Cause to pause

4 minutes reading time

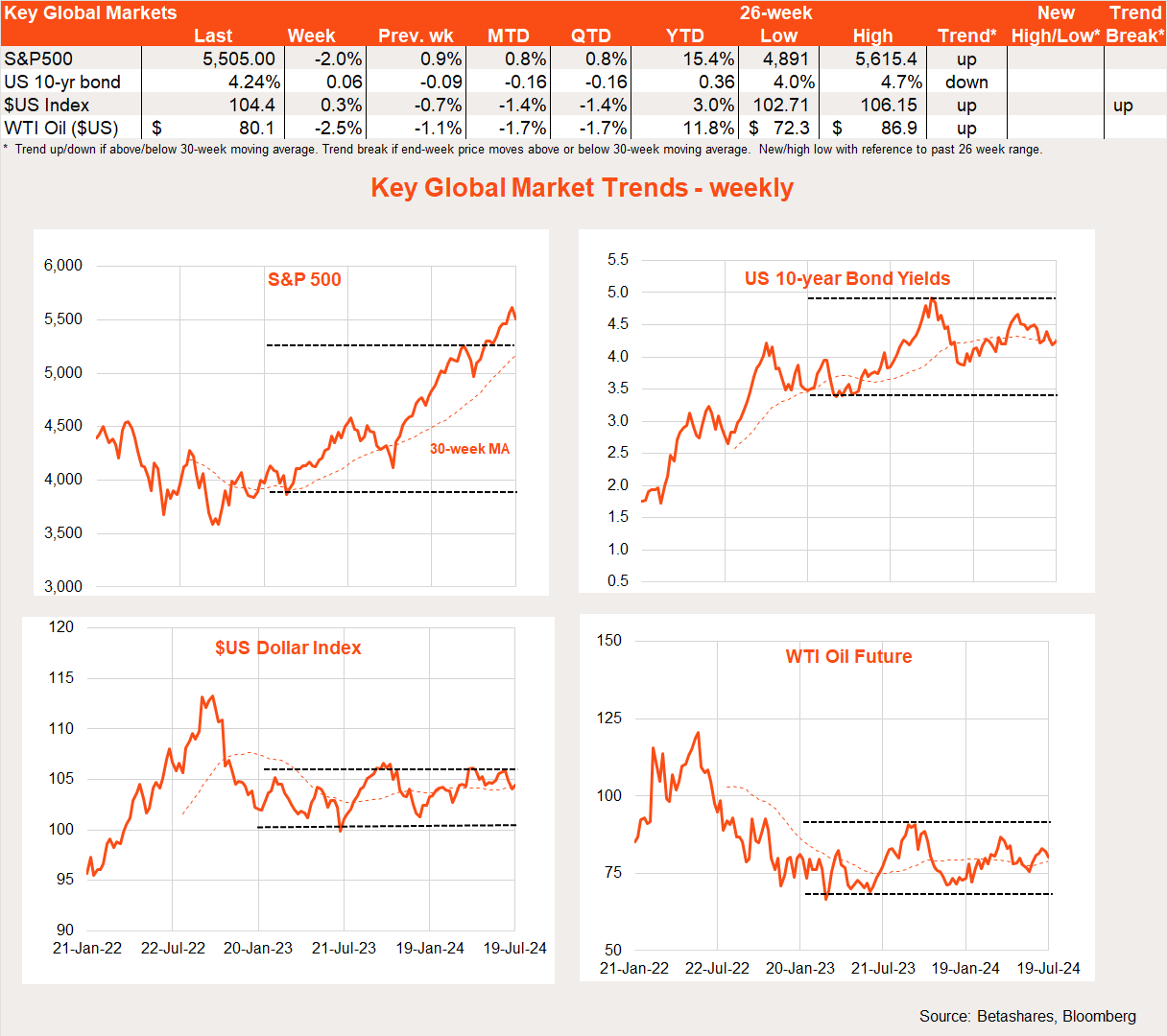

Global markets

Fears related to potential bans on US tech exports to China hurt global stocks last week, especially the US large-cap market darlings.

