What CBA’s $300 billion milestone says about building wealth

7 minutes reading time

- Equity income

For years the Australian share market has been the highest yielding equity market in the world. In countries such as the US, investors typically have to rely on fixed income as the main source of investment income. In contrast, dividends and attached franking credits fund the cash flow needs of many Australian retirees.

But Aussie dividends are increasingly coming under threat from companies facing rising costs, slowing demand and a deteriorating Chinese economy. In the recent earnings season, fewer companies than usual lifted their dividend. On average, companies returned less cash and the big miners in particular had massive dividend cuts. BHP and Rio Tinto’s dividends fell 54% and 34%, respectively.1

Dividend cuts from the big miners are problematic for two reasons

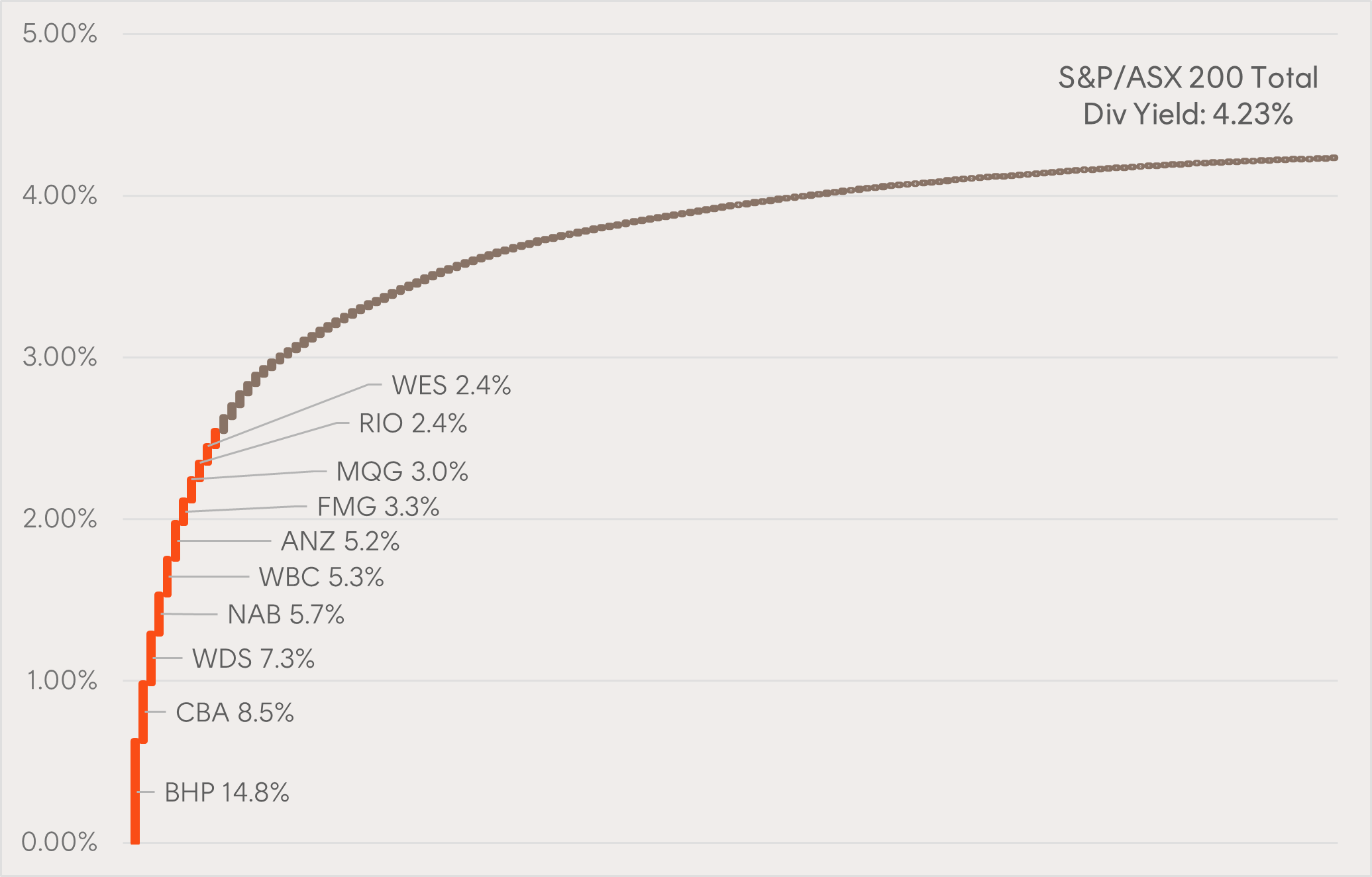

- Dividend income is highly concentrated in Australia, over half of the total S&P/ASX 200 Index yield comes from just 10 stocks. So a single hit to a sector like materials, energy or financials threatens the overall Australian market yield in a disproportionate manner.

