6 minutes reading time

BetaShares recently expanded its product range to include our first fixed income/bond fund, the BetaShares Australian Bank Senior Floating Rate Bond ETF (ASX Code: QPON). Due to the level of interest we have had in this fund so far, I thought it would be timely to write a short series on the basics of Bonds. In this first part in the series, I focus on the concepts of “interest rate risk” and “duration”. The main objective of this is to make sure that investors who are currently invested in bonds (particularly via fixed rate bonds) understand the key features of such bonds. One of the primary rationales of launching our Floating Rate Bond ETF was to allow investors to obtain many of the key benefits of Fixed Income investing, but with the simplicity that comes from a floating rate product. Let’s continue…

Bond features, valuations and pricing

Fixed income securities perform a number of functions in an investor’s portfolio. They can be a steady source of regular cash flow, offer high levels of capital stability and can also provide portfolio diversification benefits when paired with equities. Corporate bonds (such as those held by QPON) also receive preferential treatment in the capital structure to equities and in the case of high-quality investment grade bonds, entail little credit risk.

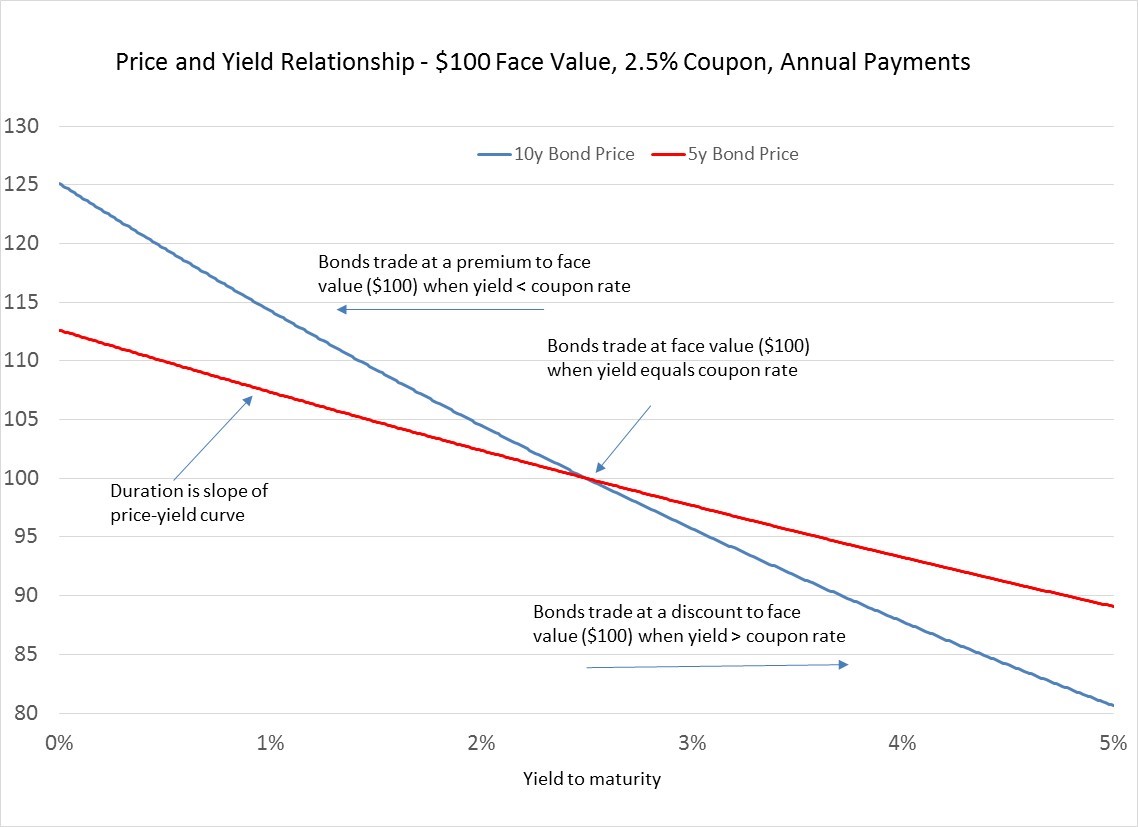

All these benefits notwithstanding, it’s important to be aware that all bonds, even the safest government debt, have some degree of capital volatility. This is particularly true in the case of fixed-coupon bonds (i.e. bonds that pay fixed amounts throughout the life of the bond), whose prices move inversely with interest rates (known as yields when applied to bonds). Note that the prices of floating rate bonds (such as those owned by QPON) by definition do not move in this way, which means they can be arguably better suited to a rising rate environment.

In terms of pricing, a bond, like any other financial instrument, is valued at the present value of its future cash flows, discounted back by an appropriate rate (the yield). The main difference between bonds and equities is that those future cash flows are known with a greater certainty, meaning the yield is the main determinant of price (interest rates are also important in equity valuation, but not to the same degree). This applies not just to fixed coupon bonds, but any type of investment involving fixed cash flows in the future, including even bank bills and term deposits (yes, term deposits also have interest rate risk, you just don’t see the price!). In fact, with the exception of at-call cash, all debt investments have some degree of interest rate risk. In fixed income investing, the duration is how we measure the amount of interest rate risk.

