6 minutes reading time

A wrap up of the charts catching our eye over the past month.

There’s a lot happening in global markets just two months into the new year. Trump’s tariffs, DeepSeek, European defence spending and Bitcoin all headline a shifting macro narrative.

Whilst the Magnificent 7 have buoyed equity market returns over recent years, investors are now asking whether there are other alluring opportunities beyond US Technology.

Find out more in this edition of Charts of the Month.

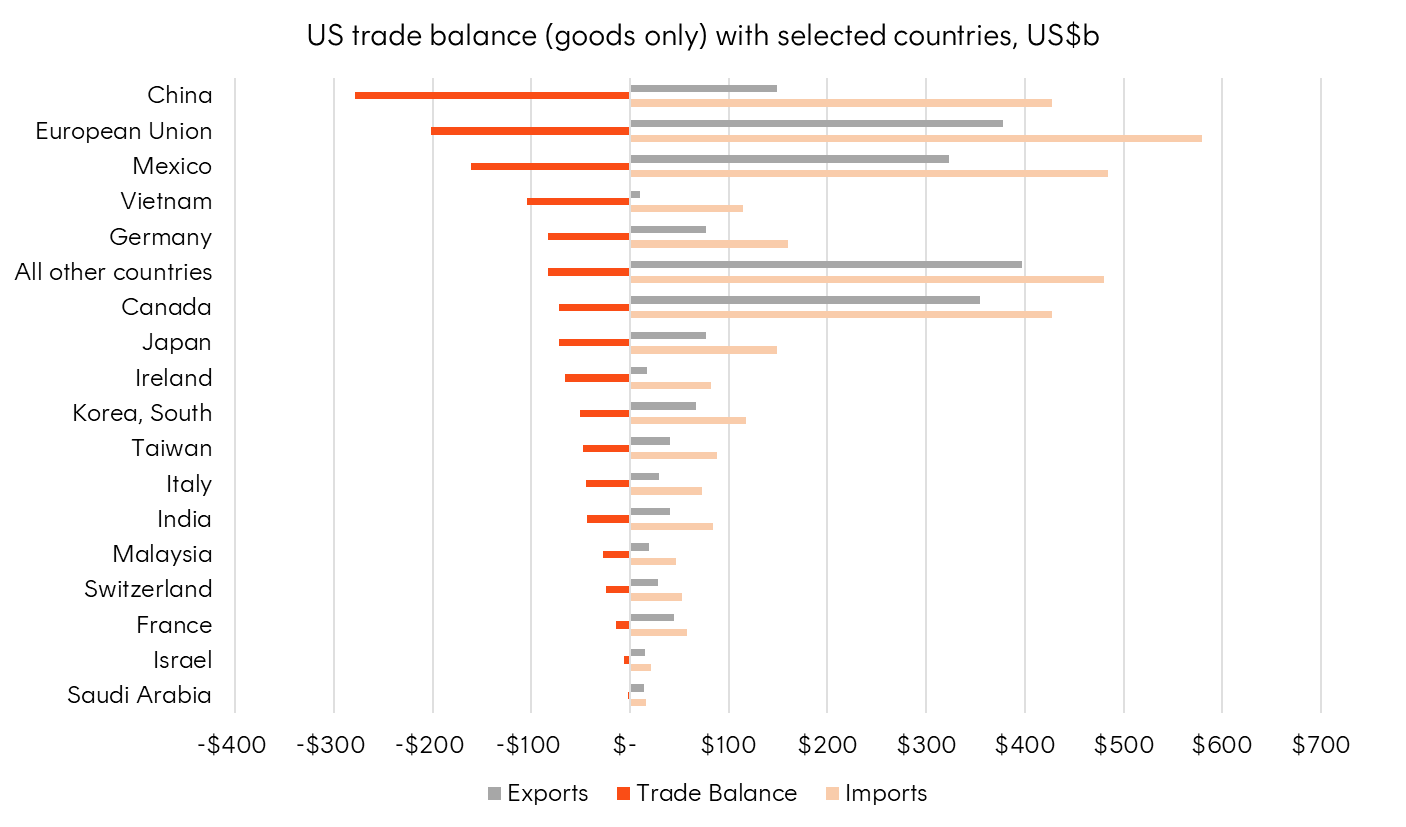

1 – Addressing the US trade deficit: Trump’s hit list

Reducing the US trade deficit (which has widened to nearly US$1 trillion) has become a top priority for President Trump in a bid to revitalise the domestic economy.

