Fed meeting recap: hawkish quarter point rate cut

4 minutes reading time

A wrap up of the charts catching our eye over the past month.

Inflation, geopolitical tension and size premia. April provided investors with themes they have become familiar with in a post pandemic world. In this edition we explore through charts, the drivers and effects of these global and market characteristics.

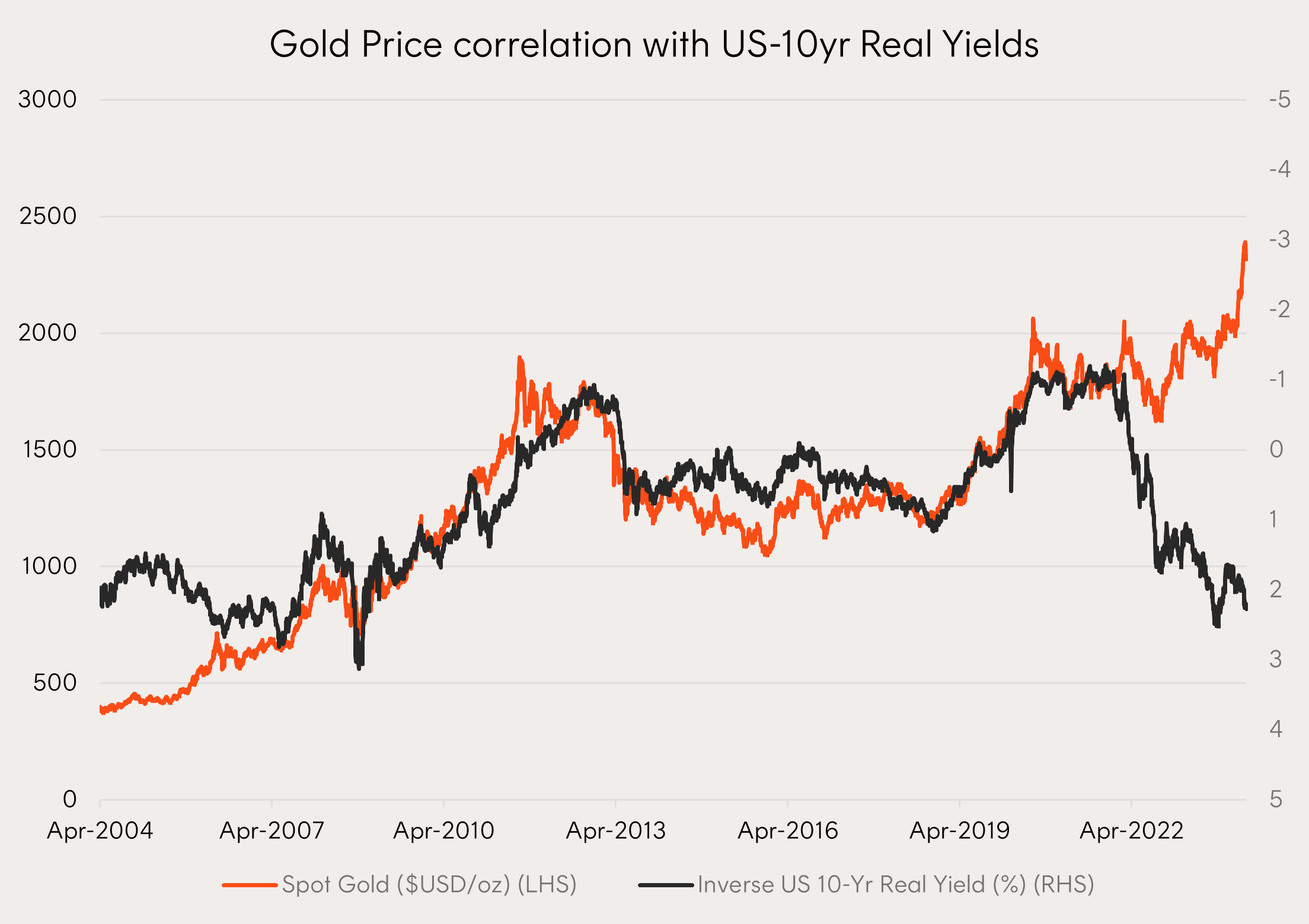

1 – Gold hits all-time highs as real yields rise

The surge in gold prices to all-time highs in April is bucking the trend of its historical inverse relationship with real yields.

When government bond yields, after adjusting for inflation expectations (i.e. real yields), are increasing, the opportunity cost of holding a non-income producing asset, like gold, also increases. In this scenario investors are paid more to use bonds as an alternative to gold. As a result, gold becomes relatively less attractive as an asset when real yields are high and/or rising.

However, this has not been the case recently as the rally in gold prices has coincided with increases in real yields since 2023, pointing to other structural factors such as central bank purchases, demand from China and price momentum which are supporting prices.

Chart 1: Gold price vs inverse US 10-yr real yields

Source: Bloomberg, Betashares. April 2004 to 2024. Past performance is not an indicator of future performance.

