7 minutes reading time

In recent years, the global push for corporate sustainability has gained momentum, with many companies making bold commitments to reduce their carbon footprint and achieve “net zero” emissions. These pledges are often positioned as voluntary sustainability initiatives designed to appeal to environmentally conscious consumers and investors.

However, there is growing evidence that numerous large corporations are engaging in “emissions gaming”—manipulating reporting frameworks and exploiting loopholes to project a more favourable picture of their sustainability efforts without meaningfully reducing their actual emissions1.

The consequences of emissions gaming are both profound and widespread. A study by the Climate Disclosure Project (CDP) highlights that just 100 companies have been responsible for over 70% of the world’s greenhouse gas emissions since 19882. When these major polluters manipulate their environmental reporting, it not only distorts the global emissions landscape but also undermines genuine climate action. This deceptive practice misleads stakeholders, from investors to policymakers, and could create a false sense of progress in the fight against climate change.

Common Emissions Gaming Tactics

One of the most prevalent tactics used by companies to game emissions reporting is selective scope reporting. The Greenhouse Gas Protocol, which is the most widely used international accounting tool for greenhouse gas emissions, defines three scopes of emissions:

- Scope 1 – direct emissions from owned or controlled sources

- Scope 2 – indirect emissions from purchased electricity, steam, heating, and cooling, and

- Scope 3 – all other indirect emissions in a company’s value chain.

Source: https://carboncredits.com/importance-scope-3-emissions/

Many companies choose to report only their Scope 1 and 2 emissions, which typically represent a small fraction of their total carbon footprint.

Recent research has revealed that many companies are skirting around their Scope 3 emissions, which often constitute the bulk of their emissions profile. A study analysing over 1,200 companies found that most are underreporting their Scope 3 emissions by up to 44%3. Companies typically focus on less significant emission categories that are easier to calculate, such as business travel, while avoiding more carbon-intensive categories like “use of sold products”.

This selective reporting allows companies to claim they are “green” while omitting substantial portions of their true carbon impact. Additionally, the complexity of value chains and limited data availability often serve as justifications for incomplete reporting, enabling companies to sidestep full disclosure of their Scope 3 emissions.

Gaming the system – examples of how companies mislead on emissions

Tech giants Google, IBM, and SAP have been accused of misleading the public about their carbon footprint by not fully reporting their Scope 3 emissions4. By focusing primarily on Scope 1 and 2 emissions, these companies potentially underreport their true environmental impact and fail to account for emissions associated with the use of their products and services, which can be substantial in the tech industry.

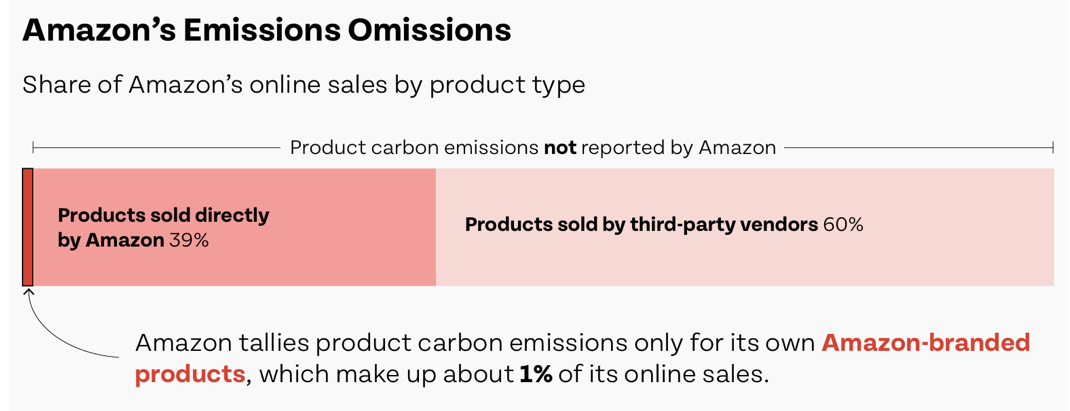

Amazon is another example of how companies pick and choose the emissions to report on. According to reports, Amazon discloses emissions for only Amazon-branded products sold on the platform, which make up about 1% of its sales5.

Outside of tech, studies have found that carmakers are significantly underreporting their emissions per vehicle. Manufacturers are using lifetime mileage figures that are lower than the actual average lifetime of their vehicles, despite having access to extensive data from their financing and dealership networks. These practices allow car manufacturers to present an environmentally friendly image while obscuring their true carbon impact.

