The companies that could be set to benefit from a global ‘regime change’

4 minutes reading time

A wrap up of the charts catching our eye over the past month.

Volatility returned to markets in July following the shocking assasination attempt on former US President Donald Trump, with political uncertainty likely a focal point for the remainder of the year. However, earnings season in the US is currently front and centre on investor’s minds as to whether stocks can continue to their rise.

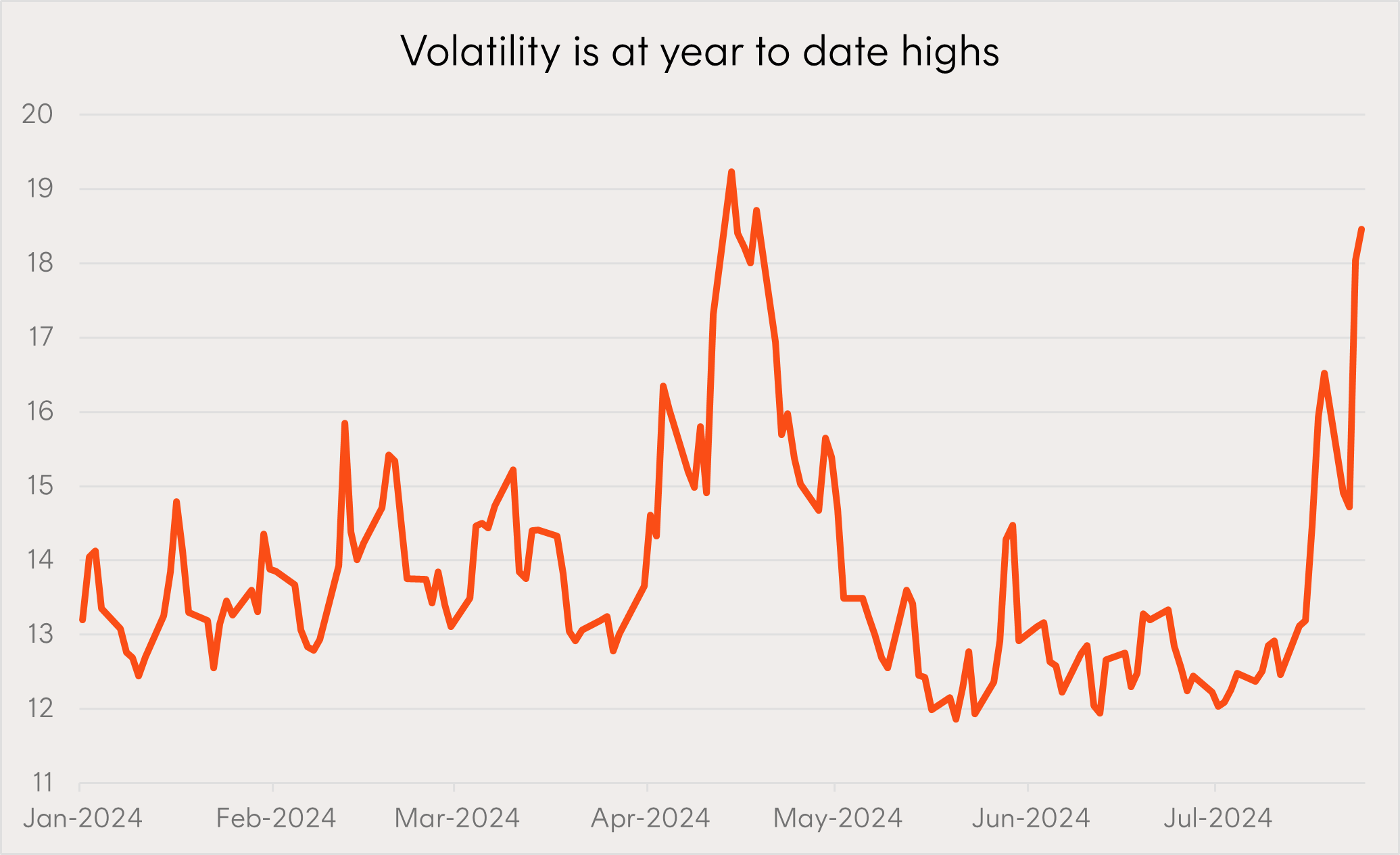

1 – Return of volatility

Volatility rose sharply in July following a confluence of left tail events including the assassination attempt on Donald Trump, and the worldwide tech outage caused by CrowdStrike which affected industries from airlines, hospitals and financial institutions.

The US equity market’s ‘fear index’ (the VIX) has risen sharply as a result.

Chart 1: CBOE Volatility Index (VIX Index)

Source: Bloomberg, Betashares as at 25 July 2024. Past performance is not an indicator of future performance.

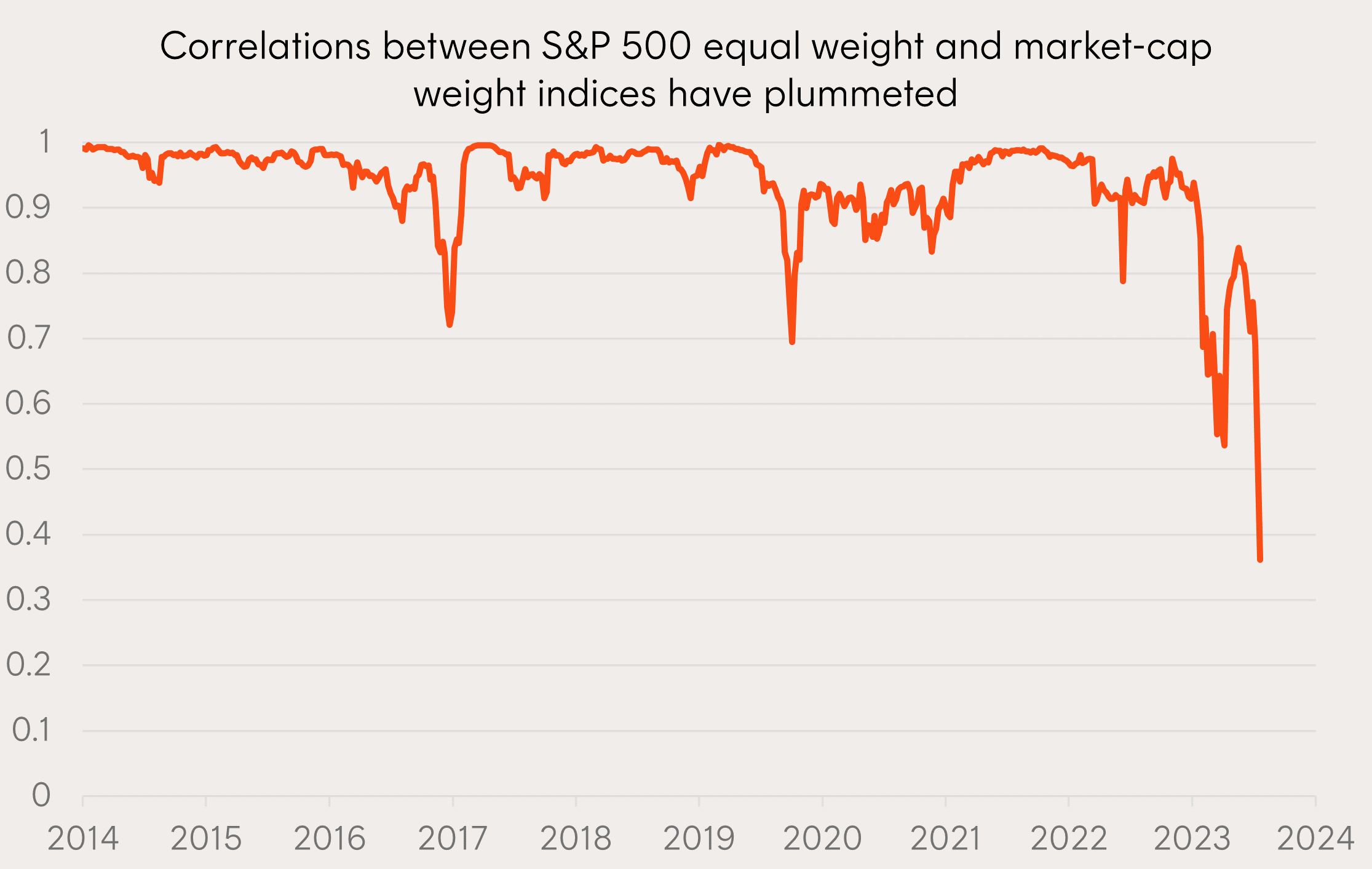

2 – Rise of equal weight

Although sharing the same underlying constituents, correlations between the S&P 500 equal weight index and market-cap S&P 500 index has plummeted over recent weeks as the market saw a rotation out of growth and technology to small cap, cyclical and value stocks.

As a result, the equal weight index has outperformed the market cap index by 3.5% over the two week period ending 26 July 2024.

Chart 2: 13-week rolling correlation between S&P 500 equal weight and market-cap weight indices (weekly returns)

Source: Bloomberg, Betashares as at 24 July 2024. Past performance is not an indicator of future performance of any index or ETF.

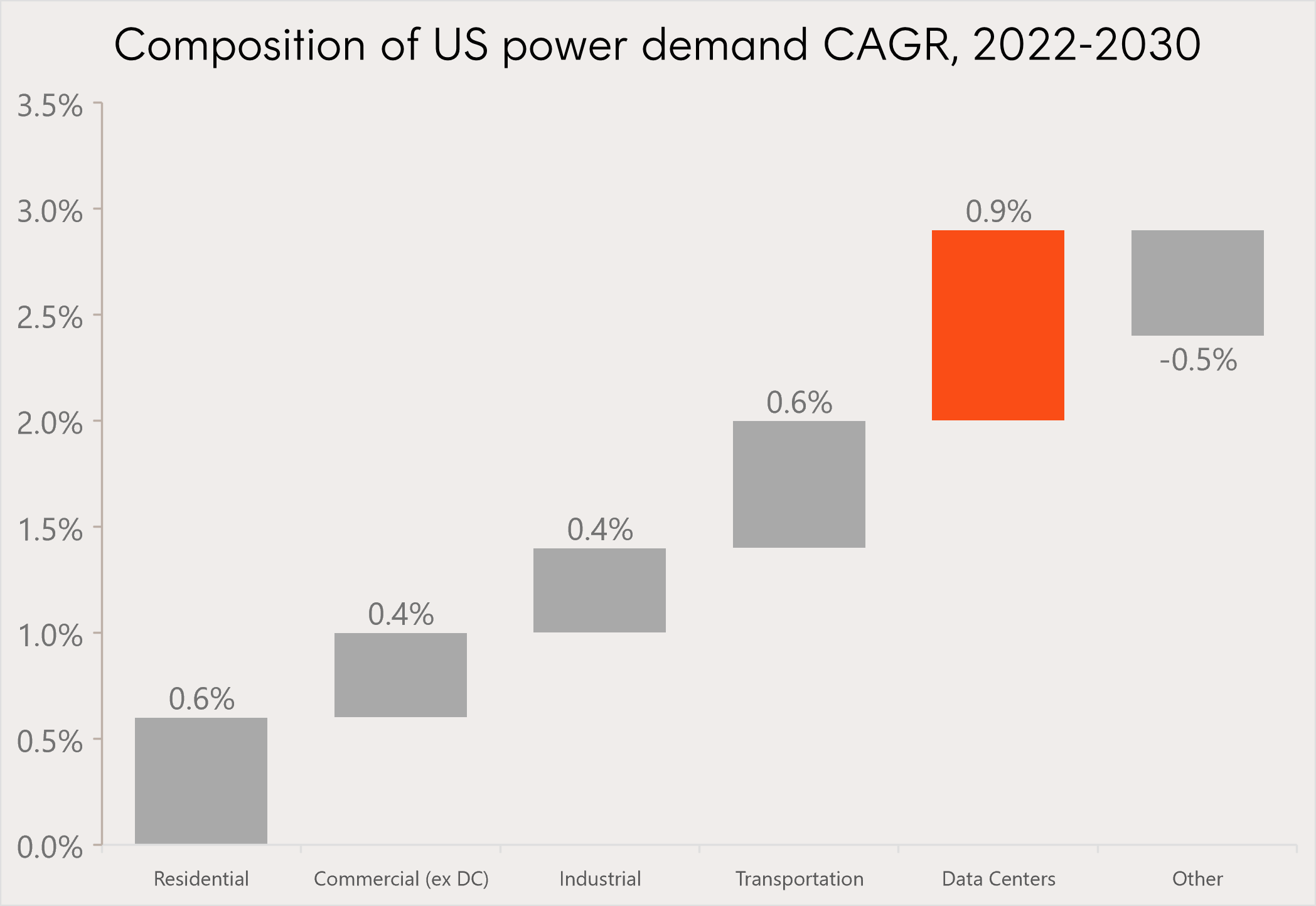

3 – Powering up America

Large technology companies like Microsoft, Amazon and Meta are spending billions of dollars on the build out of data centers to develop leading edge AI models. The demand on energy is expected be immense with Goldman Sachs predicting that data centers will contribute more than a third of America’s power demand growth from 2022-2030.

