Cautious cutter

5 minutes reading time

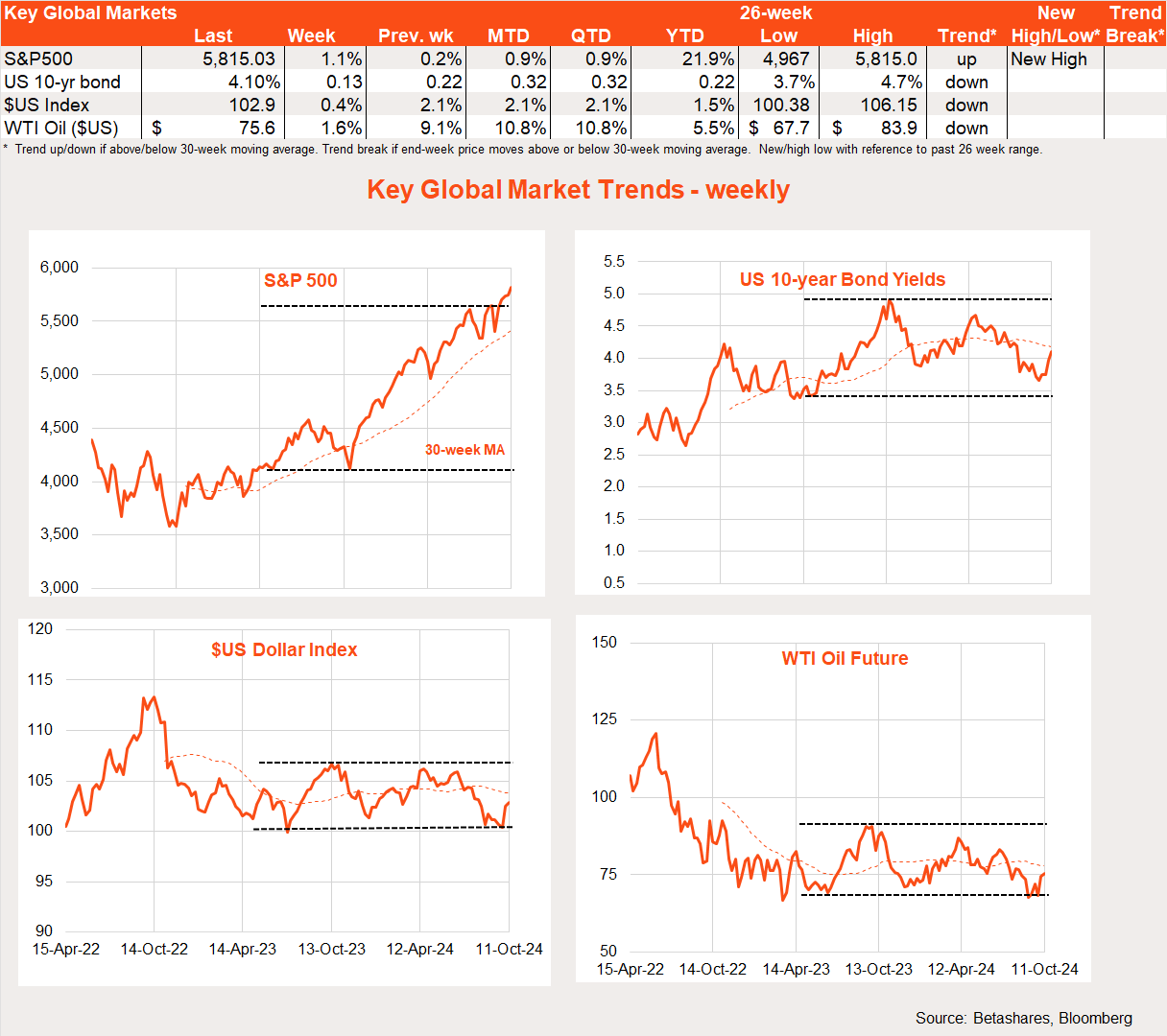

Global markets

Global equities edged higher again last week reflecting the continued prospect of US monetary easing and a good start to the Q3 US earnings reporting season. The lift in stocks came despite a higher-than-expected US inflation report and disappointment on further Chinese policy stimulus.

