6 minutes reading time

Bitcoin and the broader crypto market finished slightly higher in the week that the original Bitcoin whitepaper celebrated its 14-year anniversary.

At the time of writing, bitcoin is trading at US$21,188. Ethereum underperformed bitcoin for the week, down -1.05% vs bitcoin’s +1.43%.

Bitcoin’s market cap is US$406.5B, with the total crypto market cap hovering above US$1.05T. Bitcoin’s market dominance is at 38.67%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,188 | $21,446 | $20,086 | 1.43% |

| ETH (in US$) | $1,618 | $1,661 | $1,507 | -1.05% |

Source: CoinMarketCap. As at 6 Nov. 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

JP Morgan executes transaction using DeFi

Using the public blockchain Polygon, JP Morgan, along with DBS and SBI Digital Asset, executed its first-ever cross-border transaction using decentralised finance (DeFi) on a public blockchain. The trade was facilitated by the Monetary Authority of Singapore (MAS) Project Guardian pilot. The pilot program is exploring how traditional finance institutions can use tokenised assets and DeFi protocols for financial transactions and other use cases.

Using Polygon, an Ethereum layer-2, the trade was executed using a modified version of the AAVE protocol’s smart contract code. MAS said that a “live cross-currency transaction” was conducted, involving tokenised Singaporean dollar and Japanese yen deposits, along with a simulated exercise of buying and selling tokenised government bonds. The MAS chief fintech officer said the successful test was “a big step towards enabling more efficient and integrated global financial networks.”1

Coinbase revenue sinks

The third-quarter earnings report for Coinbase disappointed, with company revenue missing analysts’ expectations, down more than 50% from the previous year due to lack of trading activity. A loss of $545 million compared to a profit of $406 million in the same quarter last year. In addition, the company has been losing monthly transacting users (MTUs), reporting 8.5 million MTUs during the third quarter, down from 9 million in Q2. Trading volume fell to $159 billion from $217 billion the previous quarter. The company’s EBITDA was a loss of $116 million down from $618 million profit in the same period last year.

Coinbase does not see things improving over the next year. In a statement, the company said: “For 2023, we’re preparing with a conservative bias and assuming that the current macroeconomic headwinds will persist and possibly intensify”. The company’s stock is down 83% from its all-time high last year, falling more than the broader crypto market.2

Goldman Sachs launches service to analyse cryptocurrencies

Investment bank Goldman Sachs has partnered with global index provider MSCI and crypto data firm Coin Metrics to offer a service which will help institutional investors analyse, explain and categorise cryptocurrencies. The new service, called Datonomy, will classify coins and tokens into classes, sectors and sub-sectors such as decentralised finance, metaverse, smart contract platforms or value transfer coins.

The head of client strategy for Goldman’s Marquee platform said in an interview: “We’re trying to create a framework for the digital asset ecosystem that our clients can understand, because they increasingly need to think about performance tracking and risk management in digital assets.”3

On-chain metrics

Bitcoin (BTC): Realised Price

This metric is considered to be the cost-basis of the market. Realised price calculates the average price of the Bitcoin supply valued at the day each coin last transacted on-chain.

According to data from Glassnode, the bitcoin price rose above the realised price for the first time since September, taking the overall cost basis of the network to break-even.

Source: Glassnode. Past performance is not indicative of future performance.

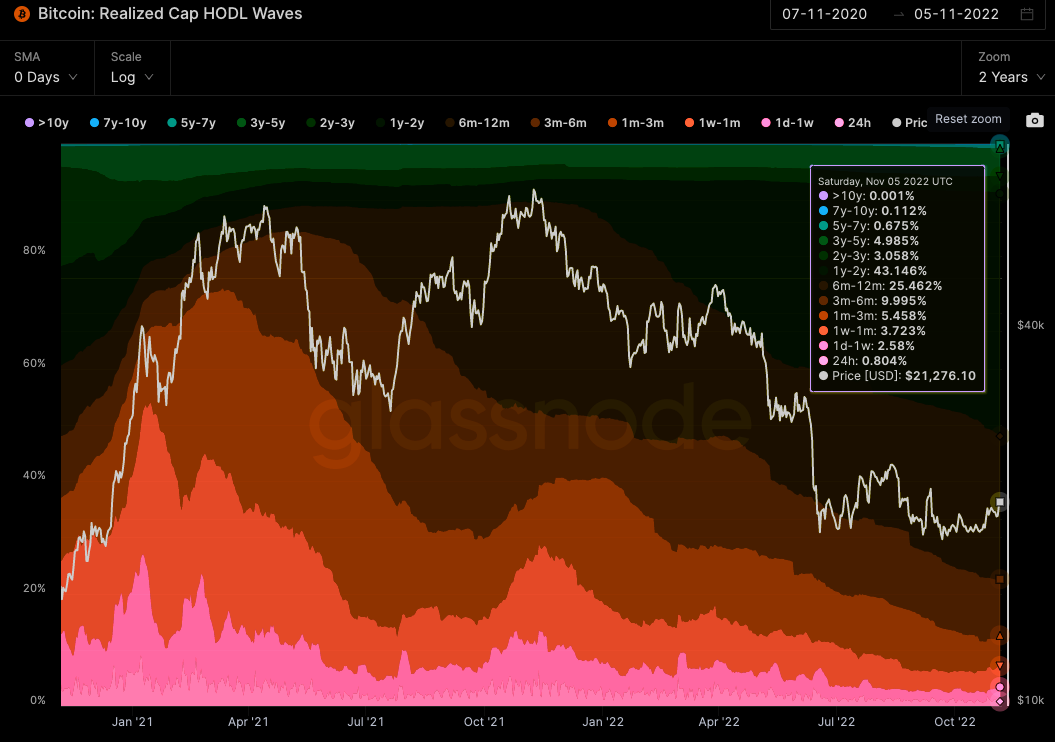

Bitcoin (BTC): Realised Cap HODL Waves

This metric shows the bundle of all active supply age bands, aka HODL waves by realised price. Each coloured band shows the percentage of Bitcoin in existence that was last moved within the time period denoted in the legend.

According to the data on Glassnode, less than 23% of bitcoin in existence has moved in the last six months, which may reflect a longer-term mindset on the part of current holders.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, Polygon (MATIC) made gains after new companies used the blockchain for the first time. As discussed above, JPMorgan used Polygon to execute its first live trade on a public blockchain, and Instagram’s parent Meta named Polygon as its initial partner for its upcoming NFT tools, which will allow users to mint, sell and showcase their digital collectibles on and off the social media platform. Other companies using Polygon for NFTs include Disney, Robinhood and Starbucks.

According to its website, Polygon is a decentralised Ethereum scaling platform that enables developers to build scalable user-friendly dApps with low transaction fees without sacrificing security. Over the last week, MATIC rose over 23% to a level not seen since May, and had a new high of 6 million active wallets in Q3.4

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://cointelegraph.com/news/jp-morgan-executes-first-defi-trade-on-public-blockchain

2. https://cryptopotato.com/coinbase-revenue-slumps-50-as-bear-market-bites-deeper/

4. https://cointelegraph.com/news/matic-price-eyes-200-gains-on-polygon-adoption-by-instagram-jpmorgan

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.