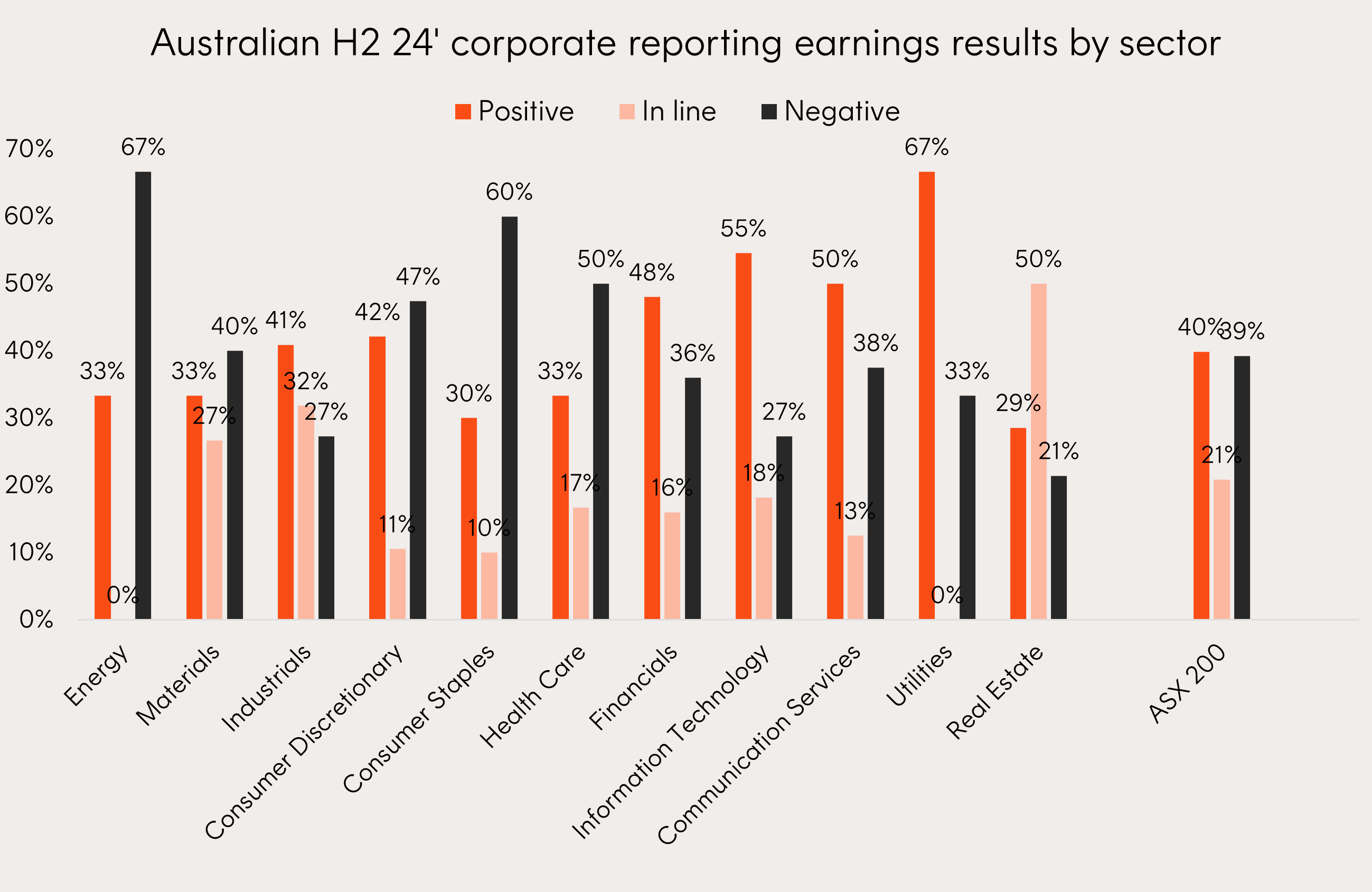

Corporate Earnings – Australia FY2024

- Results from the Australian earnings season were mixed, with an even proportion of companies beating and missing earnings expectations. The outlook remains challenging with higher input costs and interest rates affecting company margins. Indeed, ASX 200 FY24 EPS actually fell by 4.6%, marking a second straight year of falling profits for the index. FY2025 guidance generally remains cautious, particularly for some of the largest 20 companies on the ASX which face structural earnings headwinds.

