10 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Quarterly commentary from the Betashares investment strategy team. Providing an overview on global equity market performance, company earnings, valuations and fundamentals, asset class correlations, and US ETF flows.

Q1 2024

- Both in Australian and globally equity market strength began to broaden in the first quarter of 2024 as a cyclical economic recovery was underway. However, how and when rate cutting cycles begin remains in focus and poses the biggest threat to equity markets.

- Strength in the US’s mega-cap technology stocks headlined the Q4 23’ corporate reporting season alongside a focus on margins. In Australia the biggest takeaway from H2 23’ corporate reporting was the resilient consumer allowing the ASX to continue its breakout from a 2-year sideways trading market.

- From a valuations standpoint the market is bifurcated and recently unloved value and cyclical sectors may provide opportunities as if this bull market continues to run, the broader the rally will likely be. Asset classes broadly remain strongly correlated but the heightened levels of bond yields provides confidence that fixed rate bonds can play their traditional defensive role if any left tail risk events emerge.

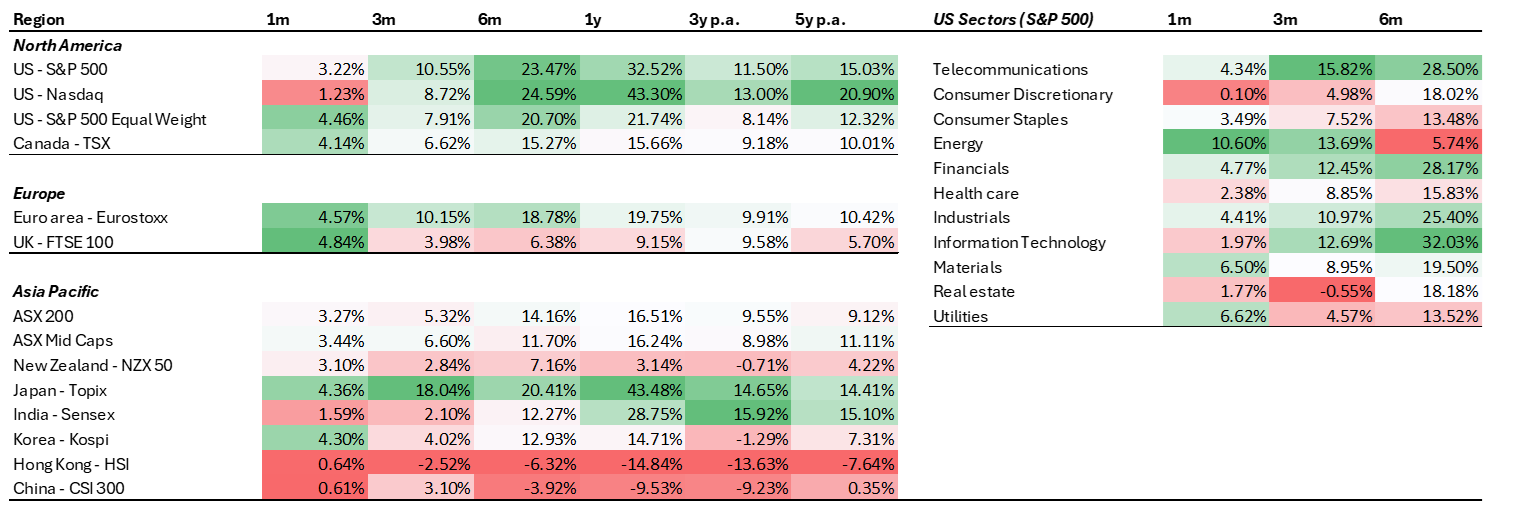

Global Equities

- The first quarter of 2024 saw several region’s equity markets trade at all-time highs (US, Europe, Japan, India, Australia) as a shift from US tech exceptionalism to a broadening out narrative began. Resilient economic growth and low unemployment coupled with moderating inflation led markets higher. The latter factor (inflation) points to rate cuts in spite of the former (resilient growth) – a goldilocks scenario.

- Nevertheless, uncertainty on when a rate cutting cycle will commence remains front and centre, with expectations for the US cuts pushed back into the second half of 2024 and 2025 (~50% chance of cut in June).

