Our rules for momentum investing

5 minutes reading time

Week in review

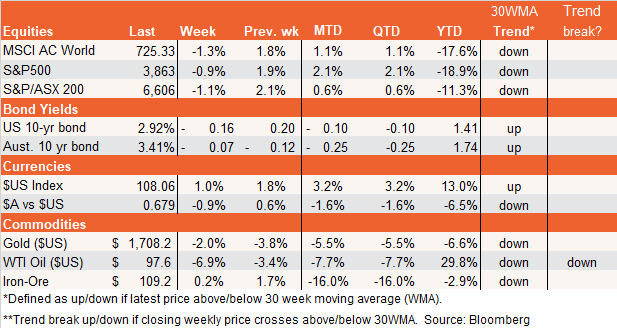

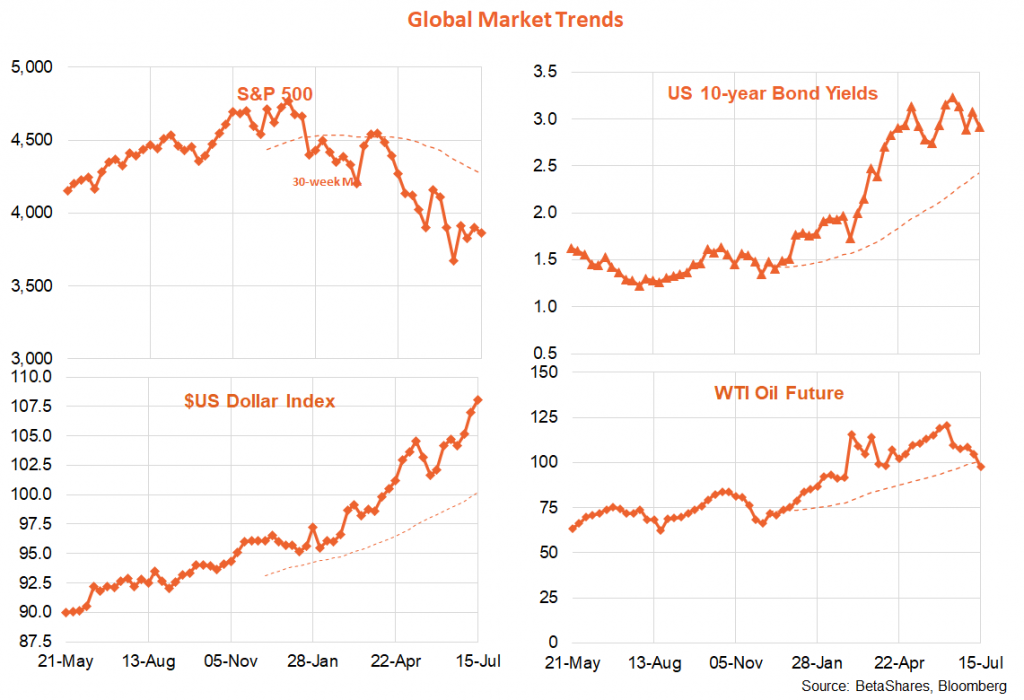

Global equities finished only modestly down over the past week, with investors taking solace in encouraging news wherever it could be found. Stocks weakened early in the week out of fear of a very hot US CPI report – and those fears were duly realised, with headline and core inflation rising in the month by a stronger than expected 1.3% and 0.7%. Underpinned by another surge in energy costs, annual headline US CPI inflation hit a new high for the cycle of 9.1%. While core annual inflation is coming down, at 5.9%, the decline remains stubbornly gradual.

By late week, however, the market was at least relieved that Fed hints suggested the hot CPI was not likely to cause it to hike rates by a massive 1% at next week’s policy meeting (only another 0.75% move!). Some heart was also taken on Friday by still solid retail spending (even though a good chunk of this is likely inflation, rather than volumes) and signs of stabilisation in the already heavily depressed University of Michigan index of consumer sentiment.