As was the case the previous week, relative weakness in US large-cap technology stocks contributed to the ‘great rotation’ theme – from growth to value – permeating global markets. Meanwhile, the overall ‘soft landing’ theme, supportive of both bond and equity markets generally, remains firmly in play.

The major global data highlight last week – in a relatively quiet week – was strong-than-expected June US retail sales, suggesting reports of the death of the US consumer (after some softness in spending earlier this year) remain exaggerated.

While this briefly hurt stocks, the major driver of weakness last week was a Bloomberg news report suggesting the US is mulling restricting sales of advanced semiconductors to China. Trump’s warnings that Taiwan should pay more for its defence and historic criticisms by his VP nominee (JD Vance) of large-cap US tech companies further soured sentiment.

China’s monthly data dump was mixed, with softer-than-expected Q2 GDP and retail spending, yet firm industrial production and business investment. In short, China appears to be battling the weakness in property investment and consumer spending through a ramping up in exports and investments in infrastructure and high-tech/green energy projects.

In Europe, the ECB left rates on hold – as widely expected – and held back on signalling further rate cuts any time soon.

Global week ahead

The week begins with news that US President Joe Biden will not contest the upcoming election, with Vice-President Harris the hot favourite (but yet to be confirmed) as his replacement Democrat nominee.

Early market reaction is likely to be that Trump is modestly less certain to win the election, though still the strong favourite. As such, we may see a modest unwinding of the ‘Trump trade’ – which has been characterised as a firmer US dollar and US yield-curve steepening due to concerns over ongoing large US fiscal deficits under Trump.

Also of importance, to the extent a new Democrat candidate makes it less likely the Republicans win a ‘clean sweep’ – with the Presidency and majorities in both the Senate and Lower House – markets may take comfort from the greater prospect of ongoing Washington gridlock, which would limit the chance of major policy changes.

Data-wise, the major highlight this week will be Friday’s US June private consumption expenditure (PCE) deflator – the Fed’s preferred inflation measure. Given already benign reports for the consumer (CPI) and producer (PPI) price indices in June, Friday’s report is also likely to be relatively benign, with the market expecting a 0.2% rise in core prices – which would keep annual core inflation steady at 2.6%.

Also of note this week is a ramping up of the Q2 US earnings reporting season, with key tech darlings Tesla and Alphabet reporting. In the current climate, any earnings miss by a large-cap US tech company – while unlikely – could be severely punished by the market.

