Is your portfolio really diversified?

7 minutes reading time

The growth of ETFs has been synonymous with the growth in passive broad market equity index investing.

However, ETFs offer investors significant opportunities outside of traditional index ETFs. For instance, income focused equity strategies can provide investors with high yields, diversification benefits, and in applicable cases, franking credits from their equity allocation.

While most investors are able to execute a strategy of buying high yielding individual stocks some ETFs offer institutional level strategies that may be complex or admin heavy for individuals.

To that end, Betashares offers a range of yield maximiser funds for investors seeking higher income from their equity exposure.

A brief primer on covered calls

Betashares’ range of Yield Maximiser funds use a ‘covered call’ strategy to offer additional income over and above dividends generated by the portfolio.

Understanding why these strategies may be well placed in the current market first requires an understanding of how they work. This video explains the concept:

The key points are:

- A covered call strategy ‘caps’ the upside potential of an equity investment.

- In exchange for this, investors receive additional income through selling options (on top of the dividends paid by the underlying portfolio).

- The strategy is better suited to bear, neutral (or sideways trading) markets and gradually rising markets. However, it would usually be expected to underperform an equivalent portfolio without the covered call strategy during a strongly rising market.

- A covered call strategy may also help to reduce portfolio volatility.

Betashares offers investors three covered call ETFs:

| Exposure | Australian Shares | U.S. Shares | |

| Fund | Betashares Australian Top 20 Equity Yield Maximiser Fund (managed fund) | Betashares S&P 500 Yield Maximiser Fund (managed fund) | Betashares Nasdaq 100 Yield Maximiser Fund (managed fund) |

| ASX Code | YMAX Australian Top 20 Equity Yield Maximiser Fund (managed fund) | UMAX S&P 500 Yield Maximiser Fund (managed fund) | QMAX Nasdaq 100 Yield Maximiser Fund (managed fund) |

| Underlying Share Portfolio | Top 20 Australian blue-chips | S&P 500 | Nasdaq 100 |

