6 ETFs for the income investor who doesn't want Big Bank share price risk

4 minutes reading time

Last year, global defence spending (in real terms) surged by 7.4% to over US$2.4 trillion. Analysts at Goldman Sachs have forecasted that this spending will continue to grow as a global regime change takes shape. But what will all this change mean for investors and how will this shift affect defence-related investments? In this piece, we find out.

Europe forced to take responsibility of its defence

The current US administration has argued that defence spending by NATO members should be at least 5% of GDP. In response to this, as well as recent remarks from US Vice President JD Vance, the European Union is proposing a five-point rearmament plan which could cost nearly €800 billion all-told. In addition, several individual nations from the UK to Denmark and Germany are making even bigger promises to lift defence spending.

How defence companies could stand to benefit from this increased spending

In addition to all this spending in Europe, the US defence budget eclipsed US$840 billion last year alone. All this increased spending suggests that defence contractors could see a significant increase in demand – even to levels that are comparable to what has happened in the artificial intelligence space.

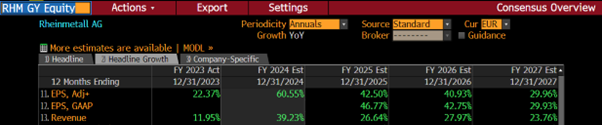

For example, analysts polled by Bloomberg who track German defence giant Rheinmetall are forecasting top line growth of around 40% for the current earnings season and approximately 40% earnings per share (EPS) growth per year for the next two years.

Source: Bloomberg. As of 5 March 2025.

Meanwhile, US-domiciled Palantir Technologies saw sales of its products to the US government surge by 45% in the 2024 calendar year. In addition, Palantir recently expanded its partnership with the US army, one that could generate as much as.

These two companies are examples of what’s been dubbed by some as the new “Trump Trade”– defence companies have been outperforming even as the wider US stock market seems likely to erase the US$3.4 trillion rally it created in the wake of Trump’s second victory in November 2024.

Source: Bloomberg. 1 January 2024 to 6 March 2025. European Defence Stocks represented by the MSCI EMU Aerospace & Defence Index, Magnificent 7 represented by the Bloomberg Magnificent 7 Total Return Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

While it is not clear how much of this demand growth will filter through to earnings, the prospect of significant growth in global defence budgets could make the companies exposed to this theme an attractive idea from a macro perspective.

Investing in defence

Betashares Global Defence ETF (ASX: ARMR) is a simple way for Australian investors to gain exposure to the global defence sector.

ARMR provides investors with exposure to leading global defence companies. These companies are aligned with NATO-allied countries and derive more than 50% of their revenues from the development and manufacturing of military and defence equipment. Some companies in the fund also develop and manufacture defence technology in addition to the hardware.

Some of the companies held in the fund currently include Lockheed Martin, Palantir Technologies, BAE Systems, Rheinmetall, and Thales. Note however that neither fund holdings nor their weightings are guaranteed and are subject to change.

ARMR may be considered for use as a satellite or minor allocation in an investor’s portfolio.

There are risks associated with an investment in ARMR, including market risk, sector risk and concentration risk. Investment value can go up and down. An investment in ARMR should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of ARMR, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

[1] https://www.iiss.org/online-analysis/military-balance/2025/02/global-defence-spending-soars-to-new-high/[2] https://www.goldmansachs.com/insights/articles/how-much-will-rising-defense-spending-boost-europes-economy[3] https://www.politico.eu/article/donald-trump-tells-allies-spend-5-percent-gdp-defense-nato/[4] https://www.theguardian.com/world/2025/mar/04/eu-plan-to-bolster-europes-defences-could-raise-800bn-for-ukraine[5] https://www.gov.uk/government/news/prime-minister-sets-out-biggest-sustained-increase-in-defence-spending-since-the-cold-war-protecting-british-people-in-new-era-for-national-security[6] https://www.gov.uk/government/news/prime-minister-sets-out-biggest-sustained-increase-in-defence-spending-since-the-cold-war-protecting-british-people-in-new-era-for-national-security[7] https://www.gov.uk/government/news/prime-minister-sets-out-biggest-sustained-increase-in-defence-spending-since-the-cold-war-protecting-british-people-in-new-era-for-national-security[8] https://eda.europa.eu/news-and-events/news/2024/11/19/2024-defence-review-paves-way-for-joint-military-projects [9] https://usafacts.org/articles/how-much-does-the-us-spend-on-the-military/[10] https://investors.palantir.com/news-details/2025/Palantir-Reports-Q4-2024-Revenue-Growth-of-36-YY-U.S.-Revenue-Growth-of-52-YY-Issues-FY-2025-Revenue-Guidance-of-31-YY-Growth-Eviscerating-Consensus-Estimates/[11] https://investors.palantir.com/news-details/2024/Palantir-Expands-Army-Vantage-Partnership-with-618.9M-Contract/[12] https://www.barrons.com/livecoverage/stock-market-today-021825/card/stock-futures-rising-defense-stocks-are-the-new-trump-trade-amid-russia-peace-talks–UKVFAwg7pypKyI18tk3x[13] https://www.bloomberg.com/news/articles/2025-03-04/us-stocks-set-to-erase-3-4-trillion-post-election-trump-rally