6 minutes reading time

Although China has genuine economic challenges, there are also reasons to believe that things may be turning. Last September, large monetary and fiscal stimulus measures were announced by the Chinese government in order to restore confidence.

Coupled with more recent AI advancements from the likes of DeepSeek, the setup for Asian technology companies looks promising in the Year of the Snake. In this article, we’ll examine the current lay of the land as well as the opportunity in front of investors.

Why has China’s economy struggled to grow?

China’s economy grew just 5% in 20241, a long way from the double-digit growth rates it achieved throughout the early 2000s.

Years of overinvestment in sectors like real estate, infrastructure and manufacturing were fueled by easy credit access. This strategy, while initially effective, led to inefficient capital allocation and, more pertinently, a debt mountain.

As a result, the Chinese economy is now vulnerable to major downside growth shocks. This was noted by former US Treasury Secretary Janet Yellen during a press conference in Beijing in April 2024.

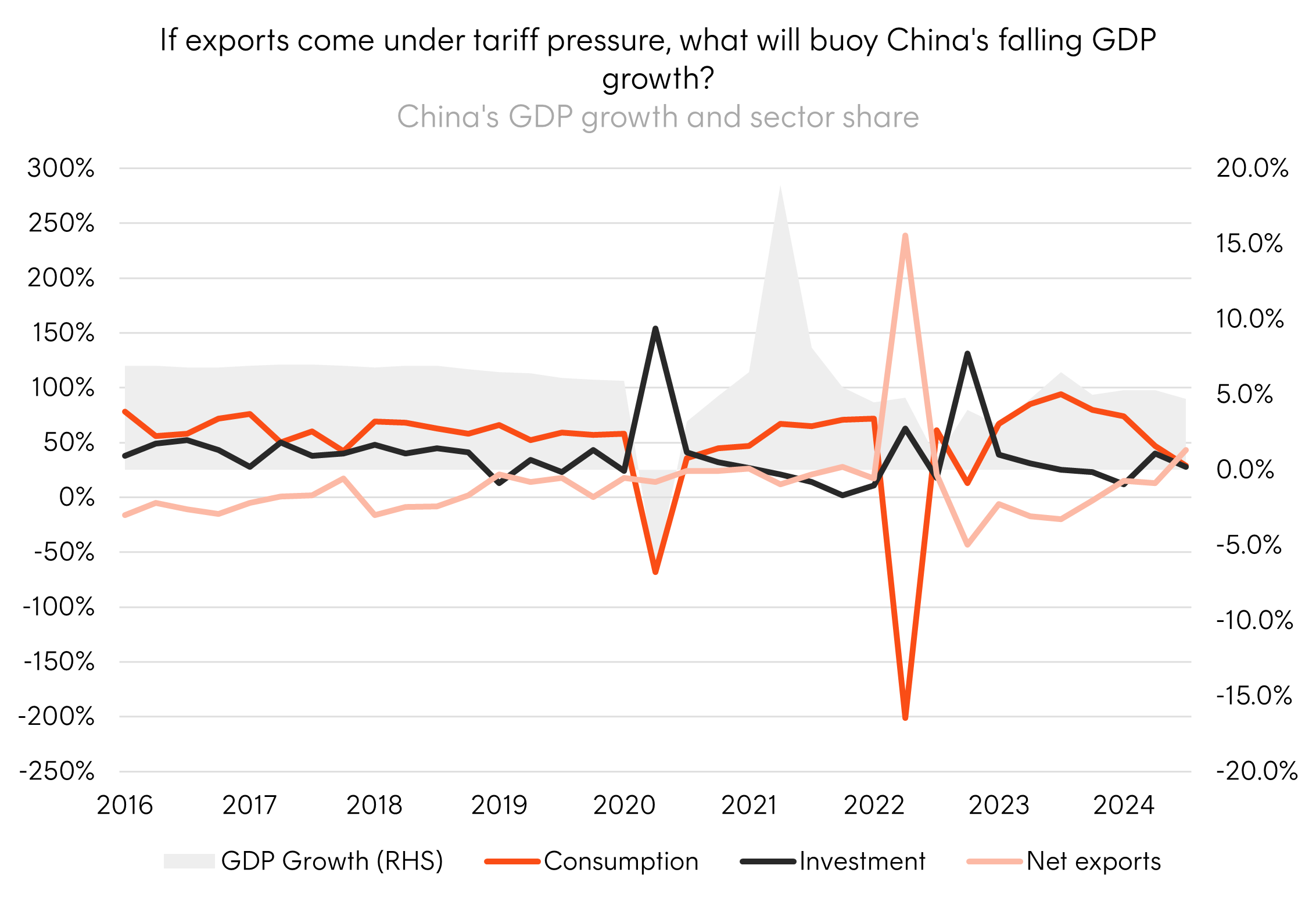

Source: Bloomberg, National Bureau of Statistics China. Quarterly data from Q1 2016 to Q3 2024.