Imposing tariffs on countries which have large trade surpluses with the US, such as China, Mexico and Vietnam, is one method to address the growing deficit. This is because tariffs make it more expensive to import goods, encouraging consumers to switch to domestic alternatives.

Below are the countries that the US has the largest trade deficits with, which may be most vulnerable to potential tariffs.

Chart 1: US trade deficit ranked by size with selected countries

Source: US Bureau of Economic Analysis. US International Trade in Goods and Services, December and Annual 2024.

2 – Keep On Truckin’

The release of DeepSeek’s leaner AI model in late January sent shockwaves through global markets.

US mega-cap tech companies suffered losses off the back of this news, with Nvidia recording a historic $US589B single day drop, as markets began to question whether the current pace of capital expenditure (capex) spend was necessary.

However, since then most of the sell-off has been unwound and the latest earnings update from these companies showed that capex spend is forecast to reach US$300B this year, according to Morgan Stanley.

Chart 2: Actual and forecasted hyperscaler capital expenditure spend in USD billions

Source: Goldman Sachs Investment Research. Datacenter supply/demand model. January 12, 2025.

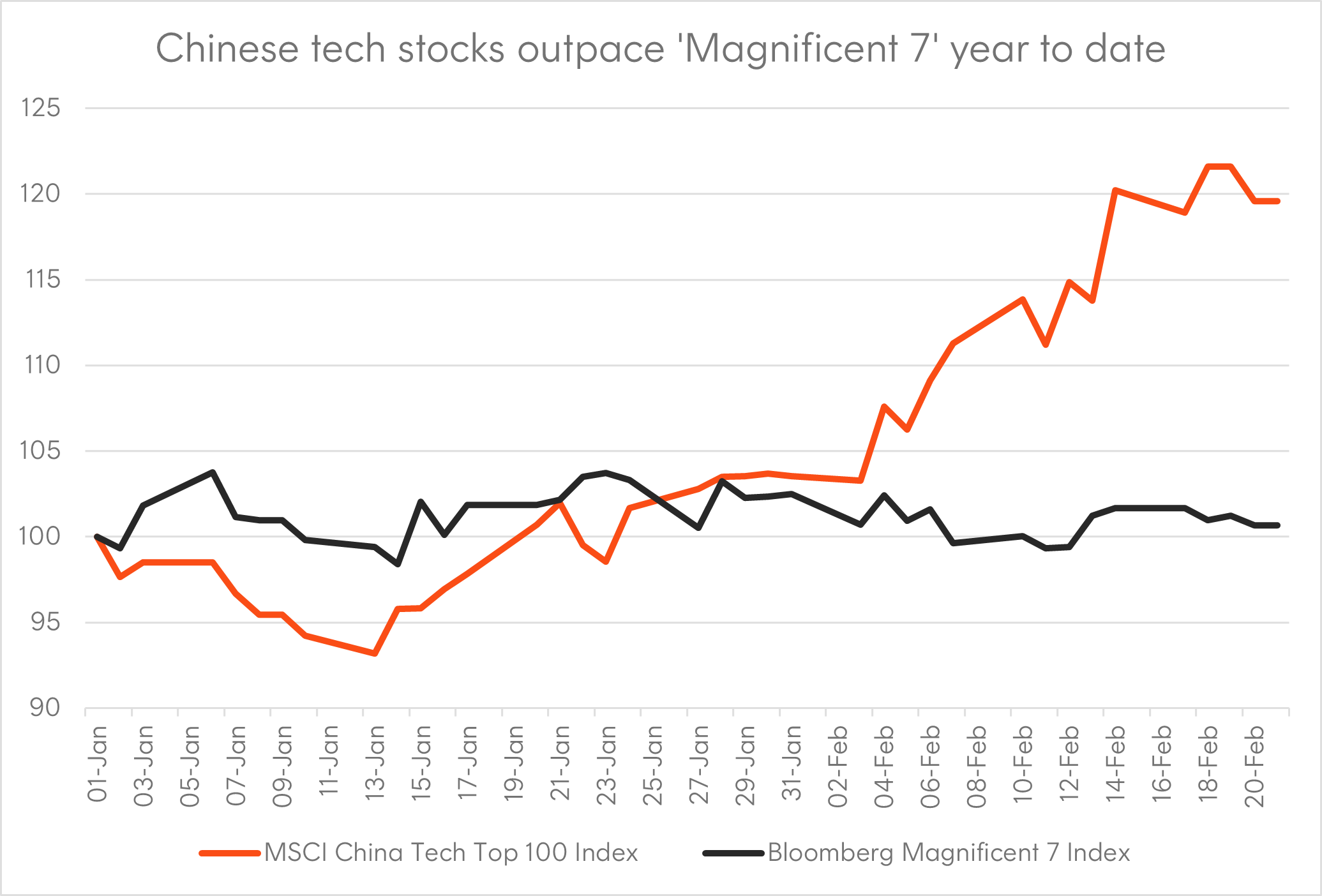

3 – Shifting dominance towards China’s ‘Terrific Ten’?

DeepSeek has nevertheless shown the ingenuity of Chinese AI developers, in the face of US chip export controls, and that AI leadership is not America’s alone.

Indeed, the price action is quite telling with a gauge of Chinese tech stocks outperforming the ‘Magnificent 7’ year-to-date. Investors are revisiting Chinese technology stocks, nicknamed the ‘Terrific Ten’, which trade on significant valuation discounts to their US counterparts and could be joining the AI race.

Chart 3: MSCI China Tech Top 100 Index vs Bloomberg Magnificent 7 Index Performance – 1 January 2025 to 20 February 2025 (rebased to 100 at 1 January 2025)

Source: Bloomberg, Betashares. 21 February 2025. You cannot invest directly in an index. Past performance is not indicative of future performance.