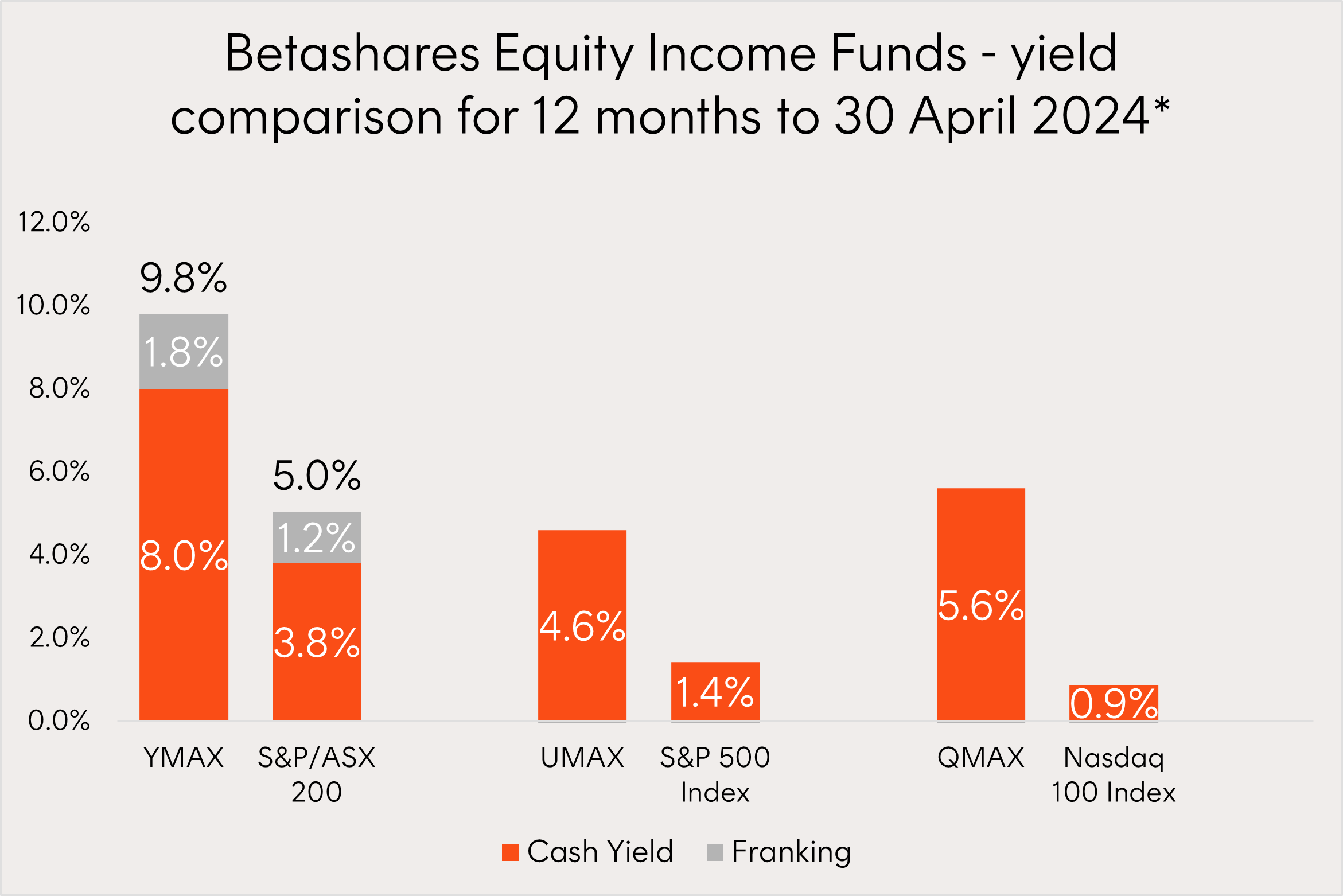

The charts below show the additional income that these strategies have produced compared to their respective benchmarks for the 12 months ending 30 April 2024.

Source: Bloomberg, Betashares, as at 30 April 2024. *This is an estimate only for this distribution period. The final amount will be determined as at the end of the financial year and may differ materially from the estimate due to various factors. Fund yield figures are calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Franking level is total franking level over the last 12 months. Not all Australian investors will be able to receive the full value of franking credits. Yield will vary and may be lower at time of investment. Past performance is not an indicator of future performance of any index or fund.

There’s one other detail to understand that isn’t covered in the video. All else being equal, option prices increases when the expected volatility of the underlying shares increases. As a covered call strategy produces income by selling options, higher expected volatility in equity markets can mean higher income from selling options.

For more detailed coverage on options pricing, please refer to our Betashares Yield Maximiser Funds brochure.

Covered call strategy in action

Taking a look over the past 5-years we can get a better understanding of covered call strategy performance in various market environments.