- Australian banks have been strong outperformers year to date, but early signs of asset quality deterioration are appearing with higher interest rates and cost of living pressures impacting loan serviceability. Earnings are forecast to be flat over the next year for the S&P/ASX 200 Banks Index. The miners (such as BHP, Rio Tinto, etc.) also flagged commodity price headwinds due to the economic slowdown in China, prior to the more recent stimulus announcements.

- There were some brights spots among growing market leaders outside of the top 20 such as JB HiFi and REA Group which continue to see sales growth supporting share prices. Investors can look beyond the largest stocks on the ASX for a broader opportunity set of businesses and sectors to invest in. This dynamic part of the Australian market is also expected to see strong earnings growth of around 13.5%1 for the next year whilst providing immediate sector diversification benefits to an Australian equities portfolio.

Source: Bloomberg, Betashares. Earnings of ASX 200 companies. Past performance is not an indicator of future performance.

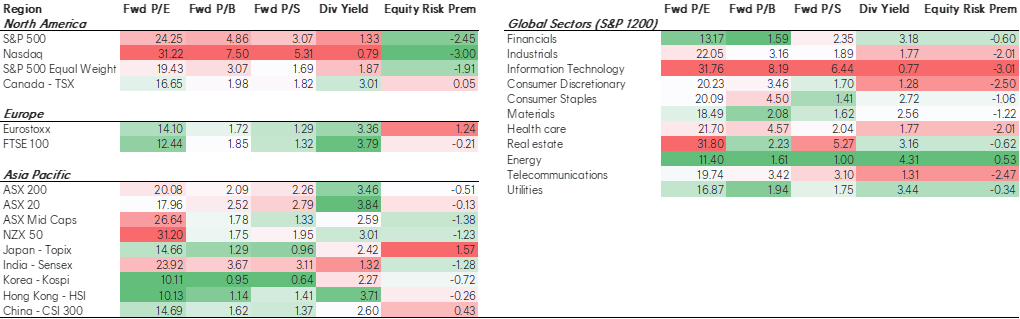

