1. Other costs, such as transactional costs and operational costs may apply. Refer to the respective Product Disclosure Statement for more information.

5 minutes reading time

The ETF industry has evolved dramatically since its humble beginnings back in the 1990s.

From the early days of ‘vanilla’ index- tracking ETFs, we have since seen the popularisation of ‘smart-beta’ ETFs, active ETFs and more. Arguably the latest iteration is the ‘all-in-one’ diversified ETF (also known as multi-asset ETFs).

A diversified ETF offers exposure to multiple asset classes through a blend of low-cost ETFs, accessible through a single investment. Taking this innovation one step further, a diversified growth ETF is a diversified ETF that predominantly or exclusively invests in risk assets – namely shares.

Advantages and disadvantages of diversified ETFs

One of the fundamentals of intelligent investing is diversification. While many investors understand the importance of investing in shares for long-term wealth accumulation, fewer appreciate the importance of doing so with sufficient diversification.

For example, investors may invest in only a small number of individual shares or may invest only in the Australian sharemarket.

Diversification means spreading your investments widely, such as across multiple geographic regions and industry sectors. In a diversified investment portfolio, your investment risk is spread. Different geographic regions and different industries don’t always perform well at the same time.

In a diversified share portfolio, if one portion of the portfolio performs poorly over a certain period, this may be offset by the better performance of another part, so you are less likely to suffer a big loss across the entire portfolio. In simple terms, diversification is about not putting all your eggs in one basket.

Beyond the diversification benefits of a diversified ETF, there are practical benefits too. All rebalancing of the underlying exposures is done at a fund level, meaning the investor doesn’t need to lift a finger.

The potential downside of this feature is that diversified ETFs are relatively rigid. The underlying exposure is set by the provider, which means the investor has no discretion or flexibility within their diversified ETF. But this may be welcomed by strictly passive investors who want a hands-off approach to investing. It can also be offset by adding satellite exposures to the core holding.

A closer look at the BetaShares Diversified All Growth ETF

The ultimate benefit of diversified ETFs is to reduce the amount of time, money and complexity involved with building a truly diversified portfolio.

To better understand how a growth-oriented diversified ETF works, let’s take a closer look at the BetaShares Diversified All Growth ETF (ASX: DHHF).

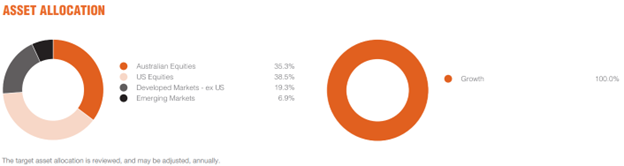

DHHF’s asset allocation

DHHF is designed for investors seeking exposure to a diversified portfolio of global stocks in a single ASX trade.

The ETF achieves this by investing in underlying funds that invest in a blend of large, mid, and small-cap companies from Australia, the United States, global developed and emerging markets. The result is exposure to approximately 8,000 companies listed on over 60 exchanges.

As at 30 September 2022

As at 30 September 2022

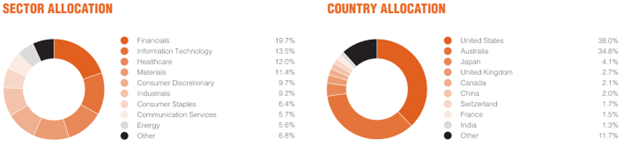

DHHF’s sector allocation

It’s well-known Australia is a top-heavy economy, with banks and miners making up over 50% of the domestic sharemarket’s value.

The beauty of diversified growth ETFs is not just the high-level exposure they provide to equities, but the precise nature of that exposure at a sector level.

In DHHF’s case, the portfolio covers varied markets, the result is a much more even spread across sectors (see chart below).

As at 30 September 2022

As at 30 September 2022

or example, technology accounts for 13.8% of the fund, compared to the under 3% that may be seen in a typical broad Australian equities ETF. Meanwhile, financials and resources make up 30% of DHHF, compared to over 50%, which may be seen in a broad Australian equities ETF. Additional diversification is naturally provided as DHHF invests in multiple major markets including the United States, Japan, Germany, and the United Kingdom.

By investing in the DHHF strategy, an investor can avoid the generally lopsided exposure and the associated risks with Australia and its banking and commodities-dominated economy.

DHHF’s fees and costs

DHHF has management costs of 0.19% per annum. Put another way, an investor invests $10,000 into DHHF, they would pay $19 per annum.1

Not only does the ETF provide exposure to around 8,000 securities with the click of a button, but it means – based on an investor’s objectives – they don’t need to incur the fees associated with brokerage, exchange, and currency conversion fees trying to create their own global portfolio.

They also don’t need to buy multiple ETFs to do the same thing. Diversified ETFs like DHHF are designed to be a one-stop-shop where much of the work pertaining to portfolio construction and periodic rebalancing completed within the ETF.

DHHF’s distributions

As a general rule, whenever the underlying companies of an ETF (be it diversified or single sector) pays distributions, the ETF issuer is required to collect and pass those to unitholders inclusive of franking (where applicable).

Final thoughts

Diversified growth ETFs are a one-stop solution for investors who don’t want the hassle of choosing from a long list of individual stocks or single-asset ETFs. They offer low cost, diversification, and automatic rebalancing.

If you’re looking for a solution that can solve the growth asset puzzle in your portfolio, why not take a closer look at DHHF today?

| There are risks associated with an investment in DHHF, including asset allocation risk, market risk, currency risk, underlying ETFs risk and index tracking risk. For more information on risks and other features of DHHF, please see the Product Disclosure Statement. |