- Within the US five sectors saw double digit gains in Q1. Most notably recent cyclical laggards: Energy, Financials, and Industrials, giving the first indication of a paradigm shift from growth to value with recession fears in the back mirror and a cyclical recovery underway. In a scenario where rate cuts continue to be delayed these sectors could continue to benefit from a broadening out of equity market returns and be a good place to hide out as they have traditionally been resilient to yields edging higher.

- Elsewhere investors taking note of a plethora of positive news surrounding Japan saw significant levels of foreign investments allow Japanese equities to continue their impressive run – leading even the Nasdaq 100 over the quarter and on a 1-year basis.

- After a tough couple of years Chinese equities may have found a floor in January, with early signs of a recovery in February and March.

- Notably the UK, Korean and European markets outperformed the US in March. Market breadth will be a trend to follow as now may be the time that the US and Japan pass the torch to markets where sentiment has been the worst to continue the next leg of this global market rally.

Betashares Global Equity Markets Monitor

31 March 2024

Source: Bloomberg, Betashares. As at 28 March 2024. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

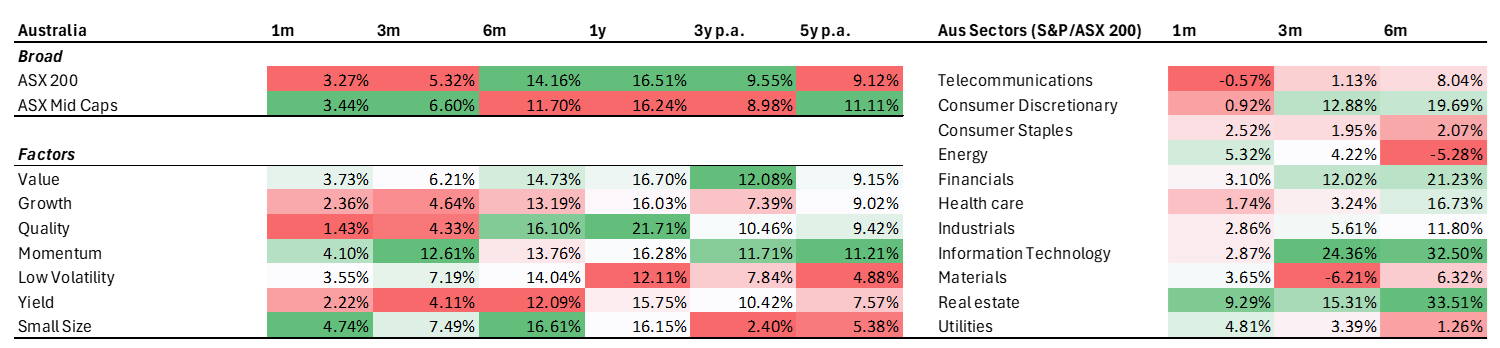

Australian Equities

- The Australian market continued its march higher in Q1, but with declining forward earnings the 6-month rally has been driven by PE expansion. In doing so Australia joined the pack of global markets reaching all-time highs during the quarter.

- While macroeconomic challenges remain, namely China’s property slowdown weighing on iron-ore prices, and interest rates remaining restrictive, economic resilience and the promise of lower rates in the face of these headwinds saw broad equity market strength. All but the Materials sector provided positive returns in Q1.

- Australia’s Information Technology sector led the way posting a 24% return in the first quarter. With investors looking for growth and to benefit from any market mean reversion, with a recent favouring of smaller sized companies which had underperformed larger caps globally since the start of rate hikes, Australia’s small sized technology sector may be a compelling place to seek to benefit from both.

- Of note, Australia’s consumer discretionary sector also provided double digit returns in what was a positive reporting season, for a sense check on the Australian consumer (commentary on corporate earning’s seasons below).

Betashares Global Equity Markets Monitor

31 March 2024

Source: Bloomberg, Betashares. As at 28 March 2024. MSCI World Factor Indices used to represent factor returns. Denotes index performance. You cannot invest directly in an index. Past performance is not an indicator of future performance.

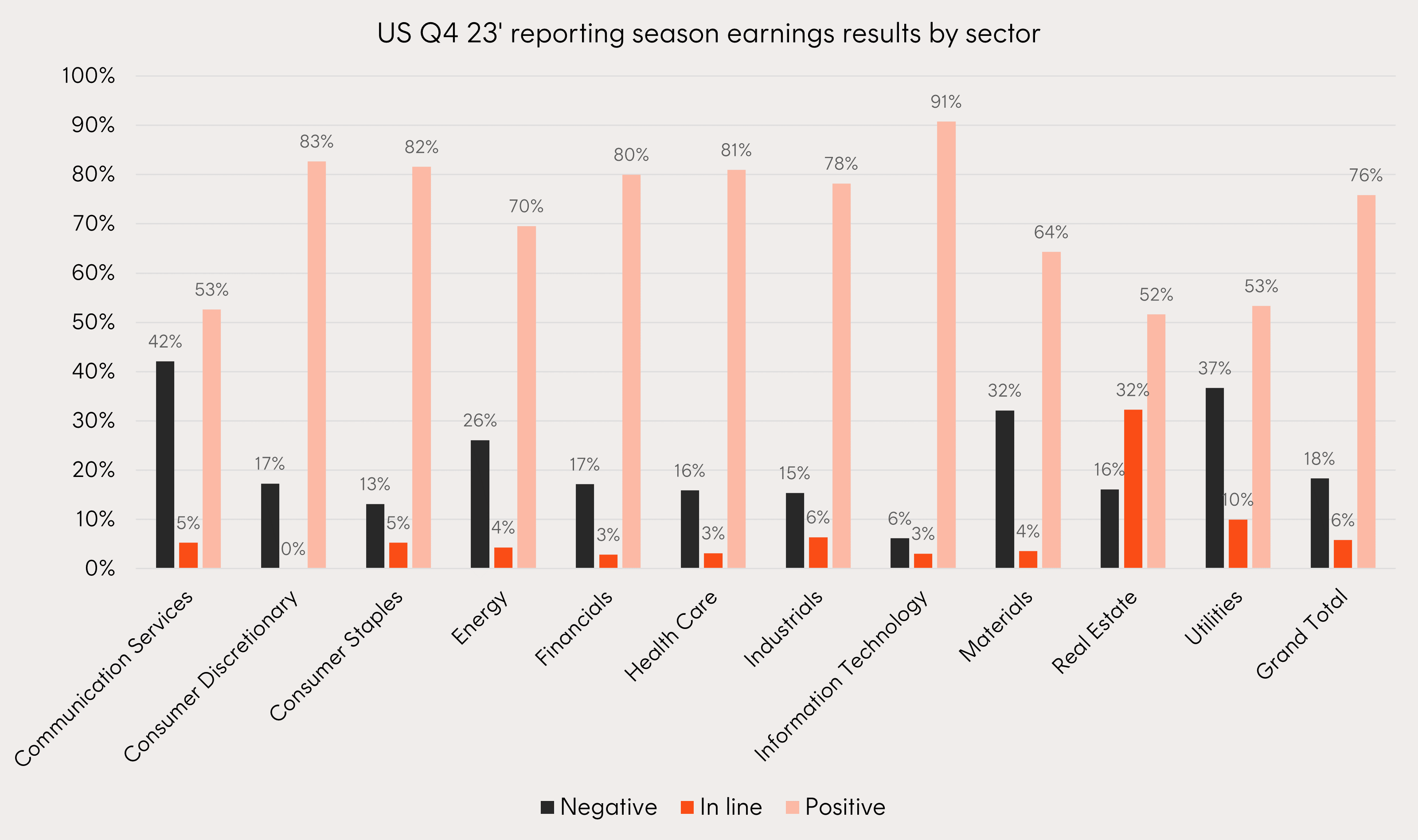

Corporate Earnings – US Q4 23’

- The US Q4 23 earnings reported in the first quarter of 2024 were headlined by Nvidia and co (the ‘Magnificent 7’) with all but Tesla reporting strong growth numbers and exceeding the market’s lofty expectations. On aggregate the ‘Magnificent 7’ reported earnings growth of a remarkable 56%. This growth once again supported recent exceptional price growth.

- On the question of whether US tech can continue this run, so long as they can continue to meet or beat market expectations their prices may remain justified. On a 2yr forward looking basis the Nasdaq 100’s P/E falls to a palatable 22x if expected earnings are realised. Missing expectations on the other hand would likely lead to a meaningful correction. Take Tesla as an example, which traded down ~18% in the 2-months following the reporting of their most recent earnings miss.

- Margins were also in focus. Mentions of layoffs on earnings calls reached levels not heard since the pandemic. These layoffs were part of a bigger theme of companies looking for efficiencies to improve net profit margins. In light of this a majority of S&P 500 sectors successfully reported improved net profit margins with markets generally rewarding those that did.

Source: Bloomberg, Betashares. Earnings of S&P 500 companies. Past performance is not an indicator of future performance.

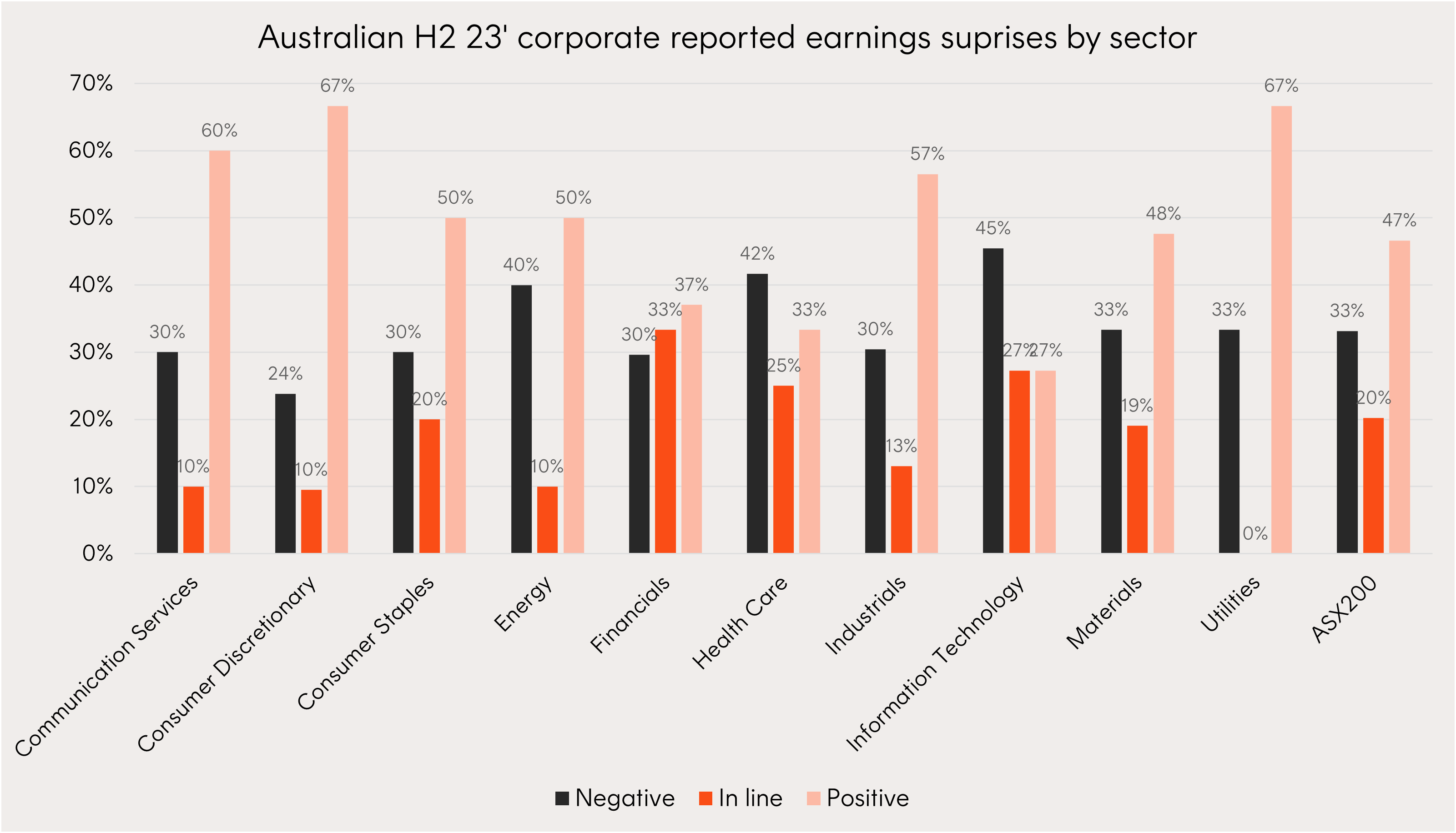

Corporate Earnings – Aus H2 23’

- In a case of ‘better than feared’ the Australian earnings season surprised investors in terms of corporate resilience, governance, and positive forward guidance. 47% of companies beat expectations, compared to 33% missing.

- Possibly the key takeaway and reason for the general positivity was around resilience of the Australian consumer. Consumer discretionary companies reported an outsized number of positive earnings surprises, and the sector experienced 5% higher earnings than expected. Tax cuts plus possible RBA rate cuts in the back half of 2024 add to hopes of an improving outlook for the retail sector.

Source: Bloomberg, Betashares. Earnings of S&P/ASX 200 companies. Past performance is not an indicator of future performance.

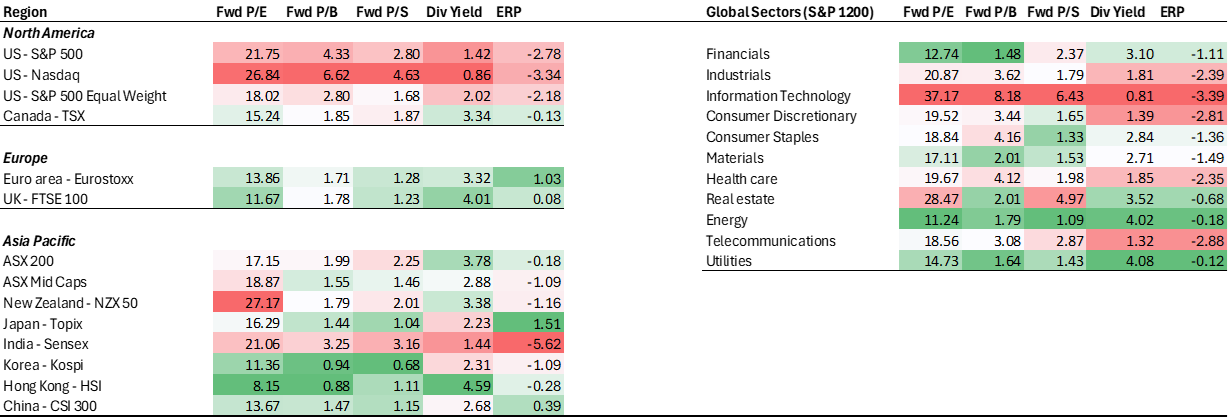

Valuations and fundamentals

- Another strong quarter of equity market returns has seen global valuations stretch to levels that could be considered historically uncomfortable: MSCI ACWI 17.7x. However, this only tells half of the story as within regions and sectors there remains a clear valuation divide.

- At a regional level the US is now trading at the upper end of historical valuation levels. Whilst much of the developed world outside of Japan and emerging markets outside of India remain cheap.

- Within global sectors Information Technology’s P/E ratio is now more than 3X that of Financials and Energy – the widest gap ever seen using available data for the S&P Global Sector Indexes (since 2006). This highlights investors’ preference for growth over cyclicals throughout 2023 – but, as discussed earlier, US cyclical sectors (in particular Energy) started to play catchup in March 2024.

- March saw Europe and the UK outperform the US and Energy and Financials outperform Information Technology. Valuations support a continuation of this trend toward market breadth and may prove to be a good place to look for outperformance – as if this bull market continues to run, the broader the rally will likely be.

Betashares Global Equity Markets Monitor

31 March 2024

Source: Bloomberg, Betashares. As at 28 March 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance.