Stock contributions to the trailing 12-month S&P/ASX 200 Index Yield (highlighting the top 10 contributors) as at 25 September 2023

Source: Bloomberg, Betashares, as at 25 September 2023. Chart shows the cumulative contribution of each stock to the overall dividend yield of the index, based on each constituent’s dividends and its proportional weight in the index as a whole. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

- The forward outlook for dividends from materials and energy looks poor. Consensus expectations for current financial year dividends are for cuts by current top 10 contributors BHP (by -16%), Rio Tinto (-16%), Fortescue (-59%) and Woodside (-45%).

As a result, the total S&P/ASX 200 Index dividend amount is expected to fall by 5% in dollar terms, to a yield of just over 4% – a level rarely seen by Australian investors outside of the Covid period.2

And, if anything, there may be further risk to the downside:

- A sharper slowdown in the Chinese construction sector would magnify the risk of lower-than-expected mining dividends. The current iron ore price of USD120 a tonne appears unsustainable.

- Expectations for dividends from our banks look a little brighter, but a slowing economy would crimp credit demand and could lead to dividend cuts from the banks. Additionally, potential APRA changes to the hybrids market may hurt bank dividends.

Other options for income-oriented investors

With the cash rate currently at ~4.10% p.a. and the 10-year government bond yield at ~4.29% p.a., Betashares offers a choice of cash, fixed income and hybrids funds with current yields for comparable exposures above these levels and the forecast S&P/ASX200 Index yield.3 Some investors may be considering whether to rotate into defensive assets with lower volatility and higher income certainty than the Australian equity market.

For those that want to maintain exposure to equities, a ‘covered call’ strategy offers a way to diversify the income received beyond just dividends.

Why a covered call strategy may be relevant

Holding shares and employing a covered call strategy has the potential to generate additional income over and above the dividends earned. This additional income comes in the form of option premiums, and it may be higher in a more volatile, higher interest rate environment. Understanding why these strategies may be well placed in the current market requires an explanation as to how they work.

Covered call basics:

- A covered call strategy ‘caps’ the upside potential of an equity investment.

- In exchange for this, the investor receives additional income through selling options (on top of the dividends paid by the underlying portfolio).

- The strategy is best suited to neutral (or sideways trading) markets to gradually rising markets. However, it would usually be expected to underperform an equivalent portfolio without the covered call strategy during a strongly rising market.

- A covered call strategy may also help reduce portfolio volatility.

