5 minutes reading time

Global markets

Global equities continued their rebound last week, supported by encouraging comments from Fed chair Jerome Powell and a Goldilocks US employment report.

In key commentary last week, Fed chair Powell conceded the US economy was stronger than the Fed thought when it first cut rates in September, and inflation has been a little higher. He then ventured “the good news is that we can afford to be a little more cautious as we try to find neutral.”

Despite this, equities rallied on his upbeat economic views and money markets retained a high chance (85%) of a third consecutive rate cut at next week’s final Fed meeting for the year. It seems the Fed can be cautious – but caution can wait until next year!

Supporting the idea the Fed can cut rates next week, Friday’s November employment result could be considered neither too hot nor too cold. Employment rebounded broadly in line with market expectations (+227k) after being held down in October by hurricanes and strike activity – with the unemployment rate ticking up to 4.2% from 4.1%.

In other news, Trump appointed Paul S. Atkins – a known advocate of lighter financial regulation and crypto currencies – as head of the Securities and Exchange Commission (SEC), which could support the current fervour around Bitcoin and Wall Street banks. Apart from its being potentially overbought in the short-term it hard to imagine the news flow disfavouring Bitcoin anytime soon given Trump & Co.’s infatuation with all things crypto.

Last but not least were more signs of woe in Europe, with the French Government toppling in the face of fierce parliamentary opposition to budgets cuts – designed to reign in the whopping budget deficit now running at 6% of GDP.

Global week ahead

The major global highlight this week will be the US November CPI report, with markets expecting another firm 0.3% gain in core prices which would keep the annual rate steady at 3.3%. Core (i.e. ex food and energy) inflation for the Fed’s preferred inflation measure – the private consumption expenditure deflator (PCED) – has been stuck at 2.8% for the past few months.

The Fed and Wall Street have, perhaps surprisingly, remained relatively sanguine about the firmer run of US inflation in recent months – seemingly because most of the lingering price pressures reflect housing (rent) pressures, which forward indicators suggest should slow eventually. That said, how long can we wait? One would think continued 0.3% core prices gains heading into 2025 will be hard to ignore at some point, which could potentially upset the current Fed/Trump/AI-fueled party on Wall Street.

In Europe, the ECB is widely expected to cut interest rates another 0.25% on Thursday – the third cut this year.

