Charts of the month: March 2025

5 minutes reading time

Week in review

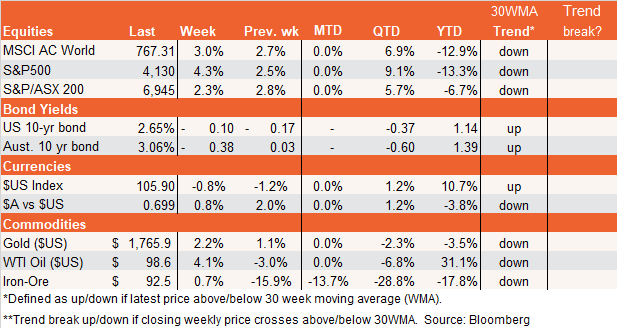

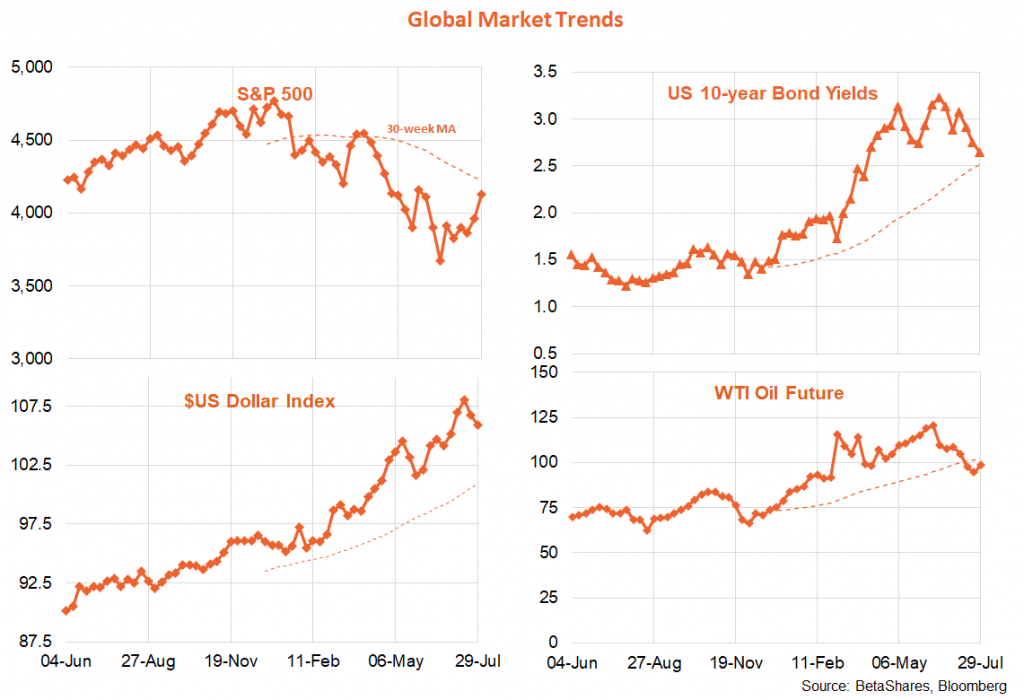

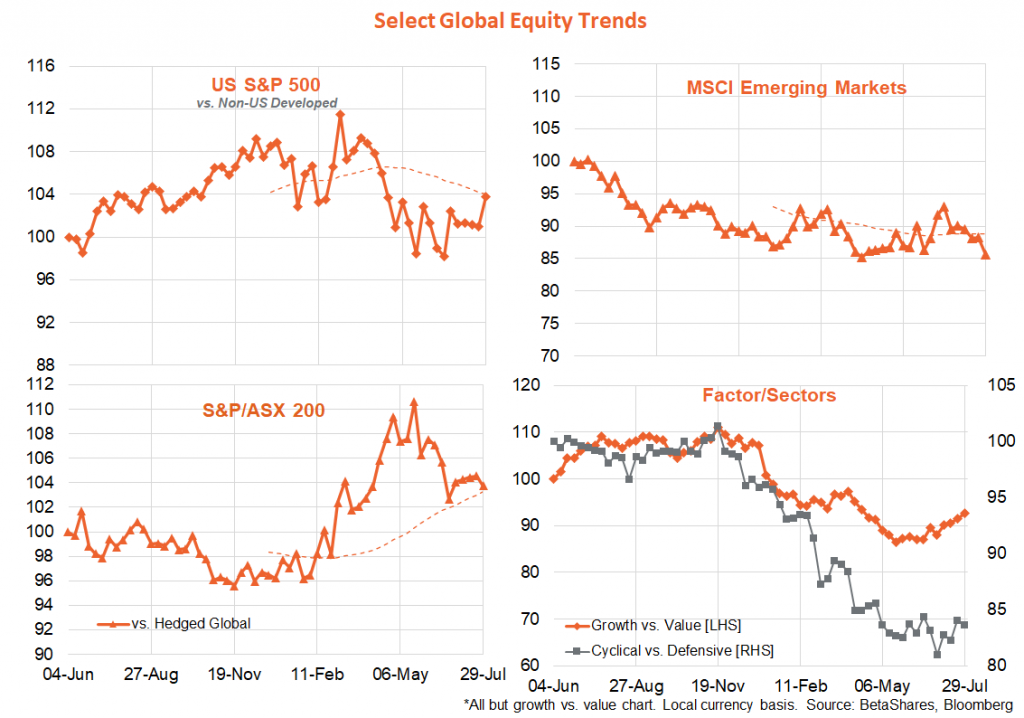

Global equities saw fit to look on the bright side again last week, rallying in the face of weakening US economic data and another jumbo-sized 0.75% Fed hike. Indeed, the US tipped into a technical recession last week with a second successive negative quarterly GDP growth outcome – though we need to wait for broader weakness in employment, spending and industrial production before the economic boffins at the National Bureau of Economic Research (NBER) proclaim an official recession.

