Betashares Australian ETF Review: November 2025

6 minutes reading time

- Fixed income, cash & hybrids

The US Federal Reserve recently began cutting interest rates, with the rate cut by half a percent to 4.75-5% p.a. on 18 September1. Investors are now faced with an evolving bond market landscape.

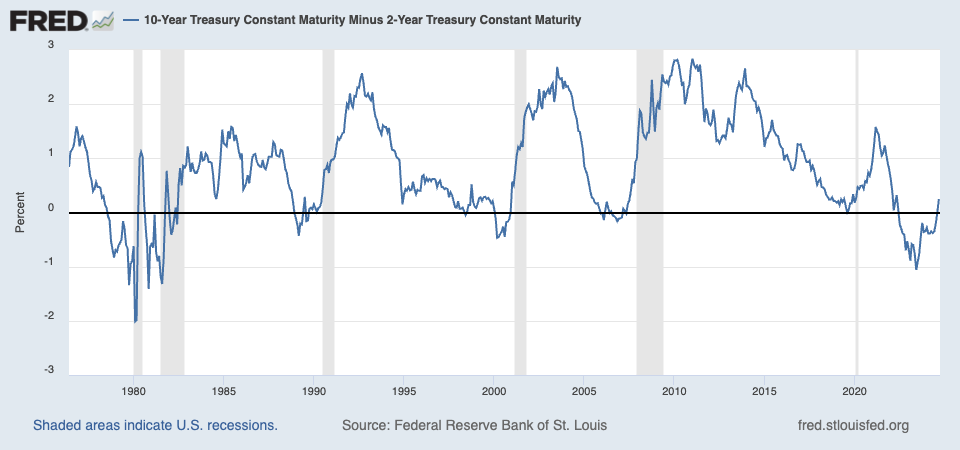

For the first time in years, we’ve seen the 10-year and 2-year Treasury yields un-invert after a historically prolonged inversion. This development signals a shift in market expectations about future interest rates and economic conditions.

US Treasury yield curve – 10-year minus 2-year

Source: Federal Reserve Bank of St Louis. Data covers 24 September 1980] to 24 September 2024. Shaded areas indicate US recessions. Past performance is not an indicator of future performance.

But why should investors care about falling rates? For bondholders, falling interest rates present a double-edged sword. On one hand, lower yields reduce the income generated from fixed income investments. On the other hand, bond prices tend to rise when interest rates fall, offering a potential for capital gains.

This article will explore strategies for navigating the bond market in a declining rate environment, provide insights into managing risks, and introduce fixed income ETFs that can help investors capitalise on falling rates.

Why falling rates can boost bond prices

The relationship between bond yields and prices is inverse — when yields fall, bond prices rise. This dynamic is crucial for understanding why bonds often rally when central banks cut rates. As rates drop, the fixed interest payments of existing bonds become more attractive compared to newly issued bonds at lower yields, driving demand and prices up.

For example, if a fixed rate bond with a 5% coupon was issued when interest rates were high, and rates then fall to 3%, the bond becomes more valuable as it offers a higher yield than what’s currently available in the market.

This potential for capital gains is what makes long-duration bonds particularly appealing during periods of falling rates.

Understanding yield curves and interest rates

To understand how to position your bond portfolio, it’s crucial to first understand the yield curve and what the recent inversion and un-inversion mean. The yield curve represents the relationship between short- and long-term interest rates on bonds. When the yield curve for government bonds inverts — meaning short-term rates are higher than long-term rates — it often signals a future (though not necessarily imminent or guaranteed) economic slowdown or recession.

The inversion of the 10-year and 2-year US Treasury yields, which lasted for an extended period, suggested investors were preparing for an economic downturn. However, as the curve un-inverts, it signals changing expectations. Markets now anticipate lower rates in the future, typically a sign that central banks will reduce rates to stimulate the economy.

Historically, bonds have generally performed well during periods of falling rates, as lower interest rates drive bond prices up. For instance, following the Global Financial Crisis of 2008, bonds experienced a prolonged rally as rates were slashed and yields fell to historic lows (see chart below).

Market yield on 10-yr US Treasuries

Source: Board of Governors of the Federal Reserve System (US), Federal Reserve Bank of St Louis. Data covers 1 January 2006 to 24 September 2024. Shaded areas indicate US recessions. Past performance is not an indicator of future performance.

Key fixed income strategies in a declining rate environment

To navigate falling rates successfully, investors should consider strategies that optimise bond exposure, balancing duration risk, diversification, and credit risk.

Focus on duration: An important factor to consider in bond investing is duration — a measure of a bond’s sensitivity to interest rate changes. Generally, the longer the duration, the more a bond’s price will rise when interest rates fall. So in a declining rate environment, long-term bonds tend to benefit the most. However, this increased sensitivity also means greater risk if rates don’t fall as expected or if they rise unexpectedly.

Fixed income ETFs to consider

For those looking to manage risk while seeking potential gains, the ETFs below could stand to benefit in a falling interest rate environment.

AGVT Australian Government Bond ETF provides exposure to high-quality Australian government bonds, with a focus on higher duration bonds compared to other Australian bond funds that do not have this focus.

Offering a diversified portfolio of high-quality Australian government and corporate bonds, OZBD Australian Composite Bond ETF provides broad exposure to the Australian fixed income market. It’s a balanced exposure for income seeking investors.

For those investors willing to take on more risk, CRED Australian Investment Grade Corporate Bond ETF provides exposure to investment-grade Australian corporate bonds. These bonds offer the potential for higher yields compared to government bonds while still maintaining an investment grade credit exposure.

US10 U.S. Treasury Bond 7-10 Year Currency Hedged ETF provides exposure to US Treasury bonds with maturities between 7 to 10 years, hedged into Australian dollars.

For those seeking a longer term duration, GGOV US Treasury Bond 20+ Year Currency Hedged ETF provides exposure to long term US Treasury bonds, hedged into Australian dollars. Long term government bonds are highly sensitive to changes in interest rates.

Who should consider fixed income investments?

Fixed income investments are well-suited for several types of investors in today’s environment:

- Balanced and conservative investors: For those investors seeking capital stability with the potential to benefit from capital returns, they may want to consider government bond ETFs. These investments offer relative capital stability with the potential for capital gains in a declining rate environment.

- Income-focused investors: For those investors seeking steady income and who are willing to take on more risk, they may want to consider corporate bond ETFs that provide an opportunity for higher yields than government bonds. These options may also benefit from falling interest rates.

Conclusion

With interest rates likely to continue falling in the US, and expectations of rate cuts in Australia growing, now could be a good time to reassess your bond portfolio and consider adding longer-term fixed income securities.

In a falling rate environment, bonds are key to a well-diversified portfolio. By understanding yield curves, managing duration, and balancing credit and interest rate risk, investors can position their fixed income exposure to benefit from looser monetary policy.

There are risks associated with an investment in the Funds mentioned in this article, which may include interest rate risk, credit risk, market risk, index tracking risk and, for US10 and GGOV, international investing risk, and for GGOV, non-traditional index methodology risk. Investment value can go up and down. An investment in the Funds should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the relevant Product Disclosure Statement and Target Market Determination, both available on the Betashares website (www.betashares.com.au).

Source: