5 minutes reading time

- Fixed income, cash & hybrids

Investors typically limit their perception of cash investing to at-call, term deposits, and platform cash. Even the thought of cash as its own asset class can be a new concept, as most investors have historically not had access to the universe of securities on offer.

Money market securities – highly liquid, low risk, and short-term debt obligations between governments, financial institutions and large corporations are generally classified as cash equivalents by the investing community due to their attributes. Large wholesale and institutional investors use these securities as a part of their cash allocation to enhance income.

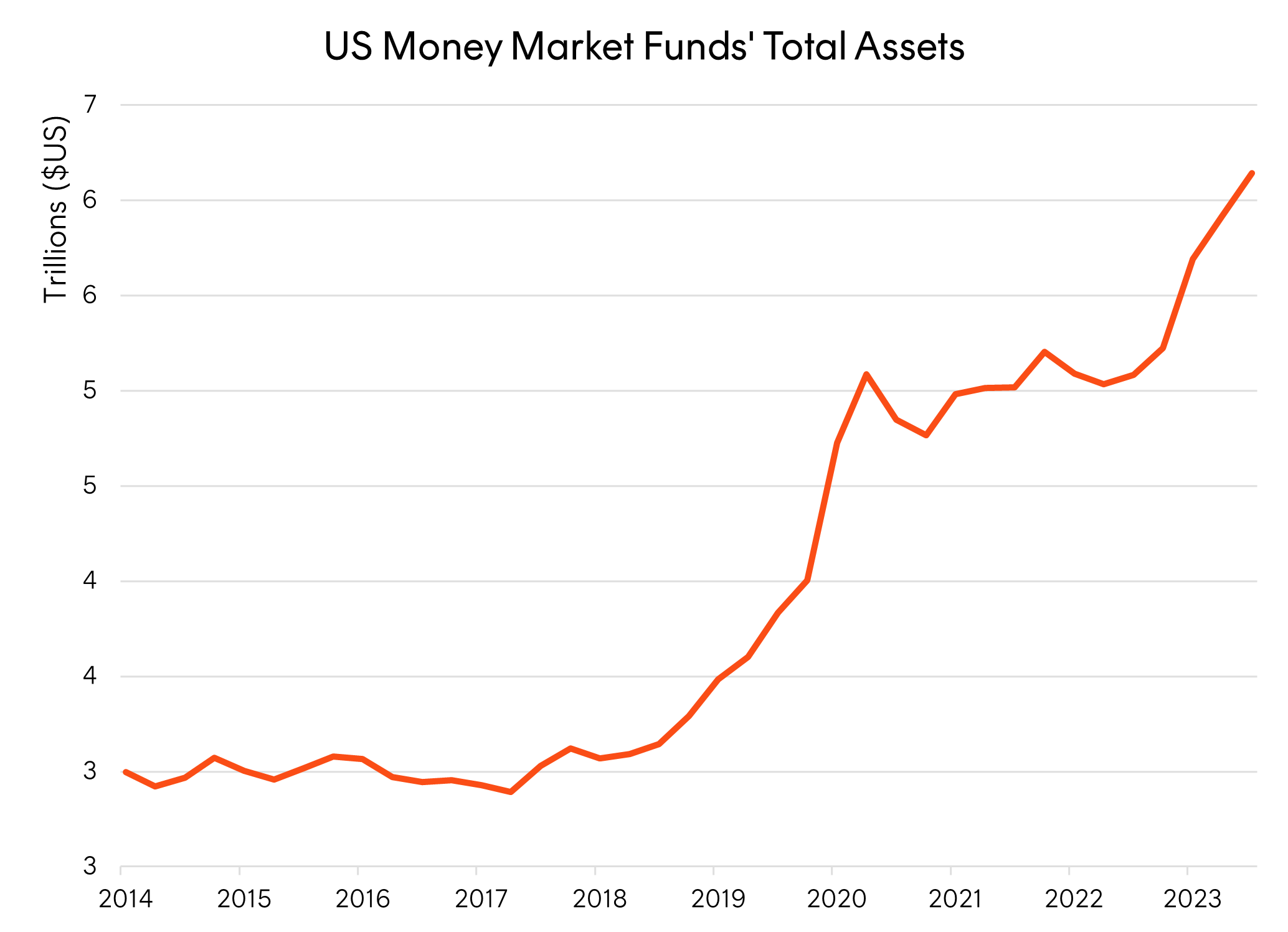

Historically, money market securities have not been more widely accessible due to high minimum investment hurdles and the level of investment expertise typically required. However, the availability of such funds in the US has seen assets grow rapidly in recent years as institutions and everyday investors alike look to enhance their cash allocations. Since 2018 assets in US money market funds have more than doubled from $US3tn to over $US6tn today.

MMKT Australian Cash Plus Fund (managed fund) now offers Australian investors access to a portfolio of cash and Australian denominated money market securities.