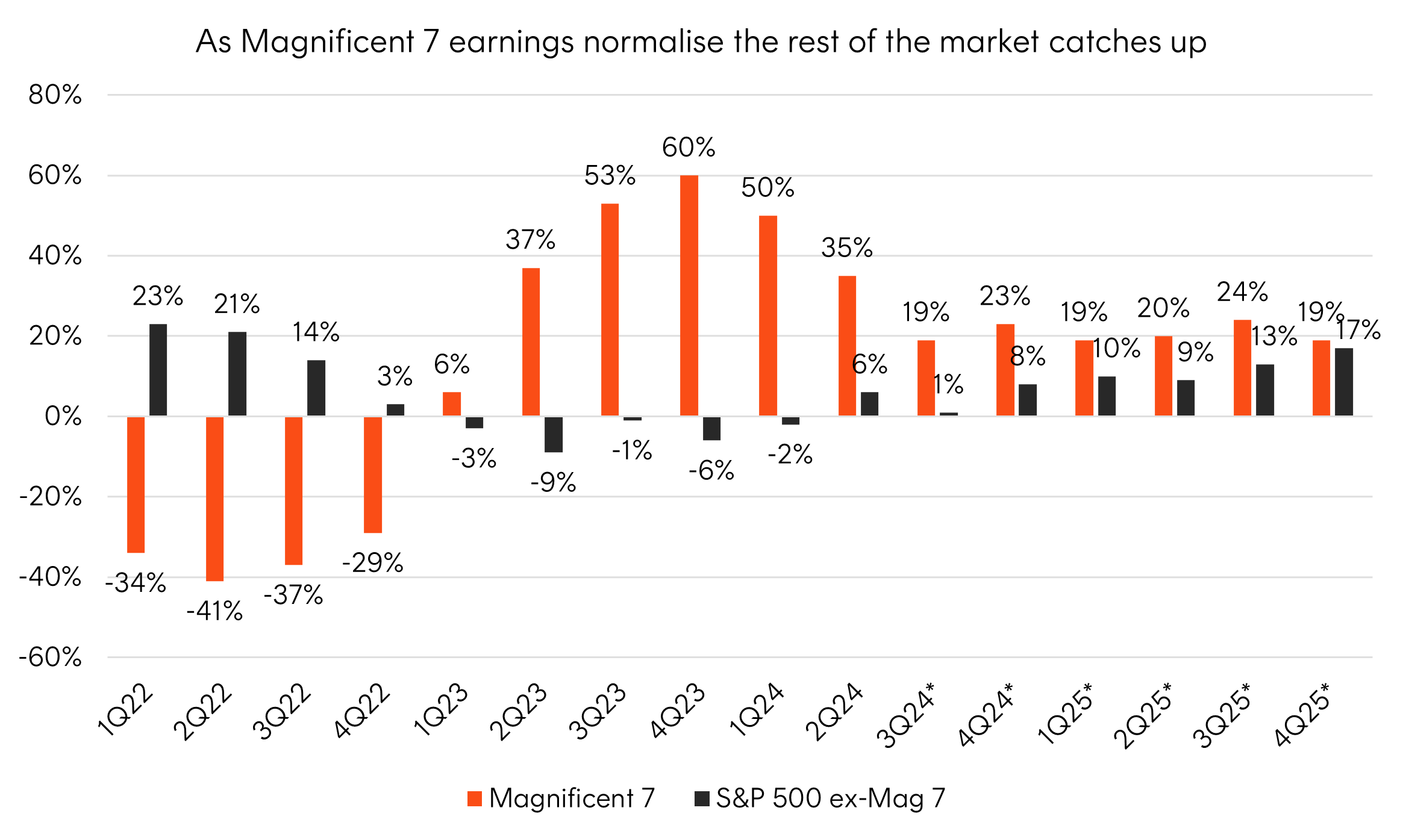

4 – Catching up to the Magnificent 7

There are also other investment opportunities within the US economy beyond just the Technology sector.

With Trump prioritising the domestic economy through deregulation and tax cuts, ‘old economy’ sectors such as the Financials and Industrials sectors may deliver healthy earnings growth throughout 2025, without the valuation premium.

Chart 4: Historical and future estimated year-over-year earnings per share (EPS) growth

Source: J.P. Morgan Asset Management. As at November 15 2024. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2024 are forecasts based on consensus analyst expectations.

