5 minutes reading time

A wrap up of the charts catching our eye over the past month.

Tariffs continue to dominate global markets as we wrap up the first quarter of 2025. The S&P 500 hit correction territory after falling more than 10% from its highs in mid-February following weaker consumer sentiment surveys and lower forecasts to US GDP growth.

During times of uncertainty, investors may look to protect their portfolios by adding defensive assets like gold and fixed-rate bonds to a broader portfolio.

Find out more in this edition of Charts of the Month.

1 – Auto tariffs shake global markets

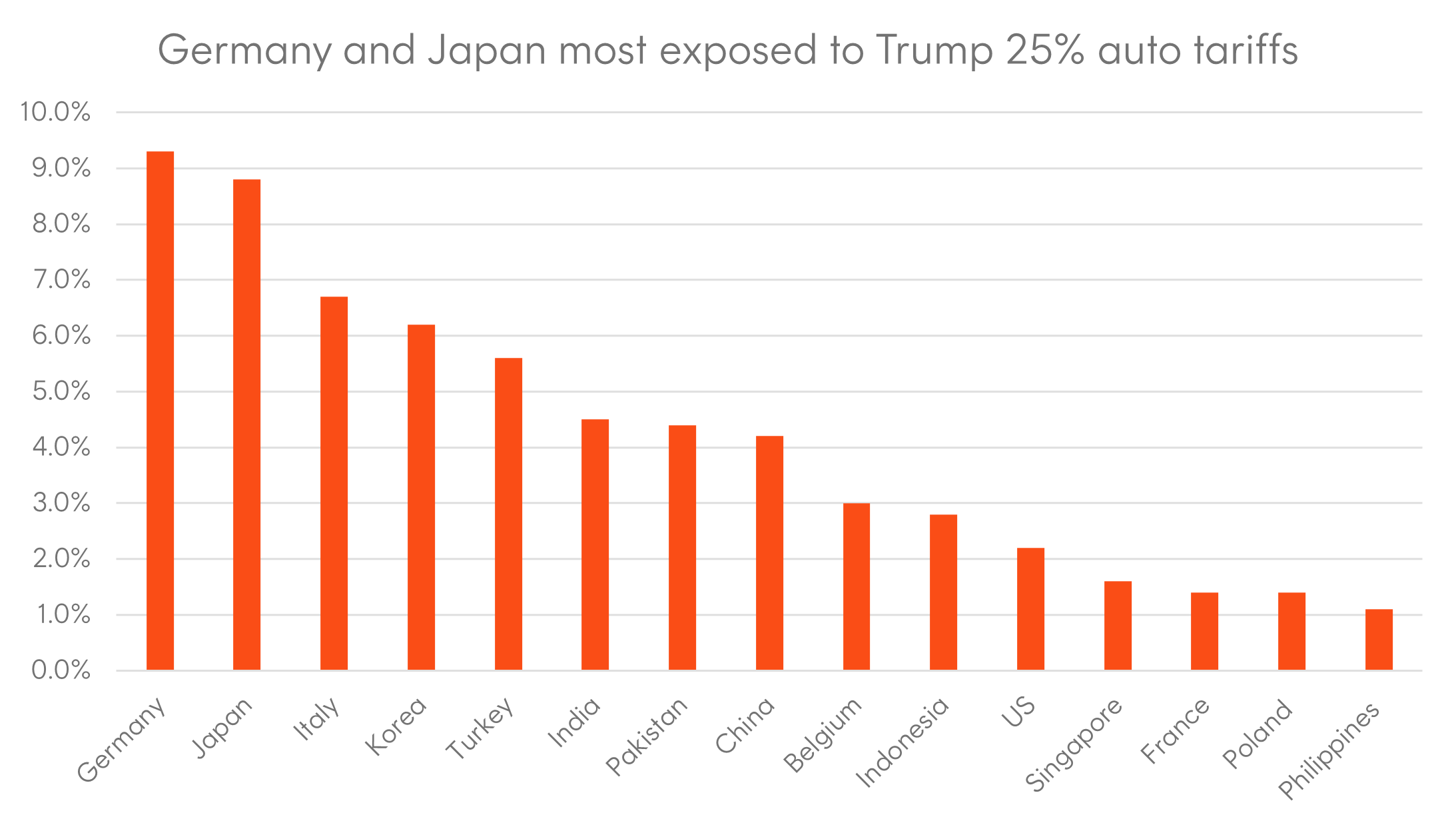

Trump’s announcement of 25% tariffs on imports of foreign-made cars have sent the share prices of global auto manufacturers Mercedes-Benz, Porsche, and Toyota falling. These tariffs will be applied to both the vehicles themselves and also the auto parts/components within them.

Whilst the focus has been on the impact on foreign auto manufacturers, the share prices of GM and Ford have also fallen given they source auto components from other parts of the world to build their cars.

Chart 1: Automobiles and Parts as % of Country Equity Market Cap

Source: Datastream, Goldman Sachs Global Investment Research

2 – Gold punches above its weight

Gold continues to make new highs, breaching USD$3,000 on 14th March and surpassing the performance of US equities as investors sought safe haven assets amidst signs of weaker growth and higher inflation in the US.

With the US dollar remaining expensive on a purchasing power parity basis, considering some exposure to a currency hedged gold ETF like the QAU Gold Bullion Currency Hedged ETF could be an intelligent move.

Chart 2: S&P 500 Index Total Return vs Gold Price (USD)

Source: Bloomberg, as at 20 March 2025. Returns shown in USD terms. Rebased to 100 as at 30 December 2022. You cannot invest directly in an index. Past performance is not an indicator of future performance.

