Our rules for momentum investing

4 minutes reading time

A wrap up of the charts catching our eye over the past month.

In a busy month for markets, both the US and Australian earnings seasons dominated the news cycle – particularly with Nvidia’s much anticipated results and Australia’s better than expected outlook. Elsewhere, the Japanese equity market ended a 34-year wait to record all time highs, and the Australian labour market eases.

1 – Can the big keep getting bigger?

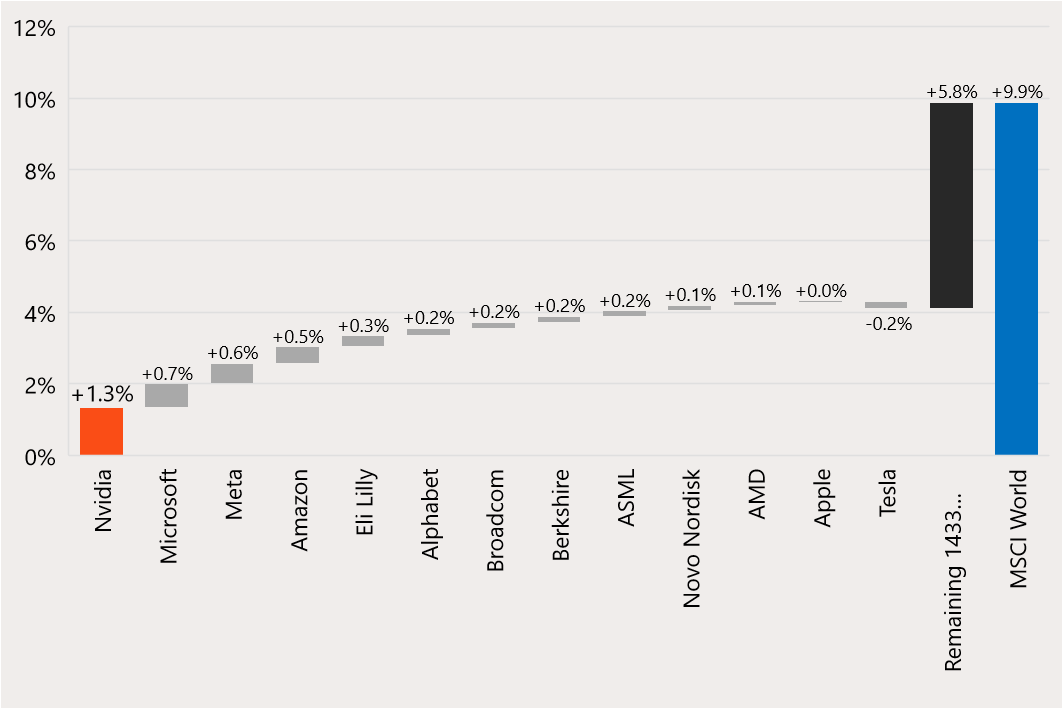

Over the three years to the end of 2023, Nvidia returned 280% – becoming the world’s 6th largest company with a US$1.2 trillion market capitalisation. Considering this, the further 63% growth year-to-date which has pushed the company within reach of the exclusive US$2 trillion club is remarkable. Given its size and performance, Nvidia alone has contributed 13% of the world’s equity market returns this year.

Chart 1: Year-to-date contribution to MSCI World ex-Aus index returns (AUD)

Source: Bloomberg. As at 23 February 2024. Past performance is not an indicator of future performance.

2 – Nikkei reclaims all time highs

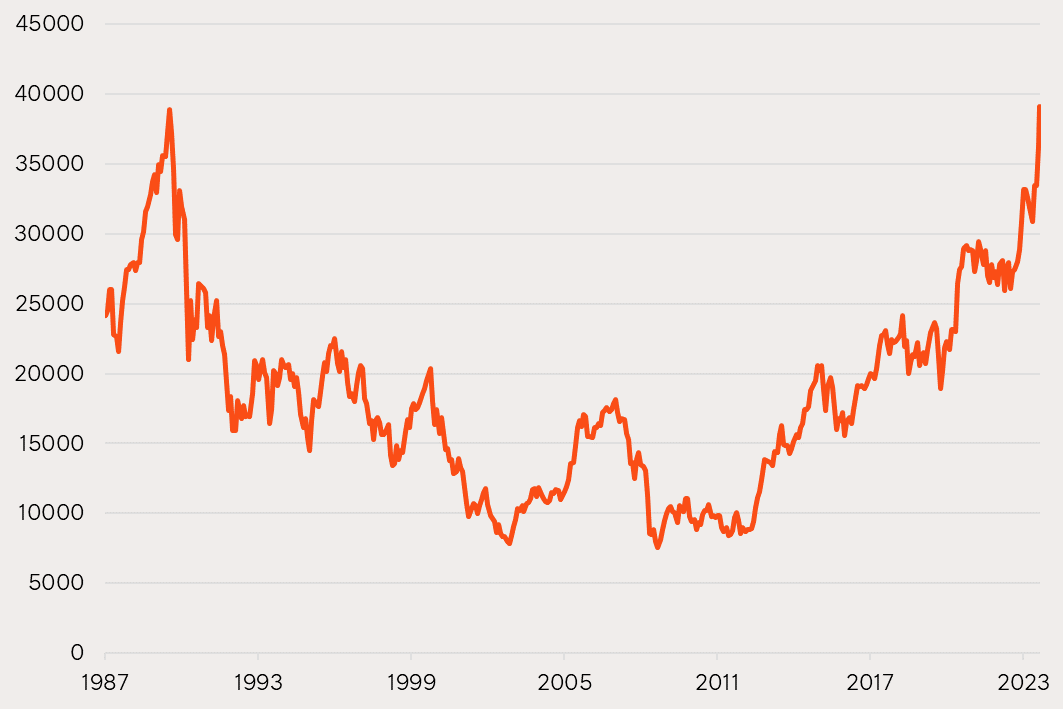

This month the Japanese Nikkei Index reached a new all-time high after a 34-year wait. Positive geopolitical tailwinds and transformative structural reforms have bolstered earnings and enticed foreign investors back to the region. We have written a lot about Japanese equities over the past few years with our most recent piece published this week.

Chart 2: Nikkei 225 Index. 1987 to 2024.

Source: Bloomberg. Past performance is not an indicator of future performance. You cannot invest directly in an index.

