Trump tensions

4 minutes reading time

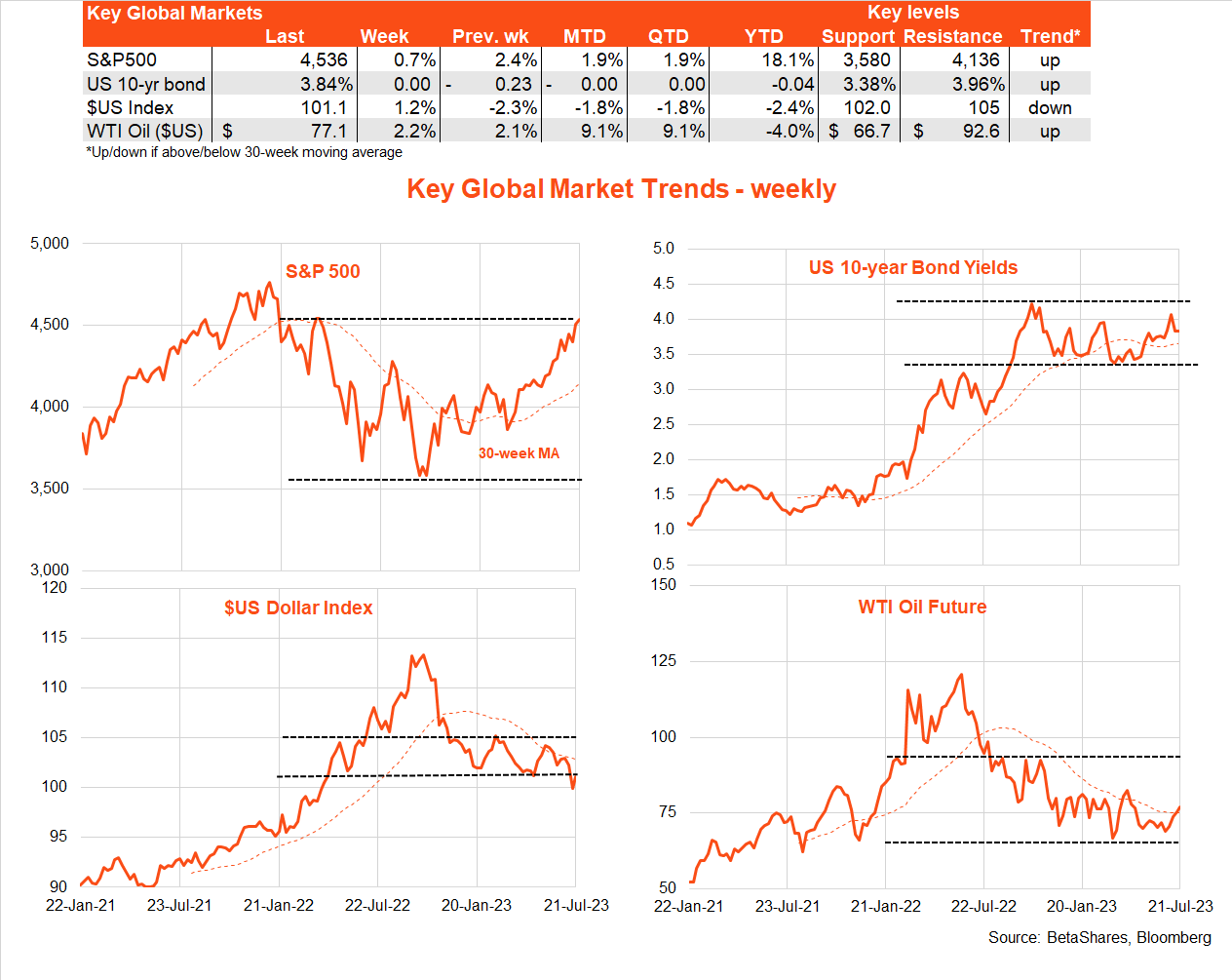

Global markets

The effective ‘melt-up’ in US stocks continued last week, with the S&P 500 adding another 0.7%. Although earnings misses by Netflix and Tesla briefly weighed on markets, the overriding narrative remains that of growing hopes of a soft landing given resilient economic growth, easing inflation, and hints the Fed could be nearing the end of its rate hike cycle.

Indeed, although US retail sales for June were below expectations, this was offset by an upward revision to the May numbers. Weekly US jobless claims also continue to hold at very low levels.

The key highlight this week will be the Fed meeting, with another rate hike widely expected. Markets are hoping this could be the last move, though it’s likely Fed chair Powell will try hard to retain a tightening bias.

As noted last week, while soft landing hopes have so far favoured growth/technology/quality exposures, there is some evidence of a broadening in the equity recovery to more value-orientated exposures in recent weeks – such as the US S&P 500 equal-weight index.