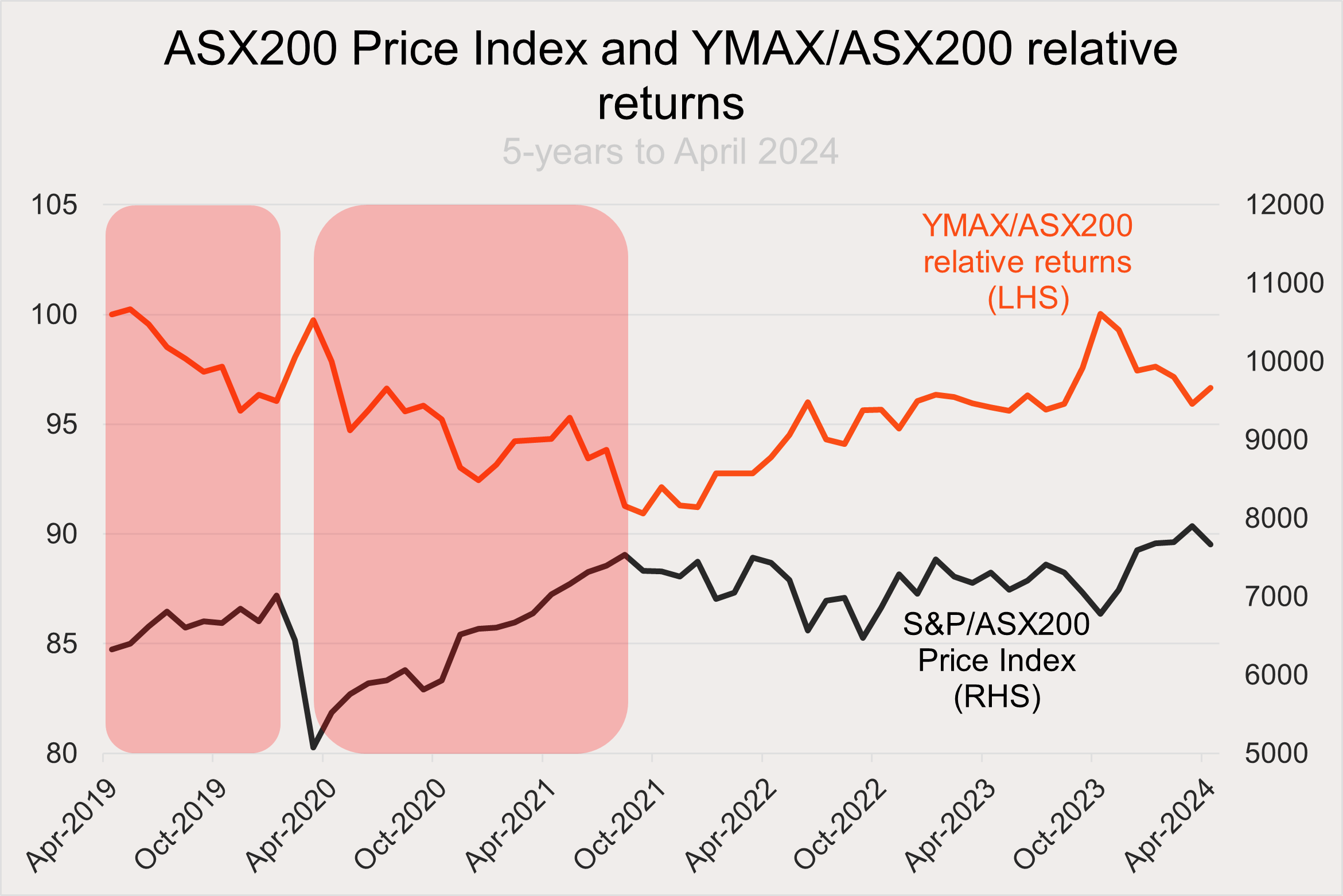

The below graphs charts two lines.

In orange is the relative performance of YMAX compared to the S&P/ASX 200 index (ASX200). When the orange line is rising YMAX is outperforming the ASX200 and when it is declining the ASX200 is outperforming YMAX.

In black is the price return index of the ASX200, depicting the movement of the Australian share market.

In the first example the strong bull markets in 2019 and through 2020 are highlighted. During these periods, whilst YMAX still had positive returns, the strong bull markets meant that the fund did not participate in the full upside of the rally, and it underperformed the ASX200 (orange line declined).

Source: Bloomberg, Betashares, as at 30 April 2024, for the 5-year period ending on 30 April 2024. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

