5 minutes reading time

Global equities stabilised last week after several consecutive weekly declines, supported by a lack of new tariff announcements from President Trump and a ‘dovish hold’ from the Federal Reserve.

Markets will remain on Trump watch again this week as the April 2 “liberation day” deadline looms. Otherwise, the February private consumption expenditure deflator (PCED) is the key data point for this week. Core PCED is expected to lift 0.3%, the same figure as in January. If it happens, this would push up the annual rate modestly from 2.6% to 2.7%.

Also noteworthy is the University of Michigan consumer sentiment report, released on Friday. While it’s not typically a market-moving indicator, it will draw special attention this week due to the concerning drop in February. A further weak report will increase concerns about the US consumer.

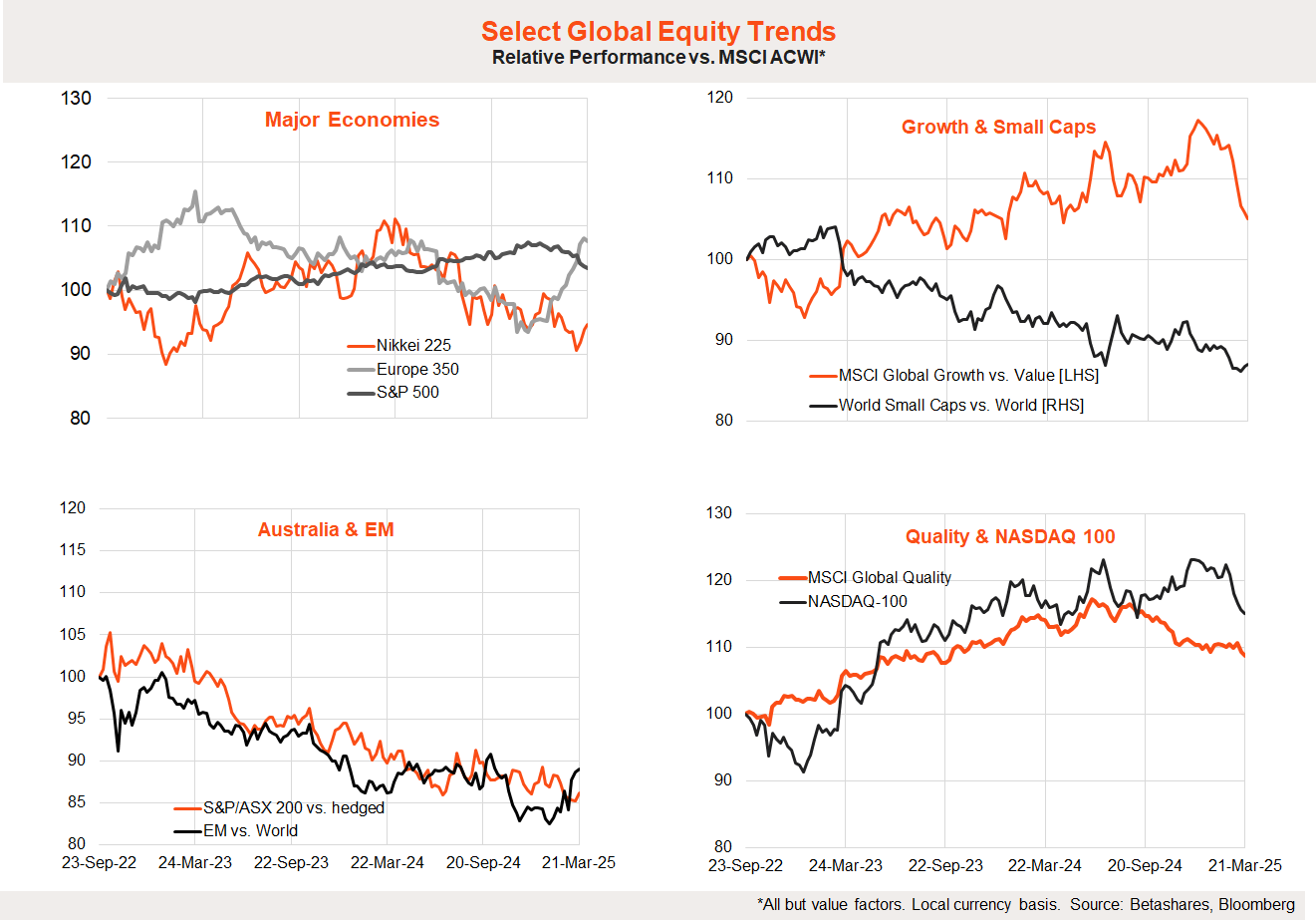

Global market trends

Non-US stocks outperformed US stocks again last week, though European stocks took a back seat and Japan/emerging markets did more of the heavy lifting.