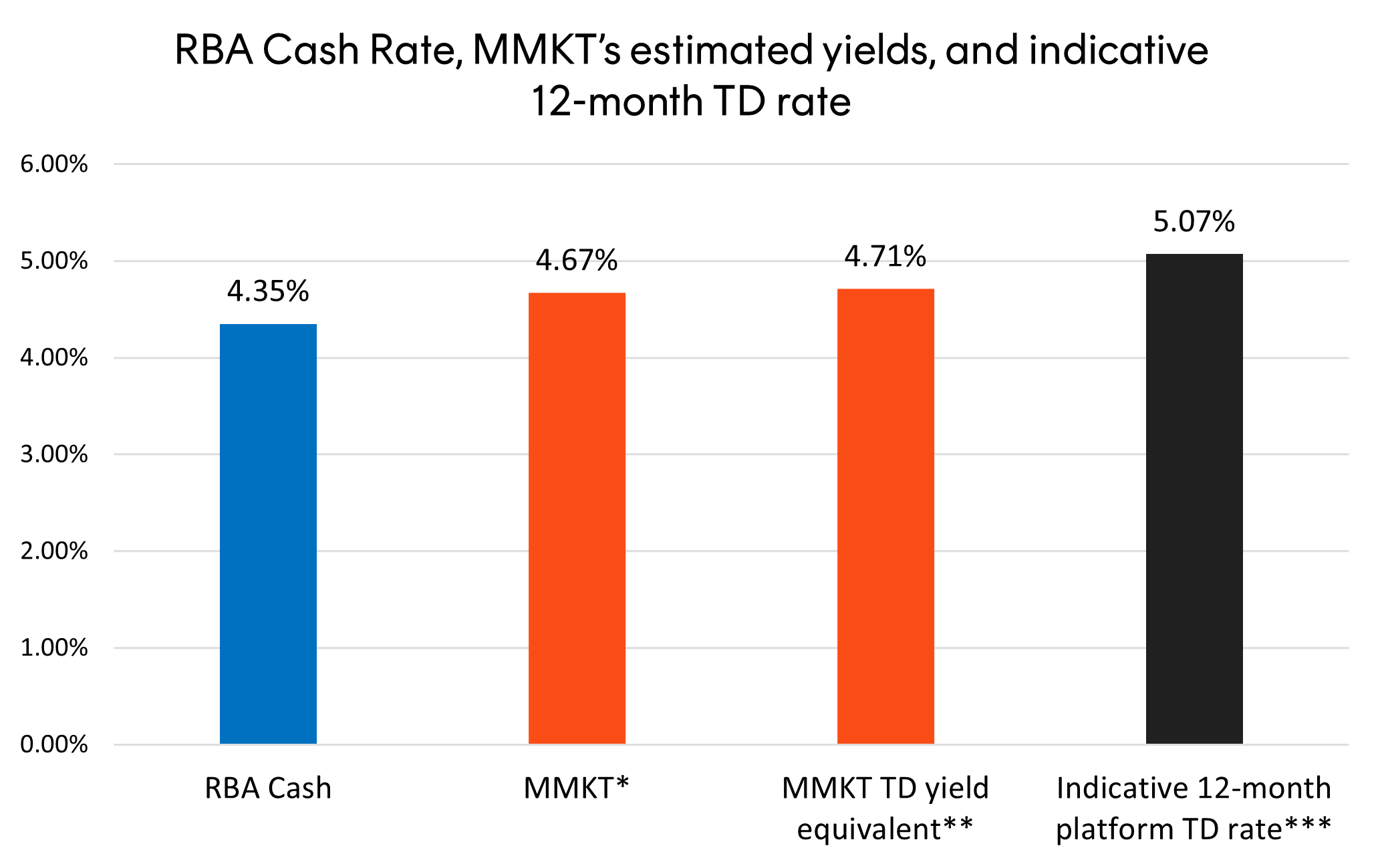

MMKT currently offers a net-of-fee estimated yield-to-maturity of 4.67% p.a.* (as at 22 January 2024), making it potentially competitive against 12-month term deposits. Unlike term deposits, which are simple interest accounts, MMKT’s interest compounds, making the fund’s equivalent 12 month estimated net-of-fee return 4.78%*.

*Yield will vary and may be lower at time of investment. Past performance is not an indicator of future performance.

While 12-month term deposits currently offer a pickup over MMKT investors must consider what they are giving up for this additional income. Locking away money in a term deposit generates investors a premium for liquidity, but it does so at the cost of one of cash’s greatest investment properties – optionality.