Valuations and fundamentals

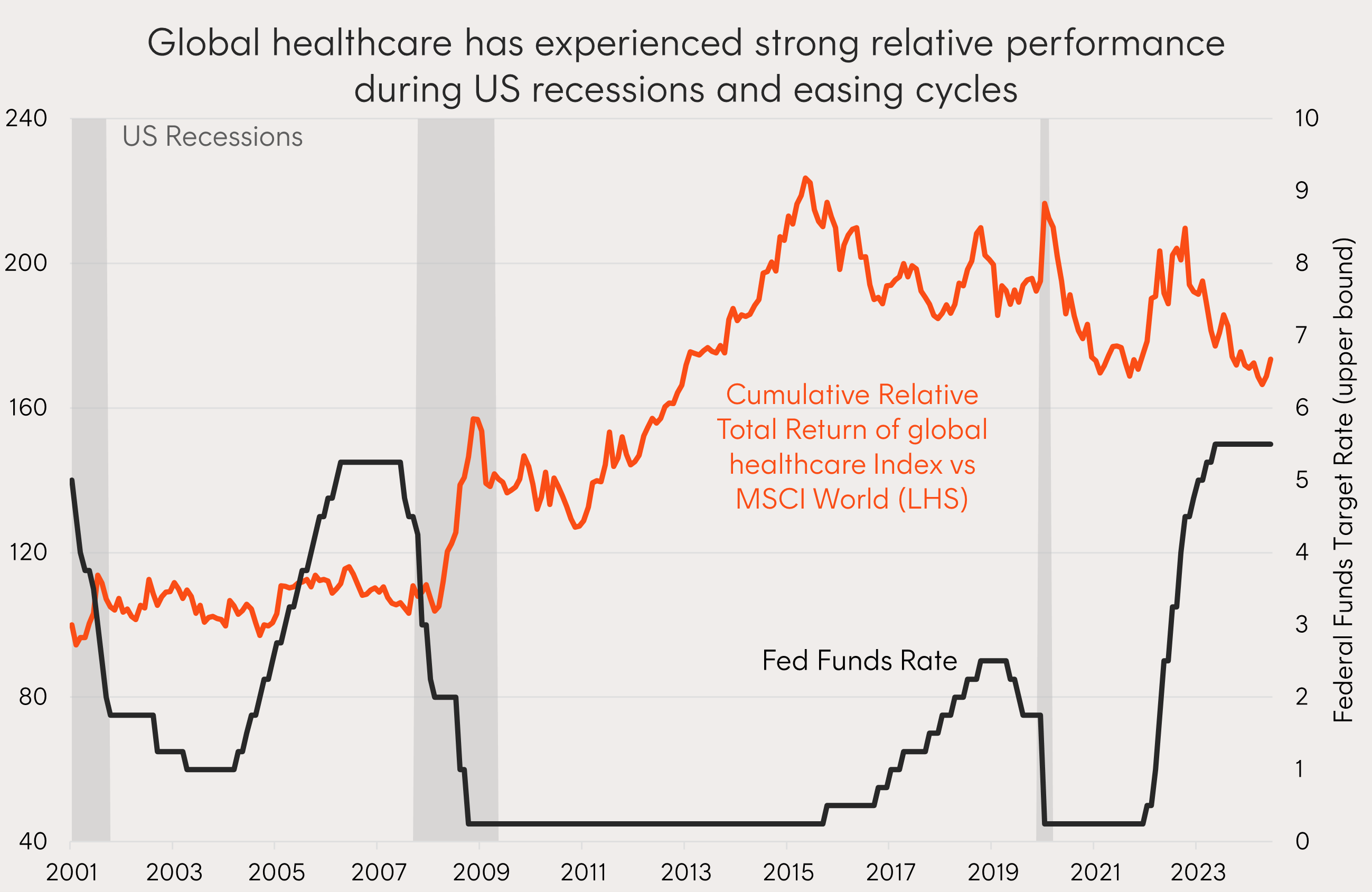

- Switzerland, Sweden, Canada, the Eurozone, New Zealand, the UK, and now the US have all cut interest rates as a global cutting cycle commences. Lower interest rates could be supportive of equity valuations broadly, as future earnings are discounted at a lower rate, so long as the soft-landing assumption remains. However, cutting cycles have historically come during or been precursors to recessions and investors may also start allocating to areas that have historically outperformed and provided defensive benefits during this phase of the cycle:

- Global healthcare is one sector that has defensive properties, with inelastic demand for products and with structural tailwinds from ageing populations, which has historically experienced strong relative performers during past rate cutting cycles.

Source: Bloomberg, Betashares as at 31st July 2024. Global healthcare index represented by Nasdaq Global ex-Australia Healthcare Hedged AUD Index. MSCI World returns in AUD. You cannot invest directly in an index. Past performance is not an indicator of future performance.

