7 minutes reading time

Cryptocurrencies have returned to the spotlight for Australian investors.

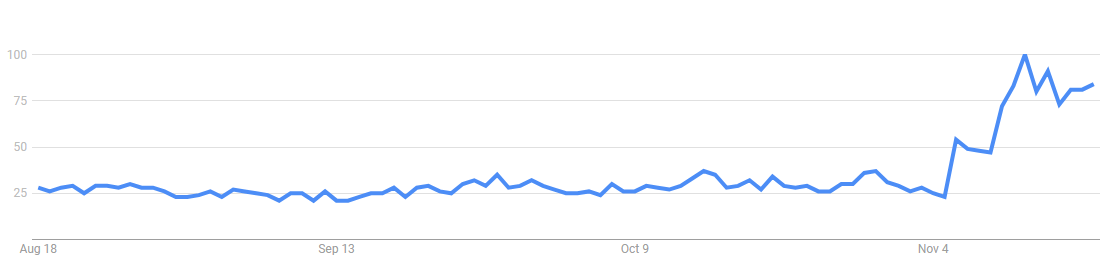

Google Trends data shows a spike in Australian search interest for “cryptocurrency” following the US election, driven by explosive price movements and heightened media coverage.

Source: Google Trends – interest in “cryptocurrency” over past 90 days (as at 19 November, 2024)

Bitcoin, the world’s largest cryptocurrency by market capitalisation, has surged past US$90,000 after Donald Trump’s reelection, sparking optimism for further gains given his vocal support for digital assets. But as we’ve warned before, chasing hot trends can be risky. A rally driven by hype and speculation can quickly lose momentum if the fundamentals aren’t there to back it. Further, digital asset markets can be expected exhibit extreme volatility.

In this article, we explore the factors behind the crypto surge and alternative ways for Australians to gain exposure to the emerging world of digital assets.

A quick refresher on digital assets

Digital assets are any forms of value that exist in a purely digital format.

In the context of cryptocurrencies, these assets include digital currencies like bitcoin and ethereum, which are supported by blockchain technology to record ownership and transactions. This technology allows for secure, decentralised transactions without the need for a central bank or government.

Beyond digital currencies, there is also the broader crypto economy which encompasses infrastructure providers and market participants that support the crypto ecosystem, such as transaction processors, trading platforms, blockchain networks, data storage, and coin mining operations.

Explaining some of the factors driving the post-election surge

Trump’s victory has sparked a wave of confidence in the crypto market, with prices of bitcoin and ethereum dramatically increasing, as seen in the chart below.

12 month performance of bitcoin and ethereum

Source: CoinMarketCap.com (as at 19 November, 2024). Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

But why? His strong support for the crypto industry, including branding himself as the “crypto president”, has played a major role. During his campaign, Trump made bold promises, including making the US the “crypto capital of the planet”1. His administration is expected to push for:

- Pro-crypto regulators2: Trump is expected to make pro-crypto appointments to key agencies like the Securities and Exchange Commission (SEC), the US markets regulator. This shift could foster innovation and accelerate the adoption of digital assets by easing regulatory hurdles. “The rules will be written by people who love your industry, not hate your industry,” according to Trump.

- Legislative momentum3: With a Republican-controlled Congress, pro-crypto legislation, such as a regulatory framework for digital assets, could gain traction and be adopted more quickly than expected.

- Strategic US crypto stockpile4: One of Trump’s boldest promises is the creation of a national bitcoin reserve, similar to how countries stockpile oil, gold, or foreign currency. This could further legitimise digital assets and underscore the US’s commitment to blockchain technology.

Trump’s family has also launched World Liberty Financial, a cryptocurrency venture expected to provide borrowing and lending services for cryptocurrency traders. In addition, Trump’s own presidential campaign accepted donations in digital currencies5.

Are investors being greedy?

Despite the optimism around cryptocurrencies, risks remain. Policy changes often take longer than expected, and if Trump’s administration fails to deliver, digital assets prices may fall sharply.

A good way to gauge market sentiment is the “Saylor-Buffett Ratio,” created by Owen Lamont, a former Harvard finance professor and portfolio manager at Acadian Asset Management6.

It compares the performance of Warren Buffett’s Berkshire Hathaway, which invests in traditional businesses, with MicroStrategy, a company that heavily invests in bitcoin. While Berkshire is up 31% this year, MicroStrategy has surged 400%, highlighting the speculative nature of crypto.

MicroStrategy-Berkshire Hathaway share price ratio

Source: Bloomberg, Acadian. Past performance is not indicative of future performance

This brings us back to Buffett’s timeless investing principle: “Be fearful when others are greedy and greedy only when others are fearful.”

Or more bluntly, as Jamie Dimon, CEO of JPMorgan Chase & Co., puts it, “If you’re stupid enough to buy it, you’ll pay the price for it one day.” We included this quote as one of the seven timeless principles from great minds in finance for good reason.

Cryptocurrencies remain extremely volatile, with scandals like FTX and regulatory uncertainty adding to the risk. Even positive news can create market bubbles that could burst, leading to losses of some or all of the initial investment. Additionally, unlike stocks that can be valued based on earnings and other factors, crypto prices are often driven by emotional sentiment rather than any reference to fundamentals or tangible assets. The digital asset markets may still be experiencing a bubble or may experience a bubble again in the future.

Nevertheless, the power of that sentiment is hard to deny, with the total market cap of cryptocurrencies topping US$3 trillion after the election as investors boosted their crypto exposure.

Source: CoinMarketCap.com (as at 19 November, 2024). Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Investing in the companies that are driving the crypto economy provides as an alternative way to gaining exposure to the crypto sector

The CRYP Crypto Innovators ETF provides ‘picks and shovels’ exposure to the companies building crypto mining equipment, crypto trading venues, and other key services that allow the crypto economy to thrive.

The fund invests in listed companies, primarily in the US that form the backbone of the crypto ecosystem, such as those involved in mining and trading platforms and other key services that allow the crypto economy to thrive..

The fund includes up to 50 crypto-focused companies including Coinbase and MicroStrategy7, capturing a broad spectrum of the sector, with its asset allocation shown in the chart below.

Source: Betashares (as at 31 October 2024)

Conclusion

The recent bitcoin rally reflects growing optimism about cryptocurrencies under Trump’s presidency. However, presidential promises don’t always result in action, legislation may face delays or fail to materialise, and sentiment-driven momentum can quickly reverse. These factors pose risks to the sustainability of crypto’s current surge.

Nonetheless, the remarkable rise of digital assets is continuing, as evidenced by the amount of money pouring into cryptocurrencies and the underlying ecosystem powering them.

Tactical investments in funds like CRYP offer exposure to the crypto ecosystem and can serve as a tactical complement to broader technology and global equities exposure, providing exposure to the crypto industry without taking on the complications and complexities of direct cryptocurrency ownership.

An investment in CRYP should be considered very high risk and should only be considered by informed investors seeking a small allocation to a very high volatility investment. CRYP provides focused exposure to companies involved in servicing crypto-asset markets or which have material investments in crypto-assets. Risks associated with an investment in CRYP includes market risk, crypto-innovators risk, technology risk, international investment risk and concentration risk. CRYP will not invest in crypto assets directly and will not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the TMD and PDS, available at www.betashares.com.au.

References:

1. Newsweek

2. CNBC

3. OMFIF

5. AP News

6. Bloomberg

7. There is no assurance that these companies will remain in CRYP’s portfolio or will be profitable investments. ↑