Another hawkish cut?

4 minutes reading time

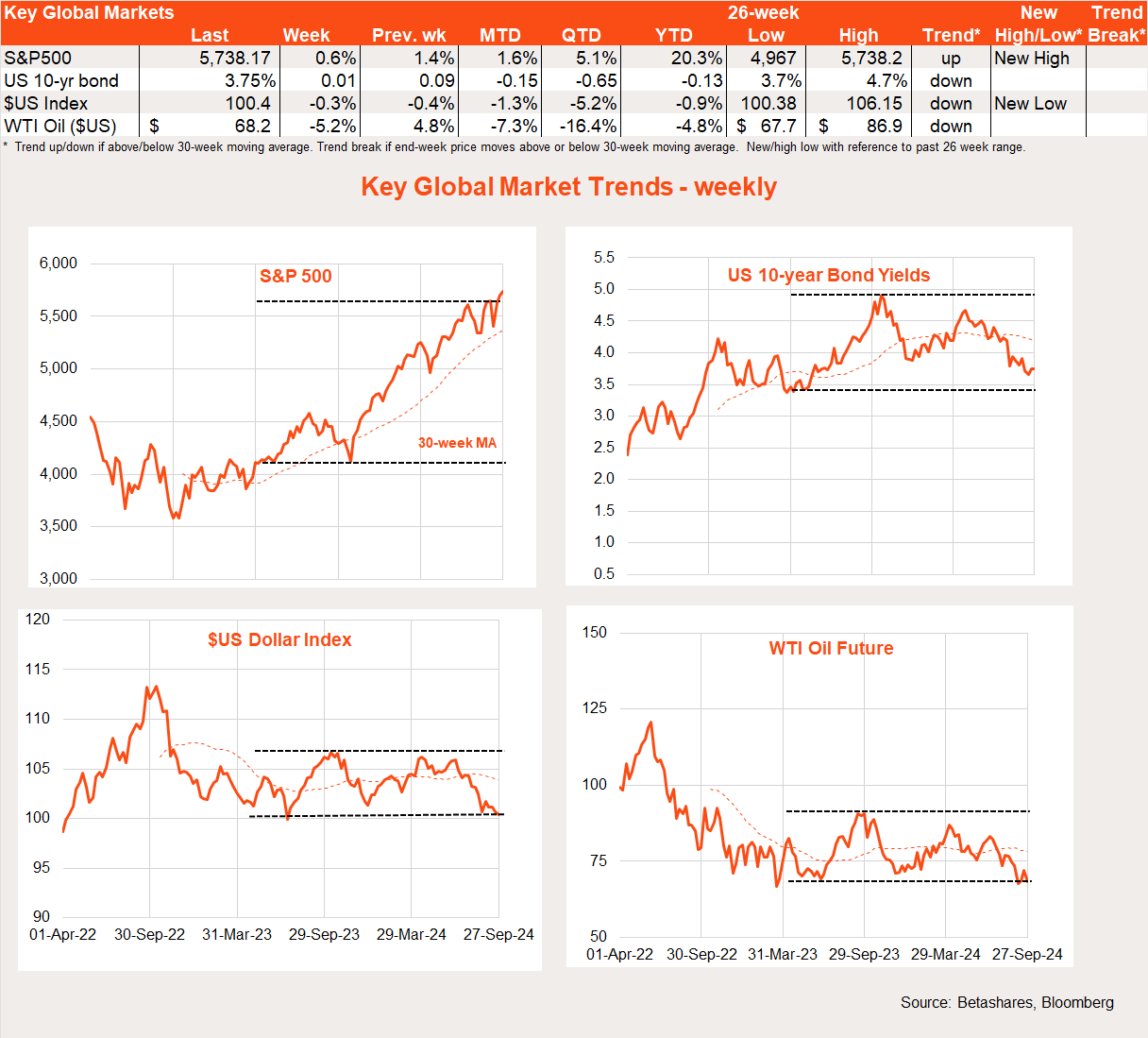

Global markets

Global equities rose further last week helped by surprise Chinese stimulus moves and the ongoing US “goldilocks” environment.

US economic data was reasonably mixed last week though broadly consistent with the soft landing or “goldilocks” scenario. On the negative side, the Conference Board US consumer confidence index fell in September to be back around long-run average levels – reflecting a softening labour market outlook. That said, weekly jobless claims remained remarkably low, an alternative (University of Michigan) consumer sentiment report ticked up and the August private consumption expenditure (PCE) inflation report matched benign market expectations.

