4 minutes reading time

Global Markets

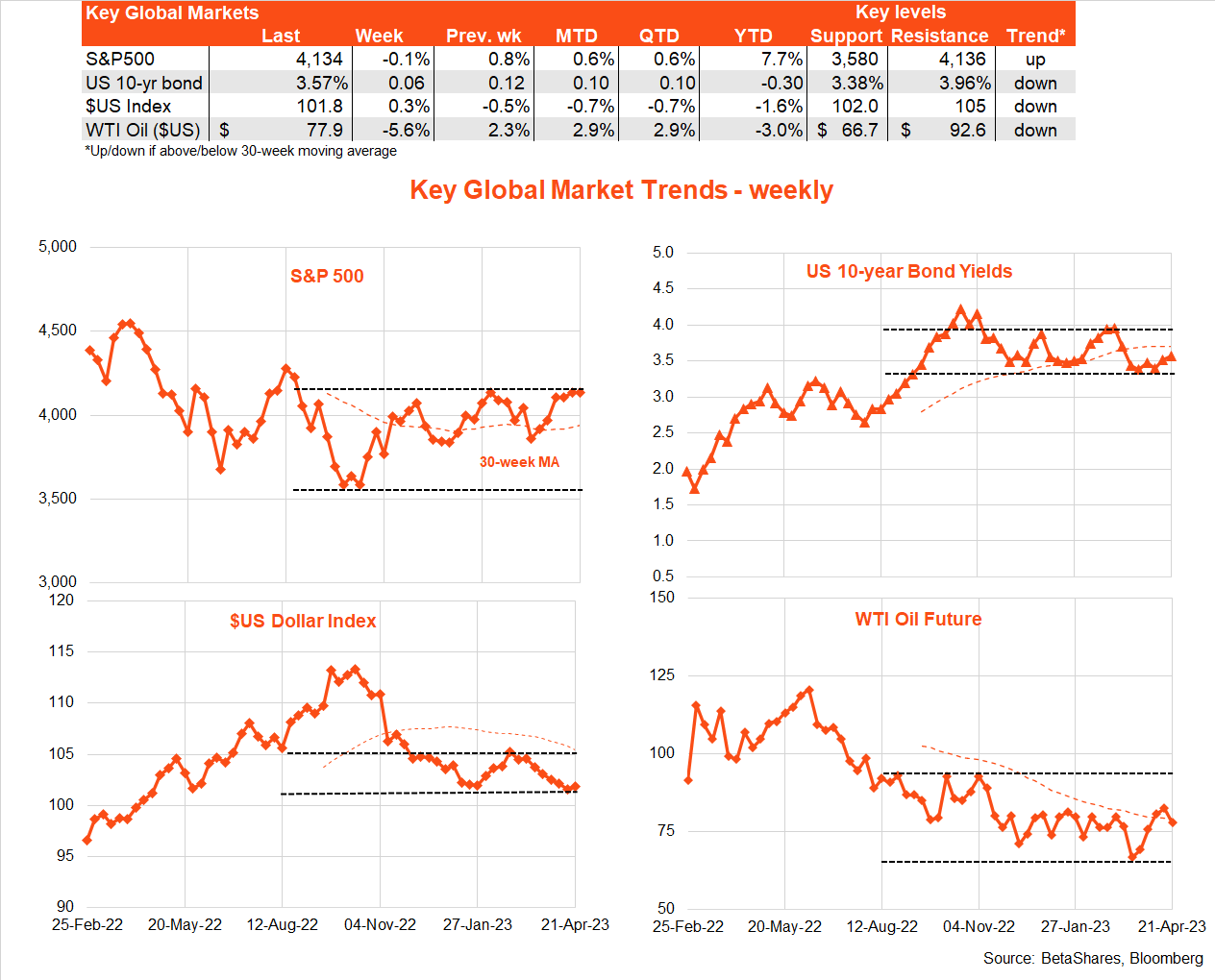

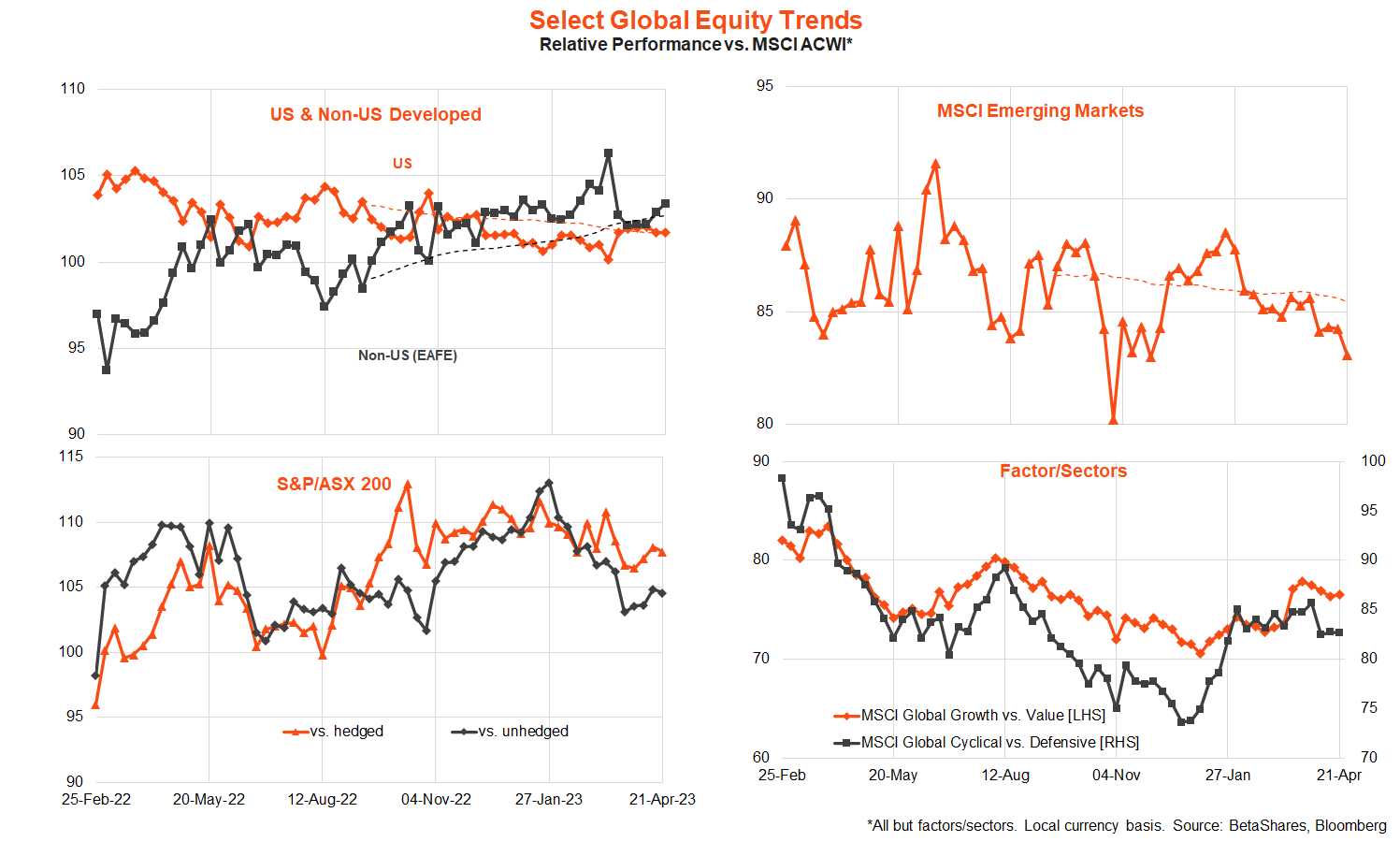

It was another relatively subdued week in global financial markets with little major economic data. A key market focus was a bunch of Fed speakers suggesting at least one more rate hike is still on the cards next week, despite further signs of slowing in the economy.

Indeed, there was a further notable lift in US jobless claims last week, suggesting its mighty labour market is finally beginning to crack. The decline from peak levels in some leading US labour market indicators, such as weekly claims and job openings, is already close to what’s usually seen in the early stages of a recession. However, the main difference today is that the starting point is one of still extremely high overall labour market demand. As a result, we’re yet to see much weakness in employment or a lift in unemployment – though if the weakness continues this will be inevitable.

Elsewhere, Chinese Q1 GDP growth was a bit better than expected, underpinned by an unsurprising rebound in consumer spending as COVID restrictions were removed. Investment in the property sector, however, remained sluggish reflecting the slump in buyer confidence throughout last year.

This week sees a slew of mega tech earnings reports from the likes of Microsoft, Alphabet, Meta and Amazon. Overall, earnings are expected to be subdued relative to year-ago levels, though this has not stopped investors from crowding into these stocks in recent months on hopes of a soft landing.

Of most importance, however, will be inflation and wage reports on Friday. The core consumption deflator is expected to show inflation remained sticky in March, with a 0.3% monthly gain (annual growth is expected to slow from 4.6% to 4.5%). The Q1 wage cost index is expected to lift by a firm 1.1% after a 1.0% gain in Q4. Gains in line with market expectations would confirm wage and price inflation remain uncomfortably high, likely cementing a Fed rate hike next week.