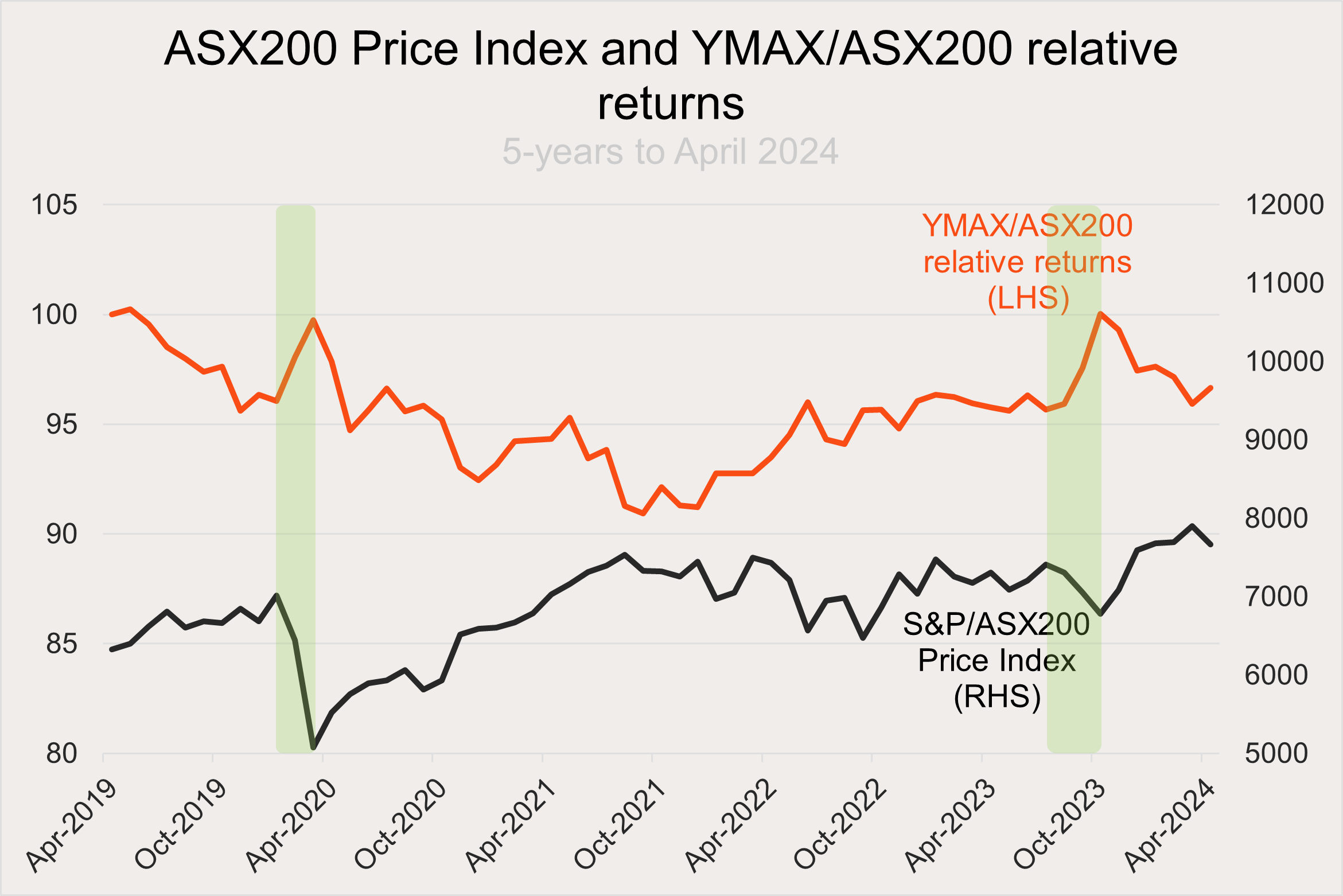

In the second example sharp bear markets in March 2020 and mid 2023 are highlighted. During these periods the additional premiums earned by selling call options provided a buffer and saw YMAX outperform the ASX200 (orange line rising).

Source: Bloomberg, Betashares, as at 30 April 2024, for the 5-year period ending on 30 April 2024. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