The key global highlight last week was the higher-than-expected US CPI inflation report, with core consumer prices lifting 0.3% (market 0.2%). Despite the slight miss, the market took it quite well – helped by generally still reassuring commentary from Fed officials on the prospect of further policy easing. Also helping was a rise in weekly jobless claims (bad news is good news!), likely reflecting hurricane-related disruptions.

Annual headline inflation still managed to ease to 2.4% – the lowest level since February 2021. With some disruptions caused by recent hurricane activity, it’s too early to fear the US disinflationary trend has already ended.

Other discomforting news came from China, with officials at two press conferences failing to live up to the – perhaps unrealistic – lofty expectations markets had developed with regard to further policy stimulus. While officials pledged to pursue this year’s 5% growth target, no new bazookas were fired – causing a correction in Chinese equities and commodity prices.

On the brighter side, the US Q3 earnings reporting season began well, with JP Morgan and Wells Fargo producing market pleasing results last Friday. Israel also has yet to retaliate for Iran’s recent missile strikes. In New Zealand, the RBNZ met market expectations and cut rates by an aggressive 0.5% – my call earlier this year for 1% of NZ rate cuts this year now looks conservative.

Global week ahead

While investors will keep a watchful eye on Middle East developments, a key focus otherwise this week is likely to be the US earnings reporting season – with major companies such as Netflix, Bank of America and Citigroup stepping up to the plate. US retail sales on Thursday will also provide an update on the (likely still good) health of the US consumer.

In Europe, the ECB is widely expected to cut rates for the second meeting in a row on Thursday – contrary its earlier signaling – given recent weak EU activity indicators. Like the Fed, the ECB is starting to place more weight on bolstering growth given continued reassuring signs of disinflation.

Last but not least, Q3 Chinese GDP is released on Friday, with annual growth expected to ease from 4.7% to 4.6% – making the Q4 target of “around 5%” something of a stretch.

