Hugh Lam

Hugh is an Investment Strategist at Betashares supporting distribution channels and assisting clients with portfolio construction across all asset classes. Prior to joining Betashares, Hugh was an Investment Analyst at Lonsec covering active equity managers, and was an Investment Solutions Consultant at Pinnacle Investment Management on their distribution team. Hugh holds a Bachelor of Commerce and Economics degree from the University of New South Wales and is also a CFA® Charterholder.

3 minutes reading time

A wrap up of the charts catching our eye over the past month

Markets had a rocky start to the month of August as an unwinding of the yen carry trade caused broad based selling across major equity indices. Whilst this episode momentarily heightened concerns of a recession, markets have since retested their year to date highs among a supportive global economy.

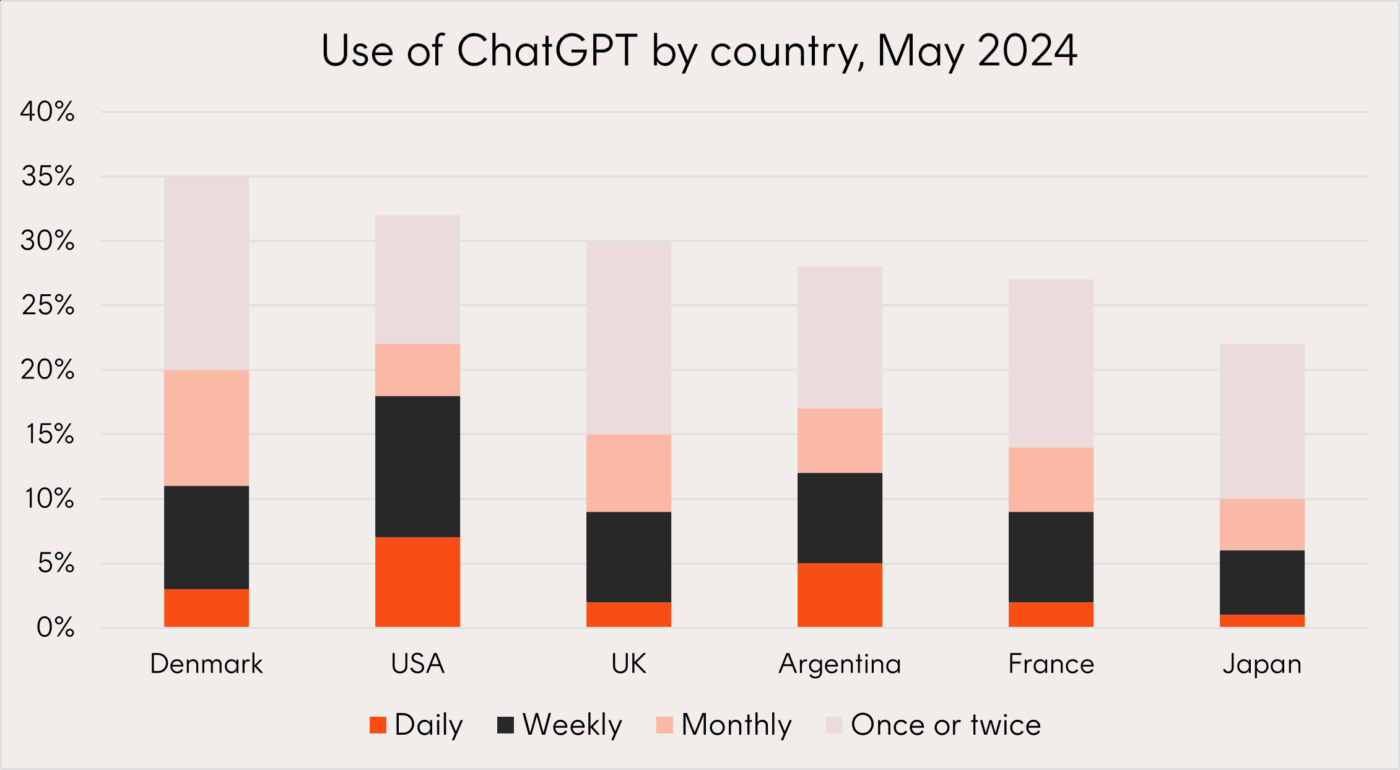

1 – Is generative AI all hype?

ChatGPT took the world by storm in late 2022, however a recent study by the Reuters Institute showed that few people have used the AI chatbot frequently.

Is this an indication of things to come? Or will the trillions of dollars ‘big tech’ are expected to spend on developing AI infrastructure and tools bring consumers more engaging and lasting applications?

You can read more about our insights on whether ‘big tech’ can monetise this spending here.

Chart 1: Frequency of ChatGPT usage across countries

Source: Reuters Institute, Betashares; as at 31 May 2024.

2 – Going global through the Nasdaq

With a deep pool of liquidity and a broad investor base, the Nasdaq has established itself as the exchange of choice for both US and international companies entering public markets.

Over recent years, an increasing number of international firms have leveraged an IPO on the Nasdaq to signal their strategic focus on innovation to their investor base.

Chart 2: Proportion of International IPOs on the Nasdaq exchange

Source: Nasdaq, Betashares as at

3 – A changing of the guard

India’s weighting in the MSCI Emerging Market index has gradually increased since 2020 as its economy continues to benefit from favourable demographics, investment in infrastructure, and liberalised rules on foreign direct investment. You can read more about these structural changes in India’s economy here.