The core PCE rose 0.1% in the month, with the annual rate ticking up to 2.7%. Annual headline PCE inflation, however, is now down to 2.2%.

In Europe, weak manufacturing data has boosted expectations of a potential ECB rate cut next month. Those expectations could rise further if, as the market expects, this week’s EU inflation report shows annual headline inflation falling to just under the ECB’s 2% inflation target.

But the global highlight last week was a succession of monetary and fiscal stimulus announcements from China – both to encourage more home buying and support the equity market. As would be expected, this caused a pop higher in Chinese equities, commodity prices and the $A – though the jury is out on whether the measures will be enough to offset China’s entrenched structural growth impediments such as over regulation, population ageing, and the debt-fuelled property bubble. I have my doubts!

Global week ahead

Key global highlights this week will be updates on the health of the US economy, with job vacancies and ISM manufacturing reports on Tuesday, jobless claims and the non-manufacturing ISM report on Thursday, followed by the all-important payrolls report on Friday.

Overall, the reports should suggest that while the economy is slowing modestly, it is not slumping into recession. A moderate 144k gain in September employment is expected, for example, which should keep the unemployment rate steady at 4.2%.

Market trends

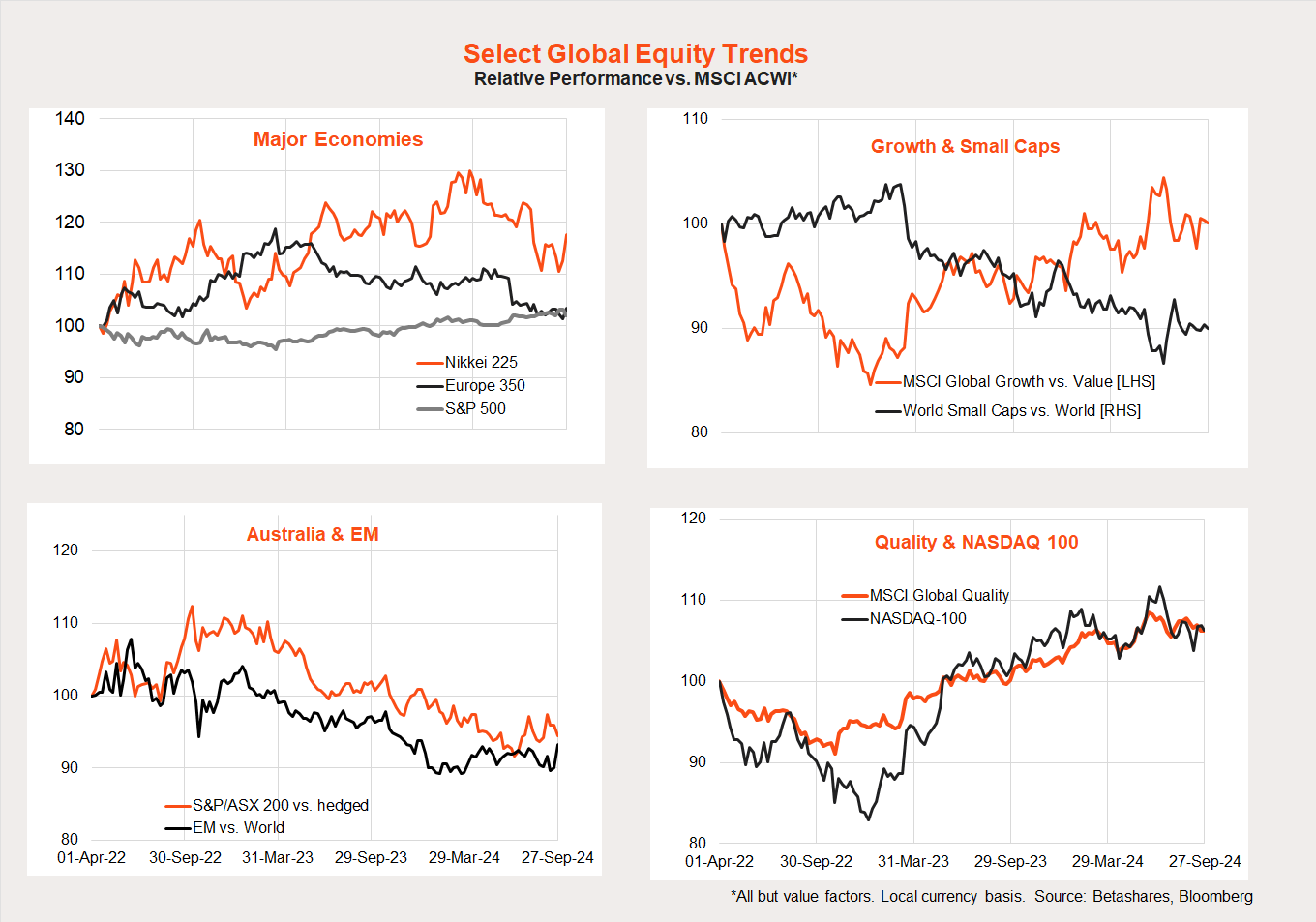

Chinese stimulus helped produce a nice pop higher in emerging market equities last week, and Japanese equities also did relatively well. Otherwise, the tug of war between growth/technology/US/large caps and cheaper alternative areas remains in a state of flux.