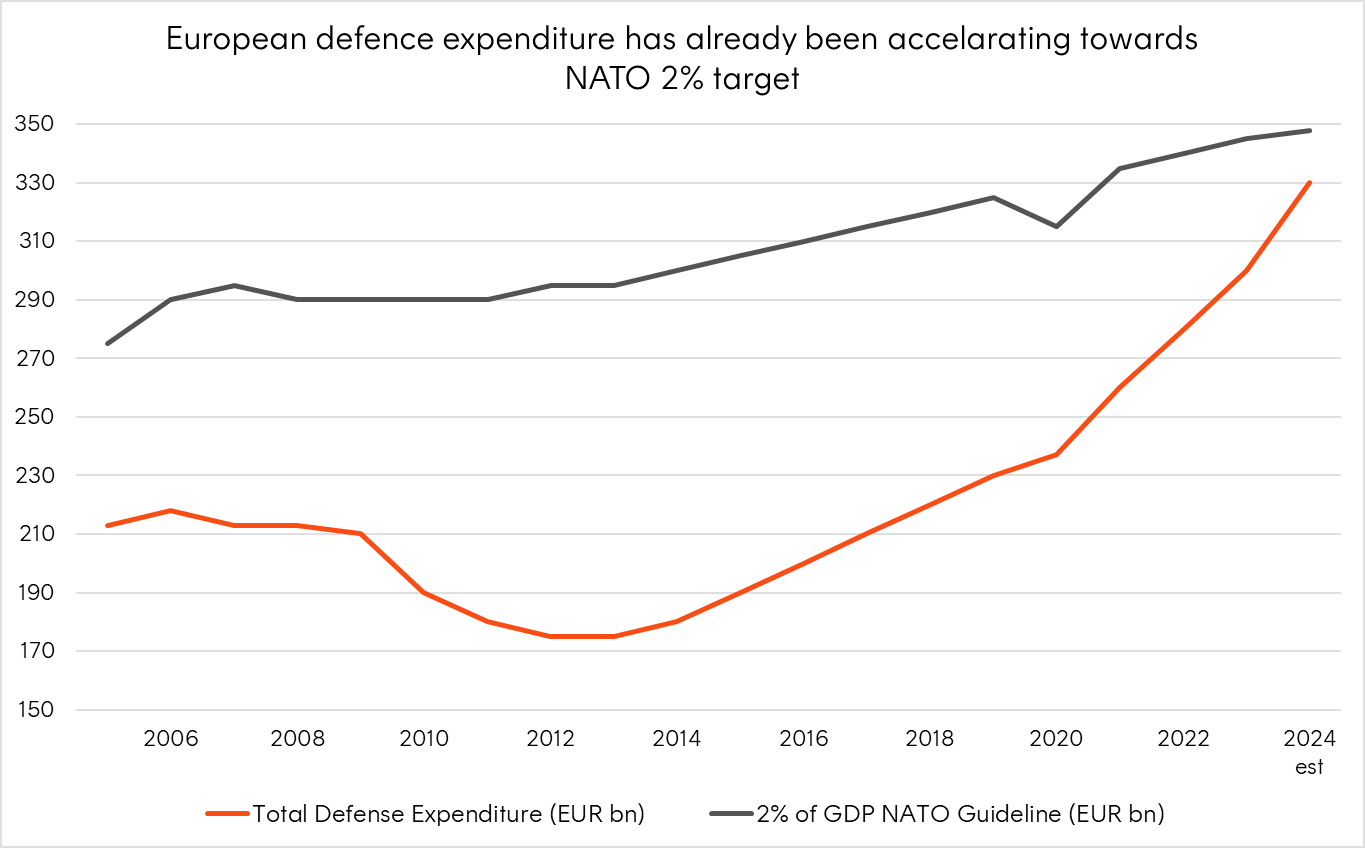

5 – European defence

Recent geopolitical shifts have set the stage for a major increase in global defence spending.

U.S. Vice President JD Vance’s remarks at the Munich Security Conference signaled a US pivot away from Europe on the defence front, EU leaders will now have to move swiftly to bolster their own security infrastructure. This shift is expected to have significant implications for defence-related equities.

The US’ strategic change will essentially remove the security umbrella that has underpinned transatlantic relations over the past 80 years, meaning EU nations will need to rapidly scale defence capabilities – providing sustained demand for defence contractors and suppliers.

European countries had already been increasing their defence budgets, with some considering raising NATO spending targets beyond the 2% of GDP threshold that is soon expected to be met for this first time. Pressure from the previous Trump administration on EU NATO members failing to meet targets, along with Russia’s invasion of Ukraine has seen spending accelerate toward the current target over the past decade.

Chart 5: Total EU defence expenditure and 2% of EU GDP NATO Guideline

Source: European Defence Agency. 2024 figure is an estimate.

