7 minutes reading time

Key Points

- China has been the best performing equity market this year, driven by optimism around local AI developments

- The key to any sustained recovery will likely be driven by a turnaround in sentiment and domestic consumption

- Becoming a global leader in technology is a strategic priority for Beijing

Chinese stocks are grabbing investors’ attention this year as the US economy faces growing concerns.

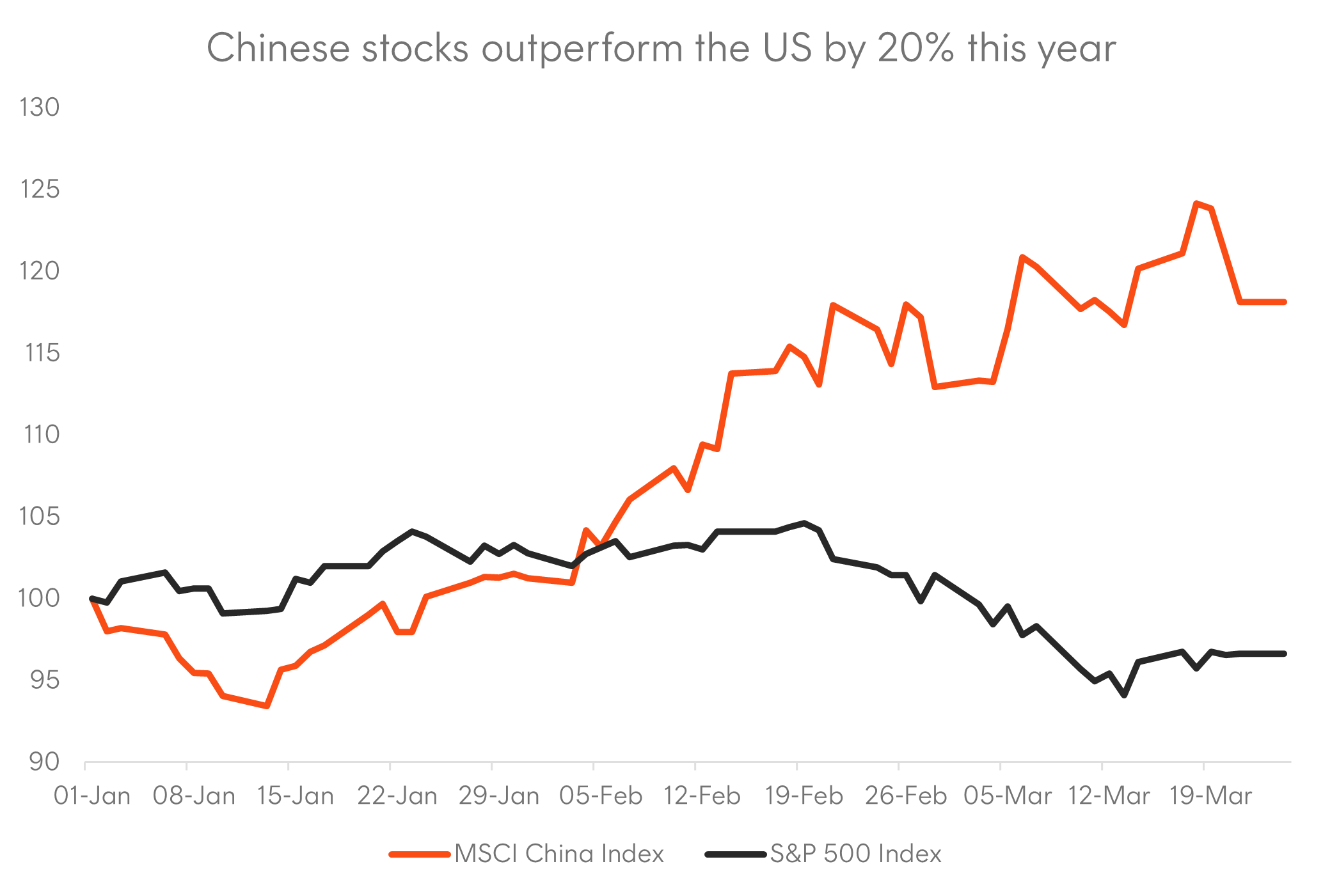

Year to date, the MSCI China Index has soared 18% whilst the S&P 500 Index has fallen by around 3.5% as at 24 March 2025. This reflects the contrasting policy mix between Beijing and Washington. In his first 50 days as US President, Trump’s tariff and fiscal austerity measures have upended the exuberant run that US shares have enjoyed over recent years. In fact, the S&P 500 recently entered correction territory, falling more than 10% from its highs set in mid-February.

Source: Bloomberg. As at 24 March 2025. You cannot invest directly in an index. Past performance is not indicative of future performance.

