Reality check

5 minutes reading time

Week in review

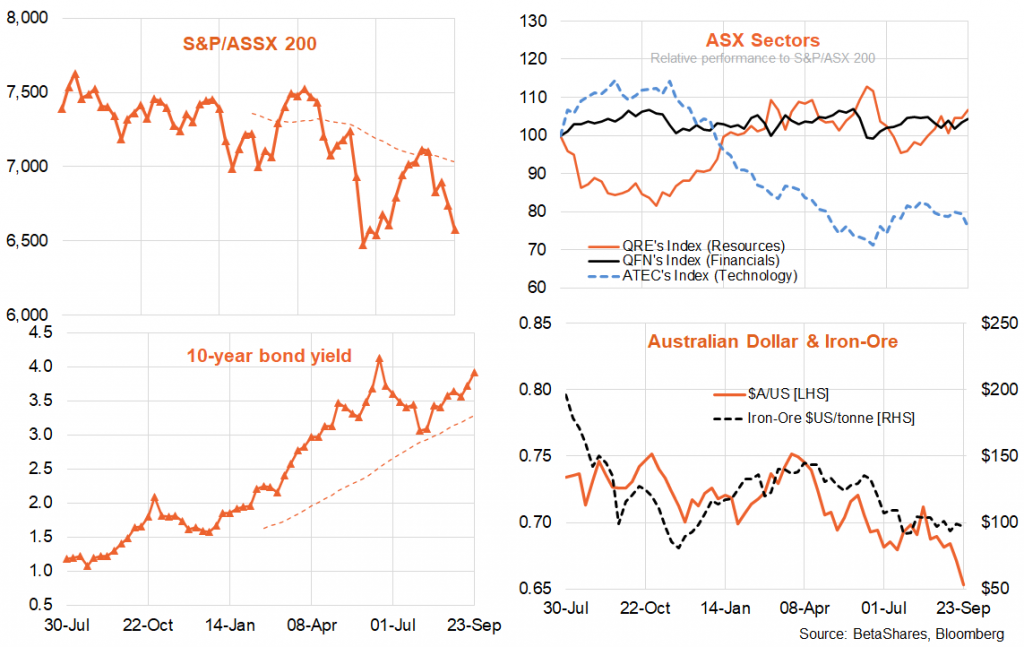

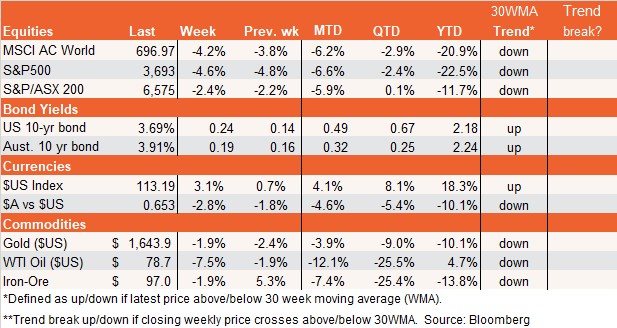

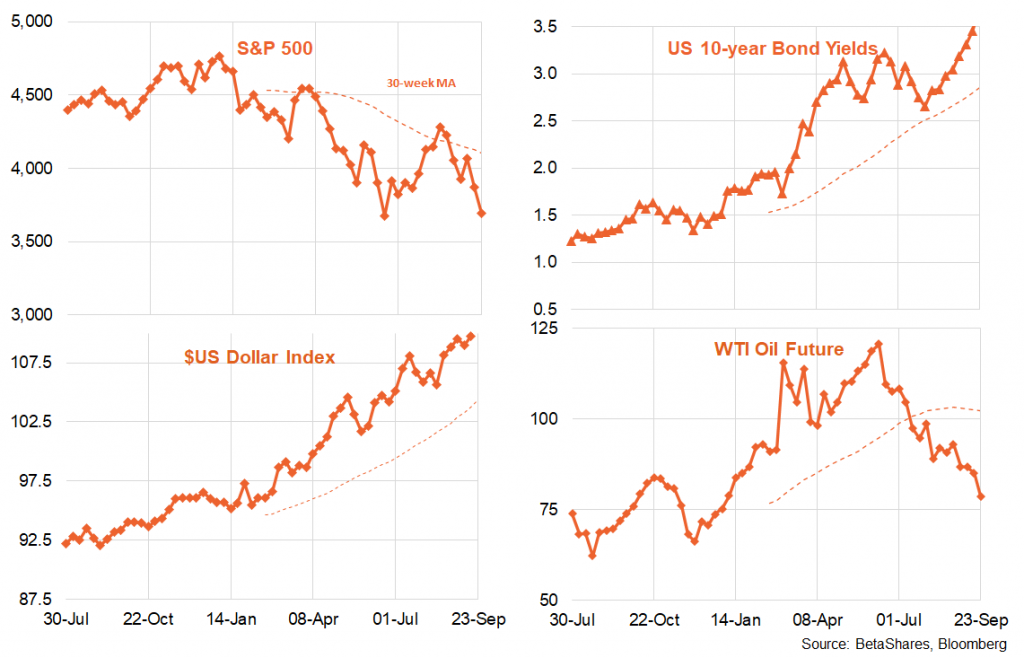

Continued hawkish actions from the US Federal Reserve again weighed on global equity and bond markets last week, with an ill-judged very stimulatory UK budget also not helping fragile global sentiment on Friday. The result is that US stocks are almost back to their mid-June lows while bond yields have broken back above their mid-June highs. The $US powers on and commodity prices remain in retreat.

Global market trends

The highlight of the week was the Fed meeting. Although the Fed baulked at raising rates by a full one percentage point, any relief this might have offered markets was shattered by a major upward revision to the ‘dot plot’ projection of anticipated future policy moves. The median forecast for the Fed funds rate among Fed members is 4.4% at year-end, implying a range for the Fed funds rate of 4.25-4.5% – or 1.25% higher than the new range set last week at 3-3.25%. It means the Fed intends to hike by a further 0.75% at the November policy meeting, and a further 0.5% at the December policy meeting. Back in June, the Fed expected the funds rate would end this year in a 3.25-3.5% range, or a full one percentage point less than it now expects.

There’s also no ‘pivot’ for the Fed in 2023, with the Fed funds rate expected to end the year in a 4.5-4.75% range – implying one further 0.25% rate hike next year and steady rates for the rest of the year. According to the dot plot, the Fed pivot won’t come until 2024, with rate cuts worth 0.75% pencilled in.