As a result, the “true” emissions of some automotive companies are on par with or greater than entire G7 economies – the combined CO2 emissions of Toyota, Volkswagen, and Stellantis are more than the total emissions of UK, France, and Italy6. Furthermore, studies indicate that investments in legacy carmakers are more carbon intensive than those in oil companies7.

Emissions of automakers are on par with or greater than entire G7 countries

Carbon Intensity – fossil fuel majors vs automakers

Another common tactic in emissions gaming is the manipulation of calculation methods. Location-based and market-based accounting are two methods for reporting greenhouse gas emissions from the consumption of electricity. The location-based method calculates emissions using average emissions intensity of the local power grid where electricity is consumed, reflecting the physical reality of power generation and consumption.

In contrast, the market-based method accounts for specific electricity purchases made by a company, including renewable energy certificates and power purchase agreements, allowing companies to reflect their choices in procuring low-carbon or renewable energy sources. However, there are issues with market-based methodologies, including potential mismatches in time-of-day usage, that could result in significant underestimation of the environmental impacts. While both methods are required for comprehensive reporting under the Greenhouse Gas Protocol, they can yield significantly different results, potentially allowing companies to emphasise the method that presents lower emissions.

Source: https://www.ft.com/content/2d6fc319-2165-42fb-8de1-0edf1d765be3

Australian companies and emissions gaming

Australian companies are not immune to emissions gaming practices. BHP has faced criticism for its emissions reporting practices. While the company has made commitments to reduce emissions, environmental groups have pointed out that BHP’s targets primarily focus on its operational emissions (Scope 1 and 2), while most of its climate impact comes from Scope 3 emissions related to the use of its products.

More recently, while BHP has committed to improving its Scope 3 disclosures, there are questions marks over the underlying assumptions that underpin its net zero strategy8.

Australia’s national airline, Qantas, has faced scrutiny over its emissions reporting and offsetting practices. The company’s carbon neutral claims have been questioned, as they rely heavily on carbon offsets rather than direct emissions reductions. There have been concerns about the quality and effectiveness of the offset projects Qantas has invested in9.

Consequences and challenges

The consequences of emissions gaming are far-reaching and significant, misleading investors, consumers, and policymakers about the true environmental impact of business. This can lead to misallocation of capital towards companies appearing to be more environmentally friendly than they actually are, diverting resources from genuinely sustainable initiatives.

Moreover, by presenting an overly optimistic picture of corporate emissions reductions, gaming practices can create a false sense of progress in the fight against climate change. This can reduce the urgency for more aggressive climate policies and actions.

In such situations, companies that report emissions accurately may find themselves at a competitive disadvantage, creating a perverse incentive for more companies to adopt deceptive reporting tactics, exacerbating the problem.

The way forward

As stakeholders become aware of these deceptive practices, there is growing momentum for change. The challenge now is to translate this awareness into concrete action aimed at closing loopholes and creating a more effective system for corporate emissions reporting and reduction.

Addressing this issue will require a concerted effort from regulators, investors, consumers, and companies themselves. Only by ensuring accurate and comprehensive emissions reporting can we hope to drive meaningful corporate action on climate change and make progress towards global climate goals.

Sources:

1. https://www.kcl.ac.uk/business/assets/pdf/research-papers/kbs-research-impact-paper-1-emissions-gaming.pdf ↑

2. https://www.cdp.net/en/articles/media/new-report-shows-just-100-companies-are-source-of-over-70-of-emissions ↑

3. https://www.unsw.edu.au/newsroom/news/2023/11/what-corporations-aren-t-disclosing-about-their-co2-emissions ↑

4. https://www.usatoday.com/story/tech/news/2021/10/23/google-ibm-sap-tech-firms-underreport-carbon-footprint-study/6157496001/ ↑

5. https://revealnews.org/article/private-report-shows-how-amazon-drastically-undercounts-its-carbon-footprint/ ↑

6. https://thedriven.io/2024/01/31/shock-report-finds-legacy-car-companies-are-bigger-polluters-than-big-oil/ ↑

7. https://www.transportenvironment.org/articles/carmakers-lifetime-emissions-50-higher-than-reported ↑

8. https://www.accr.org.au/insights/analysis-bhp’s-2024-climate-transition-action-plan-ctap/ ↑

9. https://www.smh.com.au/business/companies/qantas-accused-of-misleading-customers-with-carbon-neutral-flights-20241015-p5kiev.html ↑