Cause to pause

4 minutes reading time

Global markets

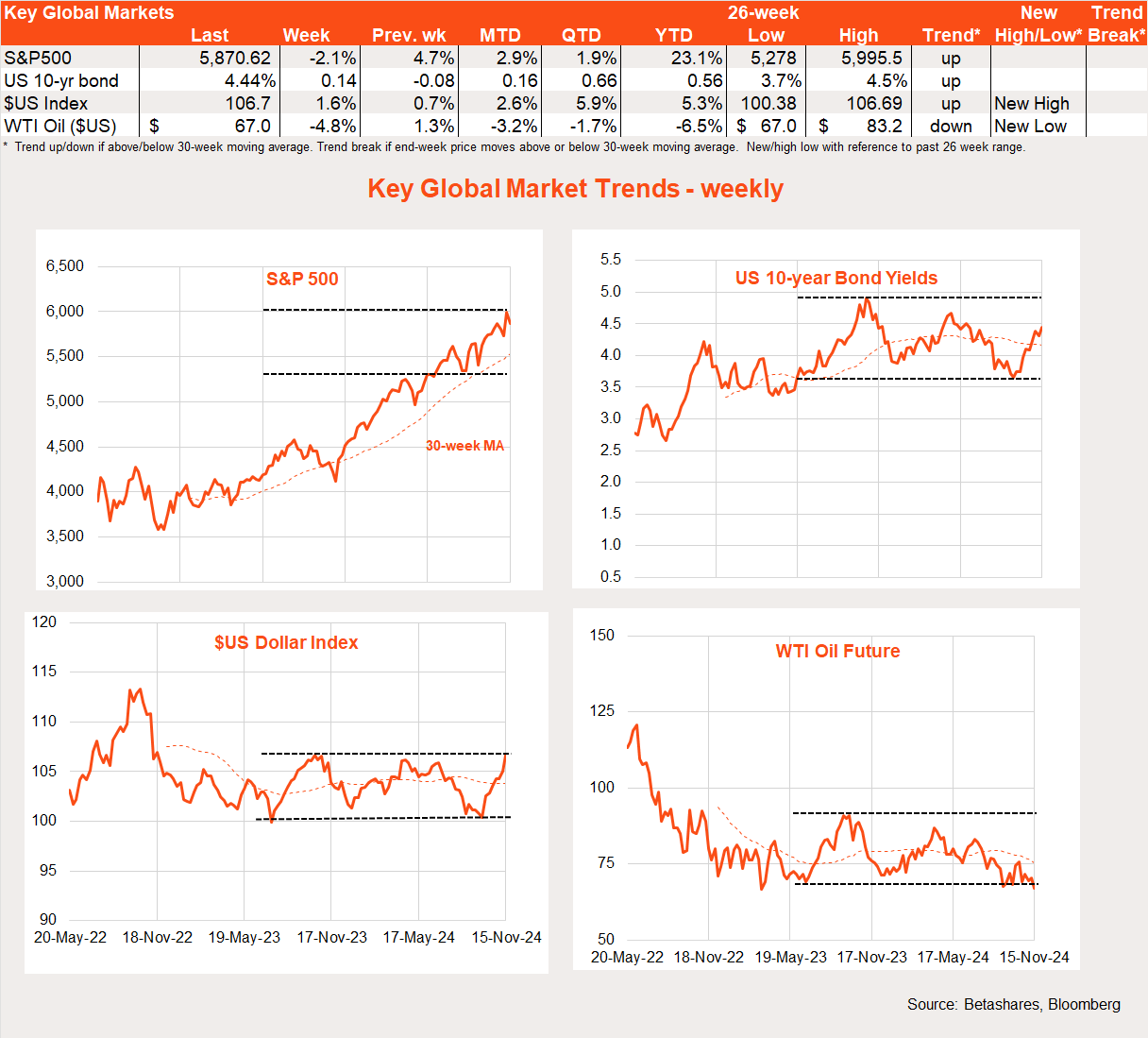

Global equities fell back last week, likely reflecting post-US election profit taking and more cautious comments from Fed chair Jerome Powell.

After a solid ‘Trump bounce’, some post-election equity profit taking last week should not be unexpected. That’s especially so as markets continue to get nervous about potentially higher bond yields and inflation given Trump’s plans to cut income tax and raise tariffs. Trump’s Friday announcement of Robert F. Kennedy Jr as Health Secretary also hurt drug companies, given his historic criticism of vaccines.

October’s US consumer price report was as expected, with gains of 0.2% and 0.3% in the headline and core measures respectively. Markets remain comfortable with the inflation outlook – despite core annual CPI inflation having now held at 3.3% for several months – likely because the lingering strength is in the housing sector, which forward indicators suggest should ease in coming months.

Along with RFK Jr., what did concern markets a little, however, were comments from Fed chair Powell who – while continuing to indicate rate cuts are still coming – suggests there’s no reason to hurry given underlying strength in the economy. Solid retail spending on Friday only added to the market concern over rate cuts. Markets have scaled back the chances of a December rate cut to around 60%, and now expect only two further rate cuts next year.

Not surprisingly, US 10-year bond yields rose a further 0.13% last week to 4.46%. Yields are still below their late-April high of 4.7% and their 5.0% peak in October last year – so, at this stage at least, the trend remains down.

Equity markets, meanwhile, are trying hard to ignore the rebound in bond yields since their cycle low of 3.6% in mid-September as, along with high US equity valuations, this has all but wiped out the positive US S&P 500 equity-risk premium that has been in place for over 20 years. This makes Wall Street increasingly vulnerable to at least a correction, especially if Trump-related concerns intensify.