The Fed is also anticipating a more notable rise in the unemployment rate to 4.4% by end-23, or a 0.9% increase from its recent low of 3.5%. Note that every time the US unemployment rate has increased by more than 0.5% in recent decades, it has usually increased by a lot more, and each time has been associated with a recession (as declared by the National Bureau of Economic Research, or NBER). This is consistent with my mid-June call that the US will tumble into recession at some point in the next 12 months.

Even with this emerging degree of slack in the economy, the Fed sees core annual inflation only slowing to 3.1% by end-23. It’s not until end-24 that core inflation gets closer to the Fed target, with an expected year-end core annual inflation rate of 2.3%.

In Australia, last week’s minutes to the recent RBA policy meeting suggested it may raise rates by only 0.25% at the October policy meeting (given interest rates are now closer to neutral). That said, the aggressive Fed outlook affirmed last week – which also sent the $A reeling toward US65c – now suggests another larger 0.5% rate increase next month seems more likely than not.

Despite growing recession fears, the continued sell-off in bond markets reflects a simple fact: in large part economic activity has yet to buckle all that much in either the US or Australia since the rate hikes began. Although the interest-rate sensitive housing market has started to cool in both economies, employment demand and consumer spending remain firm. Of course, this could reflect policy lags, but it could also reflect both the considerable post-COVID momentum both economies enjoy, and a degree of resilience to higher short-term rates due to somewhat improved corporate and household balances sheets in recent years. Indeed, the drop in oil prices in recent months has complicated the outlook – while this has helped reduce headline inflation, to the extent it has boosted real spending power it may slow the decline in core inflation.