Australian market

The local S&P/ASX 200 index was flat last week, though Chinese stimulus saw a major rotation from financial to resource stocks. The materials sector rose a lazy 9.4%, while financials (ex A-REITs) dropped 4.4%.

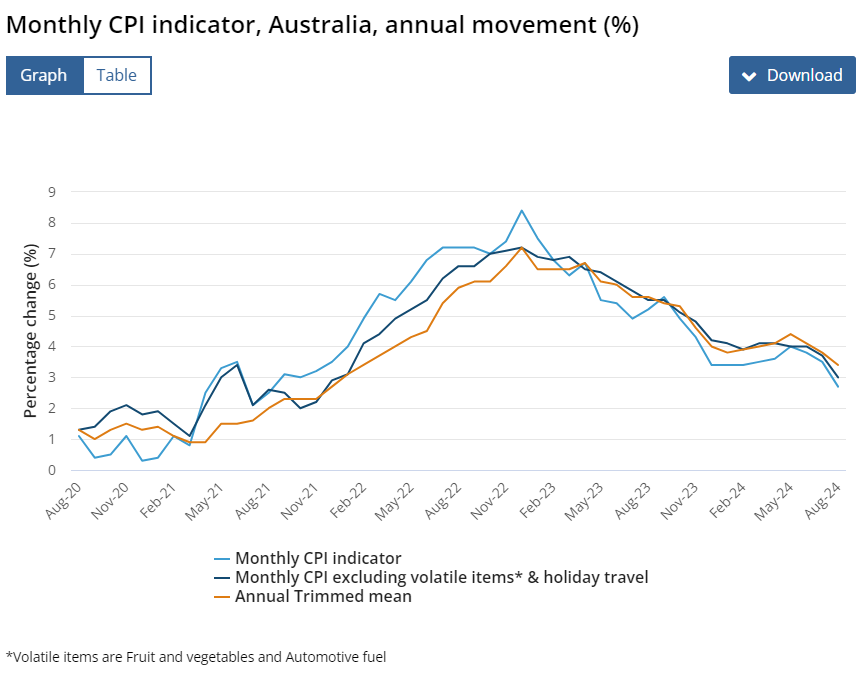

Not helping the local market remains the lingering hawkishness of the RBA. While keeping rates on hold last week, Governor Bullock stressed the Bank would look through the temporary reduction in headline inflation caused by various government cost-of-living support measures (notably, but not exclusively, electricity costs). Instead, an increased focus will be placed on underlying inflation measures such as the trimmed mean.

The good news in this regard was that Wednesday’s monthly CPI report for August revealed – along with the widely expected sharp drop in annual headline inflation from 3.5% to 2.7% – a very welcome drop in annual trimmed mean inflation from 3.8% to 3.4%. Looking across various measures of underlying inflation, a resumption of nice downtrends in annual inflation is now clearly evident over recent months. Whether this continues – and to what degree government measures are playing some role in also artificially pushing down underlying inflation – remains to be seen.

Turning to the week ahead, there is a smattering of local economic data though the likely highlight should be August retail sales tomorrow. Despite the tax cuts, retail sales were surprisingly flat in July and the market anticipates a more solid bounce of around 0.4% in August. Failure to get much of a bounce would suggest households are preferring to use tax cuts to boost saving or pay down debts – which would be of some comfort to the RBA.

Have a great week!