But in a case of bad news is good news, what most got the market’s attention were comments by Fed chair Powell suggesting rates were now close to neutral – and the Fed can now be more data-dependent in determining the pace of rate hikes from here.

Was that the Powell pivot? Time will tell, but the market is still pricing in a good chance of another 0.75% hike at the September meeting – and further rate hikes taking the Fed funds rate to around 3.25-3.5% by early 2023. That I can’t quibble with that – and nor can I quibble much with the idea that the Fed could cut rates in H2’23. What I do quibble with is the market’s blasé disregard for the likely required weakening in economic growth and corporate earnings – and/or speedy decline in inflation – to justify this speedy end to Fed rate hikes.

For this not to be a bear market rally, either inflation will need to slow quickly (allowing the Fed to pivot and avert a recession) or the Fed blinks in the face of weakening growth, allowing inflation to stay higher for longer. If inflation remains stubbornly firm, it really comes down to whether Powell wants to go down in history as more like Arthur Burns or Paul Volker. The former was Fed chair in the early 1970s and is blamed for pivoting too early and allowing inflation to ratchet higher – while the latter is credited with finally breaking the back of inflation with very tough medicine in the early 1980s.

US data on Friday would hardly have reassured the Fed – with both the core consumption deflator and the employment cost index a bit higher than the already high market expectation. Meanwhile, housing demand is plummeting as are various business sentiment surveys. The Q2 earnings season continued to roll on, with some notable hits and misses – but overall earnings ‘beats’ remain modestly below their average. Either way, it’s premature to expect much earnings weakness – that comes later.

Let’s also not forget other global concerns – Europe appears to be careering into recession under the onslaught of higher energy prices, while China is trying to juggle the bursting of its housing development bubble along with a zero-COVID strategy. Argentina is also back in crisis, which risks contagion to other indebted emerging markets.

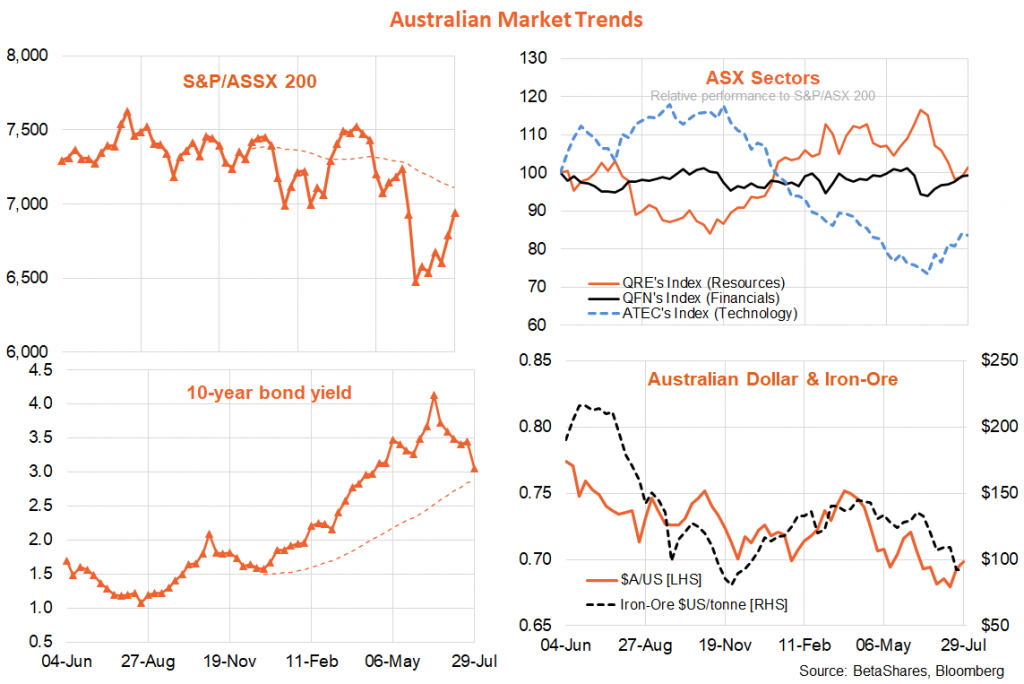

In Australia, the June quarter consumer price index was not a lot worse than feared, which likely cements an RBA rate hike of ‘only’ 0.5% this week.

Week ahead

Key global developments to watch this week include US payrolls on Friday, Fed speak, and US manufacturing and service sector surveys.

July payrolls are likely to show US employment growth is slowing, but remains firm (expected employment growth of 250k after 372k in June). We’ll also need to keep a close eye on average hourly earnings, with annual growth expected to slow only modestly from 5.1% to 4.9%. The ISM surveys of manufacturing and services are expected to weaken but hold above 50. It’s hard to know how Wall Street will respond to either weaker or stronger than expected activity data – weak data could see stocks rally on hopes of a reduced Fed rate hikes and vice versa!

What will be clearly bullish or bearish, however, will be Fed speak and inflation/wage data. Of interest will be whether Fed speakers this week talk down the prospects of a Fed pivot any time soon – perhaps reflecting unease with the stock rally and easing in financial conditions. The ISM surveys and payrolls will also contain important information on the extent of lingering cost and wage pressures.

In Australia, focus naturally will be on the RBA, which is expected to hike rates by 0.5% at its meeting tomorrow. As has been the case in the US, local bond yields have fallen notably in recent weeks with more sensible rate hike expectations now anticipated. The market now expects a cash rate of around 3.25% over the next 12 months compared to 4.25% only a couple of months ago.