5 minutes reading time

MMKT Australian Cash Plus Active ETF has just reached the one year anniversary of its listing date. Over the last 12 months it has attracted significant interest from investors, advisers and institutions (including asset managers) as a way to enhance yields on their strategic cash allocations.

Our AAA Australian High Interest Cash ETF , launched in 2012, has long been a popular choice with investors seeking an attractive rate of interest on cash, while offering T+2 liquidity.

But so far this year net inflows into MMKT have outstripped the inflows into AAA, by a ratio of three to one1. A key reason for this is the additional uplift in yield MMKT currently offers over AAA.

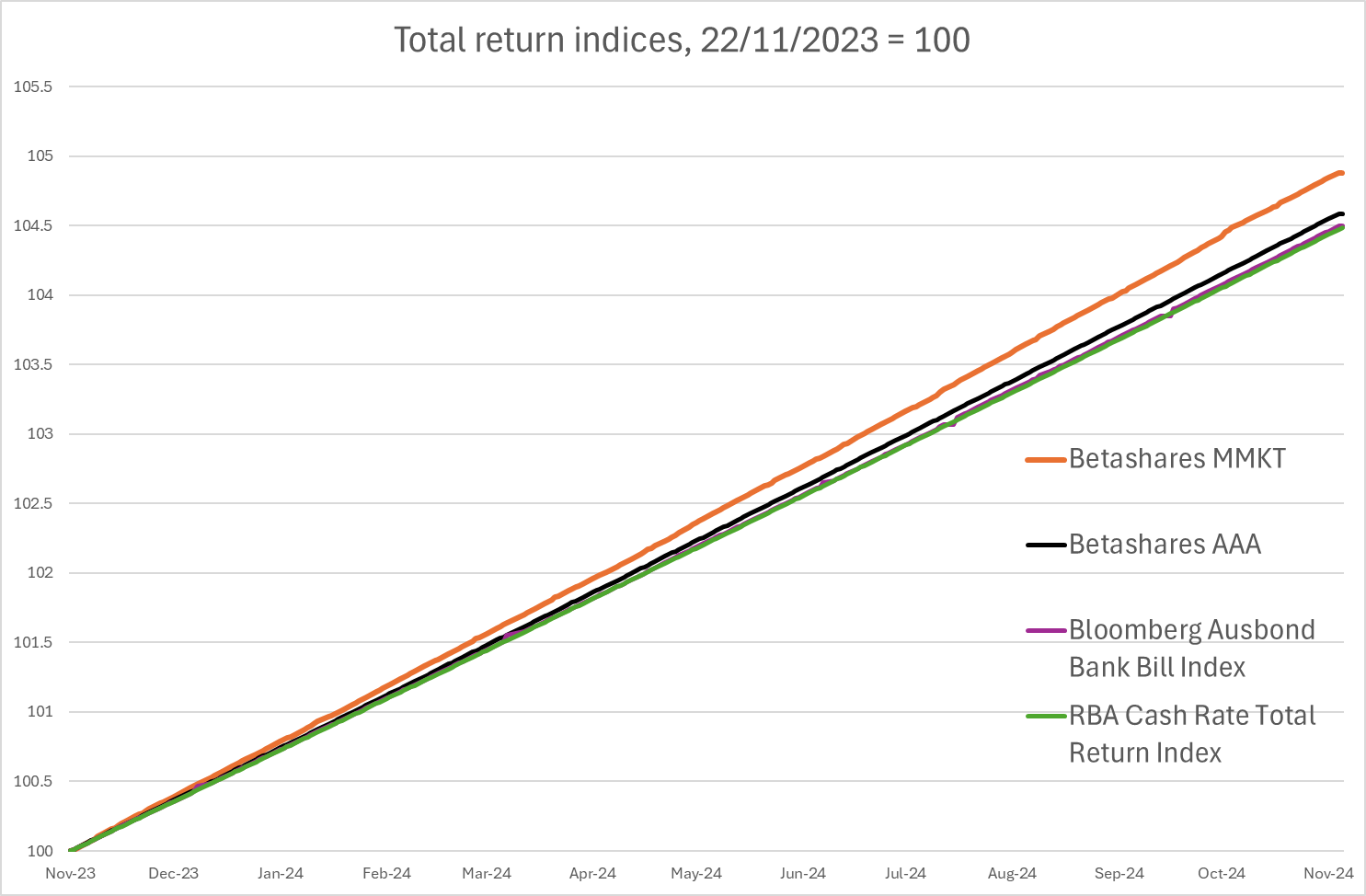

Betashares Cash ETFs vs AusBond Bank Bill Index (November 2023 to November 2024)

