Fed meeting recap: hawkish quarter point rate cut

5 minutes reading time

- Thematic

The rise of weight loss drugs in the US has revolutionised the healthcare industry and become a key investment theme that’s hard to miss.

Whilst AI and technology stocks have dominated headlines, global healthcare companies like Novo Nordisk and Eli Lilly have outperformed their tech peers so far this year1.

Their blockbuster weight loss drugs such as Ozempic and Wegovy have been prescribed to millions of American adults, and with obesity rates only increasing around the world there is no shortage of demand for these drugs.

In fact, Morgan Stanley expects that the market for obesity drugs could reach US$77 billion by 20302.

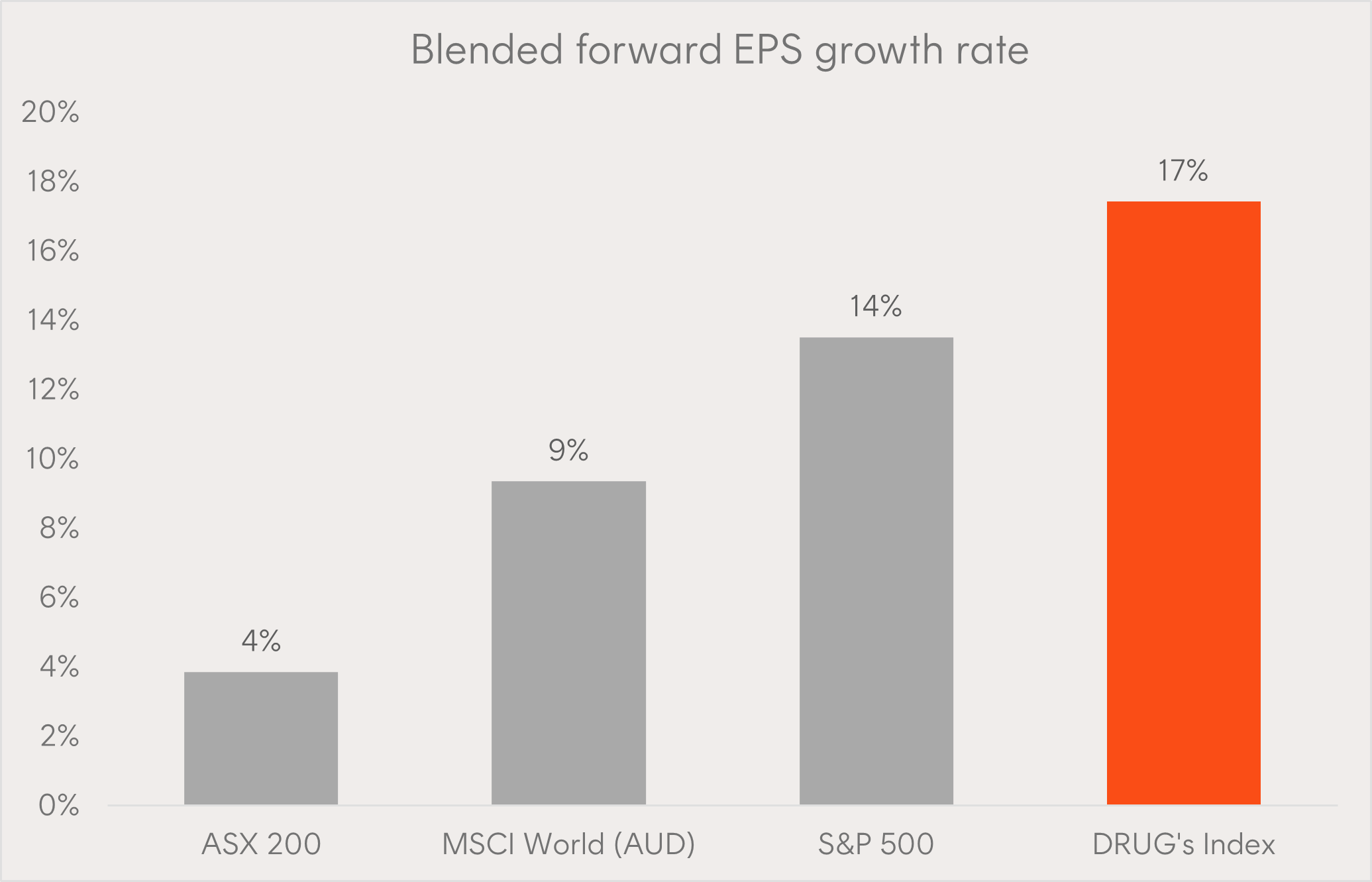

Source: Morgan Stanley Research Estimates, Betashares

Healthcare: an underrated growth sector

Clearly there are structural tailwinds behind the uptake of weight loss drugs which has benefited the healthcare industry; however, diabetes and obesity is just one of many areas that healthcare companies develop treatments for.

For example, Eli Lilly’s Alzheimer’s drug – donanemab recently received unanimous backing from the FDA (US Food and Drug Administration) advisory panel3. This pushes it one step forward to receiving final approval from the FDA to license and manufacture the drug.

Whilst neuroscience drugs accounted for just 3% of LLY’s revenue in 20234, this example shows that continued innovation in drug development can present opportunities for new sources of revenue.

Alongside an ageing population and rising living standards, medical innovation means that it is likely demand for healthcare will continue to grow for the foreseeable future.

Source: Bloomberg, Betashares as at 13 June 2024. All indices denominated in AUD. Bloomberg blended forward 12 month EPS combines actual results that have been reported and estimated results that have yet to report. You cannot invest directly in an index. Past performance is not indicative of future performance.

The chart above illustrates the growth prospects that healthcare can provide for investors.

Earnings per share (EPS) growth of companies within the Index which the DRUG Global Healthcare Currency Hedged ETF aims to track is expected to be around 17% over the next year – almost double that of a broad-based global equities benchmark proxied by the MSCI World.

Investors seeking growth within their portfolios don’t have to be limited to ‘traditional’ sectors like IT and Telecommunications. Healthcare can provide a unique investment offering with exposure to both defensive and growth characteristics.

Adding defensiveness to your portfolios

Whilst the global healthcare sector has the potential to provide compelling long-term returns from strong forecasted earnings growth, it is important to remember that healthcare is still ultimately a very defensive sector.