Source: BetaShares. Illustrative only

Source: BetaShares. Illustrative only

Duration (or more correctly, “modified duration” – we’ll use the two interchangeably) is closely related to a bond’s maturity (measured in “years”). Duration is technically the weighted average time to receive a bond’s cash flows, with a slight adjustment, and we use duration to measure the sensitivity of bond prices to yield changes. To put this into practice, for example, a 10-year bond might have a duration of 8 years, meaning a 1 basis point increase (decrease) in yield will result in an 8 basis point decrease (increase) in price. By comparison, the current “duration” of the underlying holdings in QPON is a mere 0.13 years, indicating the relative lack of sensitivity of QPON’s capital value to changes in yields.

Bond volatility in practice

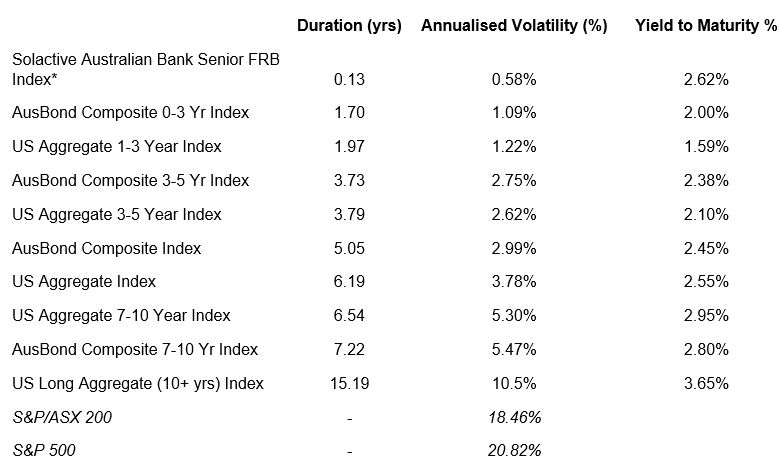

So what does all this mean for return volatility? The table below compares a number of bond indices on the basis of their duration and realised volatility over the past 10 years. As we can see, as duration increases, volatility also tends to increase by a similar proportion. In general, broad bond indices have significantly lower volatility than equities, although (much like leverage) duration can be used to increase a bond portfolio’s volatility and very long-dated bond indices (such as the US Long Aggregate) can achieve comparable levels of volatility to equities.

Daily Return Volatility – 1 July 2007 to 30 June 2017

Source: Bloomberg. Past performance is not an indicator of future performance; duration and yield to maturity as at 30 June 2017

*The index QPON aims to track

Duration and government bond yields (not credit spreads) drive bond volatility.

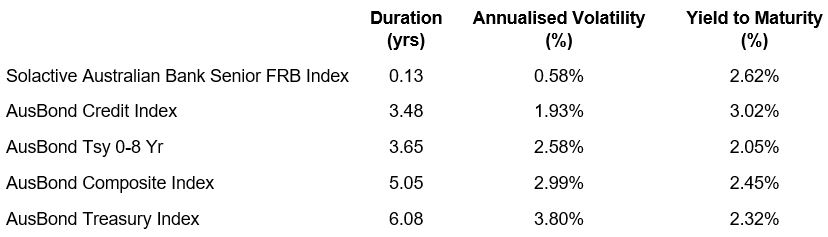

A bond’s yield can be decomposed many ways, but at a high level, it comes down to two components: a “risk-free” portion (what can be earned on an equivalent high-grade government bond) and the credit spread (the spread above the risk-free yield to compensate for taking on credit risk). In practice, credit risk can be a driver of volatility, but in most cases, duration tends to dominate. This is because the risk-free component (i.e. government bond yields) tends to be much more volatile than credit spreads. This is largely because government bond yields are subject to various global macro risks and not just domestic policy expectations.

The table below shows five Bloomberg bond indices: the AusBond composite (most investment grade fixed-coupon bonds in the Australian market), the Australian Treasury Composite (Australian Federal government debt only), the 0-8 year Treasury composite, the Australian Credit Composite (corporate and bank bonds) and the Solactive Australian Bank Senior FRB Index (the index QPON aims to track). As we can see again, volatility increases with duration. To assess the impact of credit spreads on volatility, we can compare the AusBond Credit index (duration 3.48 yrs) with the broadly duration-matched 0-8 year AusBond Treasury index (3.65 yrs) and despite the latter containing “risk-free” government bonds, it actually has a higher volatility. Furthermore, the low-duration floating rate bond index has the lowest volatility of all, despite still having credit risk.

Australian bond indices compared – 1 July 2007 to 30 June 2017

Source: Bloomberg. Past performance is not an indicator of future performance; duration and yield to maturity as at 30 June 2017.

Summary

Investing in debt provides many benefits, but it’s important to be mindful of the risks, particularly with fixed rate bonds. Duration, not credit risk, has been the main driver for bond volatility in the past and government bonds yields have tended to be much more volatile than credit spreads. Whether you select fixed coupon bonds, term deposits or floating rate bonds, it’s important to be aware of their respective interest rate risks and assess if the yield provides sufficient compensation.

Stay tuned for my next Bonds Basics piece…coming soon…

* The QPON Fund is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index at any time or in any other respect. The Index is calculated and published by Solactive AG. Neither publication of the Index by Solactive AG nor the licensing of the Index for the purpose of use in connection with the Fund constitutes a recommendation by Solactive AG to invest capital in the Fund nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in the Fund.