| MMKT | AAA | Bloomberg Ausbond Bank Bill Index | RBA Cash Rate Total Return Index | |

| 1 year | 4.84% | 4.55% | 4.46% | 4.44% |

| 6 months | 2.43% | 2.27% | 2.22% | 2.21% |

| 3 months | 1.21% | 1.13% | 1.11% | 1.10% |

Source: Bloomberg. As at 22 November 2024. Performance is shown since inception of MMKT on 22 November 2023, indexed to a starting value of 100 in the chart. Inception date for AAA was 6 March 2012. AAA and MMKT shows fund performance net of management costs of 0.18% p.a (for both funds), and assumes reinvestment of distributions. . Does not take into account brokerage or bid-ask spread that investors may incur when buying and selling units on the ASX. Past performance is not indicative of future performance.

MMKT’s cumulative outperformance over AAA has been growing consistently, month on month.

Sharp eyed readers will notice that the 1 year total return on RBA cash is 4.44%, when the official cash rate has been a steady 4.35% the whole time. This difference comes down to the power of compounding, something that both MMKT and AAA also benefit from. Conversely, interest paid on Term Deposits are calculated using the simple interest formula, which does not provide this compounding benefit.

Term deposits are often used by Australian investors to park cash. RBA market data shows the average 1-year term deposit interest rate back when MMKT was launched was 4.55%pa. While not a bank deposit, MMKT’s 1-year return eclipses that while still providing ready liquidity with T+2 settlement. Since July 2024 the ‘big 4’ banks have cut their term deposit rates by around 0.30% to preserve profitability well in advance of any possible RBA rate cuts. As at October 2024 the average 1-year term deposit interest rate was 4.20%pa, whereas MMKT’s yield (net (of management costs) currently stands at 4.70%pa2.

MMKT is able to provide an enhanced yield by investing in AUD dollar cash and high-quality, short-term money market securities with remaining maturities of less than one year issued by investment grade rated entities, using a buy-and-hold approach. By investing in money market securities, MMKT aims to generate yields (before fees and expenses) that exceed the Bloomberg AusBond Bank Bill Index (the “Benchmark”) whilst seeking to preserve invested capital and provide ready liquidity.

Money market securities are normally the domain of institutional investors due to high minimum investment hurdles and the level of investment expertise typically required. MMKT opens up this investment opportunity in a cost-effective, diversified format to a wider audience.

Why consider MMKT in today’s market

Over the cycle, we have seen that money market securities can offer a material yield uplift over bank deposits. As the RBA’s emergency COVID-era funding tapers off, banks are increasingly relying on wholesale funding markets, driving up the yield premium on money market securities. This shift presents a compelling opportunity for MMKT’s investors to benefit from the increasingly attractive yields available on wholesale cash and money market instruments compared to traditional at call cash or retail bank deposits.

An investment in AAA or MMKT does not receive the benefit of any government guarantee. There are risks associated with an investment in the Funds, including interest rate risk, credit risk, and market risk. Investment value can go up and down. An investment in the Funds should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

MMKT key facts (as at 02/12/2024)

- AUM: $173 million

- Estimated yield to maturity net of fees: 4.74% p.a*.

- Distribution Frequency: Monthly

- Holdings: Cash (overnight cash and TDs), Money Market Instruments (NCDs, CPs & Senior FRNs)

- Management Fee: 0.18% p.a**.

- Fund page: MMKT Australian Cash Plus Active ETF

*Past performance is not indicative of future performance. Please refer to the MMKT product page for further performance information.

* Certain additional costs apply. Please refer to PDS.

1. Net inflows from 1 January – 31 October 2024. ↑

2. Term deposit rates are taken from RBA statistics based on rates that are fixed for 12 months. MMKT’s yield is not fixed and will vary and may be lower at time of investment. Unlike term deposits, MMKT does not provide access to the Federal Government Bank Deposit Guarantee. While an investment in MMKT can be considered low risk, an investment in the Fund is not guaranteed and some capital variability is possible. Past performance is not indicative of future performance. . ↑