Weak household consumption has also held the economy back. With around 70% of Chinese wealth tied to property2, falling property prices have suppressed consumer confidence and, as a result, consumption overall.

Are we at a turning point for Chinese equities?

With negative sentiment priced into Chinese equities and a strong willingness from the Politburo to put a floor under further economic weakness, there are three reasons why investors might reconsider their exposures to the world’s second largest economy.

1. Valuations present an attractive entry point

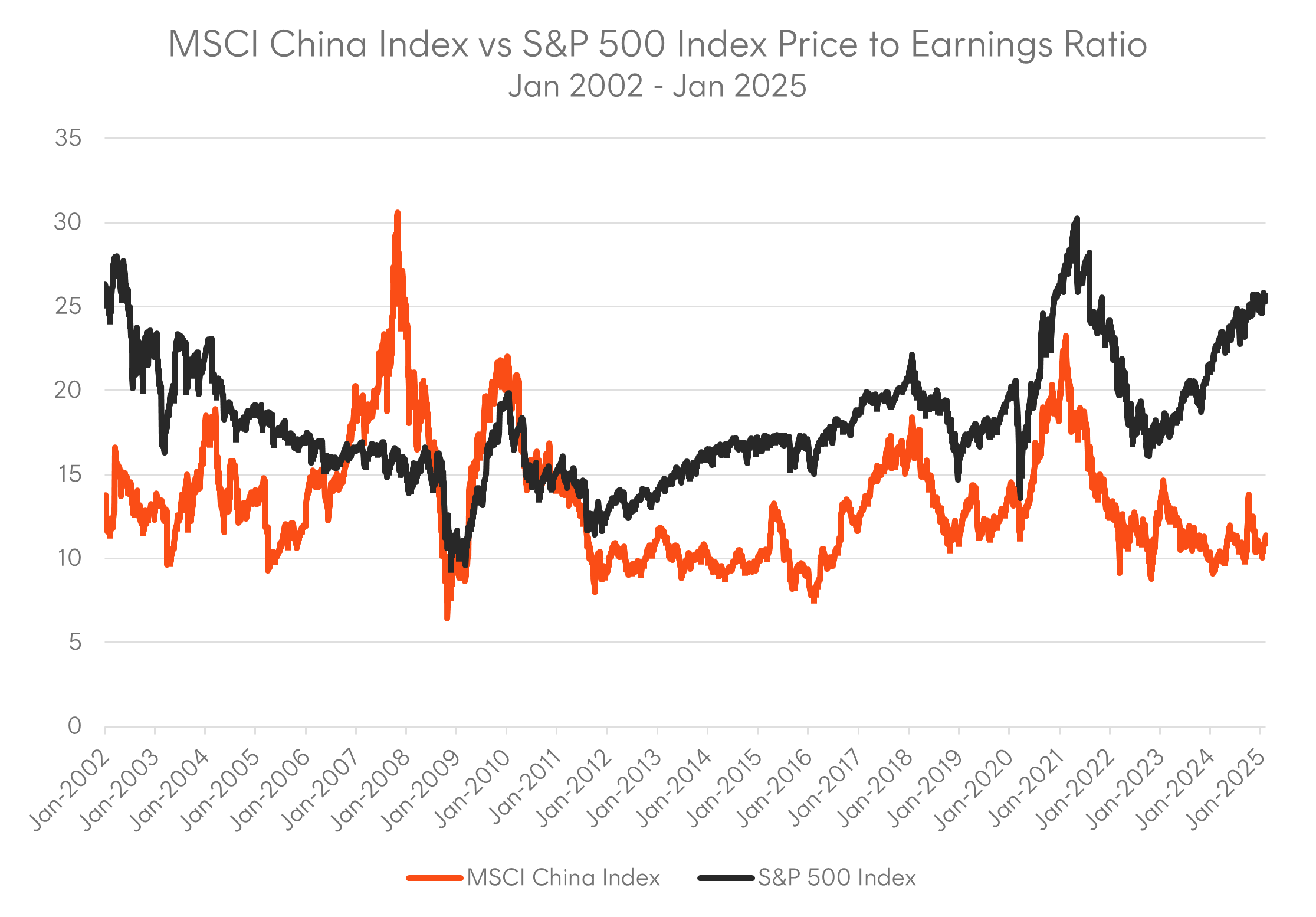

With the MSCI China Index trading at just 11.4x price-to-earnings (P/E) at time of writing, Chinese equities may present an attractive entry point for many investors. This contrasts with other indices like the S&P 500, which are trading at far loftier valuations.

Source: Bloomberg, Betashares. As at date. Past performance is not an indicator of future performance.

2. The policy environment should be supportive of the economy

Despite piecemeal support measures being ‘drip fed’ over recent years, the policy environment has changed. The slump in consumer confidence, as well as the latest round of US tariffs on Chinese imports, will likely increase the need for more stimulus.

In addition to government spending, the Chinese central bank also adopted a “moderately loose” monetary policy stance in December. It last adopted this stance in late 2008 after the global financial crisis. This strategy aims to ease credit conditions and inject liquidity into the economy. In addition, policymakers have encouraged insurers and mutual funds to invest more in the local stock market.

While we don’t know what effect all these measures will truly have on the economy, they do at least demonstrate a strong willingness by Chinese policymakers to put a floor under any further deterioration in the economy.

3. AI leadership – China’s strategic priority

Finally, Chinese policymakers have been trying to move away from legacy industries like real estate and infrastructure. Instead, investments are now being directed into new ‘high-tech’ areas of the economy such as electric vehicles, semiconductors and AI.

DeepSeek’s release of a cheaper and more efficient AI model sent shockwaves through markets. Since then, Alibaba and Bytedance have both released their own AI models which they claim can surpass both Deepseek’s and OpenAI’s o1 models.

Exploring the broader investment opportunity set in Asian technology

Although the entire Chinese technology sector is becoming of interest once again, it’s worth noting that there is a broader semiconductor supply chain that includes foundries, memory chip providers and component manufacturers. Many of these firms can be found in Asian nations.