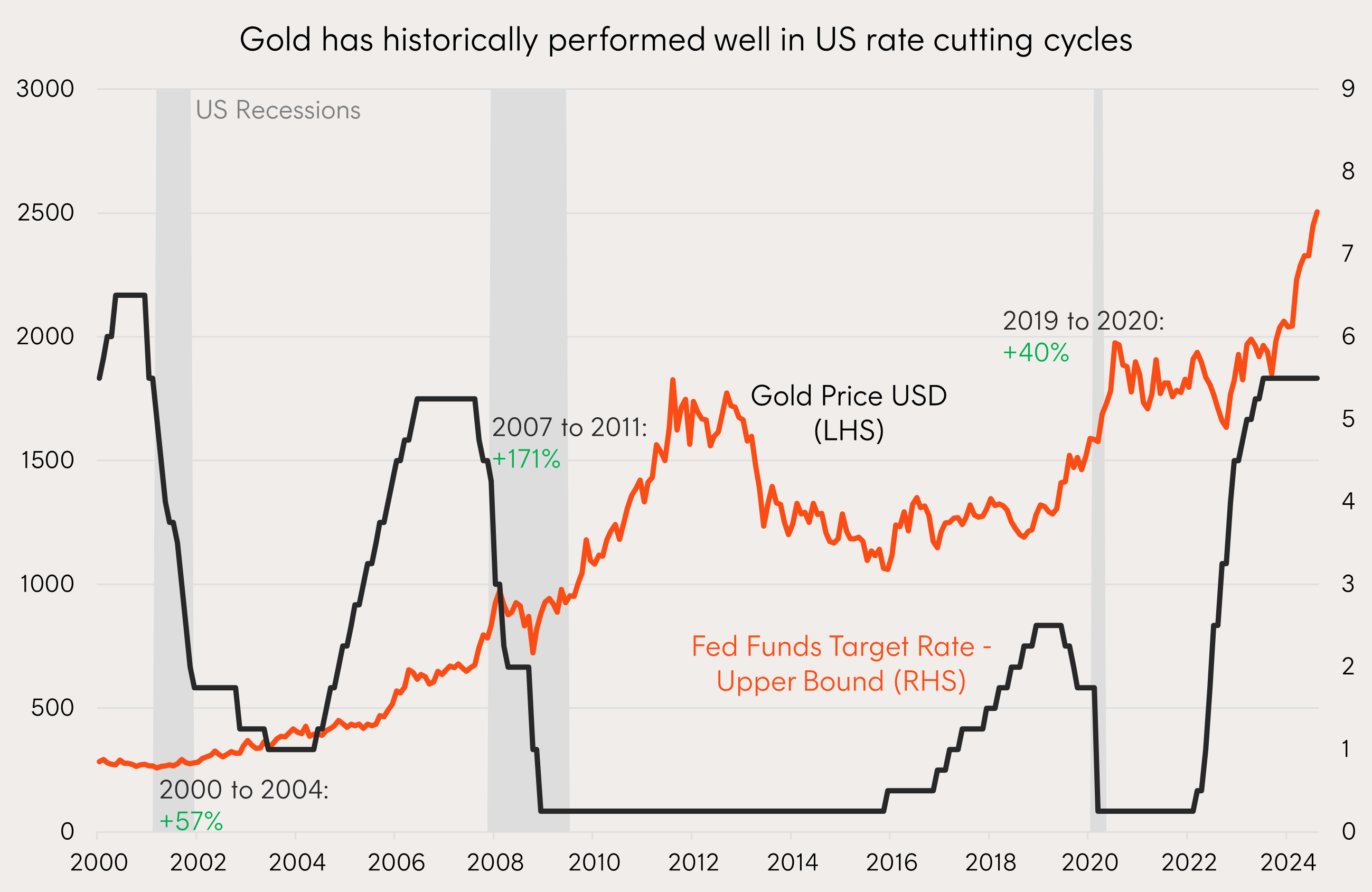

- Gold, which is already trading at all-time highs, is another historical beneficiary of rate cutting cycles. Where government bond yields fall faster than long run inflation expectations, the difference between the two, the real yield, will fall. As a result, gold becomes relatively more attractive as an asset. In response to the 2000, 2017, and 2019 rate cutting cycles gold returned 57%, 171%, and 40% respectively. Gold miners are another option for this trade as a proxy to the increasing gold price – gold miners have outperformed the gold price return over the past 12-months.

Source: Bloomberg. As at 30 September 2024. Gold return dates are 29 December 2000 to 31 March 2004, 31 August 2007 to 31 August 2011, 28 June 2019 to 31 July 2020. Past performance is not an indication of future performance.

Betashares Valuations and Fundamentals Equity Markets Monitor – 30 September 2024

Source: Bloomberg, Betashares. As at 30 September 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Asset Class Correlations

