5 minutes reading time

Recent results from the Australian earnings season were mixed, with a roughly even proportion of ASX 200 companies beating and missing earnings expectations.

The outlook remains challenging with higher input costs and interest rates affecting company margins. Indeed, earnings per share (EPS)1. for the ASX 200 fell by 4.6% over the 20242 financial year, marking a second straight year of falling profits for the index.

On the other hand, the index which AQLT Australian Quality ETF aims to track saw EPS growth of 20% over the same period. AQLT aims to select a basket of 40 high-quality companies from the largest 200 listed on the ASX.

Below we focus on three companies3 that AQLT has an overweight position in versus the ASX200 and how they reported.

WiseTech

Founded 30 years ago with a focus on Australian freight logistics, WiseTech has grown to become a leader in international logistics software servicing over 17,000 logistic companies including 46 of the top 50 global third-party logistics providers.

Reporting earnings growth of 28% for the 2024 financial year and beating analyst expectations saw the company’s share price rally 27% in response. The result means WiseTech’s EPS has increased by a factor of 15 times since listing on the ASX in April 2016.

WiseTech’s software offers logistics companies the opportunity to replace outdated, legacy software with a highly efficient, automated, and integrated solution that is becoming industry standard. Among the top 25 Global freight forwarders (companies that act as middlemen for transporting shipments) those using WiseTech’s software have experienced 82% growth in container volumes since 2011 compared to 12% for those not.4

Guidance for 2025 indicates management is confident they will continue to achieve strong growth with expected earnings growth of 33% to 41% over this period.

Breville

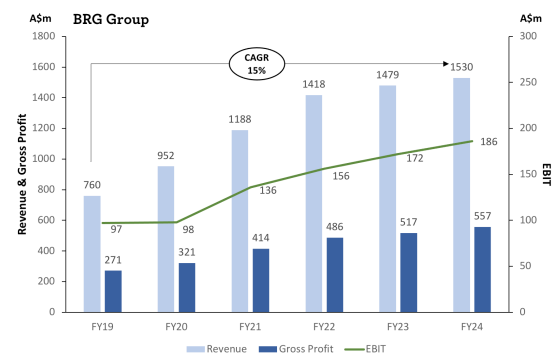

Following a challenging 5-year period for any consumer facing business, Australian founded home appliance manufacturer Breville has steadily grown earnings year on year achieving a compound annual growth rate (CAGR) of 15% over this period5.

Source: Breville Annual Report 2024

Originally based in Alexandria, Sydney, Breville evolved from manufacturing radios to kitchen appliances in the 1960’s and has today become synonymous with innovation and high quality appliances.

With the steady release of new products over recent years, much of Breville’s success has come from research and development, an area which saw increased spending to account for 14% of net sales in FY 24. New product lines like their InFizz range, an entirely new food processor range, and the Oracle Jet had a promising launch in 2024.

Their geographic expansion program which started in FY18 is another key area for sustainable growth in the future with sales performance in new regions, like Germany, Spain, Mexico and South Korea, increasing at a 45.6% CAGR from initiation during FY 18 to FY 24.

Breville’s share price responded positively, increasing by 14% in the week following their earnings report.

Hub24

Offering an integrated platform, technology and data solutions to Australian financial and wealth advisers, Hub24 has experienced both rapid growth and industry recognition in recent years.

In 2024 alone the platform recorded net inflows of $15.8b, 62% higher than the previous financial year, and ranked first for overall platform annual net inflows.6

This growth has led to the company achieving an underlying earnings CAGR of 47% from FY 20 to FY 24. Hub’s footprint has grown significantly over that time, from 10% of Australian advisers using the platform to 29% in 2024.

In our view, Hub’s position has left them well equipped for further development and, with a strong balance sheet (cash balances of $88m and operating cashflows of $109m), FY 24 Hub has announced dividend growth of 17% on FY23 and $12.5m of share buy backs.

Hub’s share price rallied 6% in the week before their earnings announcement in anticipation of a good result and a further 5% in the week after confirming that investors thought it was.

Find more information about AQLT on its fund page here.

There are risks associated with an investment in AQLT, including market risk and non-traditional index methodology risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. Earnings per share is the net profit a company produces, divided by the number of shares on issue. For an index, this is generally quoted as a weighted average of the index constituents. ↑

2. Source: Bloomberg ↑

3. No assurance is given that these companies will remain in AQLT’s portfolio or will be profitable investments. ↑

4. Source: WiseTech Global FY24 results investor presentation ↑

5. CAGR is the rate at which a given metric – usually earnings or revenue – grows over time. ↑

6. Source: Hub24 FY24 Investor Presentation ↑