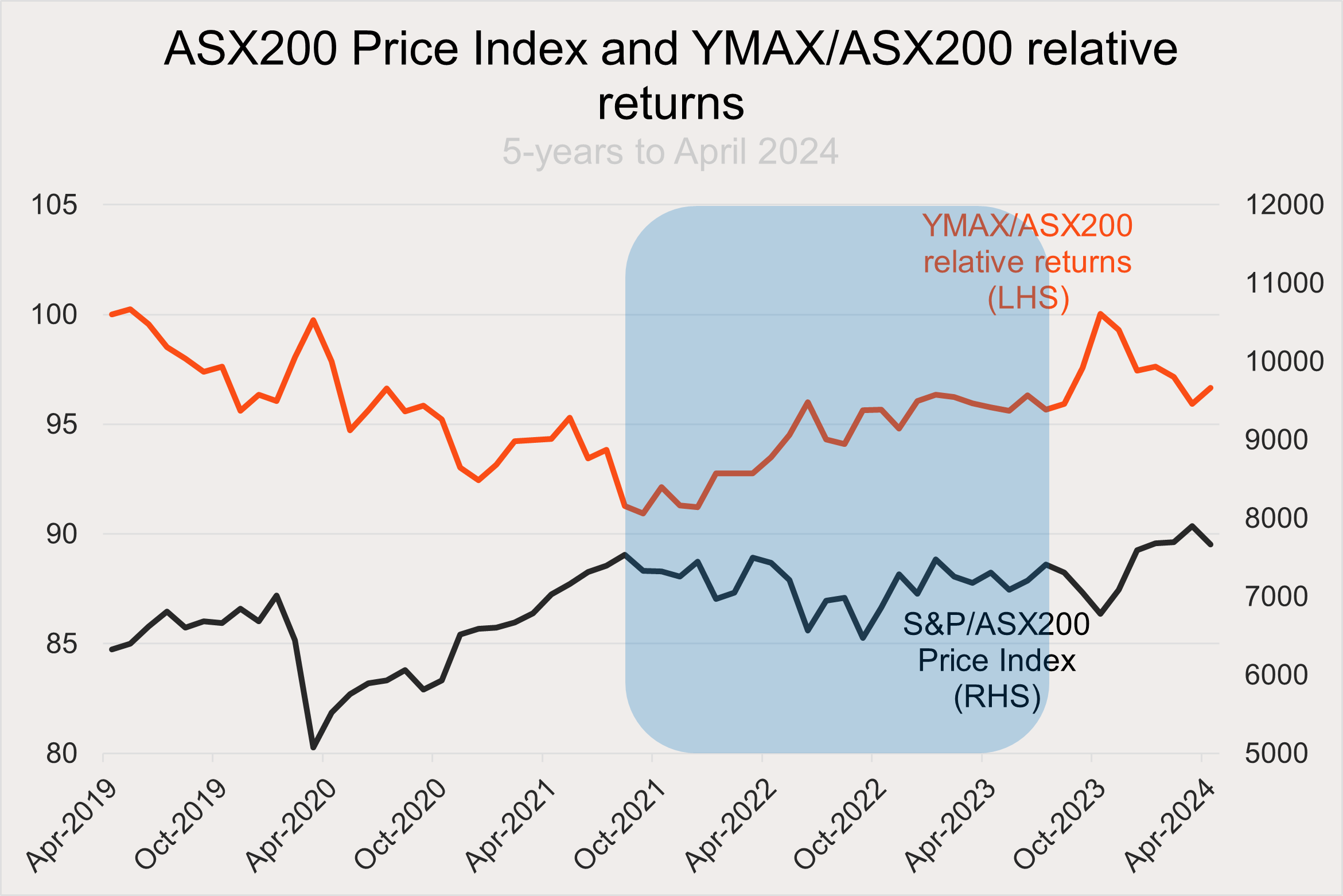

Finally, below the volatile and sideways trading market from late 2021 to early 2023 is highlighted. During this period YMAX again outperformed the ASX 200 benefitting from option premiums from calls that were not being ‘called away’.

Market volatility also meant these premiums were higher as volatility and option premiums share a positive correlation.

Source: Bloomberg, Betashares, as at 30 April 2024, for the 5-year period ending on 30 April 2024. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

