4 minutes reading time

Week in review

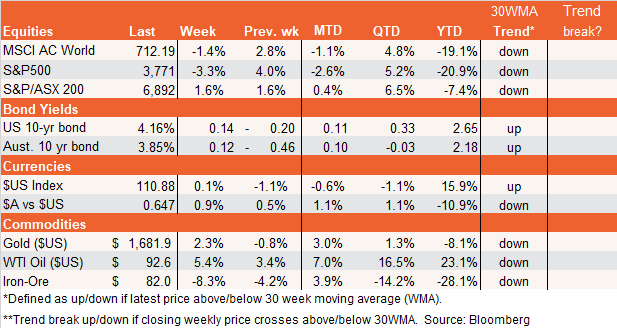

Global equities tried hard to continue to rally last week while the US Fed tried hard to prevent that from happening. The Fed hiked rates by 0.75% as widely expected, and hinted at a likely scaling back to a 0.5% (or even 0.25%) rate increase at the December meeting. But this potential ‘pivot’ good news was offset by Fed chair Powell warning that the ultimate peak cash rate could go higher than the near-5% rate projected by the Fed back in September and, either way, the Fed still likely has “some ways to go” in hiking rates.

Further mixed messages came from Friday’s US payrolls report, with a much higher than expected gain in employment and still uncomfortably high rate of wage growth (albeit no worse the expected) – despite there also being a surprise lift in the unemployment rate from 3.5% to 3.7%.

In other key news, a report on Friday (US time) briefly raised hopes that China would try to extricate itself from its zero-COVID policy, though this was denied by officials over the weekend.

All up, US equities were down for the week – correcting after two weekly gains – while US 10-year bond yields consolidated above 4%.

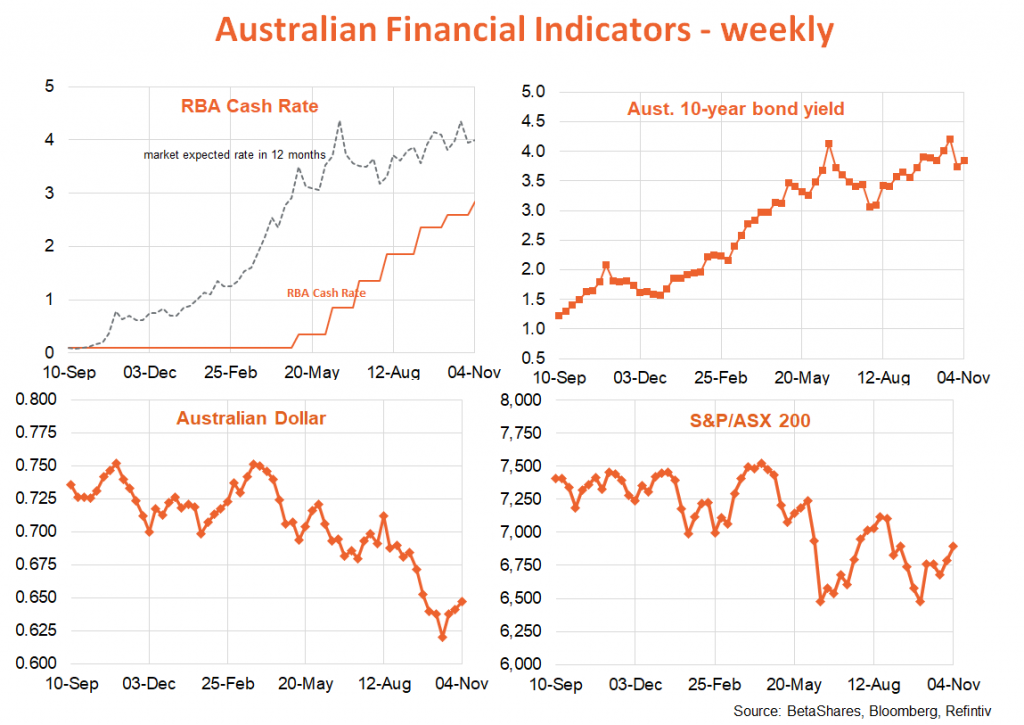

In Australia, the RBA raised rates by 0.25% as widely expected, and its Statement on Monetary Policy confirmed that the Bank appears content to wait until 2025 before inflation falls back within its 2 to 3% target band. This forecast in turn implies an agreement with market expectations that the cash rate will peak “at round 3.5% in mid-2023 before easing back to around 3% by the end of 2024.” If correct, this implies around three further 0.25% rate rises by mid-2023 after which an extended period of steady rates is anticipated.

As I outlined in this note, unlike the Fed, the RBA appears willing to let inflation take its time to fall – and ideally avoid a hard landing for the economy – provided wage growth and inflation expectations continue to remain reasonably well behaved. The RBA is also likely anticipating a deeper downturn in the US economy i.e. to some extent the Fed will do some of its work in moderating local economic growth.

In other key local news, house prices continued to slide in October while real retail spending flattened off in the third quarter – providing tentative signs that higher interest rates and weaker house prices are starting to reign in consumers.

Week ahead

The global highlight this week will be the US consumer price index report on Thursday (US time). Sadly, market consensus anticipates only glacial slowing in price pressures. The core CPI is expected to rise by 0.5% in October after a 0.6% gain in September (with annual core inflation only slowing from 6.6% to 6.5%). Headline CPI inflation is expected to rise by 0.7% after a 0.4% gain in September (with annual inflation slowing from 8.2% to 8.0%). Either way, markets are likely to be hugely sensitive to either an upward or a downward surprise – as it will likely help determine the size of the Fed’s rate hike next month.

Markets will also keep an eye on US mid-term elections on Tuesday. Rightly or wrongly (no politics here!) a strong Republican showing – which cements gridlock in Washington – would likely be the market’s favoured outcome. With voters upset over high inflation and rising interest rates, the polls suggest such a Republican ‘red wave’ is coming – though we’ve all learnt polls can be horribly wrong, and the result seems critically dependent on how many Democrats bother to show up to vote.

In Australia, on Tuesday we get updates on business and consumer confidence from the National Australia Bank and Westpac/Melbourne Institute surveys respectively. Contrary to recent trends, it could be that consumer confidence bounces back somewhat given smaller RBA rate increases – though business sentiment starts to soften as dark clouds gather around the global economy.

Have a great week!