Market trends

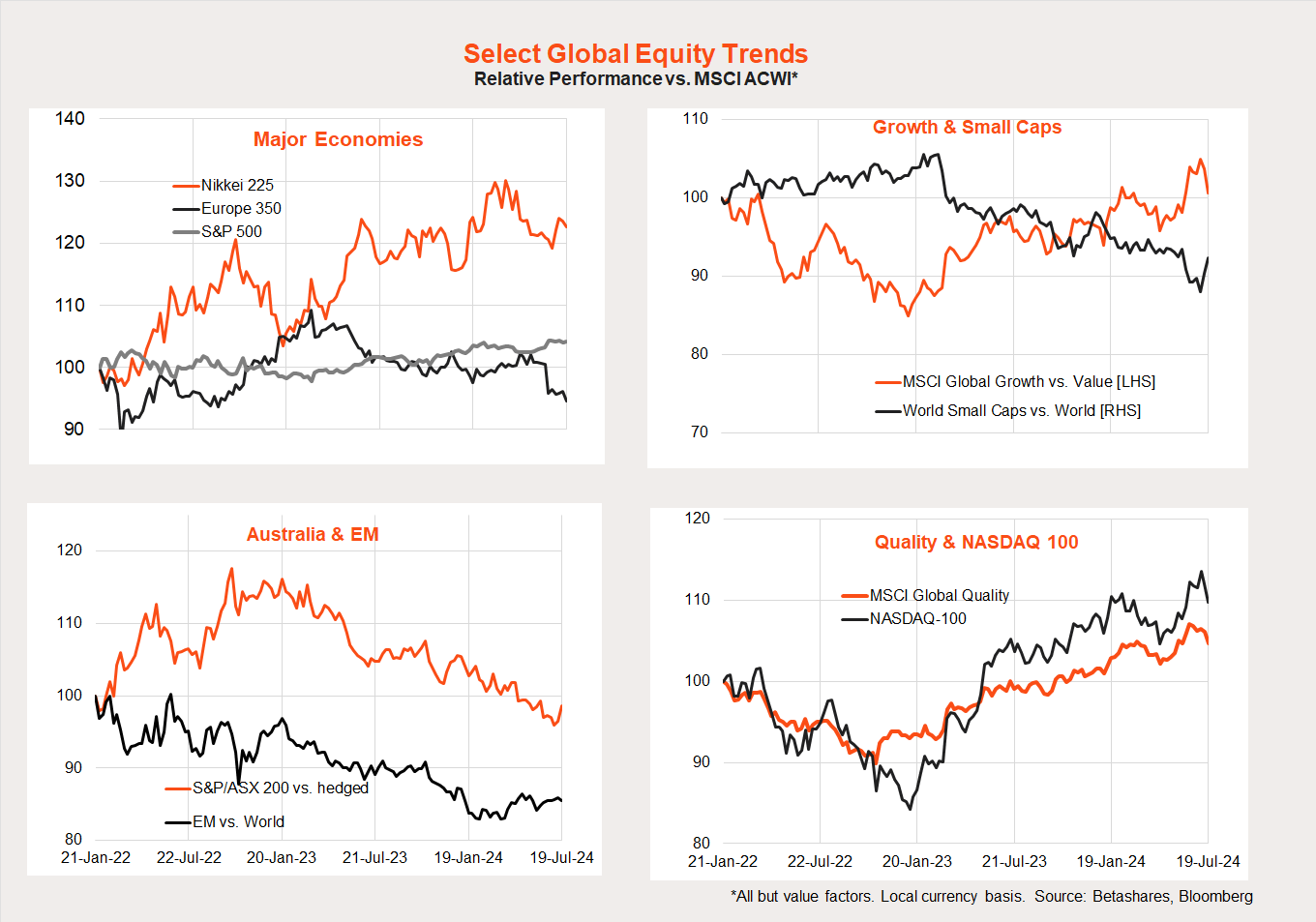

As evident in the chart set below, the most interesting development within global equity markets in recent weeks has been a rotation from growth/technology/large caps to value/small caps. Overall US relative performance is so far holding up, however, with investors instead seeking other areas of value within the market.