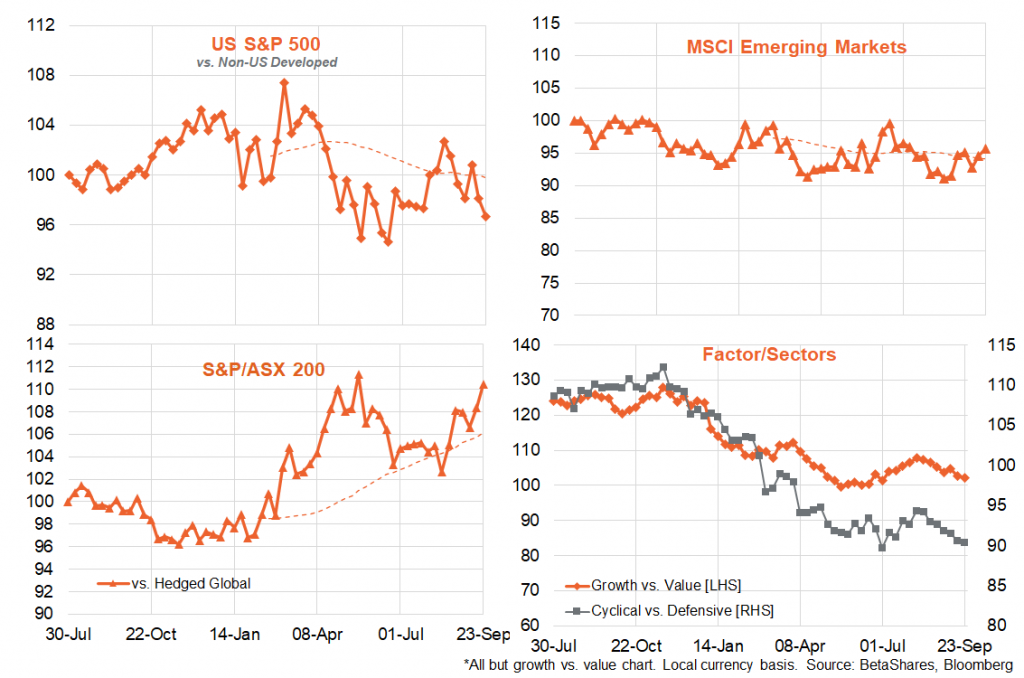

Either way, it seems likely that central banks will remain hawkish until there are clearer signs either of notable slowdown in core inflation and/or notable slowdown in employment and consumer spending. The former – least likely – scenario would be great news for both bonds and equity markets. The latter – more likely- scenario would be good news for bond markets (in the sense that yields will have peaked) but not necessarily good news for equities as a weakening economy would likely mean substantial further downgrades to earnings expectations.

Select global equity trends

Week ahead

The global data highlight this week will be the Fed’s preferred inflation measure – the private consumption expenditure deflator (PCED) – on Friday. Although the headline measure is expected to fall (due to lower petrol prices), the core measure is not expected to provide much joy – with a 0.4% monthly gain expected for August after an unusually low 0.1% gain in July. Such a result would see annual core PCED inflation edge up to 4.7% from 4.6%.

Although we likely don’t need any more commentary, there will also be a plethora of Fed speakers this week – with the market focused on the degree to which they lean in favour of a 50 or 75bps rate hike in November. Data on US durable goods, consumer confidence, house prices and new home sales will help shed light on the extent to which the economy is slowing under the weight of interest rate increases.

Similarly, local retail sales on Wednesday and job vacancies on Thursday will provide on update on the degree of slowing – if any – in consumer spending and employment demand, which in turn will play into the debate over the size of next month’s RBA rate hike. Thursday also sees the release of some partial price data covering July and August that will be included in the new ABS monthly consumer price index (CPI) report. The first full monthly CPI report – covering September and history back to 2018 – is due to be released on 26 October.