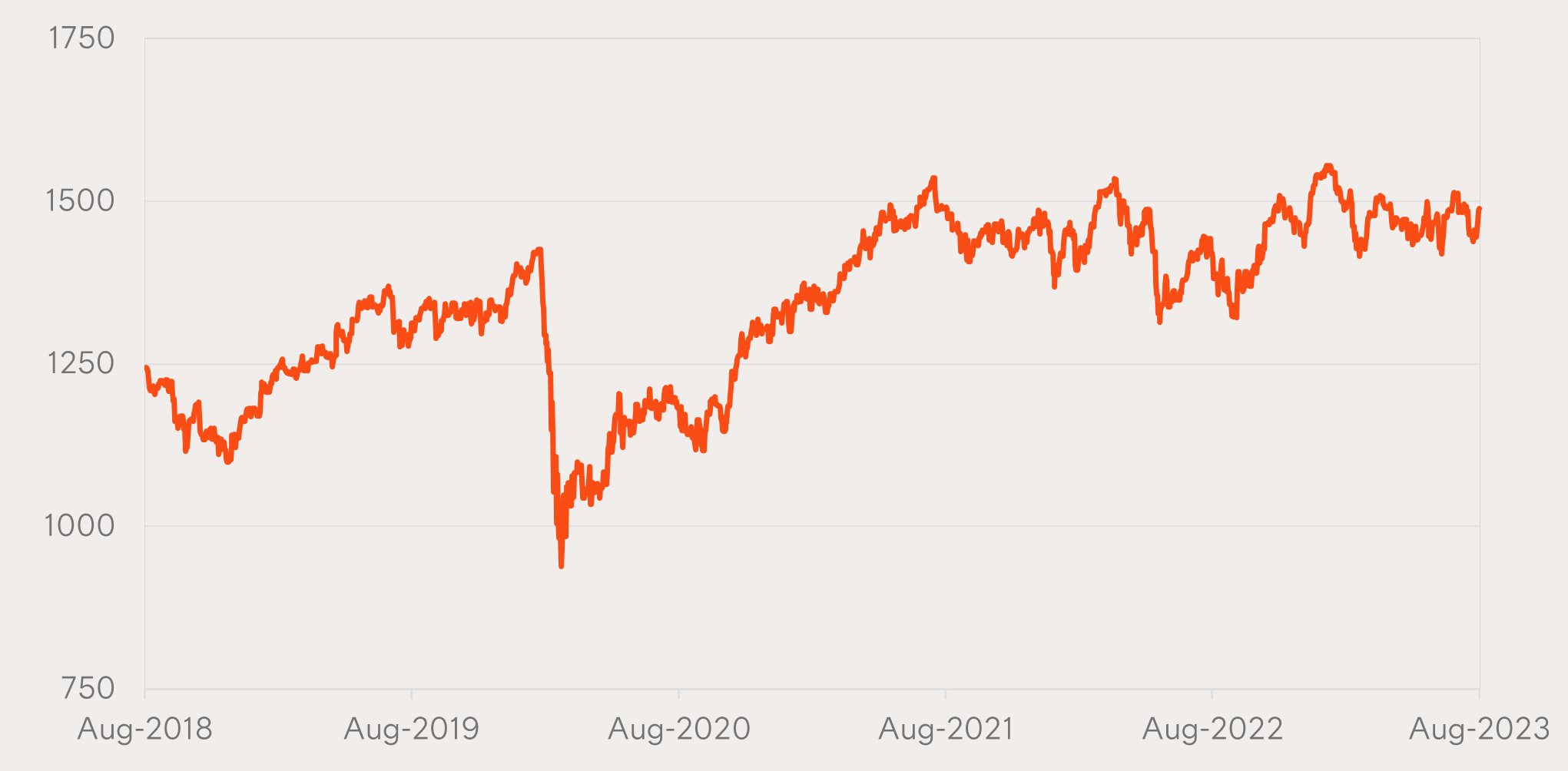

Since the start of 2022, the market dynamic has been well suited to a covered call strategy. This can be seen in the chart below showing the 5-year price return (to 31 August 2023) of the Solactive Australia 20 Index, which tracks the 20 largest companies listed on the ASX.

Solactive Australia 20 Index: 31 August 2018 – 31 August 2023

Source: Bloomberg, Betashares, as at 31 August 2023. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

Prior to 2022, the market generally moved higher, with the exception of early 2020, which saw a sharp fall. These conditions tended not to be conducive for a covered call strategy as the cap on returns was frequently reached (due to share prices moving above the strike prices for the call options), while conversely the sharp fall in share prices was not sufficiently offset by the income earned by selling the options.

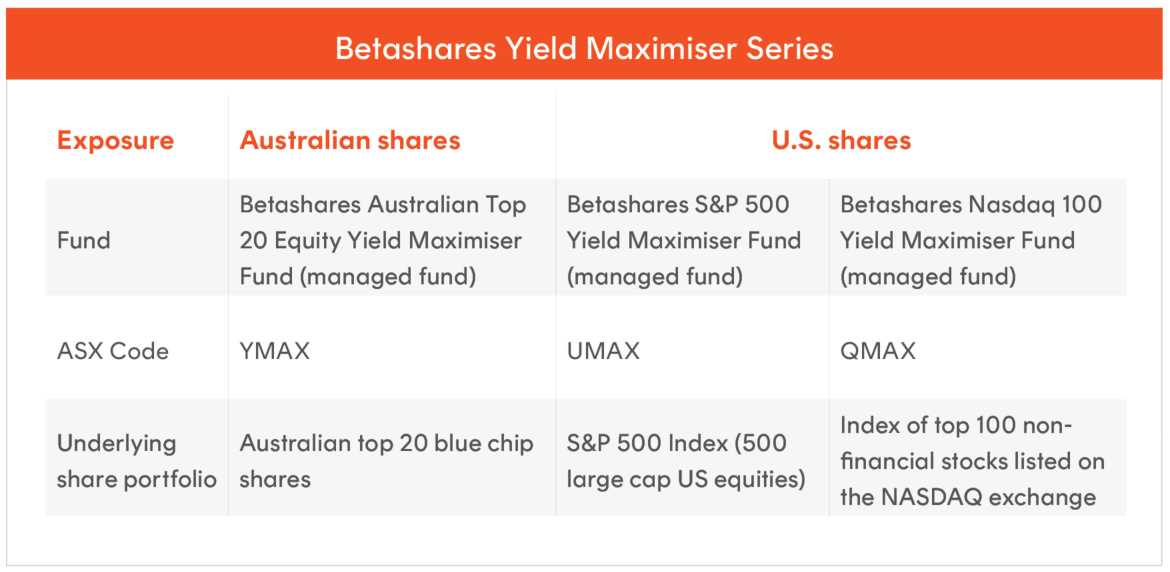

Betashares’ range of Yield Maximiser funds use a covered call strategy to offer additional income over and above dividends received on an underlying share portfolio.