3 – What earnings season tells us about the Australian consumer

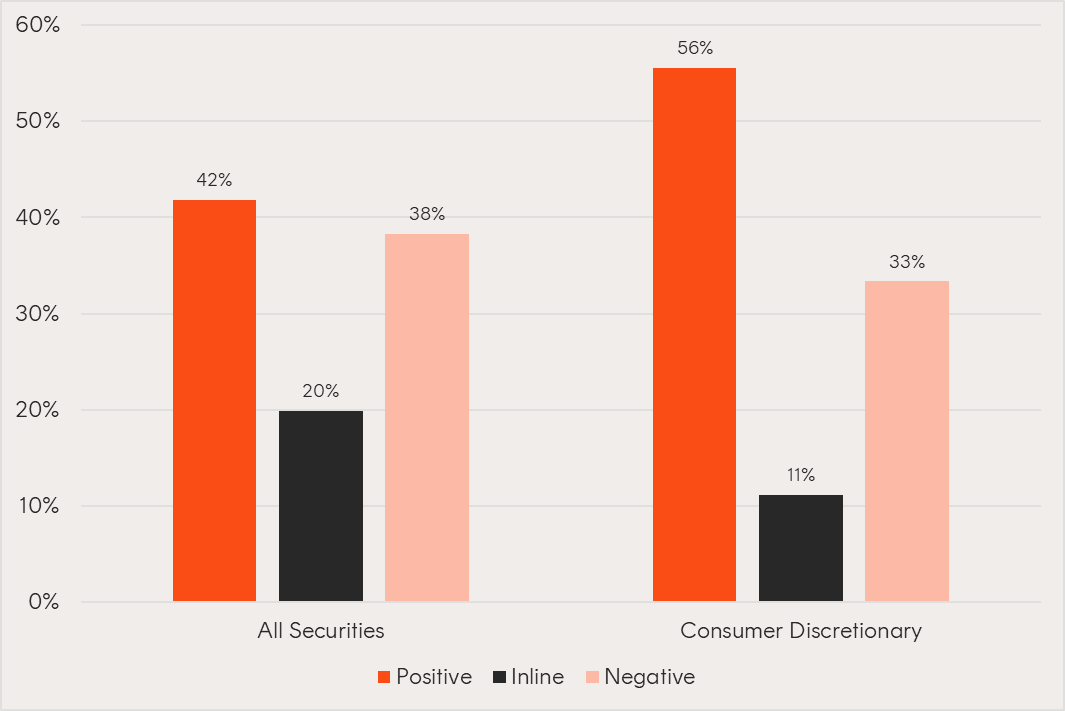

In a case of ‘better than feared’, the Australian earnings season has so far surprised investors in terms of corporate resilience, governance, and positive forward guidance. With over three quarters of companies having reported, 42% have beaten expectations, compared to 38% missing.

Possibly the key takeaway and reason for the general positivity has been the resilience of the Australian consumer. Consumer discretionary companies have reported an outsized number of positive earnings surprises, and the sector as a whole has had 4% higher earnings than expected. Retail bellwether JB Hi-Fi made new all-time highs. Tax cuts and possible RBA rate cuts in the back half of 2024 add to hopes of an improving outlook for the retail sector.

Chart 3: Percentage of earnings surprises for entire S&P/ASX 200 and the S&P/ASX 200 consumer discretionary sector. H2 2023 earnings.

Source: Bloomberg. As at 26 February 2024, when 152 out of 194 eligible S&P/ASX 200 companies had reported.

4 – Australia’s labour market easing

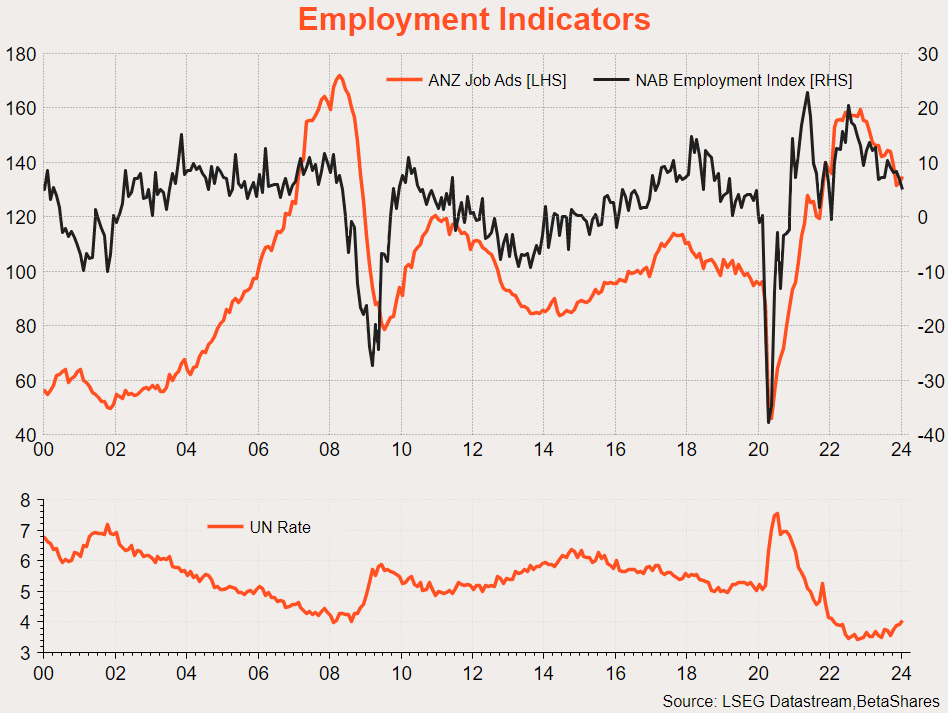

Leading indicators suggest the gradual easing in the labour market may continue. The unemployment rate has been edging higher since mid-2023 and reached 4.1% in January. This may be viewed positively for a more sustainable economic environment, so long as momentum does not pick up sending the rate to uncomfortable levels.