In contrast, Xi Jinping and his delegates have taken an opposite stance. At their annual ‘Two Sessions’ meeting held last month, Chinese officials are instead focused on stabilising expectations and ensuring that the local economy can grow at a sustainable pace.

In this piece, we look at what was discussed and how it may influence your investments.

What is the Two Sessions meeting and what was discussed?

Every year, the National People’s Congress (NPC) and its political advisory body, the Chinese People’s Political Consultative Conference (CPPCC) meet to determine the country’s economic targets and policy priorities in the ‘Two Sessions’ meeting, with the following targets determined for 2025:

- GDP growth of “around 5%”

- Surveyed urban unemployment rate of around 5.5%

- Over 12 million new urban jobs

- An inflation increase of around 2%

As a result, the tone in Premier Li Qiang’s Government Work Report (GWR) has been pro-growth with a focus on providing accommodative stimulus packages.

For example, in addition to raising the fiscal deficit target to 4%, 500 billion yuan (~A$110 billion) of special treasury bonds will be issued to recapitalise state-owned banks. Further, 4.4 trillion yuan (~A$965 billion) in local government special-purpose bonds will be issued for construction investment, purchases of idle land, and settlement of overdue payments owed by local governments to enterprises.

The issuance of these special purpose bonds provide Beijing the funding necessary to revitalise economic growth.

The GWR also highlighted that the role of monetary policy instruments would be “fully leveraged” by lowering reserve requirements more quickly and cutting borrowing costs for households.

Whilst these measures sound promising, what’s more important is whether they can be implemented in a timely manner and if the size of these packages can materially drive longer-term economic growth.

For now, the recent rally that Chinese equities have experienced largely reflects optimism around these policy expectations. But the key to any sustained recovery in the economy will likely be driven by a turnaround in sentiment and domestic consumption.

This is important given a large portion of China’s growth is driven by exports to the rest of the world, particularly in electric vehicles, solar panels and batteries. This makes its economy vulnerable to any external shocks, such as the current US tariffs imposed on Chinese exports.

Can China revive domestic consumption and improve sentiment?

Consumption was identified as a top priority from the Two Sessions meeting, which would be targeted through:

- Consumer good trade-in programs that offer subsidies for replacing old home goods with new ones,

- Tackling falling birth rates and freeing up cash for household discretionary spending through childcare subsidies. For instance, in the Inner Mongolian city of Hohhot, the first child would receive 10,000 yuan.

- Steering and generating demand by providing “high-quality” supply of goods.

Similar to the fiscal and monetary stimulus packages, these measures to boost consumption sound promising on paper but appear more short-term and targeted in their effectiveness.