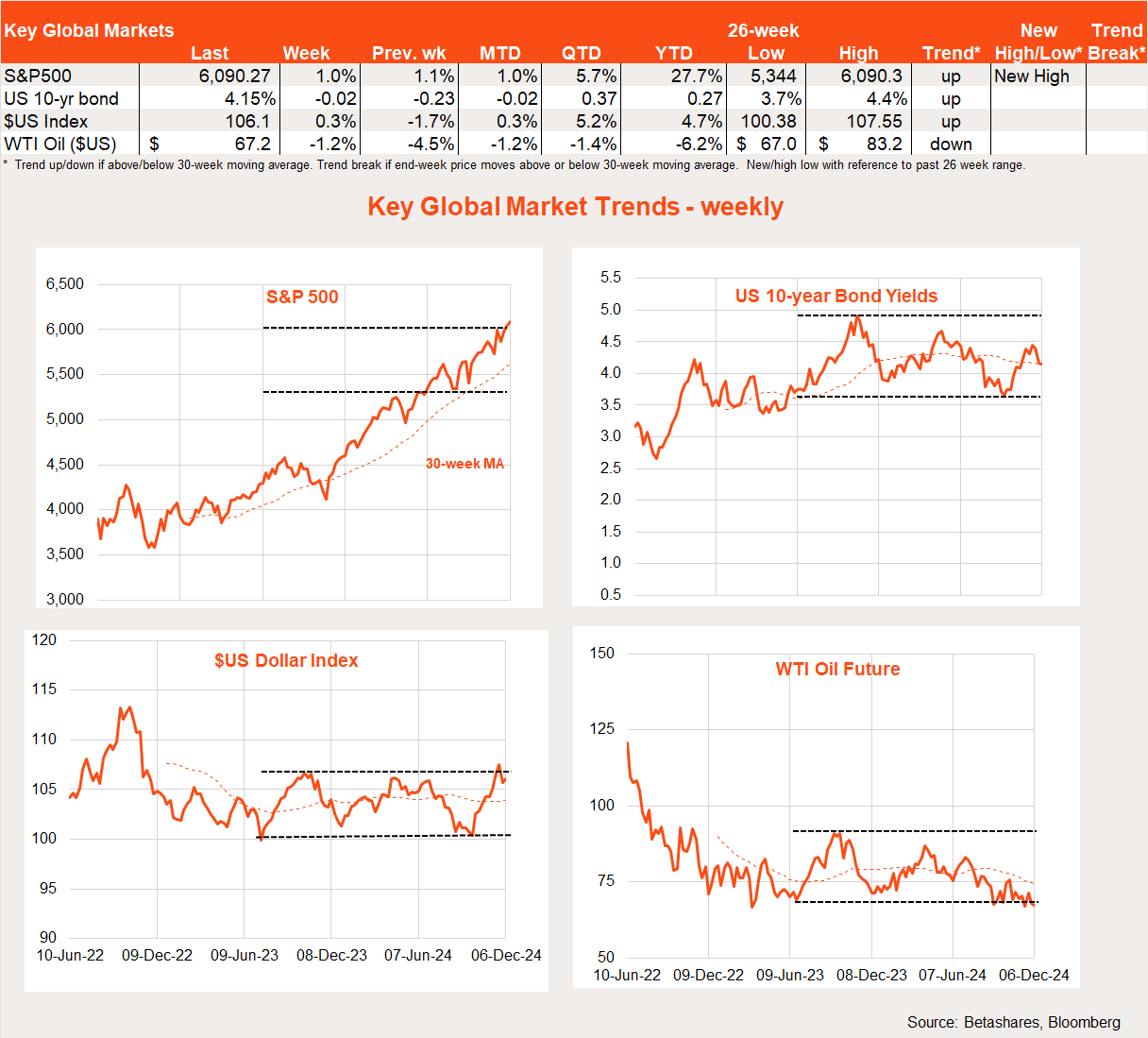

Market trends

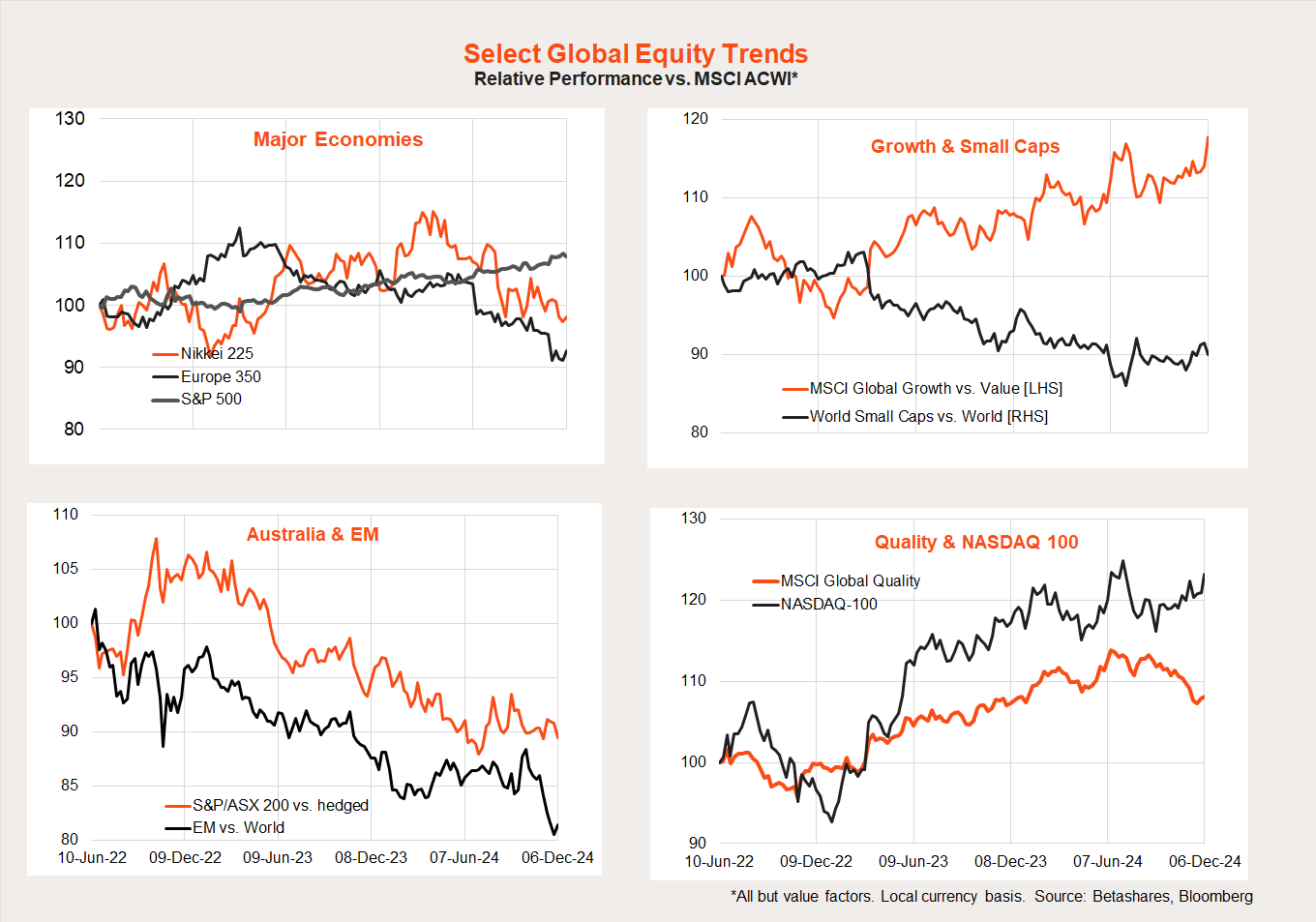

The NASDAQ-100 and the global technology sector were especially strong last week, supporting the continued outperformance trend in growth, technology and US stocks. The relative performance for emerging markets, Europe, Japan, and quality remains downwards, while it is more choppy/sideways for Australia and small caps.