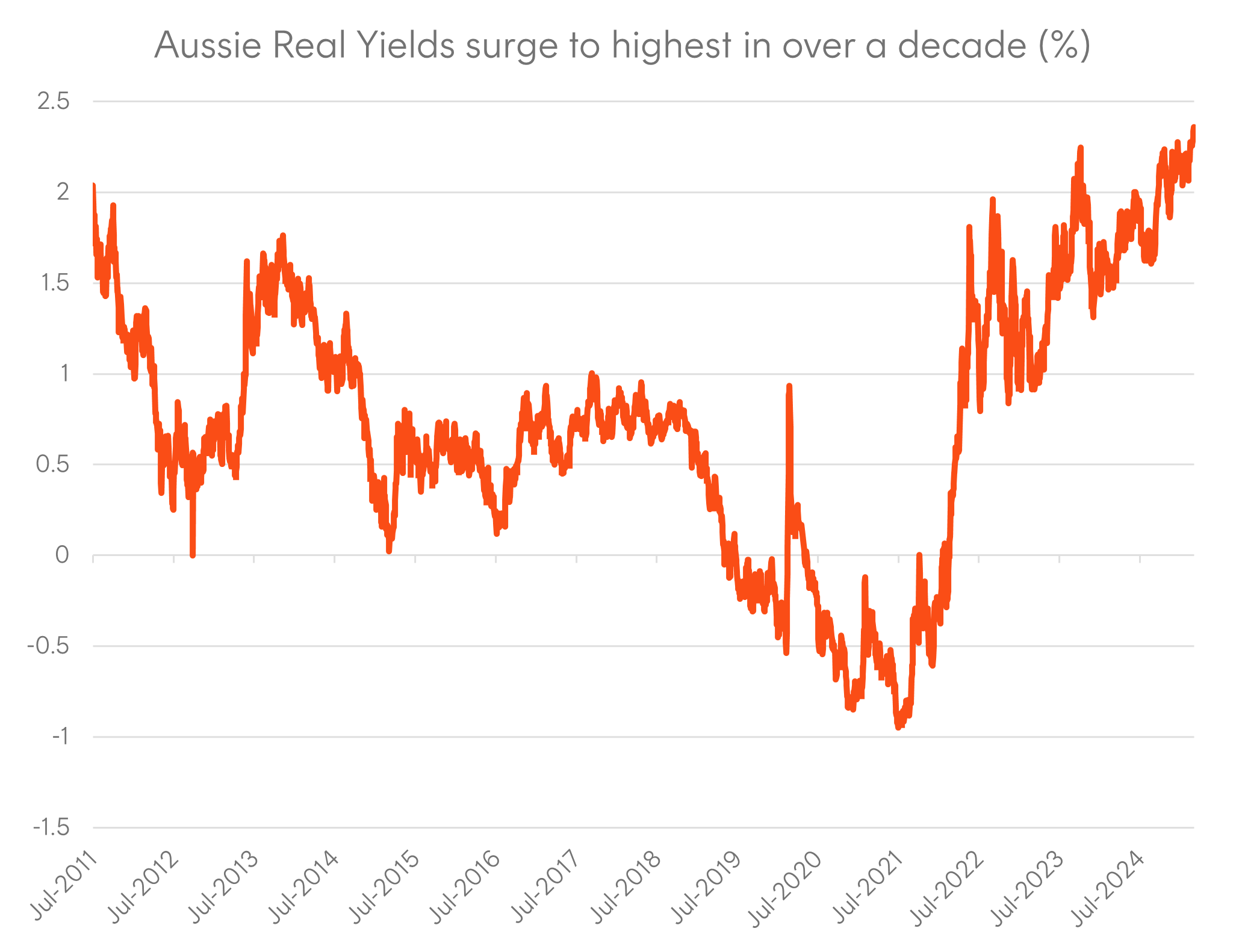

3 – Are bond market’s suggesting the RBA needs to cut more?

Australia’s inflation-adjusted bond yields have jumped to the highest in over a decade, hitting 2.36% on March 27. This follows the government’s announcement to increase debt issuance by 50% in the fiscal year starting July to fund tax cuts and other initiatives ahead of the May 3 elections.

The 62-basis point rise in Australian real yields over the last two quarters comes at odds with the RBA cutting interest rates in February, suggesting that domestic interest rates may still be too high amid financial conditions tightening globally. As a result, investors may see an opportunity to protect their portfolios through long-duration fixed-rate bonds.

Chart 3: Real Yield on Australian 10-Year Government Bonds

Source: Bloomberg. As at 28 March 2025.

4 – BYD cements its lead over rivals in 5 minutes

BYD rocked the global auto sector, unveiling a new charging system that could add about 400km in range to its electric vehicle batteries in just 5 minutes. The Chinese automaker surpassed the US$100 billion revenue mark in 2024, beating Tesla’s US$97.7 billion.

This comes at a time where Elon Musk faces multiple challenges running the Department of Government Efficiency (DOGE), Tesla, SpaceX, and X all at the same time. Tesla shares have fallen 45% from its high in December last year.

Chart 4: Range added to different electric vehicle models in five minutes of charging

Source: BloombergNEF, BYD, Aat De Kwaasteniet, CATL, automaker vehicle data.

Note: Kilometers charged estimate is based on available data and model-specific charging curves. 400 km is 250 miles. BYD charging starts at 5% state-of-charge, while all other models start at 10% state-of-charge. kWh is kilowatt-hours.

5 – Coffee-flation?

Have you ever wondered why the price of your morning flat white has gone higher over recent years?

Well, that’s because the price of coffee beans has soared to record levels due to bad weather conditions in Brazil and Vietnam.

Perhaps that explains why the share price of Breville, which sells home appliances including espresso machines, has performed well over recent years. Could Breville’s Barista Express be the solution to Australia’s cost of living crisis?

Chart 5: Arabica coffee futures (US cents/pound)

Source: Bloomberg. Period: 1 January 1993 to 31 March 2025.

That’s all for this edition of Charts of the Month. For more investment and market insights, visit the Betashares Insights page here.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each fund should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on the risks and other features of each fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.