How Liberation Day upended markets: A timeline

4 minutes reading time

- Australian shares

- Global shares

As we move into 2025, investors face concentrated equity markets at all-time highs, elevated government bond yields and policy uncertainty.

Within this context we asked five Betashares investment experts to nominate a chart that they think investors should be watching for the year ahead.

2025: The year of the tariff man

Nominated by: David Bassanese, Chief Economist

Source: Peterson Institute for International Economics

Why it’s important: Elevated tariffs could result in a modest hit to economic growth through higher consumer prices reducing disposable income, and broader trade uncertainty weighing on business investment. Although this did not materially impact Chinese export volumes in the years following the 2018 US-China trade war, higher tariffs under Trump may place further pressure on an already challenged Chinese economy.

Will term premiums remain elevated in 2025?

Nominated by: Chamath De Silva, Head of Fixed Income

Source: Bloomberg, Betashares. As at 10 January 2025.

Why it’s important: The US Treasury 10-year term premium moved back into positive territory in October 2024. This may suggest investors are demanding more compensation given the uncertainty of greater fiscal deficits and reflationary concerns under a second Trump administration.

As earnings yields fall, so too have dividends

Nominated by: Cameron Gleeson, Senior Investment Strategist

Source: Bloomberg, Betashares. As at 31 December 2024. Past performance is not indicative of future performance.

Why it’s important: Many Australian investors seek income through dividends paid out by companies listed on the ASX 200. However, with the index trading near record levels and facing earnings growth headwinds due to a weakening economy and falling commodity prices, both earnings and dividend yields will likely remain under pressure throughout 2025.

If investors see limited scope for further capital growth in Australia but still have a need for reliable income, they may consider a covered call strategy such as the YMAX Australian Top 20 Equities Yield Maximiser Complex ETF .

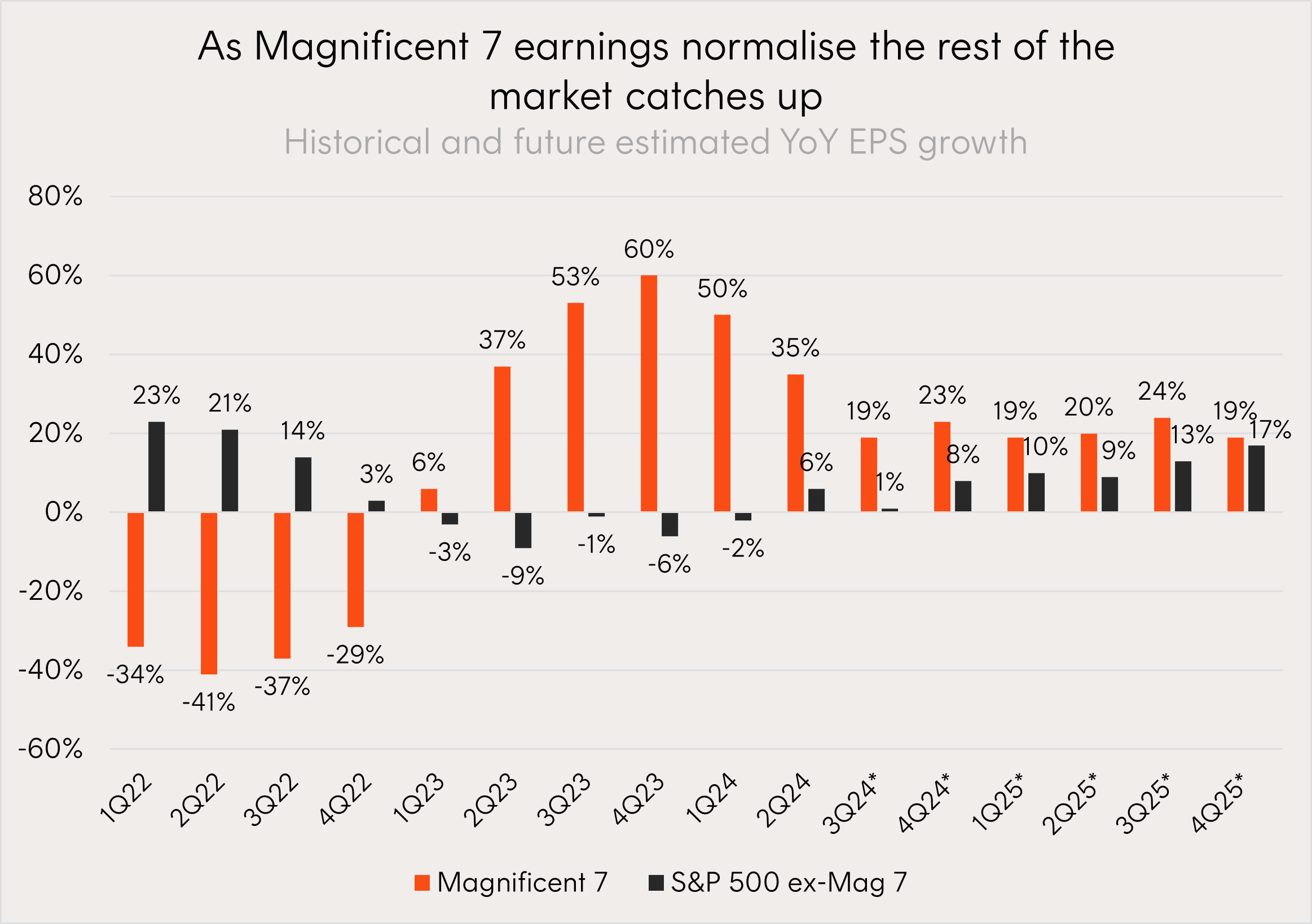

A broadening out in US equities expected to drive earnings growth

Nominated by: Hugh Lam, Investment Strategist

Source: J.P. Morgan Asset Management. As at November 15 2024. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Past performance is not indicative of future performance.