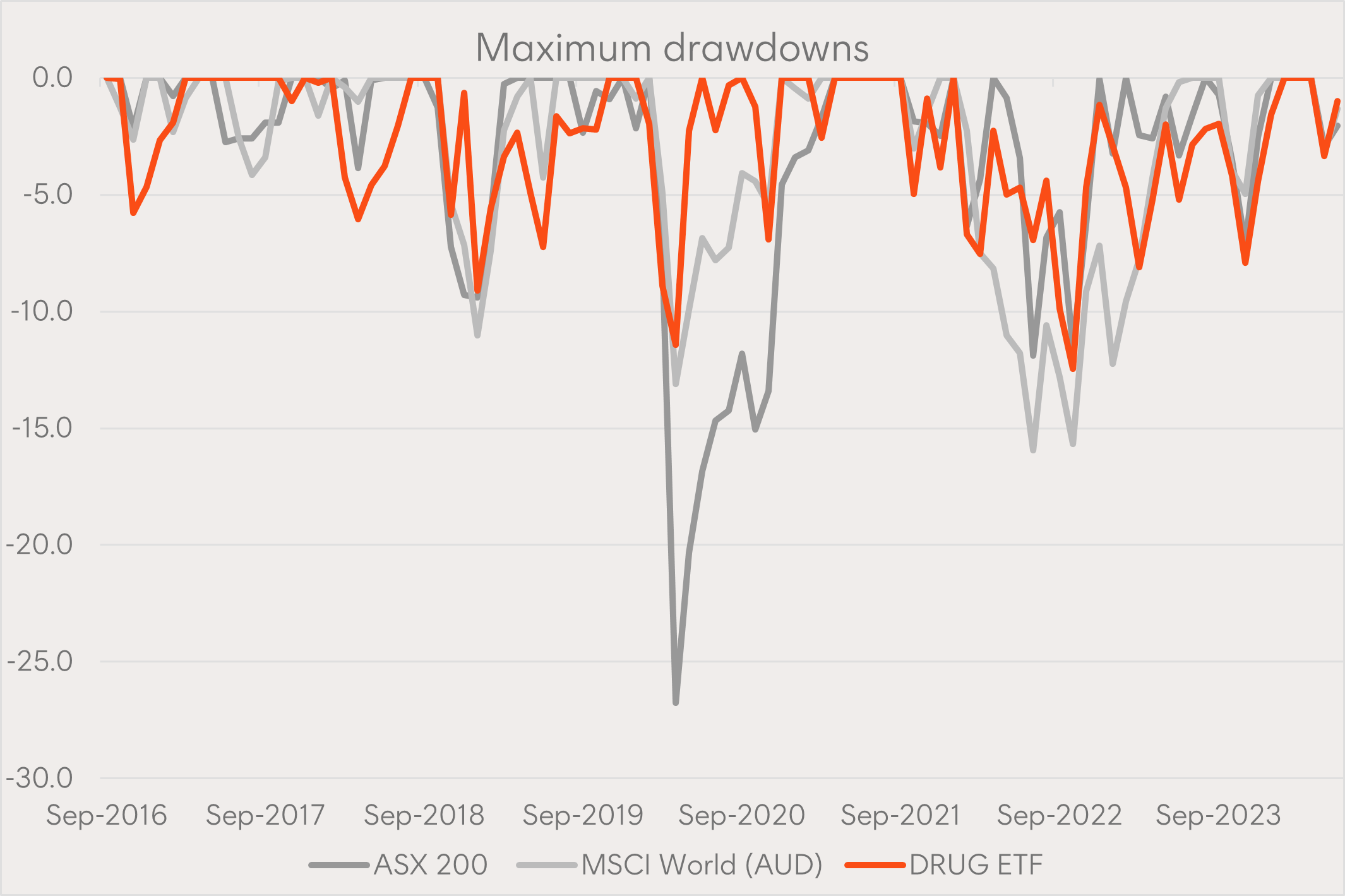

In periods of equity market weakness, the healthcare sector has generally not fallen as much as the broader market.

Source: Morningstar, Betashares as at 13 June 2024. Series from September 2016. All indices denominated in AUD.

The chart above shows how a portfolio of global healthcare companies (through DRUG) had lower maximum drawdowns (as shown through the shallower orange lines) during COVID and also during 2022 when interest rates began to rise and markets sold off.

This is because demand for healthcare treatment is generally inelastic compared to the demand for other goods and services – i.e., patients still need to buy their treatments regardless of what economic cycle we’re in or if prices of these drugs were to increase modestly.

