Is your portfolio really diversified?

8 minutes reading time

- Australian shares

Australian investors are faced with a domestic market concentrated in large-cap mature companies from cyclical industries.

While this makeup typically caters to our high dividend yield preferences, it has historically come at the expense of profitability, growth and price appreciation (not to be mistaken with total returns, which includes dividend income). From 2014 to 2023 the companies underlying the S&P/ASX 200 grew earnings on average 4%p.a. while the index’s price returned 42%, by comparison over the same period, the US’ S&P 500 experienced 7%p.a. earnings growth and 237% price growth – significantly higher than our market.

When good news is bad news – Active Australian Equity Managers

In searching for a core portfolio solution that can generate alpha over the broad market benchmark S&P/ASX200 a lot of investors turn to active managers.

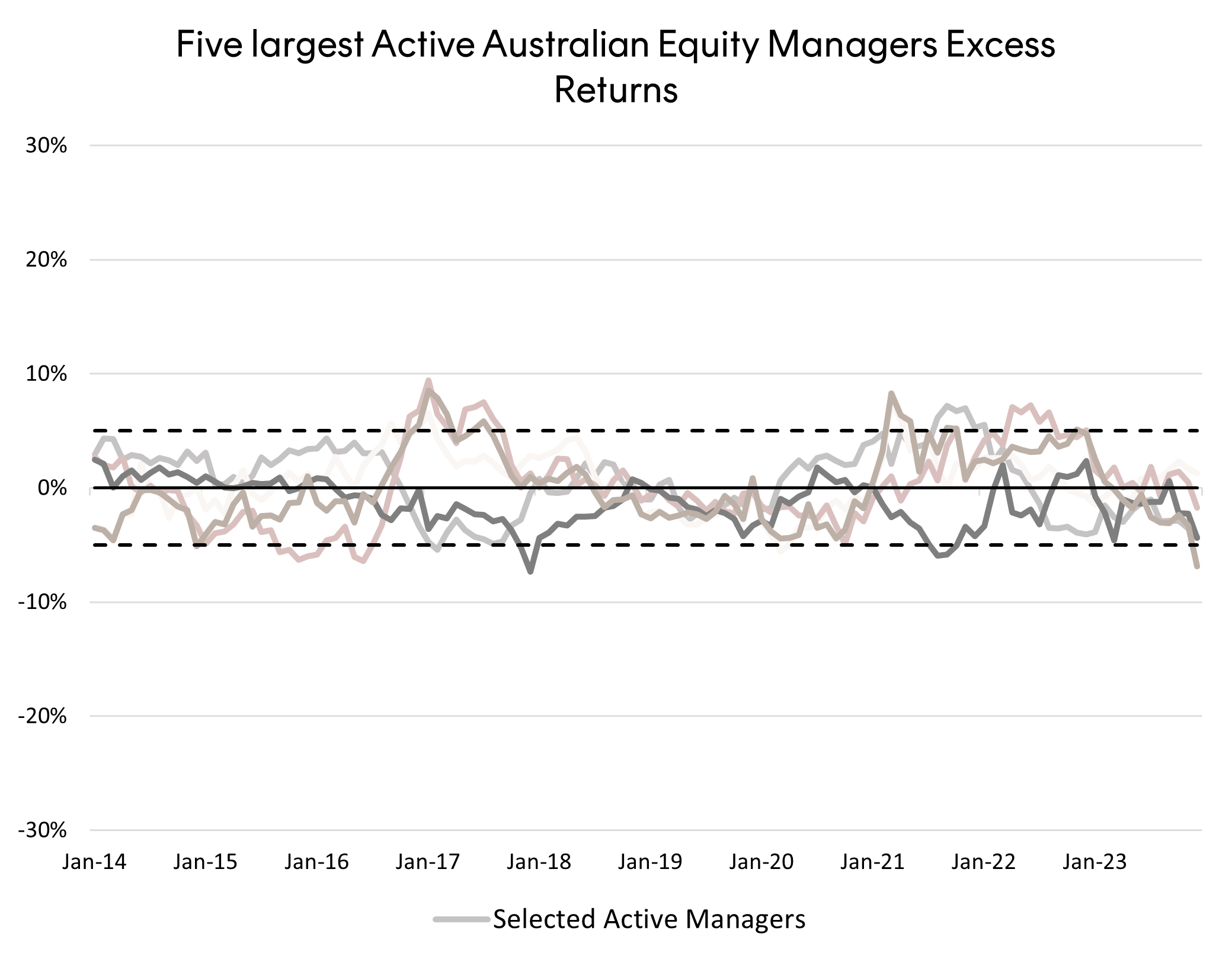

When examining the performance of the largest domestic equity active managers in Australia we find that they exhibit ‘index awareness’. Their returns do not deviate too far from the benchmark – especially when compared to Australian global equity managers. This is unsurprising given the smaller pool of companies available for investment in Australia and the lower deviation of returns amongst those companies compared to global equities. This is also a desirable outcome as periods of significant deviation, particularly underperformance, from the benchmark can be unsettling for investors.