Australian Markets

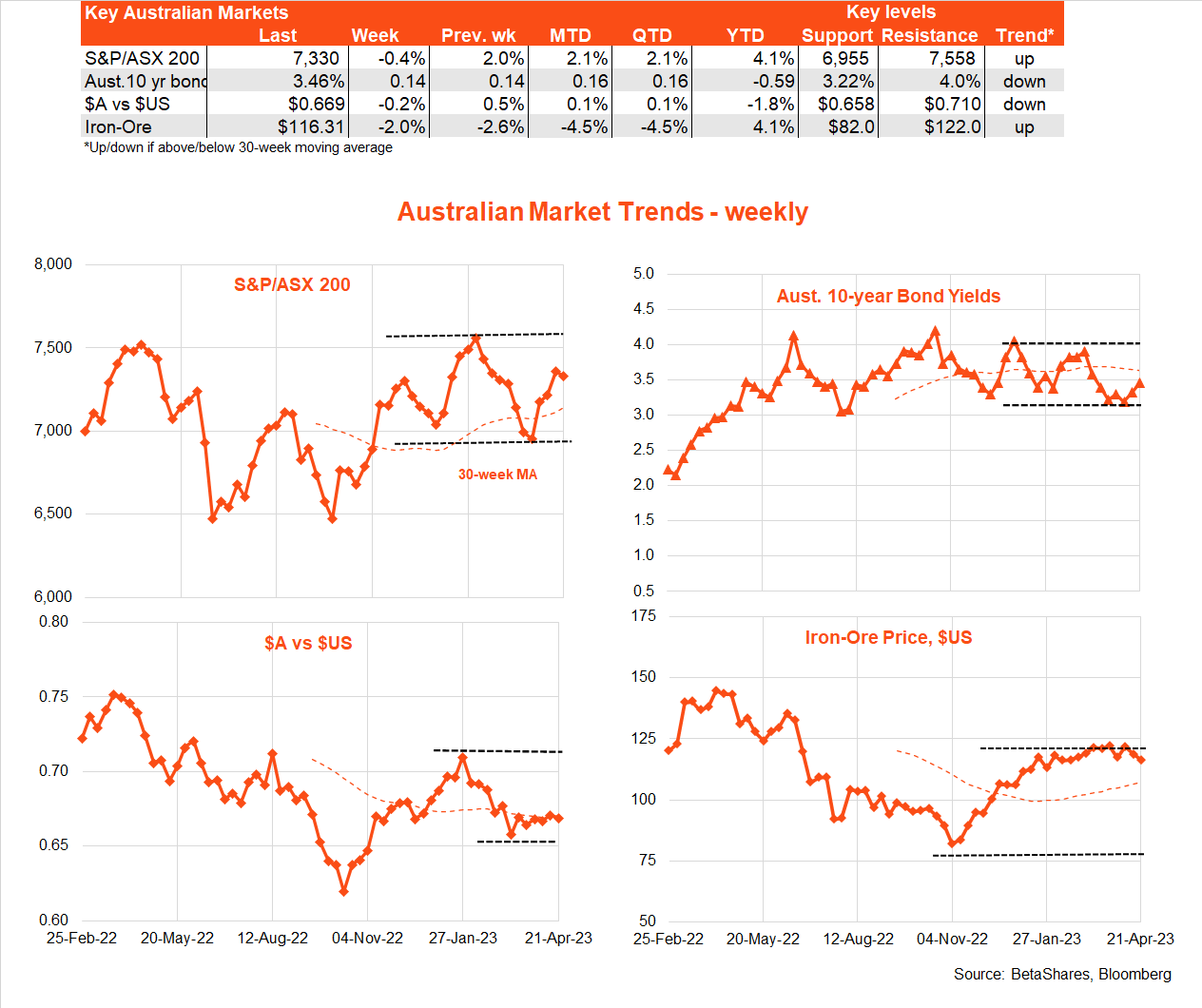

With little local data, the focus remained on the RBA. The minutes of the April meeting confirmed the Bank is still seriously thinking about raising interest rates further, though was prepared to pause at least for a time given the speed and extent of policy tightening in recent months.

Indeed, according to the minutes, the Board agreed that it should aim to have inflation back to the target range no later than mid-2025, and the Bank staff’s latest economic forecasts suggested this would still require “monetary policy being tightened a little further.” Whether this remains the case will depend on the run of upcoming economic data, most particularly the Q1 CPI report on Wednesday.

Based on the monthly CPI reports to date, there’s a good chance that the Q1 report will show a notable easing in annual headline CPI inflation to just under 7% (from 7.8% in Q4), as last year’s large energy price gains drop out of the calculation. That said, with a quarterly gain of more than 1% expected, the inflation pulse will remain uncomfortably high, and the decline in trimmed-mean “underlying” inflation should be only modest, with annual growth expected to slow from 7% to 6.8%.

Though barring a large upside surprise in the inflation numbers (as happened last time around), these results should still be good enough to allow the RBA to remain on hold at next week’s policy meeting. Beyond May, I still anticipate further signs of slowing in the economy to emerge to rule out further rate hikes this year and a likely rate cut by Melbourne Cup day.

Of course, also released last week was the long-awaited RBA Review. With changes to the inflation target effectively ruled out months ago, this was really a solution in search of a problem. My views are summarised here.