Wet lettuce

5 minutes reading time

Global markets

Disappointing earnings reports from two big tech companies – Tesla and Alphabet – contributed to a further pull back in global stocks last week, despite another benign US inflation report.

Last week’s strong market reaction to underwhelming earnings reports from Tesla and Alphabet demonstrates the now high bar for further tech outperformance given high valuations. The Nasdaq-100 dropped a lazy 3.6% on the day of their earnings results.

Tesla earnings were again weaker than expected, reflecting crimped margins on EV sales due to intense global price competition – while hype around increased future earnings from robotaxis is starting to wear thin.

Alphabet did modestly beat earnings expectations, though investors remained concerned over slowing advertising revenue, and the increasingly heavy costs involved in staying in the AI race with ChatGPT.

Both the Bank of China and Bank of Canada cut interest rates last week, by 0.1% and 0.25% respectively. Given its wobbly economy, China’s move underwhelmed investors, while Canada’s move was more encouraging – as it reflected the growing trend among global central banks to ease policy in light of falling inflation.

Last but not least, the US June consumption deflator report was good – but no better than expected – with headline and core prices up 0.1% and 0.2% respectively in the month.

Global week ahead

Key highlights this week are the US Fed meeting and Friday’s July payrolls report. While no US rate cut is expected this week, markets will be focused on any hints in the post-meeting statement about future rate cuts, with a cut in September now priced as a near-certainty.

With 177k in new jobs and the unemployment holding rate steady at 4.1%, the payrolls report is expected to remain firm – but show enough ongoing signs of a slowdown to keep alive hopes for a September rate cut.

In terms of central banks, markets attach a 60% chance to the Bank of England finally cutting rates given already decent declines in inflation, and a 70% chance the Bank of Japan will hike rates despite a recent strong rebound in the yen.

Earnings reports will also be critical, with results from Microsoft, Meta, Apple and Amazon the main focus of market attention. As noted above, investors seem less forgiving these days, and are currently of a mind to sell down the tech darlings – and rotate elsewhere – on the slightest signs of earnings disappointment.