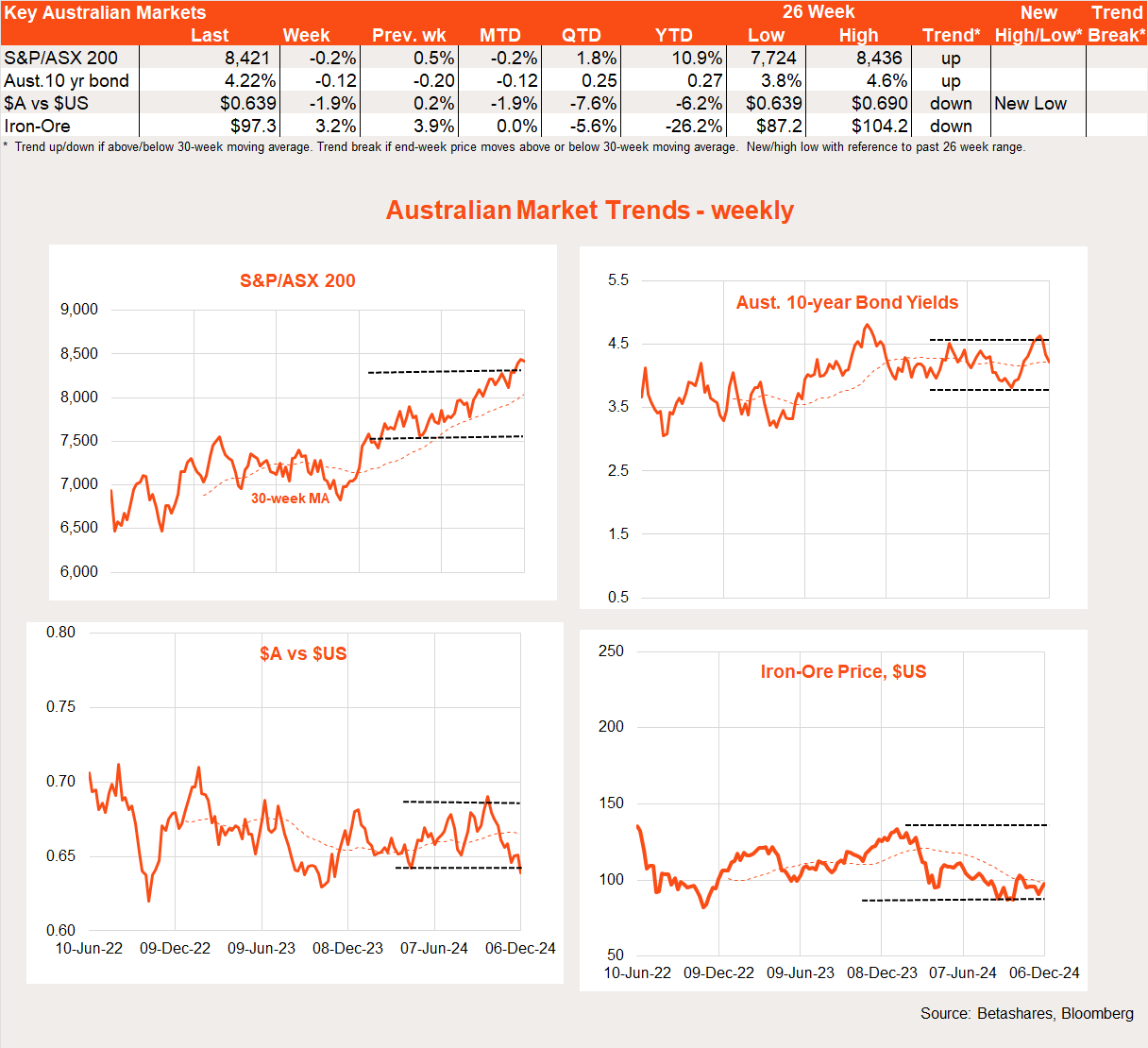

Australian market

Local stocks edged back last week, with sentiment dented by a soft Q3 GDP report, even though this modestly increased market hopes for an RBA interest rate cut early next year. Despite a rebound in iron-ore prices on China stimulus hopes, the $A sank further to just under US64c.

The main local news last week was the soft Q3 GDP report, with economic growth up only 0.3%, compared to market expectations for a 0.5% gain. Household consumer spending was flat despite a 0.8% gain in disposable income (in part due to tax cuts). There was a lot of chatter about weak private demand and strong public demand, though it should be noted the accounting treatment of electricity subsidies held back household consumer spending by around 0.4% and instead boosted public demand.

That said, overall GDP growth is still soft – though to the RBA the fact the level of activity remains high compared to available supply is the main concern, as evident from still high capacity utilisation rates and low unemployment. The RBA will be swayed more by soft inflation than by soft GDP at this stage.

On a brighter consumer note, nominal monthly retail spending spiked 0.6% higher in October – though the question remains whether this reflected a bring forward of spending to take advantage of sales, or a belated reaction to recent tax cuts.

In the week ahead, key highlights will be tomorrow’s RBA meeting and Thursday’s November labour force report. No change is widely expected from the RBA despite last week’s GDP report. Another solid employment gain of around 25k is expected, with the unemployment rate expected to edge up to 4.2% from 4.1%.

Have a great week!