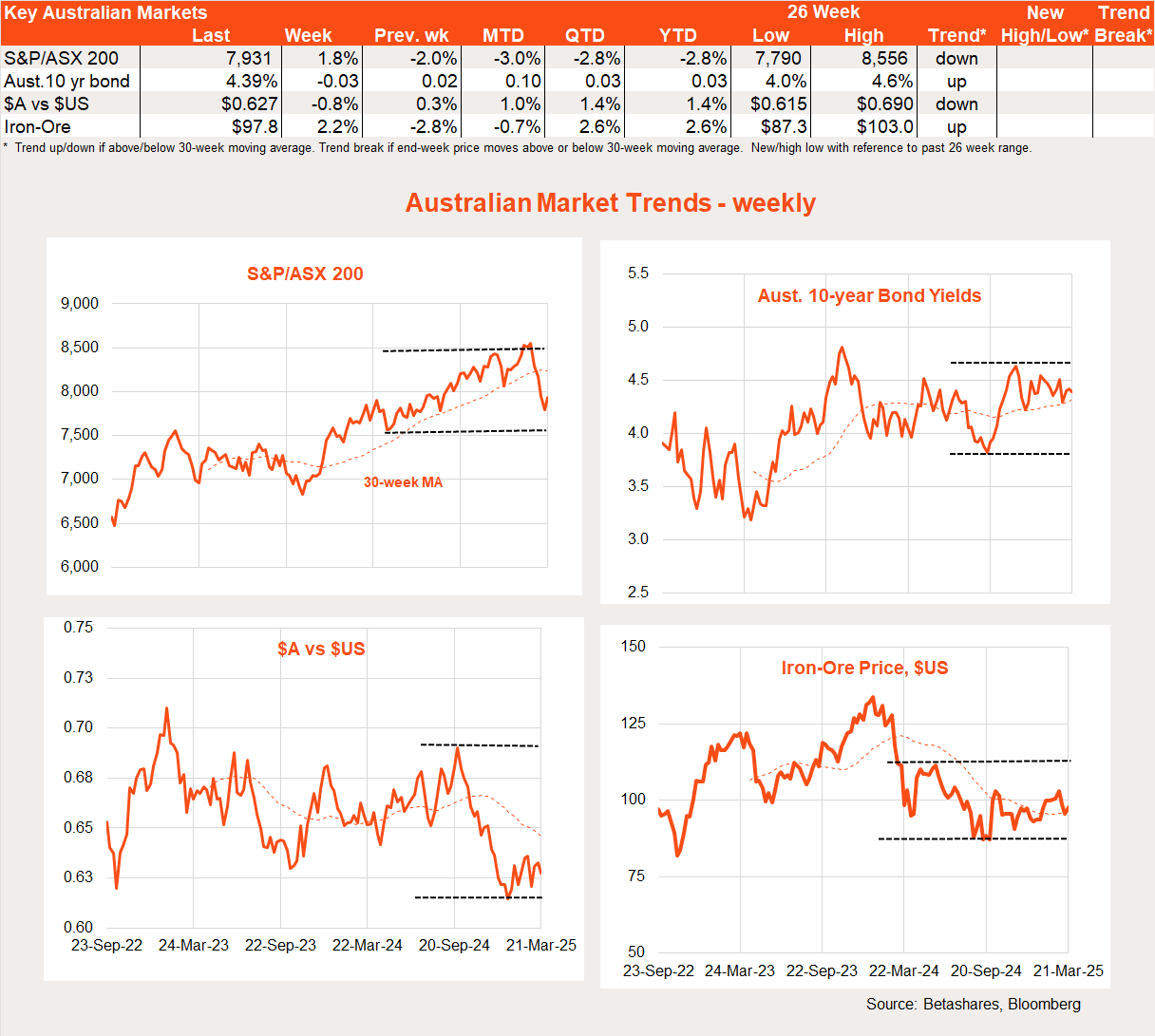

This has continued the pullback in the relative performance of the Nasdaq 100 and global growth over value. Australian stocks also outperformed last week, though it’s too early to call an end to the downtrend in relative performance.

Australian market

As noted above, local stocks did surprisingly well last week. The S&P/ASX 200 rose 1.8%. Would-be bargain hunters eagerly emerged after several weeks of declines at the index level.

Last week’s local data highlight was the surprise slump in the February jobs report. Although the unemployment rate held steady at 4.1%, there was a reduction of 52,000 jobs in the workforce. Although this may simply reflect year-end seasonal fluctuations, one theory is that the recent gradual improvement in strained household finances has finally enabled more elderly workers to take that long-postponed (but well-earned) retirement. Either way, it’s too soon to suggest any fundamental weakening of the labour market.

Local highlights this week

Tomorrow’s pre-election Federal Budget and the February monthly inflation report on Wednesday headline the week ahead.

Lacking any upward revenue surprises this year, Treasurer Jim Chalmers is expected to confirm the Budget will likely return to deficit next financial year. This means the amount of pre-election goodies being handed out will be limited. That said, reports suggest the Treasurer will announce a six-month extension of current electricity rebates.

With regards to inflation, interest will be around the extent of any further bounce back in the annual trimmed mean figure. In January, the trimmed mean rate lifted to 2.8% from 2.7% in December. The RBA’s own economists currently expect annual trimmed mean inflation to hit 2.7% in the June quarter. Therefore, even a modest increase in the monthly rate to 3% in February would be disappointing, though not necessarily a concern for the RBA’s current forecast.

Have a great week!