However, China’s weighting in the index has significantly reduced – failing to see a rebound in economic activity following lengthy Covid lockdowns as structural issues around its property market continues to weigh down on overall sentiment and consumer spending.

Chart 3: India and China’s weighting in the MSCI Emerging Market Index

Source: Bloomberg, Betashares. March 2020 to August 2024.

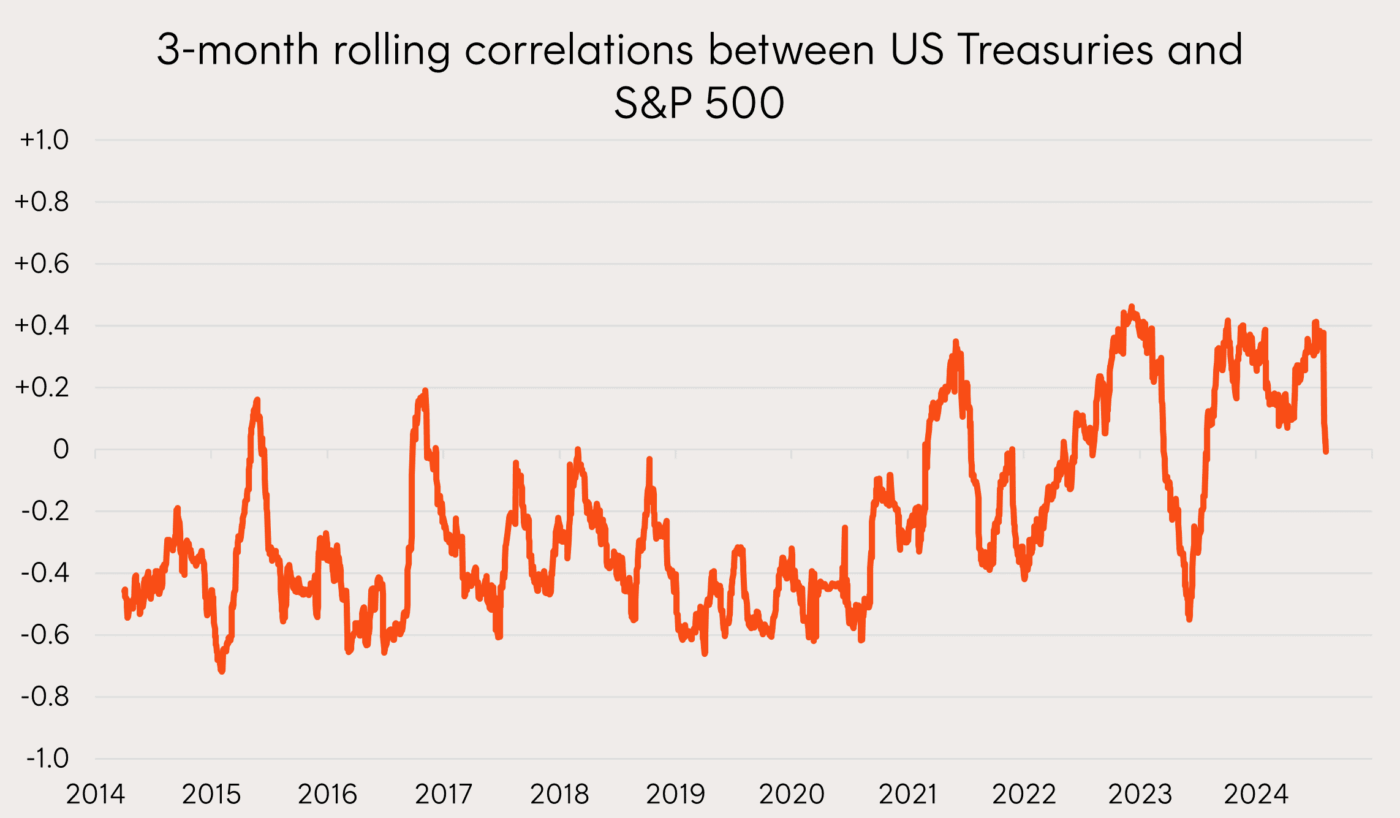

4 – Bonds are back in vogue

Bonds traditional role as a portfolio diversification tool has returned with the correlation between US Treasuries and the S&P 500 turning negative this month.

A negative correlation means that US Treasuries have once again been moving inversely with US equities. This is the traditional relationship we would expect – treasuries in a recessionary environment helping to buoy portfolio returns and reduce portfolio volatility.

Chart 4: 3-month rolling correlations between US Treasuries and S&P 500

Source: Bloomberg, Betashares as at 16 August 2024.

That’s all for now, but we’ll be back next month with more interesting insights across global and Australian markets.

Written by

Hugh Lam

Investment Strategist

Hugh is an Investment Strategist at Betashares supporting distribution channels and assisting clients with portfolio construction across all asset classes. Prior to joining Betashares, Hugh was an Investment Analyst at Lonsec covering active equity managers, and was an Investment Solutions Consultant at Pinnacle Investment Management on their distribution team. Hugh holds a Bachelor of Commerce and Economics degree from the University of New South Wales and is also a CFA® Charterholder.

Read more from Hugh.