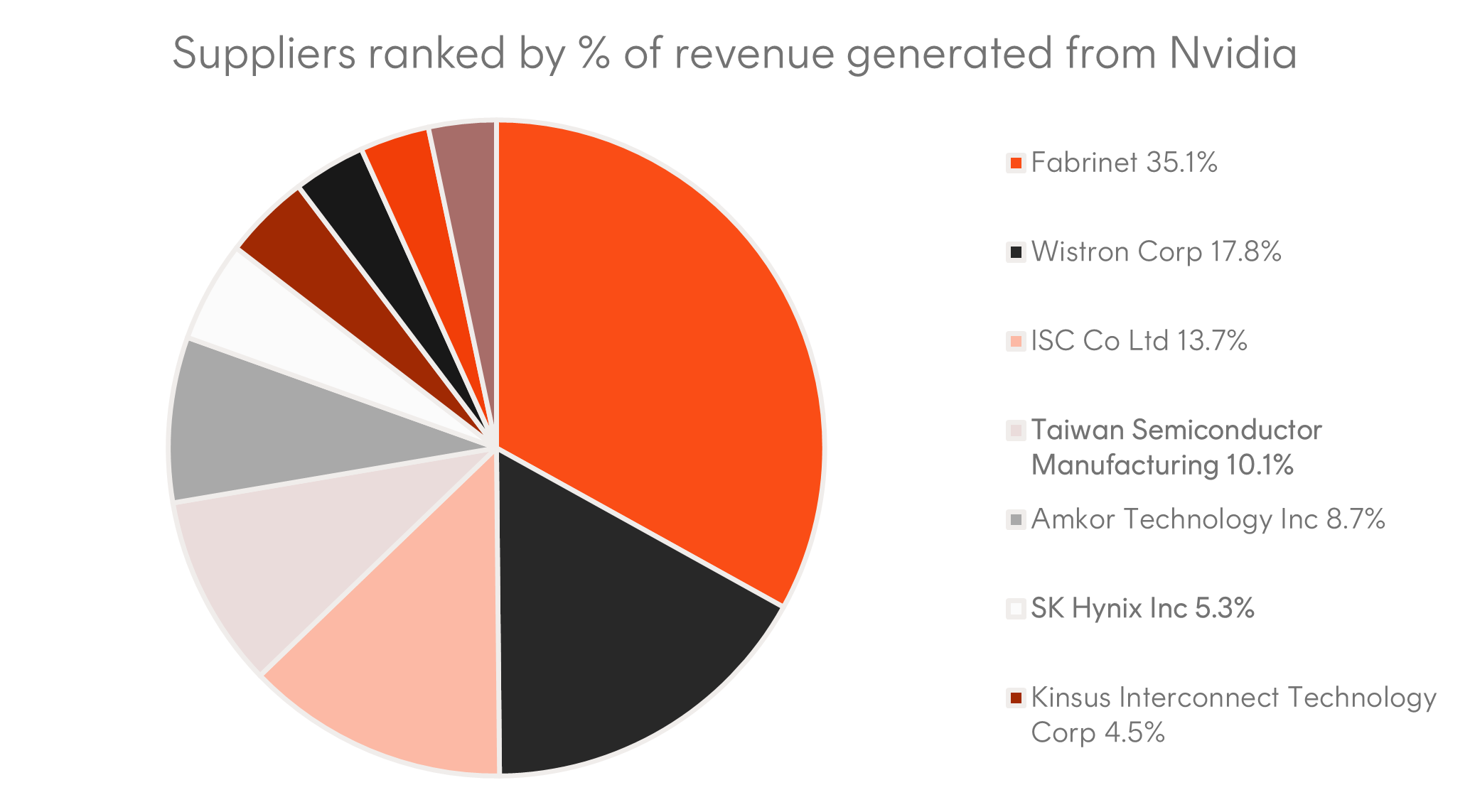

For example, while investors may be familiar with Nvidia, many of its suppliers are based in countries such as Taiwan and South Korea.

Source: Bloomberg, Betashares. As at 7 February 2025.

Some of these leading companies include Taiwan’s TSMC, the world’s largest manufacturer of advanced semiconductor chips, as well as South Korean giants Samsung and SK Hynix. Together, Samsung and SK Hynix account for almost 70% of dynamic random access memory (DRAM) chip production3 – which are vital to the manufacturing of advanced GPUs.

TSMC, Samsung and SK Hynix are all key holdings held within the ASIA Asia Technology Tigers ETF . This ETF provides investors with exposure to a portfolio of companies crucial to the semiconductor supply chain and leveraged to any consumption-led recovery in China4.

ASIA returned 43% over the year ending 31 January 2025, and has returned 9.4% p.a. over the last 5 years5.

A dynamic region

Chinese equities have been unloved for some time; however, we may be at a turning point with suppressed valuations providing an attractive entry point. Tech companies in greater Asia provide another way to participate in the AI revolution, without the valuation premium attached to the Magnificent Seven. Given many investors are currently underweight in Asian equities, now might be the time to re-think portfolio allocations to this dynamic region.

There are risks associated with an investment in ASIA, including information technology risk, concentration risk, emerging markets risk and currency risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. https://www.cnbc.com/2025/01/17/china-gdp-growth-meets-market-and-government-estimates.html ↑

2. https://www.china-briefing.com/news/explainer-whats-going-on-in-chinas-property-market/ ↑

3. https://www.chosun.com/english/industry-en/2024/02/29/SGS2LHTAAJAIHBDRMMJLBHGSFA/#:~:text=Samsung%20Electronics%20and%20SK%20Hynix%20account%20for%20almost%2070%25%20of,the%20matter%20on%20Feb.%2029 ↑

4. TSMC, Samsung and SK Hynix are currently included in ASIA’s portfolio. No assurance is given that these companies will remain in ASIA’s portfolio or will be profitable investments. ↑

5. Source: Bloomberg. Past performance is not indicative of future returns. ASIA’s returns are net of management costs of 0.67% p.a. ASIA’s inception date was 18 September 2018. You cannot invest directly in an index. ASIA’s returns can be expected to be more volatile (ie vary up and down) than a broad global exposure. ↑