*Earnings estimates for Q324 and onwards are forecasts based on consensus analyst expectations. Actual results may differ materially from forecasts.

Why it’s important: The group of Magnificent 7 stocks dominated equity market returns in 2024. But it may be time for the rest of the S&P 500 index to shine in 2025 as pro-business policies such as corporate tax cuts and deregulation should support small and mid-sized American companies. This may favour an equal weighted exposure such as the QUS S&P 500 Equal Weight ETF .

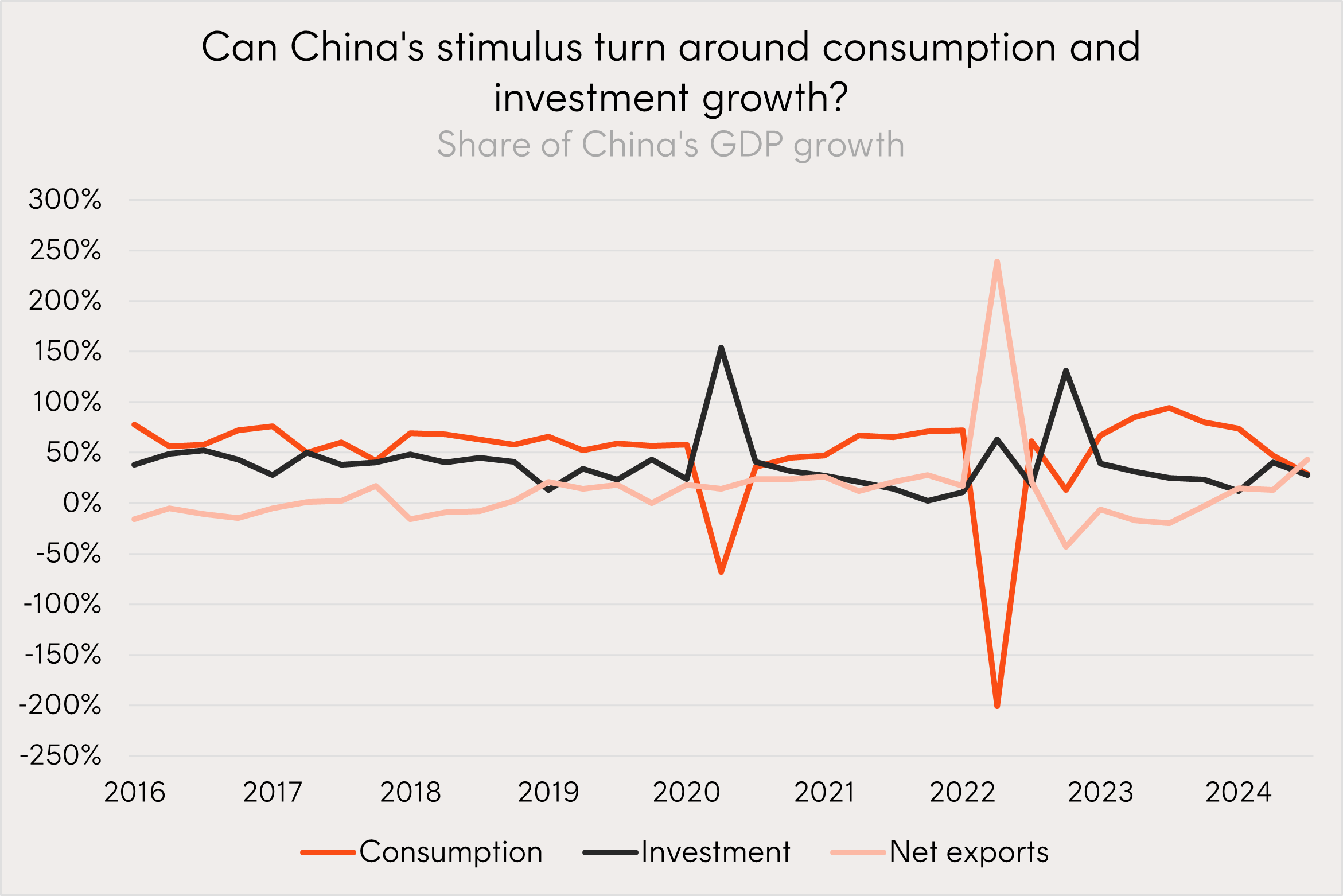

Can China keep up in 2025?

Nominated by: Tom Wickenden, Investment Strategist

Source: National Bureau of Statistics China. Quarterly data from Q1 2016 to Q3 2024.

Why it’s important: China’s economy enters 2025 three years into the fallout from a housing market crisis, undergoing a fundamental re-structuring after decades of investment driven growth, with a weakened consumer, and facing the prospect of a trade war with the US.

In response to this outlook the Chinese government has announced its largest fiscal and monetary stimulus since the beginning of the housing crisis, clearly setting its sights on buoying local governments, turning around consumer sentiment, and ending an emerging deflationary spiral.

There are risks associated with an investment in the Funds, including market risk and for YMAX, use of options risk, and for QUS, currency risk. Investment value can go up and down. An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, both available on this website.