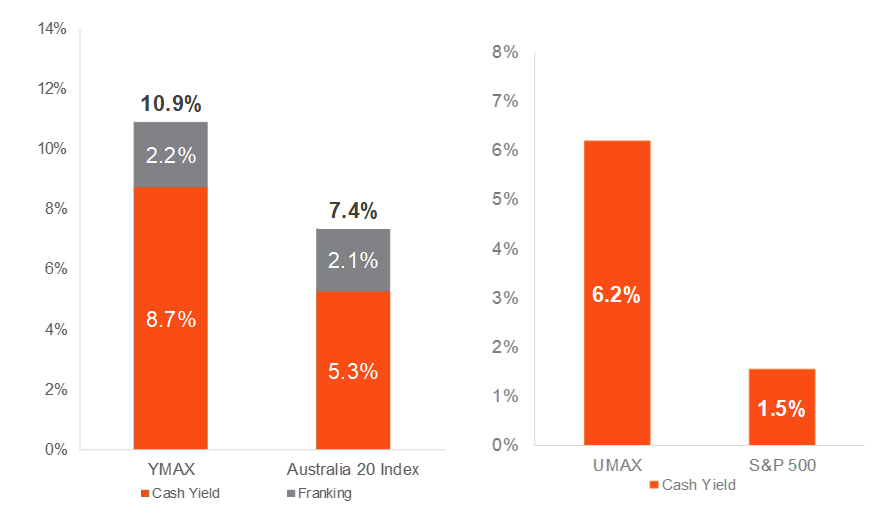

The charts below show the additional income that YMAX and UMAX have produced compared to their respective underlying portfolios for the 12 months ending 31 August 2023.

Historical yields of YMAX and UMAX relative to their underlying portfolios

Source: Bloomberg, Betashares. As at 31 August 2023. Fund yield figures are calculated by summing the prior 12-month per unit distributions divided by the closing NAV per unit at the end of the relevant period. Franking level is total franking level over the last 12 months. Not all Australian investors will be able to receive the full value of franking credits. Yield may be lower at time of investment. Past performance is not an indicator of future performance of any index or fund.

The yield uplift from these Yield Maximiser funds has been meaningful, but would become even more important to investors if dividend cuts were to eventuate. A higher interest rate environment with elevated volatility has the potential to increase the premium generated from a covered call strategy.

As investors transition to retirement, they will typically consider shifting to a more conservative risk profile with less growth assets (equities). The superior income that the yield maximiser funds target means they can seek to meet their income requirement with a smaller allocation to equity income, and thereby allowing more flexibility in asset allocation.

Why now and implementation

In a higher rate environment with equities offering an underwhelming risk premium, many are questioning whether equities still offer much capital growth upside. If your clients have a need for investment income, and you are of the view that the future prospect of stock price growth is limited, it may make sense to consider one of Betashares’ Yield Maximiser funds.

These three funds each provide some (limited) capital growth potential from the underlying stock portfolio of either Australian or US equities, but also employ a covered call strategy that seeks to materially increase the income they are able to generate.

For more information on:

- How covered call strategies work and how they are employed in the Yield Maximiser funds, please read this brochure.

- We’ve also created an easy-to-understand video explaining covered calls.

There are risks associated with YMAX, UMAX and QMAX, including market risk, use of options risk, sector concentration risk and in the case of UMAX and QMAX, currency risk. Investment value can go up and down. An investment in these funds should only be considered as a part of a broader portfolio, taking into account the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of this fund, please see the Product Disclosure Statement (PDS) and Target Market Determination (TMD), available at www.betashares.com.au.

References:

1.Fall based on equivalent USD dividend amounts from BHP and RIO in second half of calendar year 2022. 2.Source: Bloomberg, Betashares, as at 25 Sept 2023. 3.Source: Bloomberg, Betashares, as at 25 Sept 2023. Yields will vary and may be lower at time of investment.