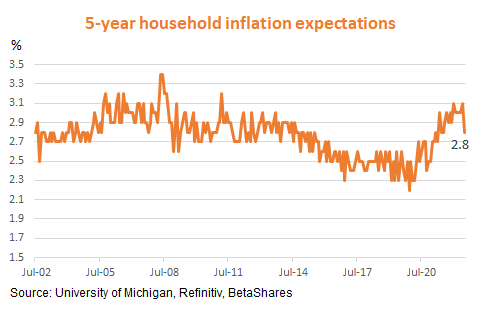

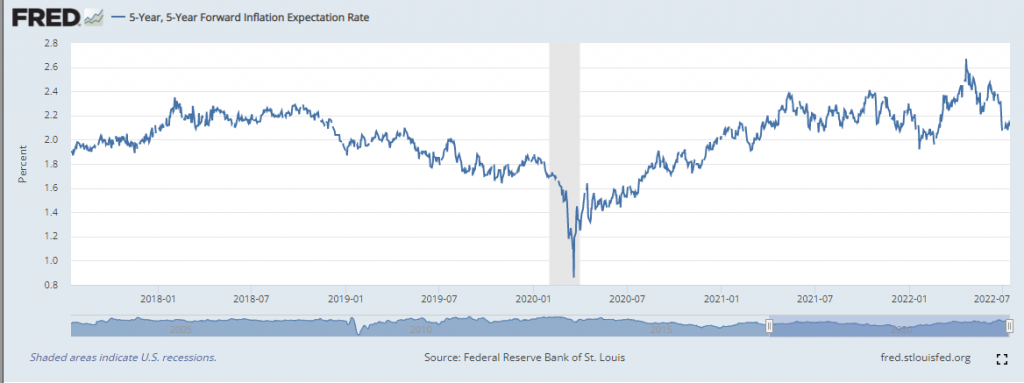

The consumer survey also revealed a welcome drop in 5-year ahead inflation expectations to 2.8% – back to be more in line with its longer-run average, after a scary surge higher in earlier readings which is thought to have contributed to the Fed’s decision to hike by 0.75% last time around.

Note also that implied break-even inflation expectations in the bond market have dropped recently, which is no doubt a relief to a still very nervous Fed.

It was also the start of the Q2 earnings reporting season, with mixed results so far. Although it’s early days, the omens are not great -according to FactSet, among the 7% of companies that have reported so far, only 60% have beaten earnings estimates which is well down on the 5-year average of 77%. What’s more, the average earnings beat is 2.0%, compared with an average beat of 8.8%.

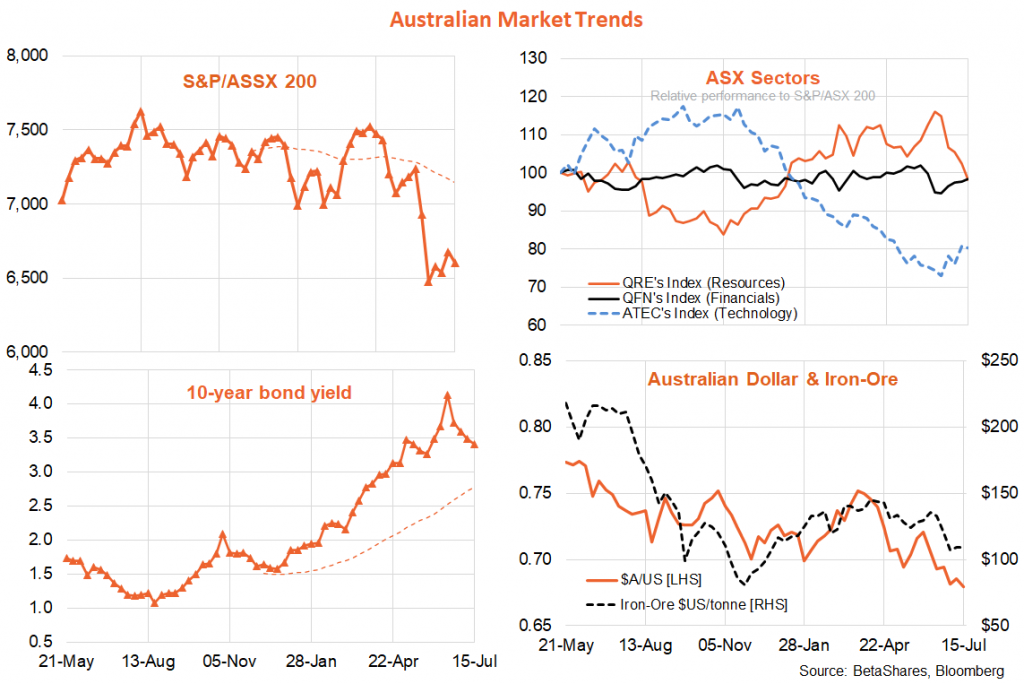

In Australia, we also got hot news – this time a strong labour market report. Corporate Australia was able to find an additional 88k workers in June, with the unemployment rate dropping like a stone from 3.9% to 3.5%. That said, reports on both business and consumer sentiment slipped further last week, as the prospect of ever higher interest rates continue to cloud the outlook.