Chart 3: Composition of US power demand across industries, 2022-2030

Source: EIA, Goldman Sachs Global Investment Research, Betashares as at 10 July 2024. Actual results may differ materially from forecasts.

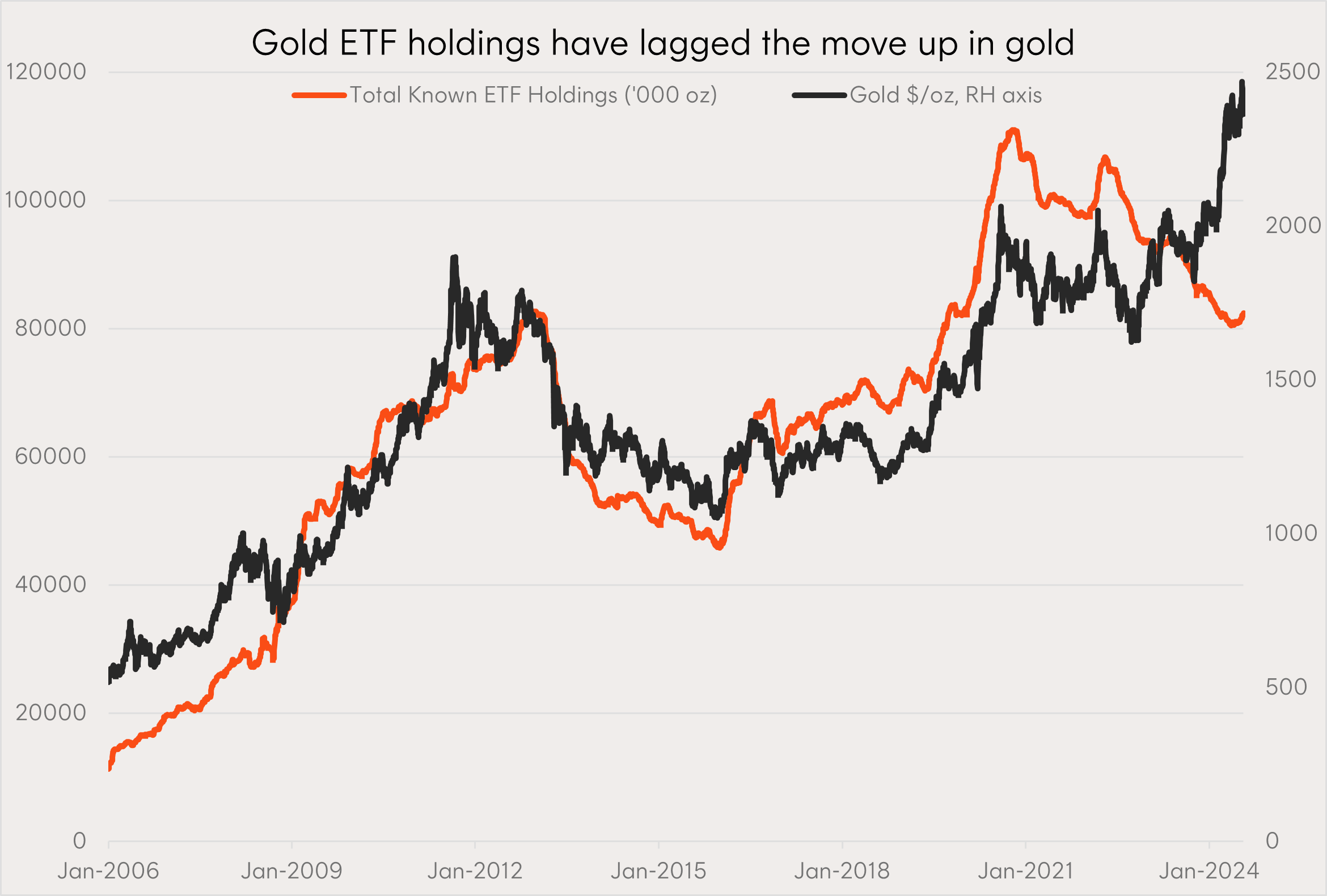

4 – Gold prices push higher as gold ETF holdings decrease

Financial flows have not played much of a role in gold’s rally recently, with gold ETF holdings lagging spot gold prices throughout this year. Whilst ETF holdings have continued to fall since mid-2022, gold has continued to rise to all time highs – supported by net purchases by central banks and strong retail demand in China.