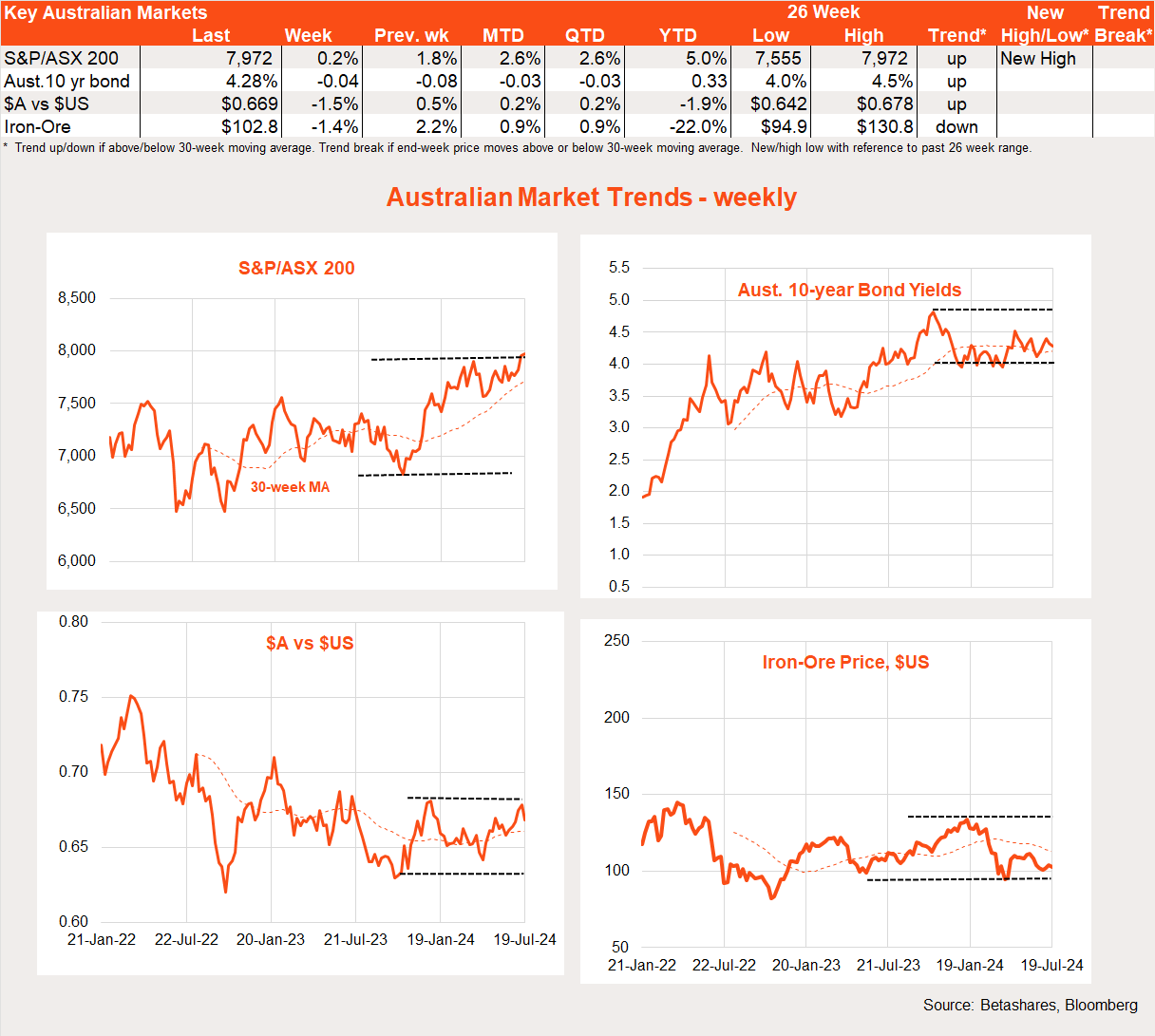

Australian market

Local stocks inched ahead last week but are yet to respond to the weakness on Wall Street last Friday.

The local highlight last week was the mixed June labour market report. While employment grew a stronger than expected 50k, this was not enough to stop the unemployment rate inching higher to 4.1% from 4.0% – thanks to ongoing strong immigration-fuelled growth in labour supply.

All up, the labour market report was not weak enough to rule out an RBA rate hike next month if next week’s all-important June quarter CPI is uncomfortably high. For that, we’d need to see annual trimmed mean inflation hit at least 4% or more, compared to the RBA’s May forecast of 3.8%. For the record, I’m forecasting an annual gain of 3.9% – which would be close, but not close enough, for the RBA to hike rates.

There is little on the local data front this week, with focus likely to remain on US developments – and ongoing fretting over next week’s Q2 CPI report.

1 comment on this

The World’s house of Cards is starting to fall. I will be interested in moving forward how you spin our stubborn inflation, interest rate issues and likelihood of recession.