Chart 4: Leading unemployment indicators ANZ Job Ads and NAB Employment Index (panel 1) and the Australian unnemployment rate (panel 2).

Source: LSEG Datastream, Betashares.

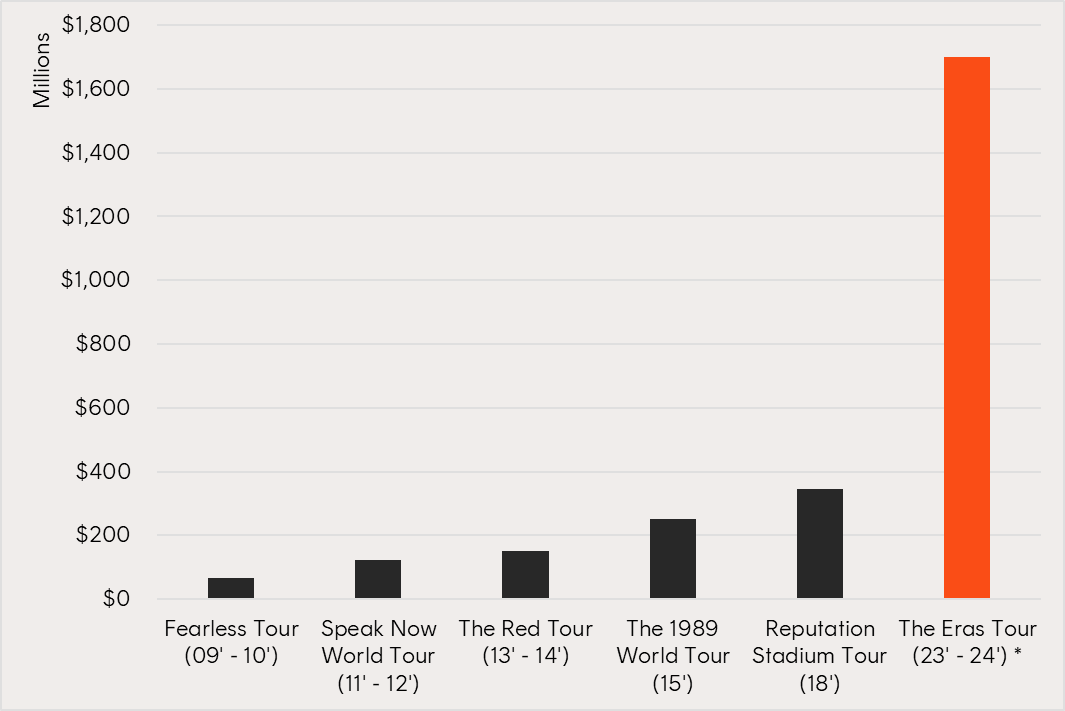

5 – Record Era’s tour hits Australia

On the lighter side of charts that we have enjoyed over the past month, Taylor Swift’s Eras Tour is already the highest grossing of all time. Not dissimilar to some of the year-on-year growth charts for Nvidia’s fundamentals we have seen recently, her ongoing tour is expected to almost double her previous five in terms of total gross revenue. Debate continues as to whether or not Tay Tay has had an inflationary impact on the Australian economy.

Chart 5: Taylor Swift’s historical world tour gross.

Source: Wikipedia. *Billboard estimated total tour gross, in USD.

2 comments on this

Hey Cameron

Are ETF’s overvalued.?

Its seems that ETF’s in the USA are now considered over valued.

Given that many of my Betashares ETF’s are + or – AU$10, I wonder if Australia has more growth before any correction.

But, when the USA sneezes, Australia get the flu.

regards

silvio fontana

Hi Silvio,

Thanks for your comment.

We cannot provide a specific perspective on the valuation of Australian shares. The valuation of ETFs is contingent upon the assets within their portfolios. Regarding the indices our products track, the assessment of whether the underlying assets are overvalued, fairly valued, or undervalued remains subjective and varies based on the specific product in question.

Best Regards,

Betashares Team.