With global growth slowing and US President Biden pleading with the Saudis to pump more oil (oh how times change!), oil prices declined a further 7% last week to drop below their 30-week moving average. Equities and bond yields continue to consolidate around their recent lows and highs respectively, while the $US charged ever higher.

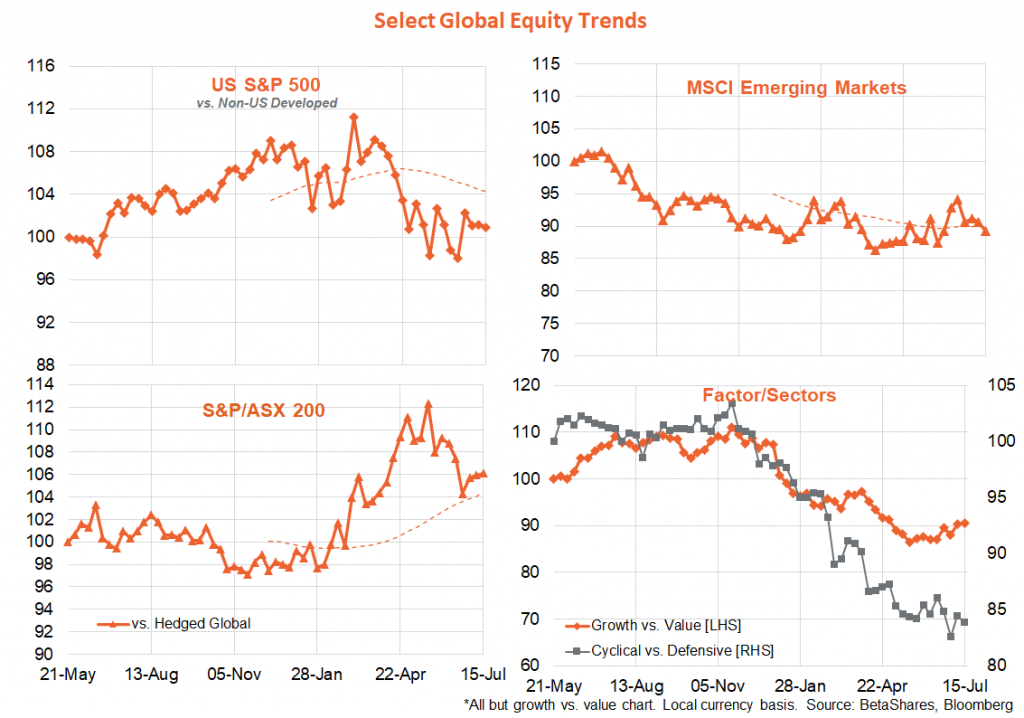

In terms of global equity themes, we’re seeing growth stocks faring a little better than value stocks in recent weeks – consistent with growth concerns starting to outweigh interest rate concerns, while cyclical stocks continue to underperform defensive, consistent with a still cautious outlook for equities overall. Health care is showing good relative performance, with investors seeking a defensive shelter from the storm.

Within the Australian market, as evident globally the growth focused technology sector is attempting a relative performance comeback along with the stabilisation in equities in recent weeks – while the resources sector’s earlier period of outperformance has unwound somewhat along with the decline in commodity prices. Bonds yields continue to retreat, as does the $A.

Week ahead

With little in the way of Fed speak or economic data this week, US market attention will likely focus on the second week of the Q2 earnings reporting season. This week we get important financial and technology updates, with the likes of Goldman Sachs and Bank of America reporting among financials, and Netflix, Twitter and Tesla reporting among the more growth exposed parts of the market.

There will also be more interest than usual in Europe, with the ECB expected to hike rates for the first time in a decade on Thursday. Tuesday sees the release of another likely hot Euro-zone CPI report.

It’s also a data light week in Australia, with focus likely on RBA rhetoric. Minutes to the latest RBA meeting are released tomorrow, and Deputy Governor Bullock and Governor Lowe also give speeches on Tuesday and Wednesday respectively.

Despite last week’s excitement, the market this morning is attaching only a 10% probability to a 0.75% move by the RBA next month and a 20% change to a 1% increase by the Fed next week. My base case is the RBA and Fed will hike by 0.5% and 0.75% respectively.