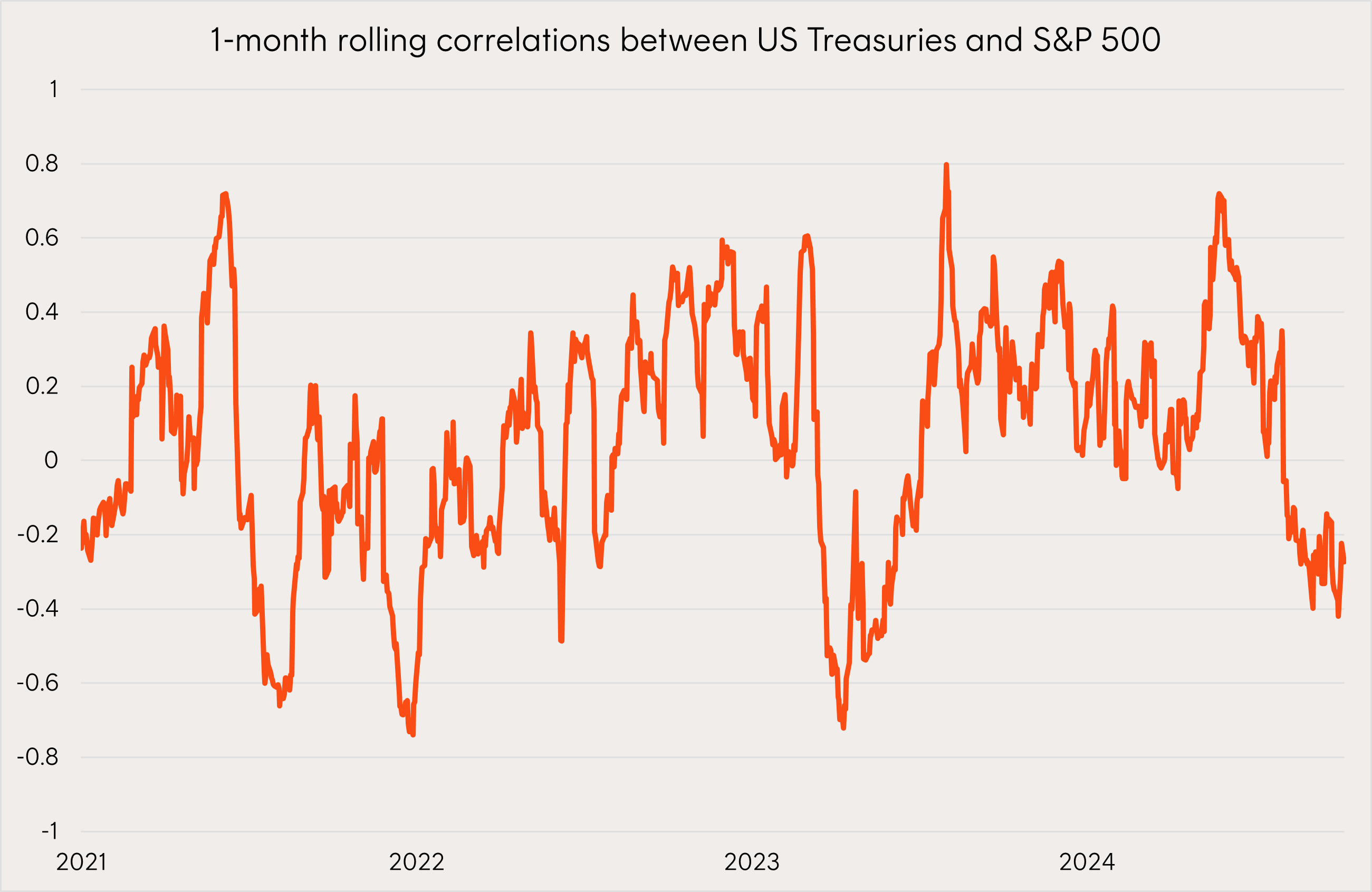

- Q3 2024 marked a major change in the market zeitgeist as for the first time since early 2021 focus shifted from inflation to slowing growth, the labour market, and overall health of the economy. Weaker data, which had previously been viewed as a positive to mitigate any further rate hikes, will now point to the potential for a harder landing and further rate cuts. As a result, correlations between stocks and bonds have been trending further negative. Asset allocators, following years of reducing duration in favour of returns from credit allocations, now have a strong impetus to reconsider their fixed income allocations and how they will serve portfolios in a risk off environment.

Source: Bloomberg. As at 30 September 2024.

