6 minutes reading time

Markets have been anything but calm lately. From Trump’s tariff announcements to AI market surprises, investors have been left guessing what’s next for the global economy. Add in China’s sluggish recovery and Europe’s ongoing energy woes, and it’s clear why volatility is back in the spotlight.

In times like these, defensive ETFs can offer a buffer against the bumps. By focusing on more stable sectors – like healthcare, government bonds and top-tier corporate debt – investors can build portfolios that stand strong when markets get shaky. Let’s look at five defensive ETFs that could help keep your investments on track through turbulent times.

Understanding market volatility and its impact on portfolios

Volatility is an inherent feature of financial markets, reflecting the constant interplay of economic data, investor sentiment and global events. While seasoned investors understand that price fluctuations are part and parcel of market activity, periods of heightened volatility can significantly challenge even the most well-constructed portfolios.

Beyond the immediate financial impact, volatility often triggers emotional responses – such as panic selling or “market timing” – that can derail long-term investment goals.

For Australian investors, recent volatility underscores the importance of resilience. Shifts in global monetary policy, subdued economic growth in key trading partners like China, and persistent geopolitical tensions have all contributed to a complex market environment.

In such conditions, traditional diversification may not always provide sufficient protection, as correlations between asset classes can rise during market stress.

This is where defensive strategies come into play. By allocating to assets designed to reduce downside risk – while still offering the potential for income or modest growth – investors can build portfolios better equipped to weather uncertainty and recover when markets stabilise.

Here’s a breakdown of some key defensive strategies and how Betashares ETFs can help you implement them:

1. Government bonds

Government bonds, especially those issued by stable governments, are a cornerstone of defensive investing. They provide predictable returns and are generally considered low risk, often acting as a buffer against stock market volatility.

- AGVT Australian Government Bond ETF : This ETF tracks an index of high-quality bonds issued by Australian government entities, offering stability during market turbulence. By incorporating AGVT into your portfolio, you benefit from consistent income generation alongside high quality assets.

2. Investment-grade bonds

High-quality bonds, including investment-grade corporate bonds alongside government and semi-government bonds, offer a balance between lower credit risk and reliable returns. This diversification within the bond market helps manage risk, while improving returns due to the typically higher yields paid out by corporates relative to the government.

- OZBD Australian Composite Bond ETF : OZBD provides exposure to a diversified mix of Australian government, semi-government and investment-grade corporate bonds, aiming to achieve a balance between income and capital stability. This well-rounded approach aims to provide greater stability during market fluctuations while still generating reliable income.

3. Subordinated debt

Subordinated debt, while carrying more risk than senior debt, typically offers higher yields. When issued by well-capitalised institutions, such as Australia’s major banks, these bonds can provide attractive income while remaining relatively stable. This makes it an option for investors seeking a higher income potential with some risk tolerance.

- BSUB Australian Major Bank Subordinated Debt ETF BSUB provides investors with the opportunity to access attractive monthly income through investment-grade subordinated bonds. The fund offers exposure to a portfolio of subordinated bonds issued by Australia’s ‘big four’ banks.

4. Enhanced cash

For investors seeking a high degree of capital stability and easy access to their money, cash-like investments are often the answer. Money market funds and short-term debt instruments prioritise capital preservation and liquidity, making them suitable for periods of heightened uncertainty. While they may offer lower yields compared to equities or bonds, their primary strength lies in their stability.

- MMKT Australian Cash Plus Active ETF : This fund aims to deliver a higher return than traditional cash by investing in high-quality, short-term money market instruments and corporate debt securities. MMKT prioritises capital preservation and daily liquidity, making it a suitable choice for investors seeking lower-risk investments during volatile periods.

5. Healthcare

When it comes to equities, the healthcare sector is generally seen as defensive. People need medical services and products regardless of the economy, making these companies less vulnerable to downturns. This stability can translate into reliable income streams for investors.

- DRUG Global Healthcare Currency Hedged ETF : This ETF offers exposure to a diversified basket of large global healthcare companies such as Johnson & Johnson, Roche and Pfizer, with the added benefit of protection against foreign exchange fluctuations. You gain access to innovative healthcare firms and established players with strong financials, providing a solid foundation for your portfolio.

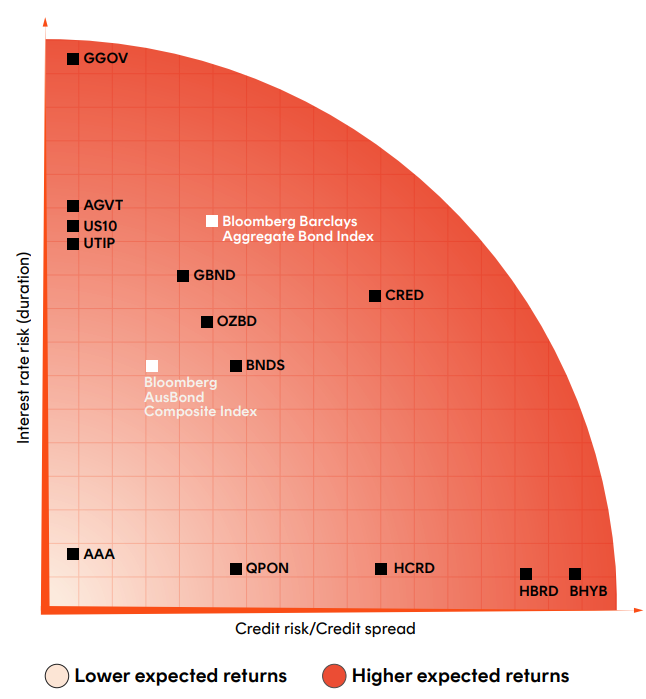

This chart shows how various fixed-income ETFs, including AGVT and OZBD align across the risk-return spectrum. It’s helpful to understand the relationships between interest rate risk, credit risk and potential returns so you can pick the right fixed income ETFs to fit in with your portfolio.

Source: Betashares guide to fixed income. Provided for illustrative purposes only.

Remember, a well-diversified portfolio that incorporates both growth and defensive investments can help you weather market storms and achieve your long-term financial goals.

By incorporating these defensive ETFs into a diversified portfolio, investors can enhance resilience against market volatility while maintaining exposure to income and some growth opportunities.

Building a resilient portfolio with defensive ETFs

Creating a resilient portfolio involves balancing the need for stability with the desire for long-term growth. Defensive ETFs are a versatile tool that can help achieve this balance, offering a way to reduce risk exposure without entirely stepping away from market opportunities.

For investors, the key is to integrate defensive ETFs thoughtfully. Allocating a portion of your portfolio to funds like AGVT and OZBD can provide stable income and mitigate the impact of equity market downturns. Meanwhile, options such as DRUG or BSUB combine defensive characteristics with the potential for modest growth, ensuring a blend of stability and opportunity.

Diversification is also crucial. By spreading investments across asset classes, investors can reduce portfolio concentration risk. Additionally, funds like MMKT can serve as a “cash park”, offering liquidity and stability while earning a higher yield than traditional cash accounts.

There are risks associated with investing in Betashares Funds including market risk, industry sector risk, currency risk and index tracking risk. Investment value can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.