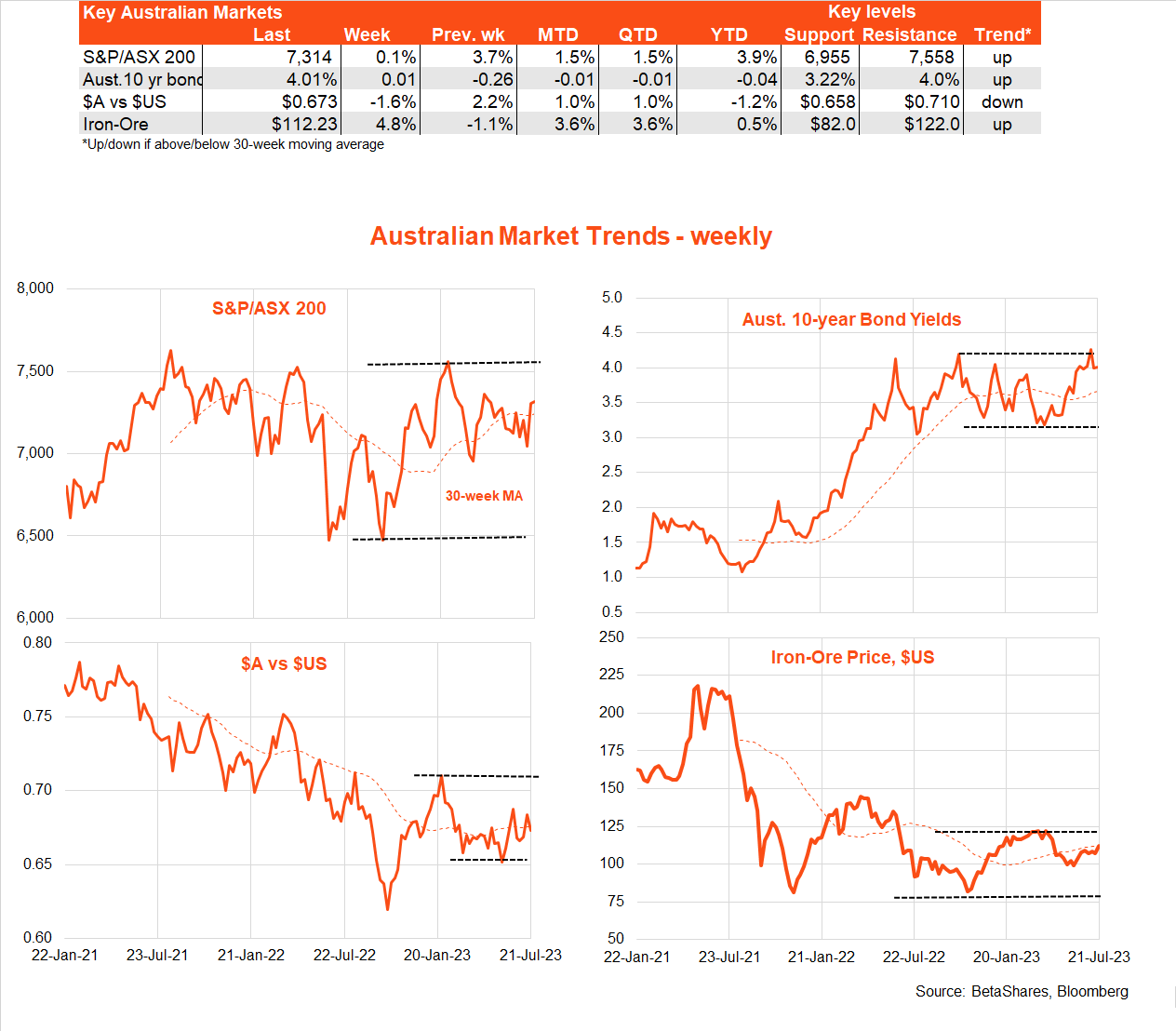

Australian market

It’s a case in Australia at present that “good news is bad news” – as stubbornly strong economic data, such as last week’s employment report, only heightens fears the RBA will raise interest rates further. Investors are also not relishing the prospect of the upcoming earnings reporting season, with widespread fears of downgrades given the prospect of an eventual slowing in economic growth by next year.

That said, the minutes of the July RBA meeting released last week hint at the Bank becoming a little more worried about the downside risks to growth given the aggressive tightening to date and policy lags. Of course, much now depends on this Wednesday’s Q2 quarterly CPI result – an outcome higher or even in line with market expectations could see the Bank raise rates again next month (even though markets see this as a less than 50% prospect).

The lower-than-expected May monthly CPI result, however, holds out the tantalising prospect that annual headline and/or trimmed mean inflation could drop below 6% – which would seemingly be good enough for the RBA to leave rates on hold for at least a month or two longer.

Have a great week!

| Top events of the past week | Comment |

| US earnings | The Q2 earnings season has so far been fairly mixed, with good financial sector results but some key technology sector misses. According to FactSet, of the 18% of S&P 500 companies that have reported so far, 75% beat estimates, which is slightly below the 5-year average of 77%. |

| Soft Q2 Chinese GDP | Annual growth in Chinese GDP slowed to 6.3% in Q2, which was below market estimates of 7.1%. The faltering Chinese recovery has markets hoping for a large fiscal stimulus package sometime soon. |

| Strong Australian employment | Another 32k job gain was reported for June, with the unemployment rate dropping to 3.5%. Strong labour force growth is still being readily absorbed by the market, indicating labour demand remains solid. |

| Key events to watch this week | Comment |

| Fed & ECB decision | Both the Fed and ECB are expected to raise rates another 0.25% this week, in what could be the last moves for each this cycle. That said, both central banks are likely to signal more rate rises could be on the table if inflation remains sticky. |

| Australian Q2 CPI | Annual growth in both headline and trimmed mean inflation is expected to slow to 6.2% and 6.0% respectively, helped in part by electricity rebates. Given the lower-than-expected May monthly CPI, there is a chance annual inflation for both could drop below 6%, making it more likely that the RBA leaves rates on hold next month. |

| US earnings | The Q2 earnings reporting season rolls on, with key results from Microsoft and Alphabet due this week. Given high valuations, markets have been unforgiving where tech companies miss estimates. |