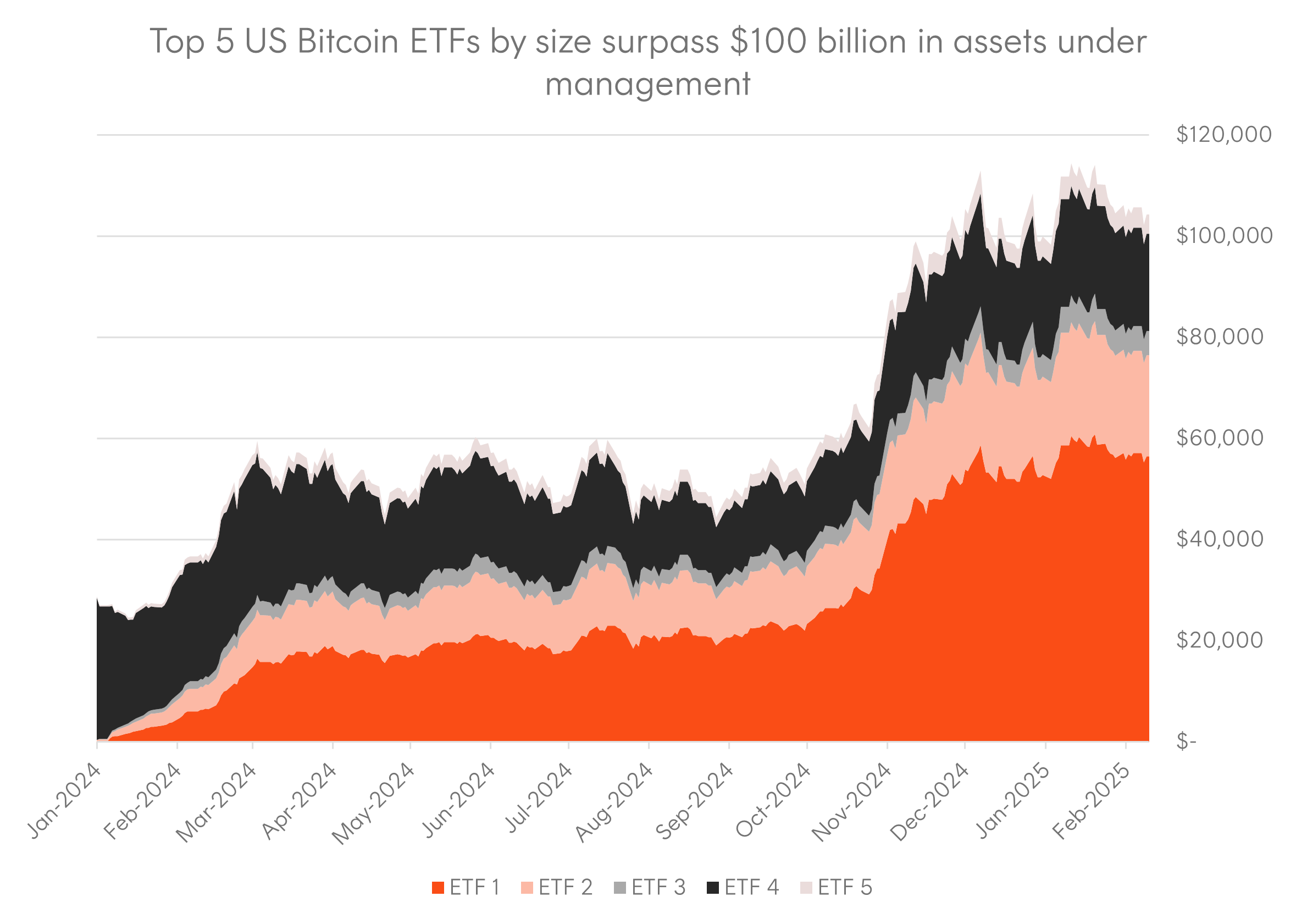

6 – Bitcoin ETFs soar in popularity

As the price of bitcoin and institutional investor interest continues to rise, spot bitcoin ETFs in the US have seen incredible growth in assets under management.

The largest 5 bitcoin ETFs in the US cumulatively manage more than US$100 billion in AUM. Last week Betashares launched its Bitcoin and Ethereum ETFs, providing investors a simple access vehicle to the price of Bitcoin and Ethereum respectively.

Chart 6: Cumulative assets under management across largest 5 US Bitcoin ETFs – 11 January 2024 to 20 February 2025

Source: Bloomberg, Betashares. 11 January 2024 (earliest date with available data across select ETFs) to 20 February 2025.

That’s all for this edition of Charts of the Month. For more investment and market insights, visit the Betashares Insights page here.