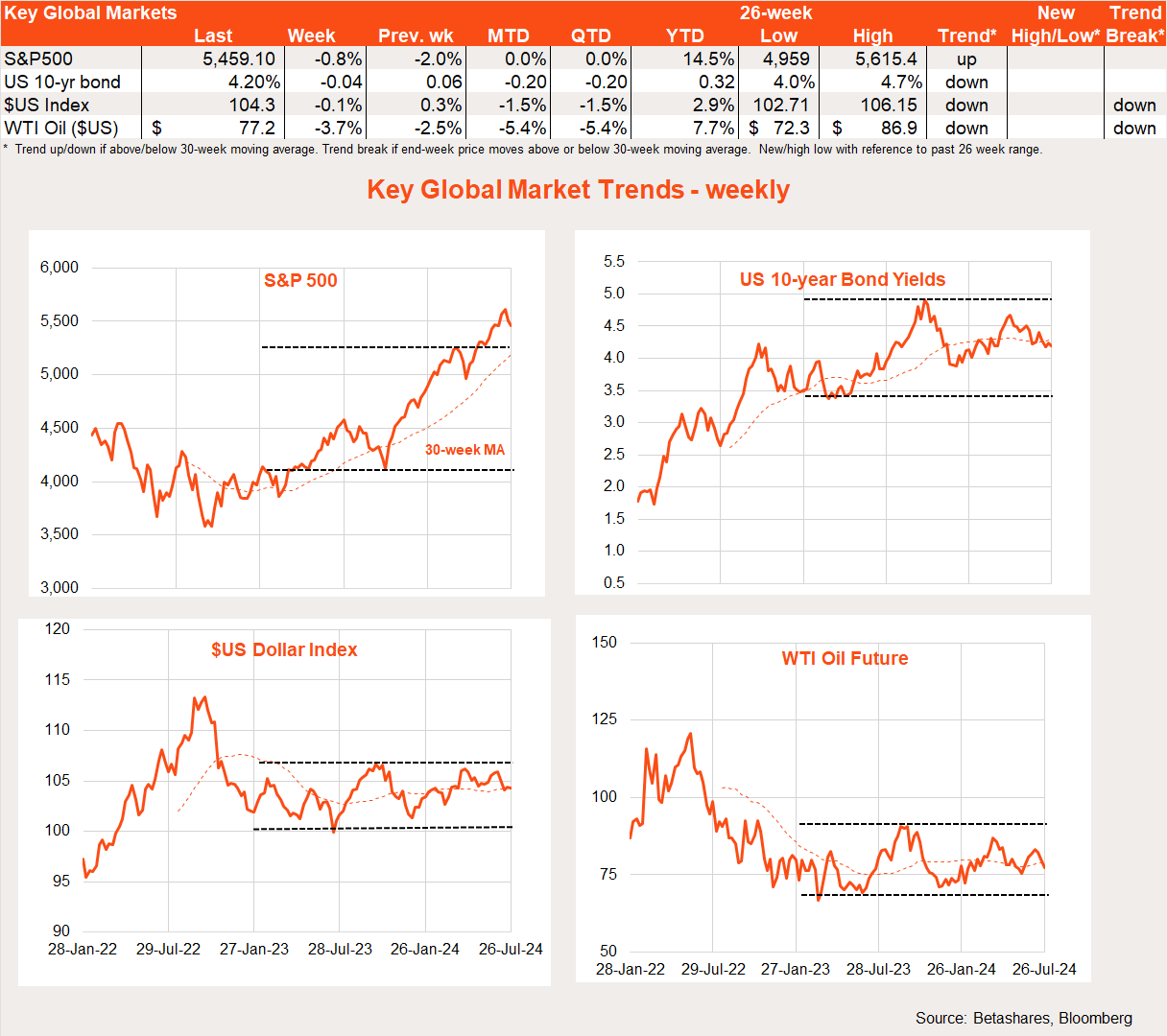

Market trends

As evident in the chart set below, the most interesting development within global equity markets in recent weeks has been a rotation from growth/technology/large caps to value/small caps.

Overall US relative performance is so far holding up, however, with investors instead seeking other areas of value within the market. Japan’s relative performance correction continues in the face of a higher yen and concerns over BOJ rate hikes.