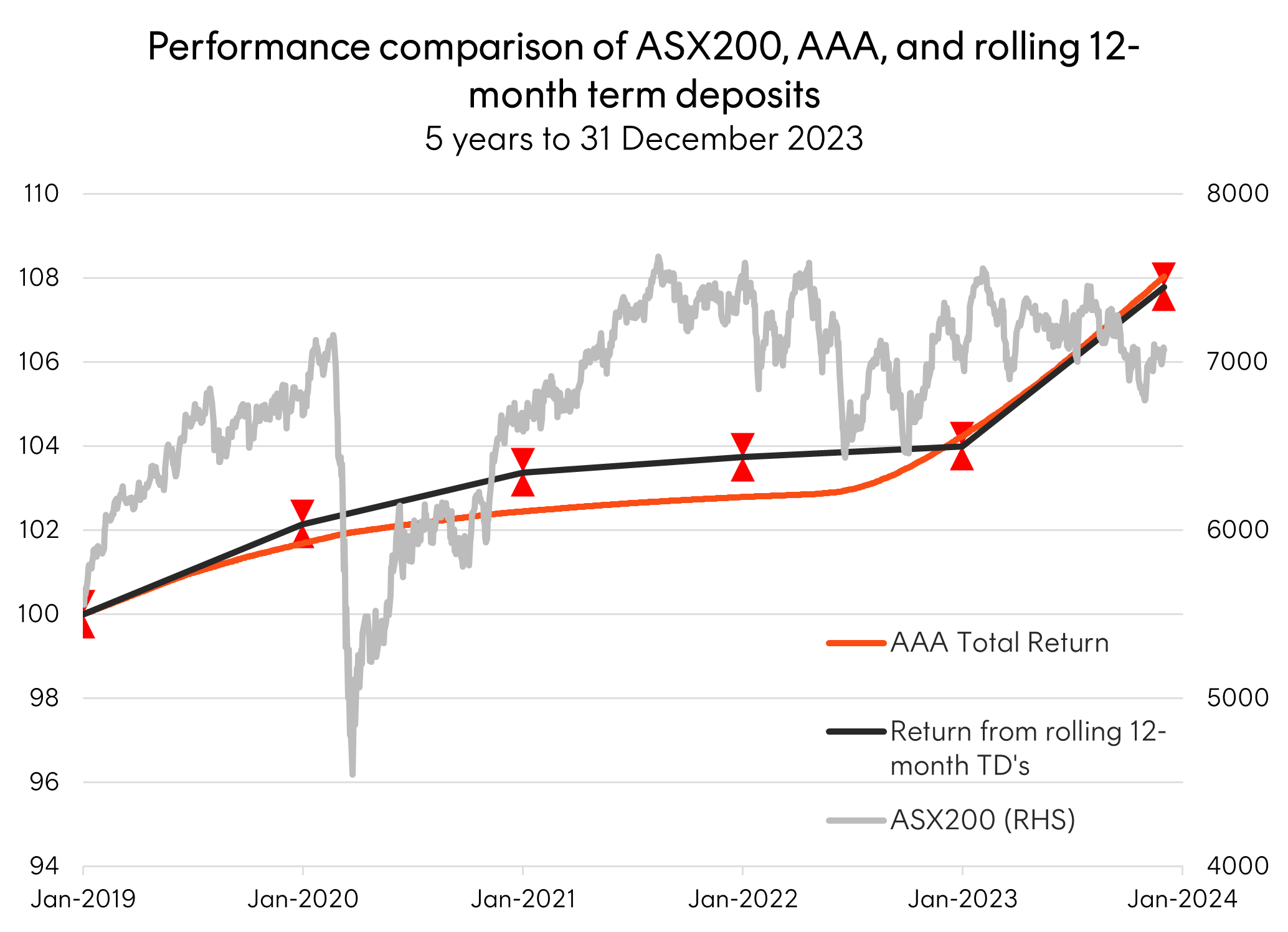

In the chart below the black line represents the return from rolling 12-month term deposits with the red arrows representing the periods an investor could choose between this re-investment and investing in the ASX200. The orange line represents the returns from Betashares High Interest Cash ETF (ASX: AAA). AAA is used here as a proxy for a high interest cash investment noting that MMKT is always expected to yield more than AAA.

Both investments ended the period with similar returns – with AAA outperforming 12-month term deposits over the period. Significantly, investors in AAA also had the option to re-invest in the market at any time over the 5-year period. Doing so at any period between the 2019 and 2020 term deposit rolls for instance could have improved an investor’s total returns.

Importantly, MMKT, which among money market securities, can also hold term deposits in its underlying portfolio, is traded on the ASX and provides T+2 liquidity.

MMKT can be used in a diversified portfolio as a core cash allocation or as a complement to platform cash or at-call deposit accounts to provide enhanced income.

For more information on Betashares ETF platform availability please use the following link.

There are risks associated with an investment in the Fund, including interest rate risk, credit risk, and market risk. Investment in the Fund does not receive the benefit of any government guarantee. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available here.

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.