Market trends

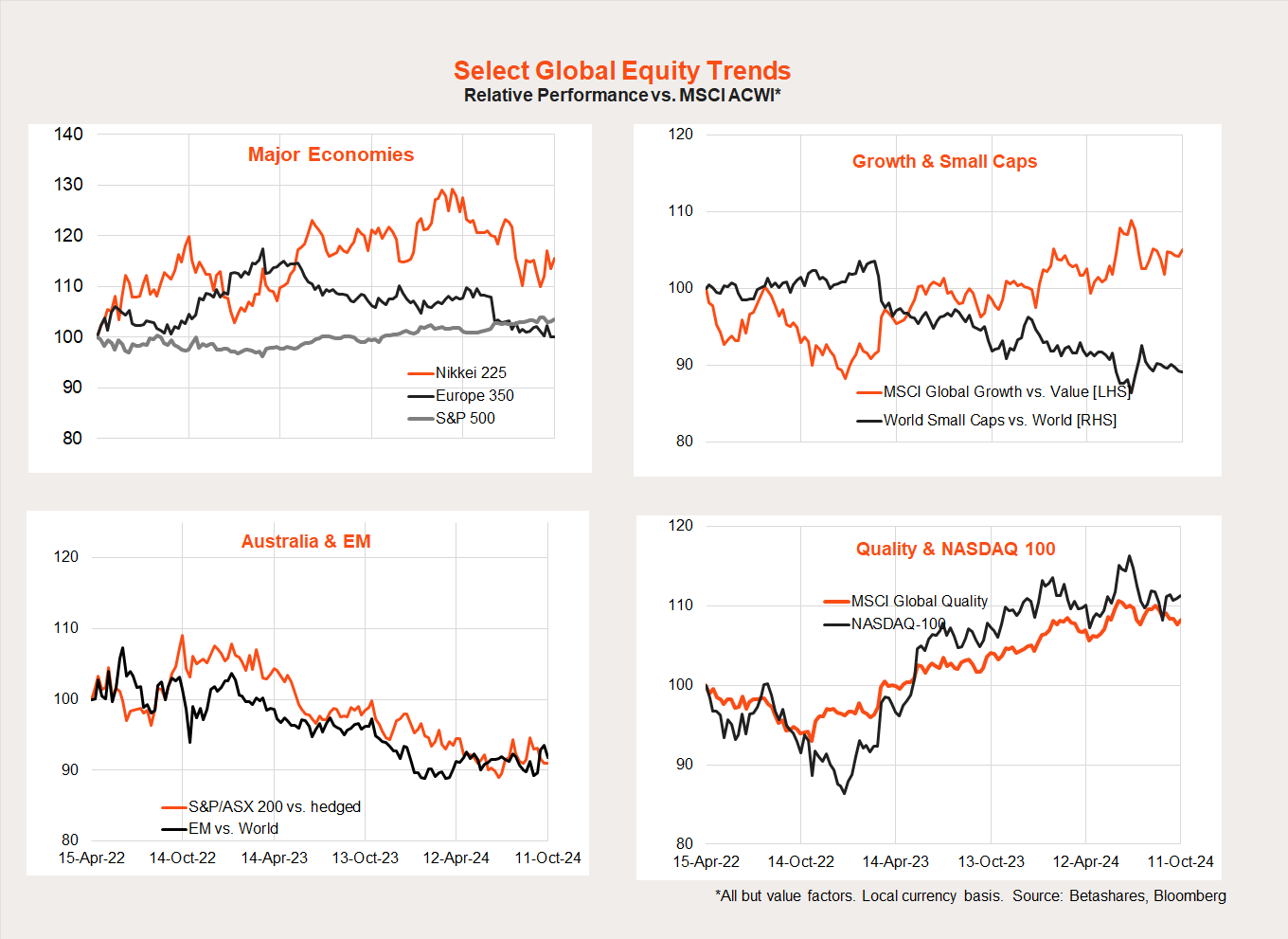

The most interesting development in global equity markets of late has been the Chinese stimulus, which has helped produce a nice pop higher in emerging market equities. The energy sector is also benefiting from the rebound in oil prices in the wake of heightened military tensions.

The major global market theme – the ‘soft landing’ miracle – remains in place, and could be starting to benefit cheaper areas of the market beyond US large-cap technology stocks.

There appear to be increased signs of a waning in the growth/quality/technology trend of outperformance, though this has yet to clearly favour global small-caps and/or clearly dis-favour the US market overall.

Australian market

The local S&P/ASX 200 index rebounded 0.8% last week, helped by the rise in global markets and signs of stabilisation in local business and consumer confidence. Despite further strength in iron-ore prices, the $A edged back, reflecting a firmer $US on reduced prospects of another large 0.5% Fed rate cut at the November policy meeting.

As already noted last week, the Westpac survey of consumer confidence revealed a nice 6% rebound in October, seemingly reflecting reduced fears of another local interest rate hike. Last week’s NAB business survey was also encouraging, with a moderate lift in both confidence and conditions in September. After gradually easing from robust levels over the past two years, there’s tentative signs of a bottoming out in business conditions at back around long-run average levels. This is consistent with continued subdued growth in the economy, but just strong enough to avoid outright recession.

The major local highlight this week will be Thursday’s September jobs report, with another solid 25k gain in employment expected – keeping the unemployment rate steady at 4.2%. RBA chief economist Sarah Hunter also gives a speech on the economy one day earlier.

PS. On Friday I’ll be sweating for a good cause at the 24-hour cycle Spinathon. If you’d like to know more and donate, please visit here.

Have a great week!