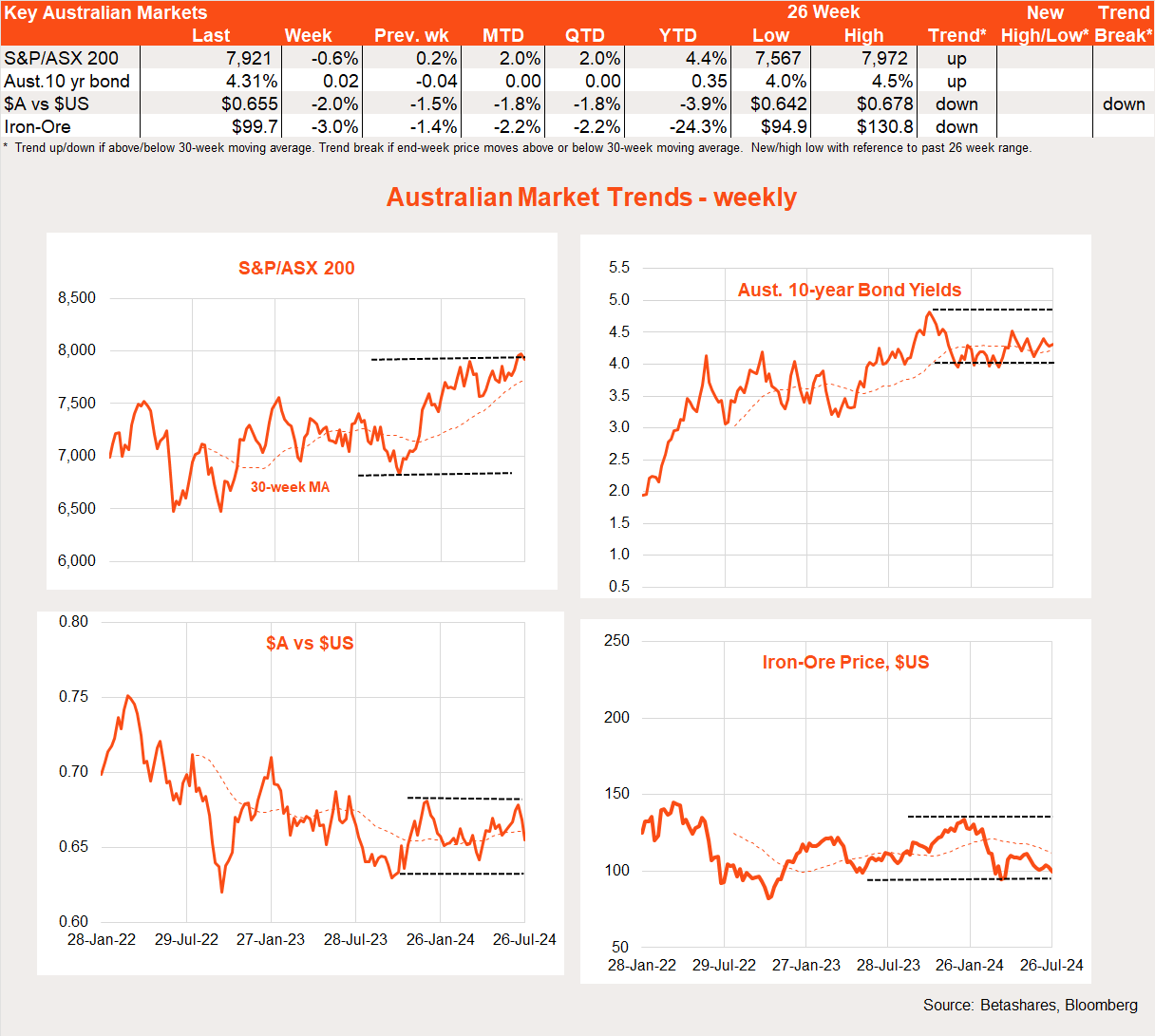

Australian market

With little on the local data front last week, local stocks dropped back largely in sympathy with global trends.

The key highlight this week will be the all-important June quarter consumer price index report on Wednesday – with a bad enough result likely to increase pressure on the RBA to hike rates next month. With two monthly CPI results already out, the omens are not good and this week’s June results will provide an important update on a range of (likely still firm) service sector prices.

As it stands, the market now attaches only a 20% risk of a rate hike – despite market expectations for a 1% quarterly gain in the trimmed mean underlying inflation measure, which would push up annual TM inflation from 4.0% to 4.1% – well above the RBA’s May forecast of 3.8%.

Is that bad enough for a rate hike? The market at least doesn’t think so. The saving grace might be the headline CPI, with a 1% quarterly gain market expectation consistent with annual inflation lifting from 3.6% to 3.8% – though at least the 3.8% result is no higher than the RBA’s May forecast.

For the record, I expected annual trimmed mean inflation to rise to only 3.9% – which would not be bad enough to see the RBA raise rates next month.

Either way, if the market is right and underling inflation pushes well above the RBA’s May forecast, the Bank will be under pressure to either raise rates or forecasts a further delay – from late 2025 to early 2026 – in getting annual underlying inflation back within the target zone. The market is effectively betting the RBA would rather further delay getting inflation back to target than risk another rate rise.

Also out on Wednesday and somewhat relevant to the interest rate outlook will be June retail sales. Sales popped 0.6% higher in May and the market expects a more modest 0.3% gain in June. All up, this would suggest underlying sales remain soft – though with the benefit of tax cuts coming in July!

1 comment on this

ha, ha, itza coming, higher inflation, equities about to plunge