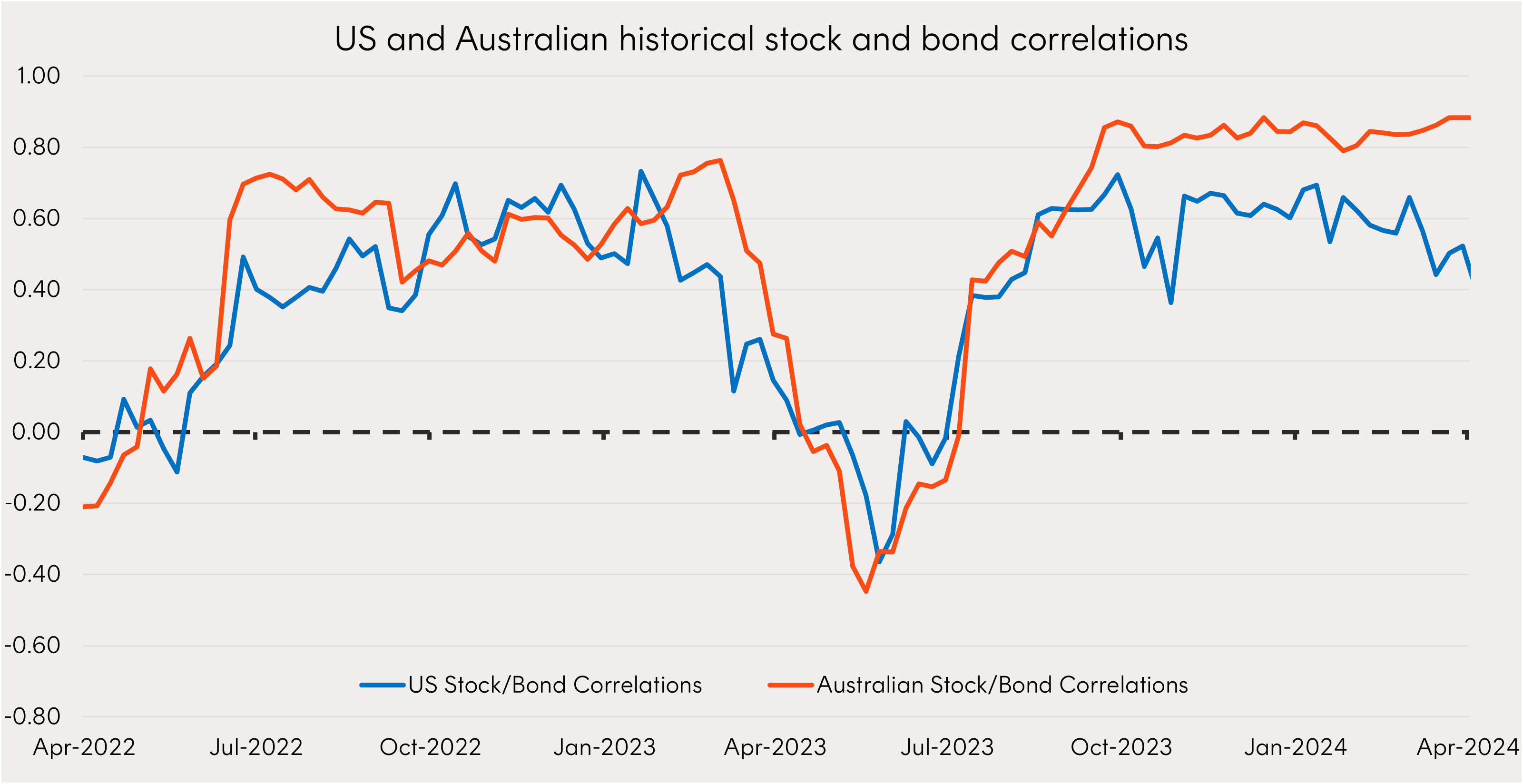

Asset Class Correlations

- The pushing out of central bank rate cut expectations halted the downward trend for government bond yields in Q1. Rising US yields saw stock and bond correlations for the country fall but remain in positive territory. Meanwhile in Australia a small choppy rise in yields over the quarter coincided with the ebbs and flows of the equity market to leave correlations at the highest levels in years.

- With equity market strength broadening out, bullish gold and oil sentiment, and the ultimate gauge of growth, bitcoin, remaining near all time highs correlations across asset classes may grow stronger until there is a clear shift from market strength.

- Nevertheless, with 10-year bond yields in Australian and the US above 4%pa, fixed rate bonds remain one of the best diversification tools against threats to the equity market earnings outlook, like the US regional banking credit shock in H1 2023.

Source: Betashares, Bloomberg. As at 28 March 2024. S&P 500 represents US Stocks, Bloomberg US Aggregate Bond Index represents US Bonds, S&P/ASX 200 represents Australian Stocks, Bloomberg Australian Enhanced Yield Composite Index represents Australian Bonds. Past performance is not an indicator of future performance.

Flows

- While broad US ETFs pulled in the lion’s share of flows in the US ETF market in Q1 with $US32b, global international equity ETFs were not far behind with $US28b. Within the US’s global equity ETF flows Japanese and Indian ETFs continued strong momentum from 2023.

- Notably, the appetite for the Asian region did not extend to Chinese ETFs, with the highest ranked China centric ETF coming in at number 72 for the first three months of the year. This will be an interesting trend to follow in the months ahead, with the Chinese equity market having potentially found a floor to rebound off in January.

Source: Bloomberg. As at 28 March 2024.

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk.

To the extent permitted by law BetaShares accepts no liability for any errors or omissions or loss from reliance on the information herein.