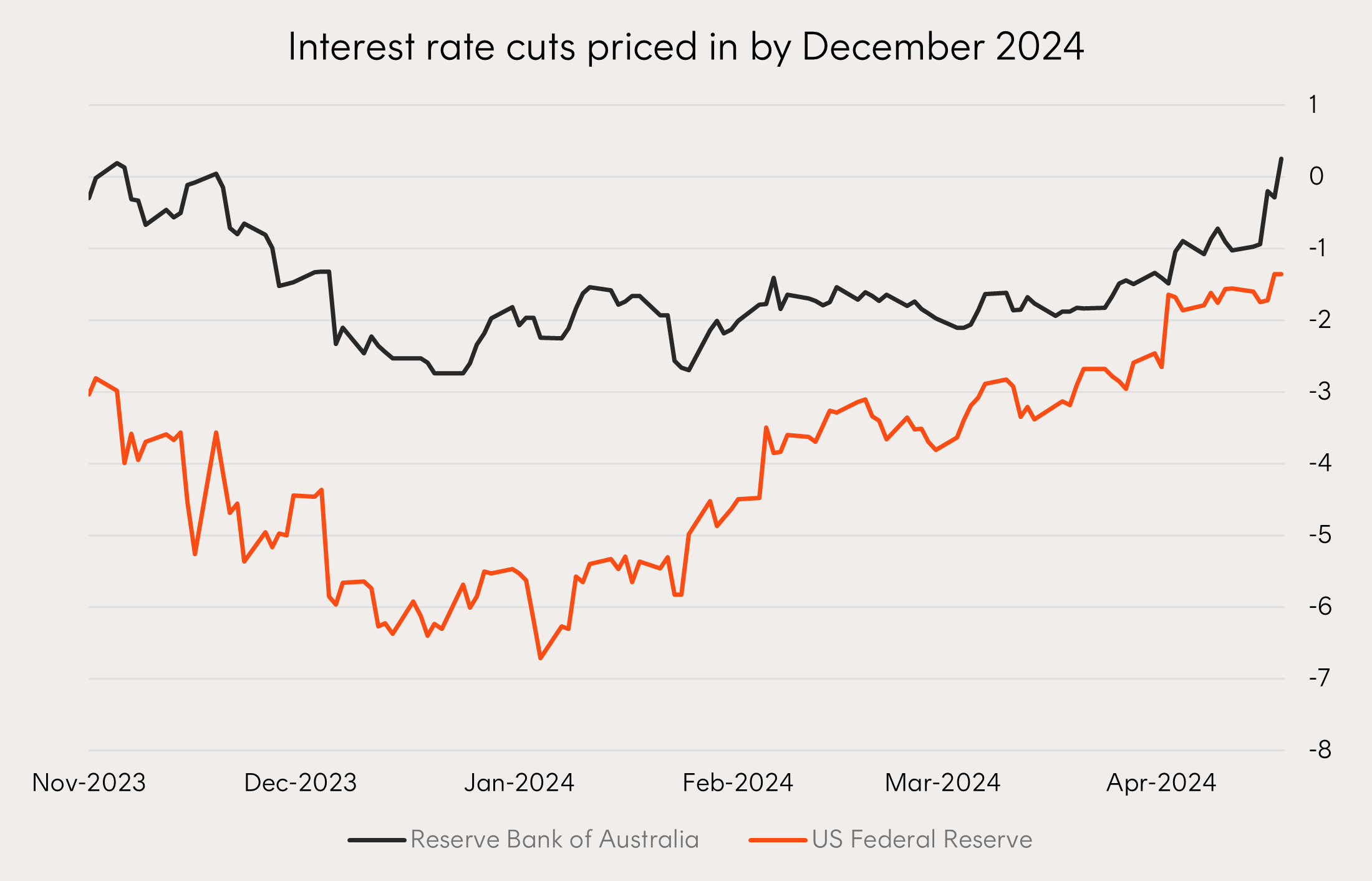

2 – Where are the rate cuts?

At the start of 2024 the market had priced in more than six 25 basis point interest rate cuts in the US. However, three stubborn inflation prints in a row has turned those expectations on their heads with less than two cuts now priced in.

Closer to home, there is now a small implied probability of an interest rate hike by the RBA this year as core inflation expanded by 4% on an annualised basis in the March quarter.

Chart 2: Evolution of interest rate cut forecasts by the Fed and RBA

Source: Bloomberg, Betashares. As at 26 April 2024. Data based on Bloomberg’s World Interest Rate Probability (WIRP) function which calculates the implied forecast for interest rates based on pricing in futures markets. A negative number represents the number of interest rate cuts whilst a positive number represents the number of interest rate hikes.