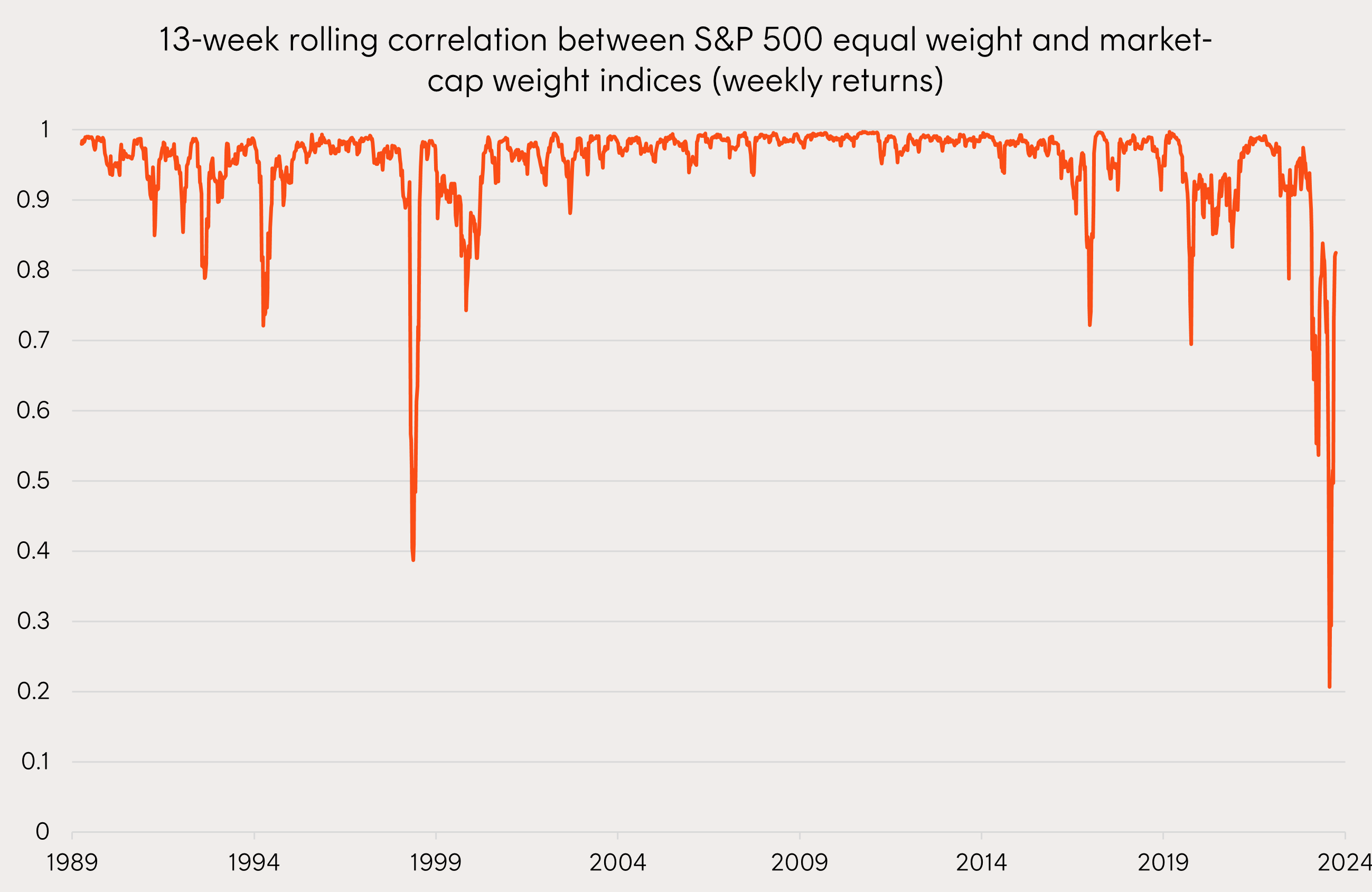

- Within US equity markets the dislocation between the performance of a few tech mega-caps and the rest of the market has led to a remarkable decline in the correlation between the S&P 500 and S&P 500 equal weight (S&P EW) indices. While both indices hold the same 500 companies the S&P 500 currently has 25% weight to both the top 5 and bottom 400 names, compared to 1% for the top 5 and 80% for the bottom 400 in the S&P EW. The influence the largest names are having on the S&P 500 performance saw correlations between the two indices fall below 0.4, leading the equal weight index to provide greater diversification benefits than in any time over the past 45 years.

Source: Bloomberg. As at 30 September 2024.

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk.

To the extent permitted by law Betashares accepts no liability for any errors or omissions or loss from reliance on the information herein.

Reference:

1. Bloomberg consensus earnings forecasts for Solactive Australia ex-20 Index. As at 25 September 2024. ↑