Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

Bitcoin sold off throughout the week and finished noticeably lower along with the broader crypto market. Crypto markets continued to sell off yesterday with Bitcoin falling to under $50K before rebounding to the $55K level this morning. Helping push prices down was the weak July US jobs report, and the continued risk off sentiment which also sent broad US equity indices reeling.

Bitcoin and Ethereum were down 10.13% and 9.71% respectively over the 7 days to 4 August. Bitcoin’s market capitalisation was down to US$1.19 trillion. The global crypto market cap is at US$2.16 trillion, while bitcoin’s market dominance rose to 55.6%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $60,592 | $69,932 | $60,114 | -10.13% |

| ETH (in US$) | $2,908 | $3,393 | $2,881 | -9.71% |

Source: CoinMarketCap. As at 4 August 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Ether ETFs after two weeks of trading

There are currently nine spot ETH ETFs, however the Greyscale Ethereum Trust (ETHE) was a conversion from a fund that already held over US$9 billion worth of ETH. In the last two weeks, over $2.1 billion has been sold off from ETHE. However, positive inflows in the remaining eight ETFs, led by BlackRock and Fidelity, has brought cumulative net outflows from spot Ether ETFs to $511 million since their market debut on 23 July1.

Bitcoin opens up to Morgan Stanley advisers

CNBC has reported that wealth management firm Morgan Stanley has opened up the ability for its advisers to offer bitcoin ETFs. However, only clients that have a net worth of at least $1.5 million, have a high risk tolerance and the intention to invest in speculative assets can be solicited. The ETFs available are limited to BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund.

According to the report, which cited people with knowledge of the policy, it will take effect on 7 August, and will be allowed in taxable brokerage accounts but not retirement accounts. Morgan Stanley will also take steps to ensure that holdings in accounts are not excessive.2

Coinbase beats revenue expectations

Cryptocurrency exchange Coinbase beat revenue expectations but missed earnings expectations for Q2 2024, according to its quarterly report released last Thursday. Revenue spiked 104% over the year. Total revenue came in at $1.45 billion, beating FactSet estimates at $1.398 billion. Coinbase also reported earnings of $0.14 per share, improving from a loss of $0.42 per share for the same period last year. However, the earnings missed expectations, which were at $0.95 per share.

Coinbase is currently held in Betashares Crypto Innovators ETF (ASX: CRYP)4. According to the company’s website, Coinbase is ‘updating the century-old financial system by providing a trusted platform that makes it easy for people and institutions to engage with crypto assets, including trading, staking, safekeeping, spending and fast, free global transfers’.

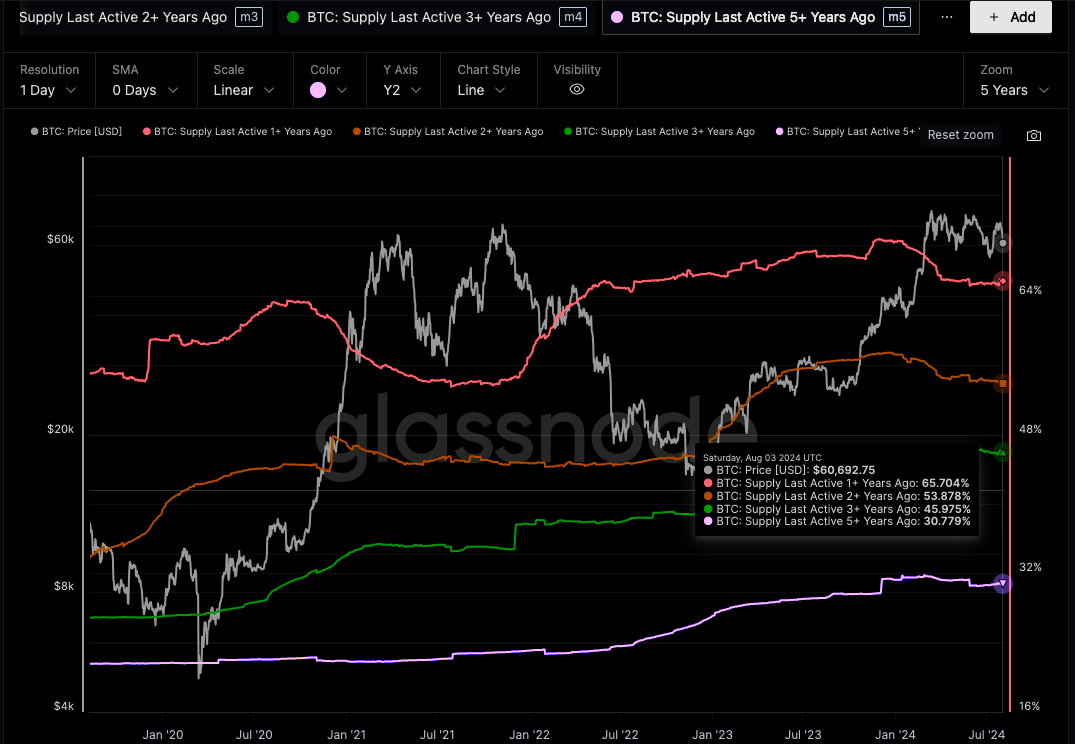

Bitcoin (BTC): Supply last active 1yr+ age bands

This metric shows the activity of long-term holders of bitcoin. Bitcoin bull markets naturally attract sell-side pressure, as higher prices incentivise long-term holders to take profits on some of their holdings.

According to data from Glassnode, the rate of decline across 1-year and 2-year supply has slowed recently, suggesting a gradual return to “HODLing” dominant investor behaviour.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Mining Difficulty

This metric shows the current estimated number of (raw) hashes required to mine a block. A higher network difficulty demands higher computational power for processing bitcoin transactions, but also secures the network against external attacks.

According to data from Glassnode, bitcoin mining difficulty broke its 3-month long downtrend and rose over 10.5% on 1 August, to a new all-time high.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

‘Top 20′ altcoins were in the red over the 7 days to 4 August, but taking the worst hit, down just over 21%, was NEAR Protocol. However, NEAR has been making headlines and catching investors’ attention due to its increasing focus and integration of its blockchain with artificial intelligence applications. NEAR Protocol is up around 219% over the last year5.

According to its website, the NEAR blockchain is “bringing AI and Web3 together to enable a user-owned internet that guarantees privacy and ownership of data and assets, where everyone can be a builder”.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://cointelegraph.com/news/ethereum-etfs-major-movements-ethe-outflow-august-2024

2. https://www.cnbc.com/2024/08/02/morgan-stanley-wealth-advisors-bitcoin-etfs.html

3. https://www.investors.com/news/coinbase-stock-q2-earnings-bitcoin/

4. As at 4 August 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.