Equity Markets Quarterly Commentary Q1 2025

5 minutes reading time

- Global shares

Global markets – week in review

After four consecutive weekly gains, global equities took a breather last week with the S&P 500 inching ahead only 0.03%. Firm US service sector data and “high for longer” Fed rhetoric saw traders take profits in both the bond and equity markets after recent gains.

Probably the main highlight in a data-light week was the strength in the US services sector PMI. The S&P US service sector index blew past market expectations, rising to 54.4 from 51.1. Also concerning was a lift in input costs. The result ran counter to a run of recent softer reports for employment growth and retail sales. Overall, the US economy remains firm, though whether this necessarily implies inflation will prove stubbornly firm remains to be seen.

Also encouraging a degree of market consolidation last week was a chorus of Fed speakers who reiterated the view that – while rate further rate hikes seem unlikely – rate cuts are also unlikely anytime soon.

There was little joy in New Zealand last week either, with the RBNZ Monetary Policy Statement upgrading its inflation and interest rate outlook, while downgrading its growth outlook following a recent stronger than expected inflation report. While markets are toying with an NZ rate cut as early as late this year, the RBNZ currently does not expect a rate cut before August 2025. My own call of rates cuts later this year – in expectation of a speedy fall in inflation due to ongoing recessionary conditions – is not looking too good at present!

In other news, the UK called a surprise early election, with the Conservatives staring down the barrel of a loss to the Labour Party. In Europe, surprisingly firm Q1 EU wage data was not bad enough to rule out a June ECB rate cut, though did raise questions about the size and timing of further cuts.

The week ahead

The major global highlight this week is the Fed’s preferred inflation measure on Friday (US time) – the private consumption expenditure (PCE) deflator. The good news is that thanks to recent softer readings for the consumer and producer price indices, the market expects only a 0.2% rise in core PCE prices (down from 0.3% in February and March and 0.5% in January) – though which would only keep annual growth steady at 2.8%.

Also of interest will be European inflation data on the same day, with May headline annual CPI inflation expected to tick up to 2.5% from 2.4% – a result considered good enough to still allow a rate cut next month.

In New Zealand, we get ANZ business confidence, the employment indicator, building consents and the national Budget. Most of the activity data is likely to remain subdued – and (as in Australia) any optimism around potential Budget stimulus could be quickly quashed by the consequent interest rate implications.

Global equity trends

Looking at global equity trends, the equity rebound over recent weeks has favoured a bounce back in the relative performance of NASDAQ-100/global quality exposures. There are also growing signs of a broader rebound in global growth over value.

At the same time, the China-led rebound in emerging market relative performance has stalled a little. Japan is enduring a relative performance correction after recent strong gains while Australia and global small caps continue to underperform.