However, index awareness must be coupled with outperformance over the benchmark otherwise investors would simply be better off investing in a low-cost index tracking ETF. Of these five active managers only one provided outperformance of 1% or greater over the S&P/ASX200 over this 10-year timeframe. Taking the most recent SPIVA findings over all active Australian equity managers we know that 79% underperformed the S&P/ASX 200 over the 10-year period ending 30 June 2023.

Considering this and examining the profile of the broad Australian market, (represented by the benchmark S&P/ASX 200 – the blue dot below) we can hypothesise an enhanced solution to broad market investing in Australia – i.e. upweighting to higher quality companies.

Quality companies are defined by their high return on invested equity, low levels of leverage and earning stability. Historically, companies with these attributes have outperformed broader benchmarks while displaying defensive properties. Taking a quality investment approach in Australia could therefore improve profitability and solve for our market’s relatively low returns.

In fact, several active Australian fund managers already take this approach. Represented by the brown dots below these managers achieve their goal of a higher quality exposure to Australian equities. However, pursuing this sole aim can come at the arguably undesirable result of a very high growth and volatile portfolio – leading to periods of significant deviations from the benchmark. Namely these active managers tend to have a very high growth exposure, small size bias, with high volatility, and low yield when compared to the S&P/ASX200.

AQLT – A balanced approach to quality investing in Australia

AQLT Australian Quality ETF Australia’s only passive quality Australian equities ETF, takes a more considered approach. AQLT maintains exposure to the largest Australian companies – weighting them by their quality attributes rather than size. It also holds and weights the highest quality companies from the remainder of the S&P/ASX200.

The result, as represented by the orange dots below, is a more balanced portfolio profile with an emphasis on quality. AQLT’s index has historically outperformed the largest Australian active managers while not suffering from the significant deviations from the benchmark that Australian active quality fund managers have.

Australian quality investing in practice

As an example of AQLT’s index approach Macquarie, rather than Commonwealth, typically has the largest weighting for a bank in the portfolio. Although Macquarie has a smaller market capitalisation than Australia’s ‘Big 4’ banks, it has historically displayed higher quality characteristics, for example having an average return on equity of 15% over the past decade compared to a 12% average for the ‘Big 4’ banks. This has translated into Macquarie shares having a price return of 334% over the same 10-year period whilst the average of ‘Big 4’ banks, who pay out most of their earnings as dividends rather than reinvesting for growth, experienced 0% price return for the period.

By taking this enhanced index approach to Australian equities AQLT’s index has historically outperformed the benchmark ASX200 and most of the largest Australian active managers:

While not suffering from the same significant deviations from the benchmark that Australian active quality fund managers have:

AQLT can be used in a diversified portfolio as a core Australian equities allocation. Used alongside existing low-cost passive Australian ETFs AQLT can improve portfolio diversification and fundamentals.

AQLT is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

There are risks associated with an investment in AQLT, including market risk, and non-traditional index methodology risk. Investment value can go up and down and Betashares does not guarantee the performance of the Fund. An investment in the Fund should only be made after considering your client’s circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available here.

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

The Lonsec Ratings (assigned September 2023) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “general advice” (as defined in the Corporations Act 2001) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold any Betashares fund, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the Betashares for researching the product using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please go to http://www.lonsecresearch.com.au/research-solutions/our-ratings.

2 comments on this

Hi – I already have AQLT as my main core holding. Can I ask though how do you deal with dividends that are paid, for example, in March, when the ETF pays in July? David

Hi David,

Thanks for your comment.

To answer your question, cash received from dividends is held in the fund until it is paid out as a distribution. Depending on the fund and the level of cash it could be invested in stocks or index futures. Any cash balance held by the fund will accrue interest that is passed through to the fund.

I hope this helps answer your question.

Best Regards,

Betashares Team