Chart 4: Gold price and ETF holdings

Source: Betashares, Bloomberg as at 26 July 2024. Past performance is not an indicator of future performance.

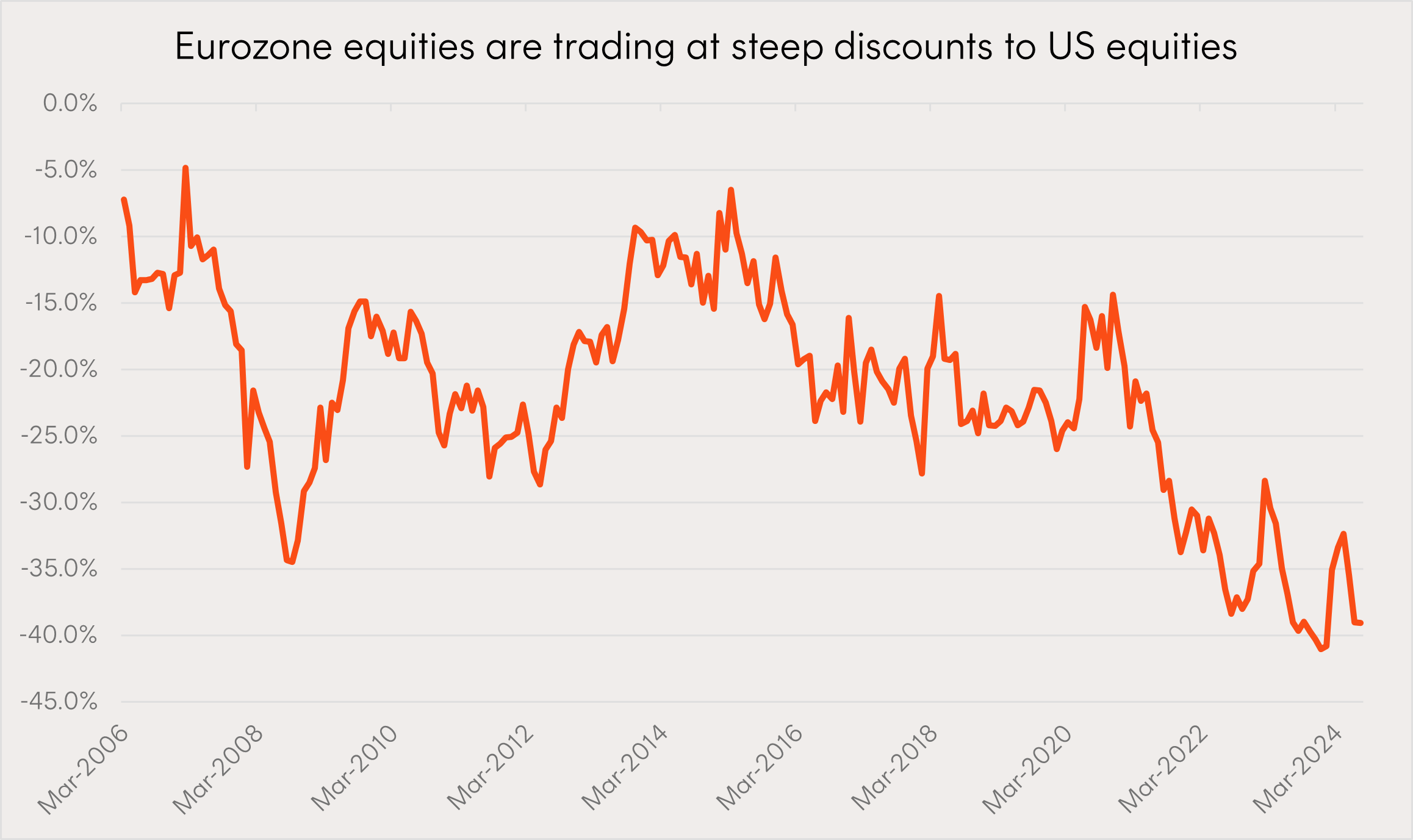

5 – Opportunities in Eurozone equities

Investors may find value in Eurozone equities which are trading at a forward price/earnings discount of nearly 40% to their US peers, versus a 21% discount on average in the past 18 years.

Chart 5: Relative forward price-earnings ratio between MSCI Eurozone Index and the S&P 500

Source: Bloomberg, Betashares; as at 26 July 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance of any index or ETF.

That’s all for now, but we’ll be back next month with more interesting insights as US earnings season unfolds.