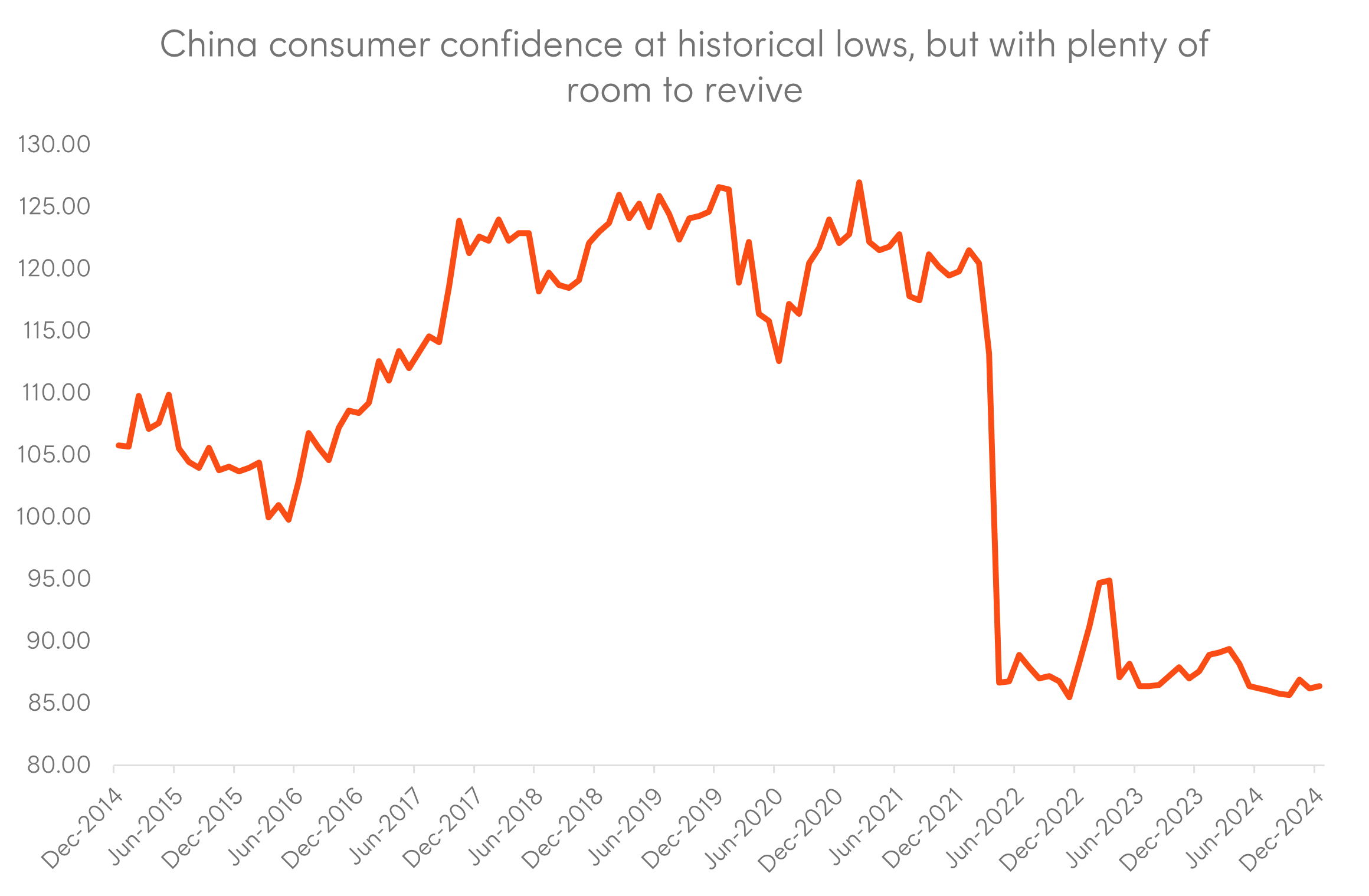

Ultimately, sentiment still remains weak as shown in the chart below due to ongoing structural issues around an indebted property market, high youth unemployment, and an ageing population.

Source: Organisation for Economic Co-operation and Development via FRED.

For Chinese consumers to start feeling confident about spending again, the property market would have to show clear signs of bottoming out given a large portion of wealth is tied to their homes.

Additionally, with the youth unemployment rate nearing 20%, young graduates need to feel more optimistic about their future job prospects. Many struggle to find jobs that match the degrees they earned at university, as employers often prioritise practical skills and experience that many graduates lack. This mismatch between supply and demand places significant pressure on China’s aging population, as it leads to lower income and tax generation.

But getting Chinese consumers to spend significantly more requires more than one-off cash handouts. It will take a shift in psychology, as China has historically been a high savings nation due to having a weaker social safety net and other cultural reasons.

Winning the AI arms race

One bright spot is Beijing finally recognising that the high-tech private sector will be essential in transforming the future trajectory of its economy. This marks a dramatic shift in tone from the regulatory crackdown in late 2020, which ultimately led to the cancellation of Ant Group’s IPO.

Following the release of DeepSeek, optimism around AI and championing national leaders within the technology space were expressed throughout the report with various measures aimed to promote AI development.

This includes improving the quality of education across elementary schools and universities, revitalising funding for science and technology research, and empowering local governments through healthy competition to vie for national recognition as local high-tech champions.

Source: Bloomberg Economics

In addition, there have been promising developments from the incumbent technology leaders in Alibaba, Tencent and Xiaomi. For example:

- Alibaba released its own Qwen 2.5-Max AI model which rivals the performance across GPT-4o, DeepSeek-v3 and Llama-3.1-405B1

- Tencent plans to devote a low-teens percentage of its 2025 revenue toward AI infrastructure capital expenditure to catch up with local rivals2

- Xiaomi plans to expand its second electric car factory in Beijing after the success of its first model prompted the company to raise its sales target to 350,000 vehicles this year3.

These are all companies held in the ASIA Asia Technology Tigers ETF which provides a simple access point to the dynamic technology sector in China and other neighbouring countries like South Korea and Taiwan.

Conclusion

China’s Two Sessions meeting revealed that domestic conditions have become too uncomfortable for top policy makers. Whilst policymakers have acknowledged their willingness to address these concerns, it has become clearer that securing China’s position as the global leader in technology is key to its long-term growth story.

There are risks associated with an investment in ASIA, including information technology risk, concentration risk, emerging markets risk and currency risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. https://qwenlm.github.io/blog/qwen2.5-max/ ↑

2. https://www.reuters.com/technology/tencent-joins-chinas-ai-spending-race-with-2025-capex-boost-2025-03-19/ ↑

3. https://www.bloomberg.com/news/articles/2025-03-19/xiaomi-plans-to-expand-beijing-ev-factory-to-meet-surging-demand ↑