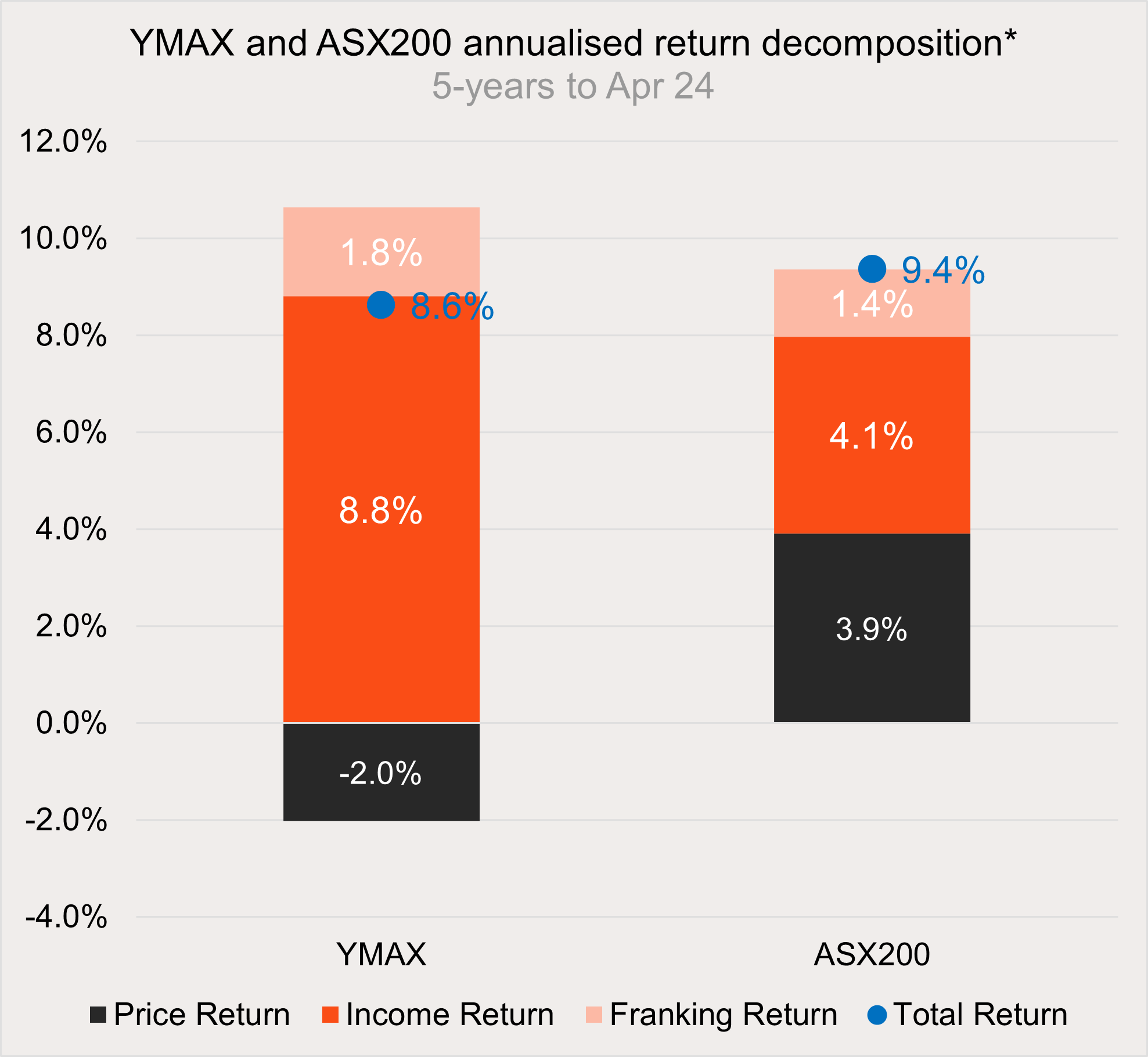

Over the entire 5-year period, while the ASX200 outperformed YMAX the fund experienced lower volatility, 14.1% p.a. versus 16.4%1 (standard deviation of monthly returns over the 5-year period), and importantly returned a lot more to investors by way of income.

Source: Bloomberg, Betashares, as at 30 April 2024, for the 5-year period ending on 30 April 2024. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index. *The Franking return is an estimate only for this distribution period. The final amount will be determined as at the end of the financial year and may differ materially from the estimate due to various factors. Not all Australian investors will be able to receive the full value of franking credits. Yield will vary and may be lower at time of investment.

Looking ahead as markets are trading near all time highs and stubborn inflation continues to push back rate cut expectations, covered call strategies may be beneficial for investors if these circumstances see markets trade in choppy sideways ranges or grind higher.

Takeaways

ETFs can offer options beyond just dividends for income-seeking investors.

Dividend income can be enhanced by a covered call strategy, in return for capping the upside potential of the shares.

There are risks associated with an investment in the Funds, including market risk, use of options risk, sector concentration risk and in the case of UMAX and QMAX, currency risk. Investment value can go up and down and returns are not guaranteed. An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the Product Disclosure Statement (PDS) and the Target Market Determination (TMD), available at www.betashares.com.au.

Source:

1. Standard deviation of monthly returns over the 5-year period April 2019 to April 2024. ↑