Australian markets

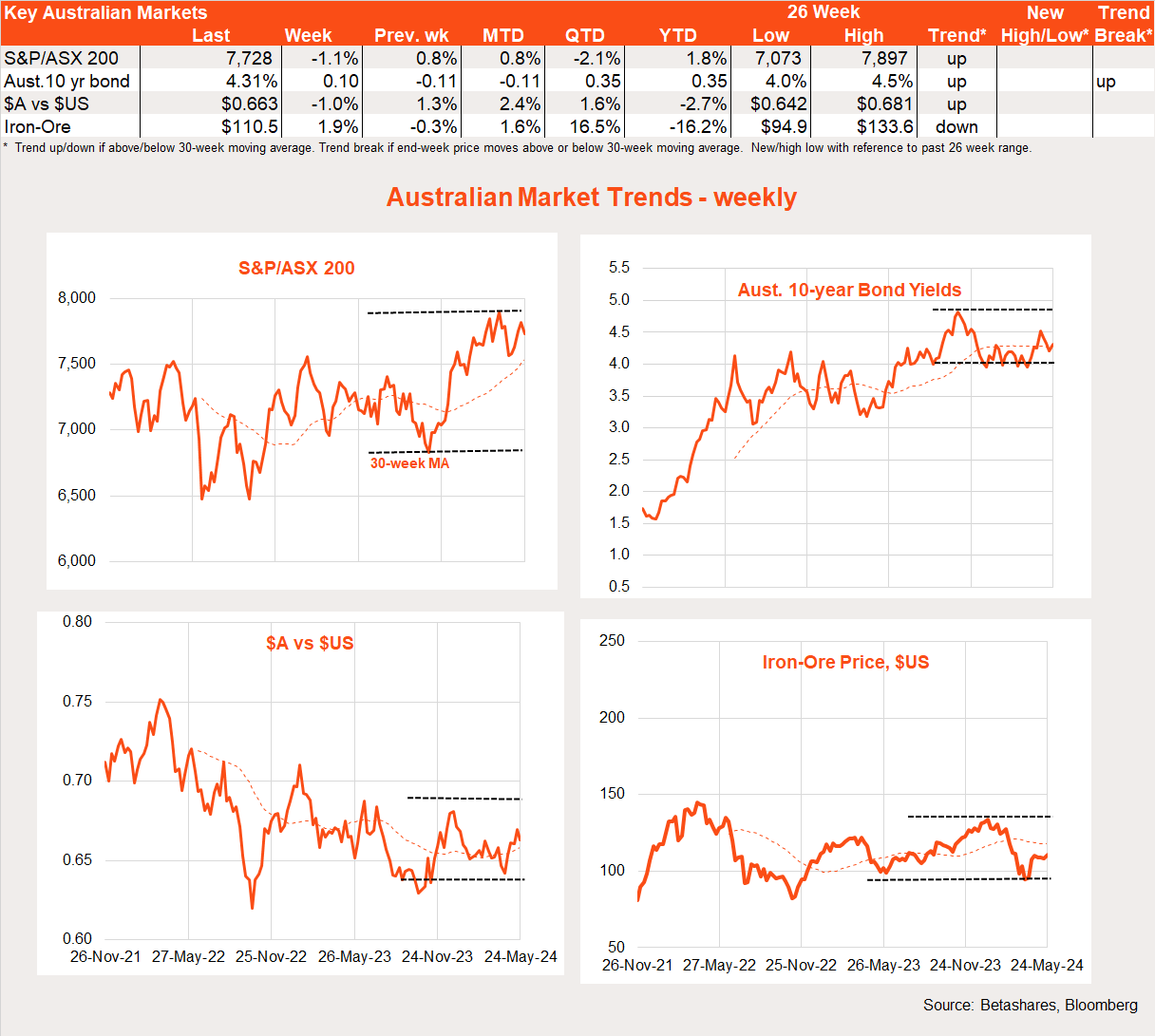

The S&P/ASX 200 slipped back 1.1% last week, not helped by minutes from the latest RBA policy meeting suggesting a mild tightening bias remains in place. After its encouraging break above 7,500 earlier this year, the S&P/ASX 200 has since gyrated in a choppy range.

Also of note, consumer sentiment remained fairly subdued last month – with ongoing cost-of-living concerns limiting any Federal-budget bounce.

We get a range of economic updates this week, with April retail spending tomorrow, Q1 construction work on Wednesday and business investment plans and home building approvals on Thursday. Of interest will be any rebound in retail spending after a surprisingly weak 0.4% decline in March. Construction data is expected to highlight the ongoing crowding out of home building by booming public sector infrastructure spending. Actual investment spending is expected to remain firm in the quarter, with the expectations survey likely to suggest still solid but slowing growth in capital spending next financial year.

Of course, the current economic challenge is any good news on the activity front is likely bad news for the interest rate outlook – which in turn is likely bad news for the equity market outlook. The RBA remains extremely concerned about lingering inflationary pressures given limited spare capacity – and simply does not want to see much of a lift in overall demand anytime soon. In Australia it appears the case that bad news is bad, but good news is fairly bad also!

Against that backdrop, the major local data highlight this week will be Wednesday’s April monthly CPI report. The market anticipates a slight easing in annual headline inflation from 3.5% to 3.4%, though – as was the case last month – there are potential upside risks due to the recent phasing out of Government electricity rebates.

In large degree Australia’s lingering inflation problems reflect gross historic policy failures with regard to housing and energy policy. With such a large land mass and abundant energy resources, it’s a crying shame we are forced to pay so much for both housing and electricity.

Have a great week!