Global week ahead

There’s only second tier data in the US this week, with a focus likely to be on what a smattering of other Fed speakers think about the chances of a December rate cut. Otherwise markets will nervously await what other weird and wacky choices Trump throws up for his Administration.

Market Trends

Given the rise then fall in equity markets in the past two weeks, the post-US election trend in global equity markets remains somewhat unclear. Global quality has tended to underperform in recent weeks, though growth and the NASDAQ-100 generally have so far held up relatively well.

By region, Europe and emerging markets have underperformed, likely reflecting concerns over Trump’s trade potential trade war.

Australian market

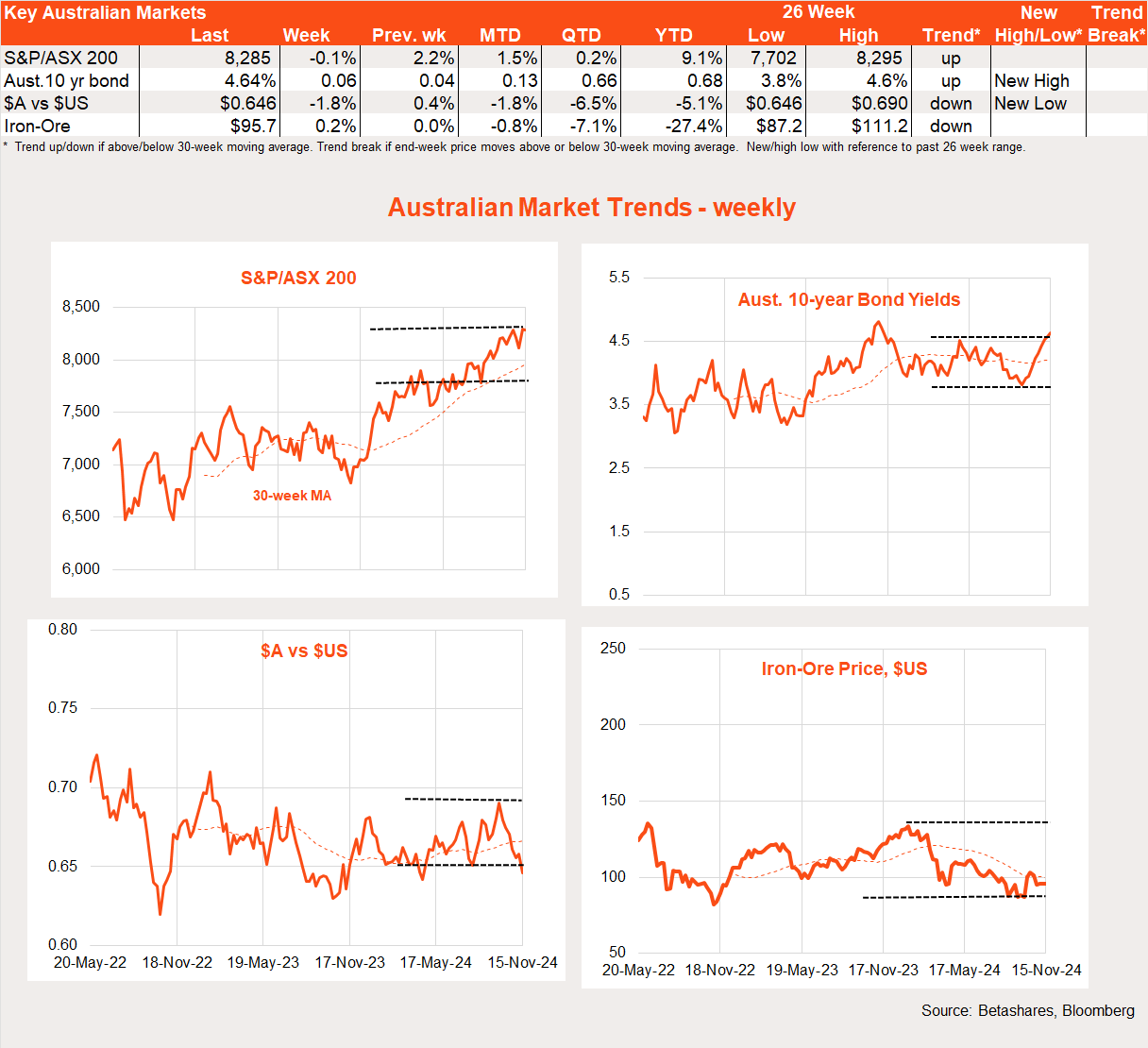

Local stocks were largely flat over the week and futures suggest only a small dip on the open despite the S&P 500’s 1.3% slump on Friday.

Last week’s data was generally upbeat, suggesting little need for the RBA to overly worry about downside risks to the economy from its continued restrictive policy stance. It leaves the onus for rate cuts squarely on the outlook for inflation.

Indeed, the Westpac survey of consumer confidence revealed a further lift in sentiment – almost back to long-run average levels – as fears of further interest rate hikes subsided and the outlook for employment improved.

The NAB survey of business conditions pointed to continued stabilisation around long-run average levels after a gradual weakening in sentiment up until a few months ago.

Employment growth slowed in October, though broadly in line with slowing population growth so as to leave the unemployment rate unchanged at 4.1%.

Tomorrow’s minutes to the latest RBA meeting and a Thursday speech by Governor Bullock are the local highlights this week, though it’s unlikely we’ll get any shift in tone from its current cautious hawkishness.

Have a great week!