Value for money

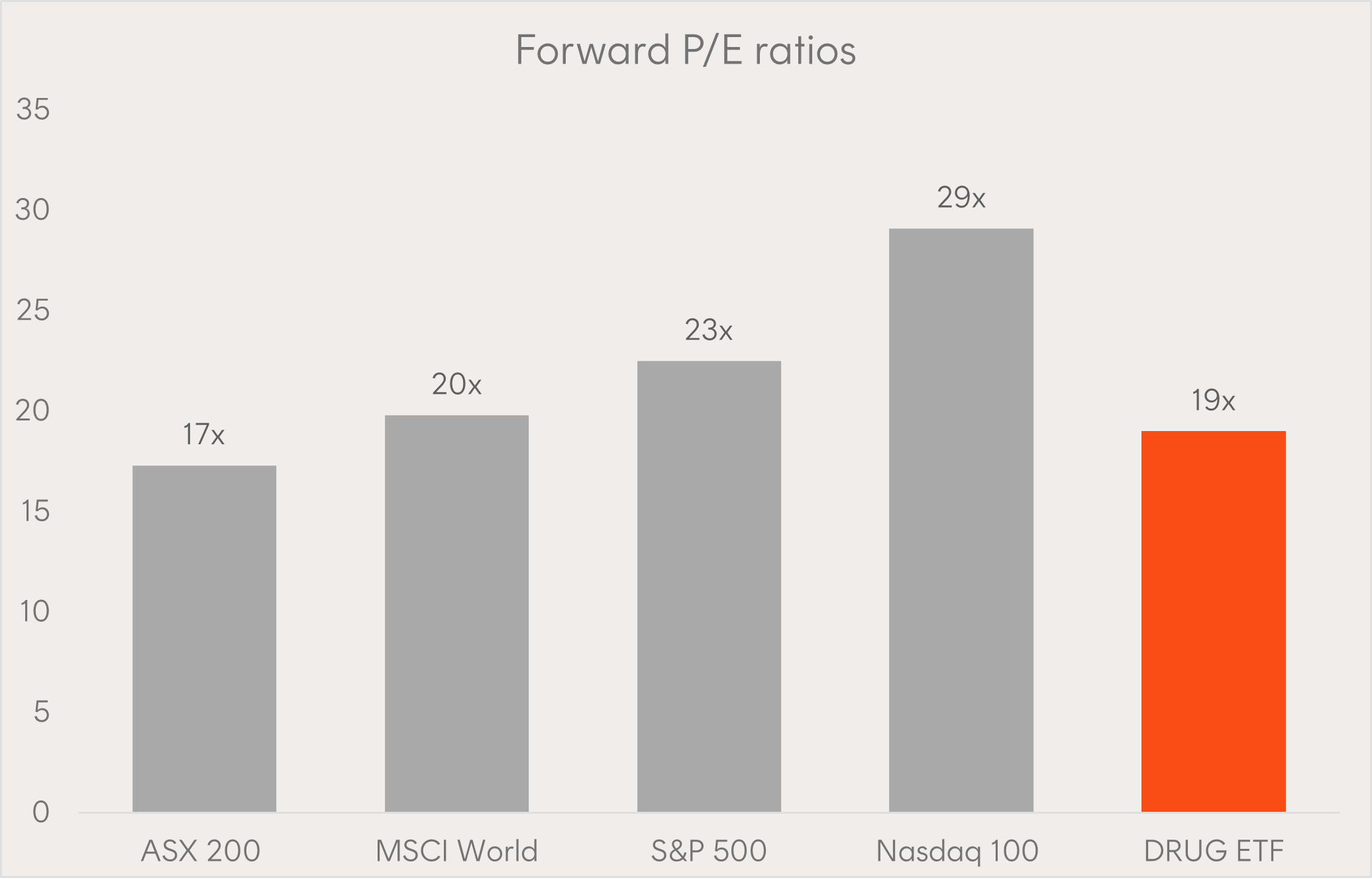

Finding a bargain in markets can be difficult with valuations at all time highs in the US.

Although the AI rally has been fueled by very strong earnings growth of large cap tech companies, it has pushed the valuation of the Nasdaq 100 index to around 29x forward earnings.

This is around 50% more expensive than DRUG which trades at just 19x.

Source: Bloomberg, Betashares as at 13 June 2024. DRUG’s forward P/E ratio as at 30 April 2024 from Betashares factsheet.

The global healthcare sector (through DRUG) can give you more value for money by offering both defensive and growth characteristics at lower valuations than global equity benchmarks shown in the chart above.

Portfolio Implementation

Investors may consider DRUG:

- to complement a broader global equities allocation, or as a tactical exposure to the global healthcare sector,

- to lower volatility and/or drawdowns of an existing portfolio.

DRUG provides a convenient, cost-effective exposure to the largest global healthcare companies (ex-Australia), hedged into Australian dollars. The global healthcare sector provides unique access to a global growth opportunity with strong tailwinds from ageing populations and rising living standards, as well as defensive characteristics in periods of market weakness.

You can find more information on DRUG at its fund page here.

There are risks associated with an investment in DRUG, including market risk, international investment risk, healthcare sector risk and concentration risk. Investment value can go up and down and Betashares does not guarantee the performance of the Fund. An investment in the Fund should only be considered as part of a broader portfolio, after considering your client’s circumstances, including their tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

1. Tech peers being Apple, Google and Microsoft as at 13 June 2024 ↑

2. https://www.morganstanley.com/ideas/obesity-drugs-investment-opportunity ↑

3. https://www.reuters.com/business/healthcare-pharmaceuticals/us-fda-advisers-review-eli-lilly-alzheimers-drug-2024-06-10/ ↑

4. Eli Lilly 2023 Annual Report ↑