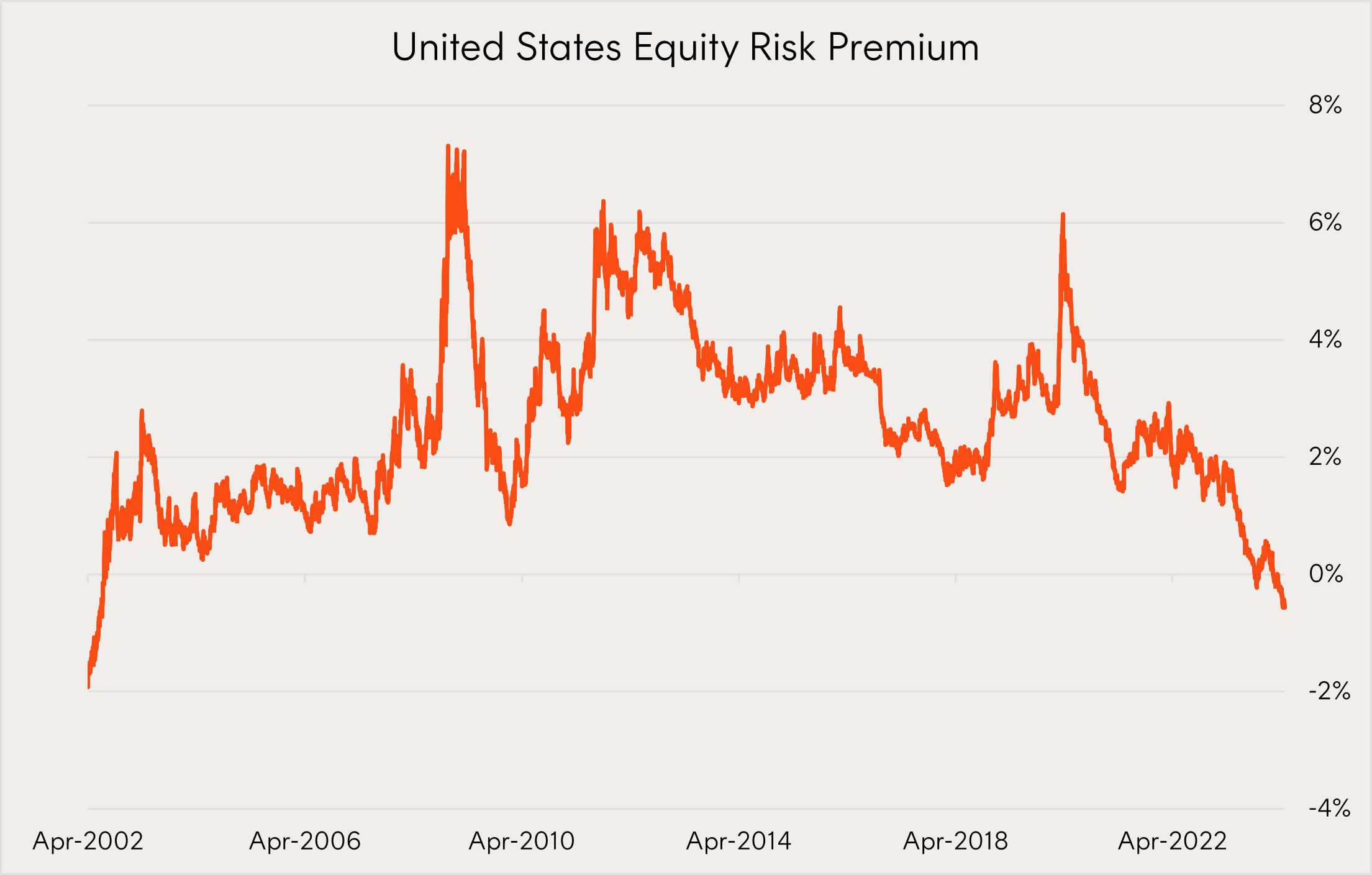

3 – Is the juice worth the squeeze in equities?

Expected returns on US stocks are now lower than bonds for the first time in over 20 years.

The equity risk premium (the extra return you get from stocks over bonds) turned negative as both bond yields and equity valuations rose to multi-decade highs. Allocators may face a difficult path ahead if equity markets continue to outperform despite the availability of relatively appealing alternatives.

Chart 3: US equity risk premium

Source: Bloomberg, Betashares. April 2002-2024. Equity risk premium estimated by the earnings yield on the S&P 500 minus the US 10-yr government bond yield.

4 – Large caps prevailing in the post pandemic world

Much has been talked about the disconnect between US mega caps (see the “magnificent 7”) and the rest of the market. However, the US is not alone. The Australian equity market has experienced a similar divergence over the past few years with the largest companies outperforming the rest. As investors consider where the next leg of an equity market rally could come from in a soft landing scenario, those medium and smaller sized companies may be a place to look as history shows mean reversion is a powerful market force.

Chart 4: Performance charts of Australian top 20, 200 and top 200 ex top 20 stocks

Source: Bloomberg, Betashares. April 2021 to April 2024. Solactive Australia 20 Index, Solactive Australia 200 Index, and Solactive Australia ex 20 Index depicted. Past performance is not an indicator of future performance. You cannot invest directly in an index.

That’s all for Charts of the month but we’ll be back with more interesting insights as markets enter a crucial inflection point – balancing elevated valuations, slowing economic growth and higher than expected inflation.

2 comments on this

would be great to be able to login to our accounts via the web. instead of having to miss out on possible profits

Hi Mike,

Thanks for your feedback.

Betashares Direct Web app will be made available within the next 1-2 months. Stay tuned for our marketing communications to learn about our new feature releases.

Cheers,

Betashares Support team.